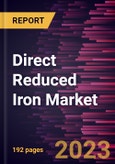

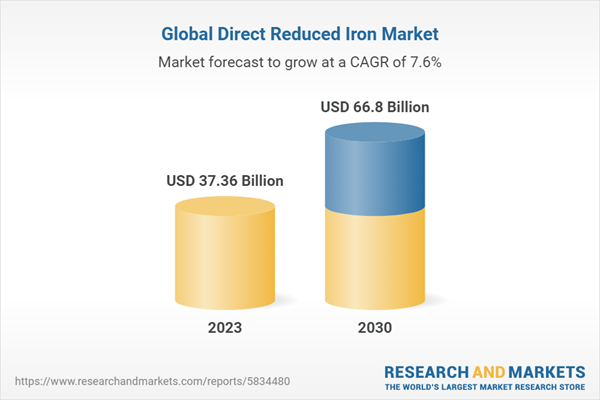

The direct reduced iron (DRI) market size is expected to grow from US$ 37.36 billion in 2022 to US$ 66.80 billion by 2030; it is estimated to register a CAGR of 7.6% from 2023 to 2030.

Awareness regarding carbon emissions and taking a step ahead in achieving sustainable goals is the primary concern for manufacturing industries. Carbon emissions from manufacturing industries prominently contribute to the greenhouse gas generated throughout the world. According to the World Steel Association, the steel industry generated 3 billion tons of CO2 in 2021. CO2 emissions from the steel industry alone contribute to ~7-9% of overall greenhouse gas emissions, leading to a huge impact on the climate. Various government bodies are taking initiatives to reduce carbon emission levels to achieve a sustainable future. The US administration has launched clean hydrogen initiatives to support sustainable manufacturing, which include low-carbon production of the steel and aluminum needed for electric vehicles, wind turbines, and solar panels. For instance, in May 2023, The U.S. Department of Energy (DOE) announced nearly $42 million in funding for 22 projects in 14 states to advance critical technologies for producing, storing, and deploying clean hydrogen. Further, the Canadian government has introduced Emission Reduction Plan to minimize greenhouse gas emissions and to achieve net zero emissions by 2050. The European Clean Steel Partnership was launched in June 2021, wherein the technology was developed in collaboration to reduce the CO2 emissions from European steel production by 80-95% while maintaining the competitiveness and viability of European steel. Such government initiatives have catalyzed a shift toward carbon-free manufacturing in the steel industry. The hydrogen-based technology for iron-making is one such process for nullifying carbon emissions by replacing coke and fossil fuel in traditional blast furnace-based steelmaking.

Based on application, the direct reduced iron (DRI) market is bifurcated into steel making and construction. The steel making segment held the larger share in 2022. The construction is expected to register the highest CAGR from 2023 to 2030. DRI is distinctive because of its metallic richness and uniform chemical and physical characteristics owing to which it finds applications in the construction and infrastructure industries. DRI is used to produce steel rebars and ingots. The construction industry has undergone massive changes relating to the use of environment-friendly materials in infrastructure projects. However, the industry could take a giant step toward sustainable development by shifting from high-emission steel to near-zero emission steel. Steel produced from DRI is one such initiative to lower the carbon footprint and meet the demands of sustainable construction processes.

In terms of region, the direct reduced iron (DRI) market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. In 2022, Middle East & Africa held the largest share of the market and is Asia Pacific is estimated to register the highest CAGR from 2023 to 2030. The market growth in this region is mainly attributed to rapid industrialization.

Nucor Corp, Cleveland-Cliffs Inc., Kobe Steel Ltd, Voestalpine AG, Ternium SA, SMS Group GmbH, JSW Steel Ltd, Tenova SpA, Liberty Steel Group Holdings UK Ltd, and Bharat Engineering Works Pvt Ltd. are among the key players operating in the direct reduced iron (DRI) market. These players engage in developing affordable and innovative products to meet the rising customer demands and expand their market share.

The overall direct reduced iron (DRI) market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. Participants in this process include VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the direct reduced iron (DRI) market.

Awareness regarding carbon emissions and taking a step ahead in achieving sustainable goals is the primary concern for manufacturing industries. Carbon emissions from manufacturing industries prominently contribute to the greenhouse gas generated throughout the world. According to the World Steel Association, the steel industry generated 3 billion tons of CO2 in 2021. CO2 emissions from the steel industry alone contribute to ~7-9% of overall greenhouse gas emissions, leading to a huge impact on the climate. Various government bodies are taking initiatives to reduce carbon emission levels to achieve a sustainable future. The US administration has launched clean hydrogen initiatives to support sustainable manufacturing, which include low-carbon production of the steel and aluminum needed for electric vehicles, wind turbines, and solar panels. For instance, in May 2023, The U.S. Department of Energy (DOE) announced nearly $42 million in funding for 22 projects in 14 states to advance critical technologies for producing, storing, and deploying clean hydrogen. Further, the Canadian government has introduced Emission Reduction Plan to minimize greenhouse gas emissions and to achieve net zero emissions by 2050. The European Clean Steel Partnership was launched in June 2021, wherein the technology was developed in collaboration to reduce the CO2 emissions from European steel production by 80-95% while maintaining the competitiveness and viability of European steel. Such government initiatives have catalyzed a shift toward carbon-free manufacturing in the steel industry. The hydrogen-based technology for iron-making is one such process for nullifying carbon emissions by replacing coke and fossil fuel in traditional blast furnace-based steelmaking.

Based on application, the direct reduced iron (DRI) market is bifurcated into steel making and construction. The steel making segment held the larger share in 2022. The construction is expected to register the highest CAGR from 2023 to 2030. DRI is distinctive because of its metallic richness and uniform chemical and physical characteristics owing to which it finds applications in the construction and infrastructure industries. DRI is used to produce steel rebars and ingots. The construction industry has undergone massive changes relating to the use of environment-friendly materials in infrastructure projects. However, the industry could take a giant step toward sustainable development by shifting from high-emission steel to near-zero emission steel. Steel produced from DRI is one such initiative to lower the carbon footprint and meet the demands of sustainable construction processes.

In terms of region, the direct reduced iron (DRI) market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. In 2022, Middle East & Africa held the largest share of the market and is Asia Pacific is estimated to register the highest CAGR from 2023 to 2030. The market growth in this region is mainly attributed to rapid industrialization.

Nucor Corp, Cleveland-Cliffs Inc., Kobe Steel Ltd, Voestalpine AG, Ternium SA, SMS Group GmbH, JSW Steel Ltd, Tenova SpA, Liberty Steel Group Holdings UK Ltd, and Bharat Engineering Works Pvt Ltd. are among the key players operating in the direct reduced iron (DRI) market. These players engage in developing affordable and innovative products to meet the rising customer demands and expand their market share.

The overall direct reduced iron (DRI) market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. Participants in this process include VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the direct reduced iron (DRI) market.

Table of Contents

1. Introduction

1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

1.3.1 Direct Reduced Iron (DRI) Market, by Form

1.3.2 Direct Reduced Iron (DRI) Market, by Production Process

1.3.3 Direct Reduced Iron (DRI) Market, by Application

1.3.4 Direct Reduced Iron (DRI) Market, by Geography

1.2 Research Report Guidance

1.3 Market Segmentation

1.3.1 Direct Reduced Iron (DRI) Market, by Form

1.3.2 Direct Reduced Iron (DRI) Market, by Production Process

1.3.3 Direct Reduced Iron (DRI) Market, by Application

1.3.4 Direct Reduced Iron (DRI) Market, by Geography

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. Direct Reduced Iron (DRI) Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Threat of New Entrants:

4.2.2 Bargaining Power of Suppliers:

4.2.3 Bargaining Power of Buyers:

4.2.4 Competitive Rivalry:

4.2.5 Threat of Substitutes:

4.3 Ecosystem Analysis

4.3.1 Overview:

4.3.2 Raw Material Suppliers:

4.3.3 Manufacturers

4.3.4 Distributors/Suppliers

4.3.5 End-Use Industries

4.4 Expert Opinion

4.2 Porter’s Five Forces Analysis

4.2.1 Threat of New Entrants:

4.2.2 Bargaining Power of Suppliers:

4.2.3 Bargaining Power of Buyers:

4.2.4 Competitive Rivalry:

4.2.5 Threat of Substitutes:

4.3 Ecosystem Analysis

4.3.1 Overview:

4.3.2 Raw Material Suppliers:

4.3.3 Manufacturers

4.3.4 Distributors/Suppliers

4.3.5 End-Use Industries

4.4 Expert Opinion

5. Direct Reduced Iron (DRI) Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Rise in Steel Production and Use

5.1.2 Expansion of Direct Reduced Iron Plants

5.2 Market Restraints

5.2.1 Shortage of High-Quality Raw Materials

5.3 Market Opportunities

5.3.1 Rising Preference for Green Steel Production

5.4 Future Trends

5.4.1 Initiatives by Various Government Bodies to Lower Carbon Footprint

5.5 Impact Analysis

5.1.1 Rise in Steel Production and Use

5.1.2 Expansion of Direct Reduced Iron Plants

5.2 Market Restraints

5.2.1 Shortage of High-Quality Raw Materials

5.3 Market Opportunities

5.3.1 Rising Preference for Green Steel Production

5.4 Future Trends

5.4.1 Initiatives by Various Government Bodies to Lower Carbon Footprint

5.5 Impact Analysis

6. Direct Reduced Iron (DRI) - Global Market Analysis

6.1 Direct Reduced Iron (DRI) Market Overview

6.2 Direct Reduced Iron (DRI) Market -Volume and Forecast to 2030 (Kilo Tons)

6.3 Direct Reduced Iron (DRI) Market -Revenue and Forecast to 2030 (US$ Million)

6.4 Market Positioning - Key Market Players

6.2 Direct Reduced Iron (DRI) Market -Volume and Forecast to 2030 (Kilo Tons)

6.3 Direct Reduced Iron (DRI) Market -Revenue and Forecast to 2030 (US$ Million)

6.4 Market Positioning - Key Market Players

7. Global Direct Reduced Iron (DRI) Market Analysis - By Form

7.1 Overview

7.2 Direct Reduced Iron (DRI) Market, By Form (2022 and 2030)

7.3 Lumps

7.3.1 Overview

7.3.2 Lumps: Direct Reduced Iron (DRI) Market - Volume and Forecast to 2030 (Kilo Tons)

7.3.3 Lumps: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

7.4 Pellets

7.4.1 Overview

7.4.2 Pellets: Direct Reduced Iron (DRI) Market - Volume and Forecast to 2030 (Kilo Tons)

7.4.3 Pellets: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

7.5 Fine

7.5.1 Overview

7.5.2 Fine: Direct Reduced Iron (DRI) Market - Volume and Forecast to 2030 (Kilo Tons)

7.5.3 Fine: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

7.2 Direct Reduced Iron (DRI) Market, By Form (2022 and 2030)

7.3 Lumps

7.3.1 Overview

7.3.2 Lumps: Direct Reduced Iron (DRI) Market - Volume and Forecast to 2030 (Kilo Tons)

7.3.3 Lumps: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

7.4 Pellets

7.4.1 Overview

7.4.2 Pellets: Direct Reduced Iron (DRI) Market - Volume and Forecast to 2030 (Kilo Tons)

7.4.3 Pellets: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

7.5 Fine

7.5.1 Overview

7.5.2 Fine: Direct Reduced Iron (DRI) Market - Volume and Forecast to 2030 (Kilo Tons)

7.5.3 Fine: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

8. Global Direct Reduced Iron (DRI) Market Analysis - By Production Process

8.1 Overview

8.2 Direct Reduced Iron (DRI) Market, By Production Process (2022 and 2030)

8.3 Coal Based

8.3.1 Overview

8.3.2 Coal Based: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

8.4 Gas Based

8.4.1 Overview

8.4.2 Gas Based: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

8.2 Direct Reduced Iron (DRI) Market, By Production Process (2022 and 2030)

8.3 Coal Based

8.3.1 Overview

8.3.2 Coal Based: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

8.4 Gas Based

8.4.1 Overview

8.4.2 Gas Based: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

9. Global Direct Reduced Iron (DRI) Market Analysis - By Application

9.1 Overview

9.2 Direct Reduced Iron (DRI) Market, By Application (2022 and 2030)

9.3 Steel Making

9.3.1 Overview

9.3.2 Steel Making: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

9.4 Construction

9.4.1 Overview

9.4.2 Construction: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

9.2 Direct Reduced Iron (DRI) Market, By Application (2022 and 2030)

9.3 Steel Making

9.3.1 Overview

9.3.2 Steel Making: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

9.4 Construction

9.4.1 Overview

9.4.2 Construction: Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

10. Global Direct Reduced Iron Market - Geographic Analysis

10.1 Overview

10.2 North America: Direct Reduced Iron Market

10.2.1 North America: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.2.2 North America: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.2.3 North America: Direct Reduced Iron Market, by Form

10.2.4 North America: Direct Reduced Iron Market, by Production Process

10.2.5 North America: Direct Reduced Iron Market, by Application

10.2.6 North America: Direct Reduced Iron Market, by Key Country

10.2.6.1 US: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.2.6.2 US: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.2.6.2.1 US: Direct Reduced Iron Market, by Form

10.2.6.2.2 US: Direct Reduced Iron Market, by Form

10.2.6.2.3 US: Direct Reduced Iron Market, by Production Process

10.2.6.2.4 US: Direct Reduced Iron Market, by Application

10.2.6.3 Canada: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.2.6.4 Canada: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.2.6.4.1 Canada: Direct Reduced Iron Market, by Form

10.2.6.4.2 Canada: Direct Reduced Iron Market, by Form

10.2.6.4.3 Canada: Direct Reduced Iron Market, by Production Process

10.2.6.4.4 Canada: Direct Reduced Iron Market, by Application

10.2.6.5 Mexico: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.2.6.6 Mexico: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.2.6.6.1 Mexico: Direct Reduced Iron Market, by Form

10.2.6.6.2 Mexico: Direct Reduced Iron Market, by Form

10.2.6.6.3 Mexico: Direct Reduced Iron Market, by Production Process

10.2.6.6.4 Mexico: Direct Reduced Iron Market, by Application

10.3 Europe: Direct Reduced Iron Market

10.3.1 Europe: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.2 Europe: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.3 Europe: Direct Reduced Iron Market, by Form

10.3.4 Europe: Direct Reduced Iron Market, by Production Process

10.3.5 Europe: Direct Reduced Iron Market, by Application

10.3.6 Europe: Direct Reduced Iron Market, by Key Country

10.3.6.1 Germany: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.2 Germany: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.2.1 Germany: Direct Reduced Iron Market, by Form

10.3.6.2.2 Germany: Direct Reduced Iron Market, by Form

10.3.6.2.3 Germany: Direct Reduced Iron Market, by Production Process

10.3.6.2.4 Germany: Direct Reduced Iron Market, by Application

10.3.6.3 France: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.4 France: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.4.1 France: Direct Reduced Iron Market, by Form

10.3.6.4.2 France: Direct Reduced Iron Market, by Form

10.3.6.4.3 France: Direct Reduced Iron Market, by Production Process

10.3.6.4.4 France: Direct Reduced Iron Market, by Application

10.3.6.5 Italy: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.6 Italy: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.6.1 Italy: Direct Reduced Iron Market, by Form

10.3.6.6.2 Italy: Direct Reduced Iron Market, by Form

10.3.6.6.3 Italy: Direct Reduced Iron Market, by Production Process

10.3.6.6.4 Italy: Direct Reduced Iron Market, by Application

10.3.6.7 United Kingdom: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.8 United Kingdom: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.8.1 United Kingdom: Direct Reduced Iron Market, by Form

10.3.6.8.2 United Kingdom: Direct Reduced Iron Market, by Form

10.3.6.8.3 United Kingdom: Direct Reduced Iron Market, by Production Process

10.3.6.8.4 United Kingdom: Direct Reduced Iron Market, by Application

10.3.6.9 Russia: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.10 Russia: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.10.1 Russia: Direct Reduced Iron Market, by Form

10.3.6.10.2 Russia: Direct Reduced Iron Market, by Form

10.3.6.10.3 Russia: Direct Reduced Iron Market, by Production Process

10.3.6.10.4 Russia: Direct Reduced Iron Market, by Application

10.3.6.11 Rest of Europe: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.3.6.12 Rest of Europe: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.3.6.12.1 Rest of Europe: Direct Reduced Iron Market, by Form

10.3.6.12.2 Rest of Europe: Direct Reduced Iron Market, by Form

10.3.6.12.3 Rest of Europe: Direct Reduced Iron Market, by Production Process

10.3.6.12.4 Rest of Europe: Direct Reduced Iron Market, by Application

10.4 Asia Pacific: Direct Reduced Iron Market

10.4.1 Asia Pacific: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.4.2 Asia Pacific: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.3 Asia Pacific: Direct Reduced Iron Market, by Form

10.4.4 Asia Pacific: Direct Reduced Iron Market, by Production Process

10.4.5 Asia Pacific: Direct Reduced Iron Market, by Application

10.4.6 Asia Pacific: Direct Reduced Iron Market, by Key Country

10.4.6.1 Malaysia: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.2 Malaysia: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.2.1 Malaysia: Direct Reduced Iron Market, by Form

10.4.6.2.2 Malaysia: Direct Reduced Iron Market, by Form

10.4.6.2.3 Malaysia: Direct Reduced Iron Market, by Production Process

10.4.6.2.4 Malaysia: Direct Reduced Iron Market, by Application

10.4.6.3 China: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.4 China: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.4.1 China: Direct Reduced Iron Market, by Form

10.4.6.4.2 China: Direct Reduced Iron Market, by Form

10.4.6.4.3 China: Direct Reduced Iron Market, by Production Process

10.4.6.4.4 China: Direct Reduced Iron Market, by Application

10.4.6.5 India: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.6 India: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.6.1 India: Direct Reduced Iron Market, by Form

10.4.6.6.2 India: Direct Reduced Iron Market, by Form

10.4.6.6.3 India: Direct Reduced Iron Market, by Production Process

10.4.6.6.4 India: Direct Reduced Iron Market, by Application

10.4.6.7 Japan: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.8 Japan: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.8.1 Japan: Direct Reduced Iron Market, by Form

10.4.6.8.2 Japan: Direct Reduced Iron Market, by Form

10.4.6.8.3 Japan: Direct Reduced Iron Market, by Production Process

10.4.6.8.4 Japan: Direct Reduced Iron Market, by Application

10.4.6.9 South Korea: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.10 South Korea: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.10.1 South Korea: Direct Reduced Iron Market, by Form

10.4.6.10.2 South Korea: Direct Reduced Iron Market, by Form

10.4.6.10.3 South Korea: Direct Reduced Iron Market, by Production Process

10.4.6.10.4 South Korea: Direct Reduced Iron Market, by Application

10.4.6.11 Rest of Asia Pacific: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.12 Rest of Asia Pacific: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.12.1 Rest of Asia Pacific: Direct Reduced Iron Market, by Form

10.4.6.12.2 Rest of Asia Pacific: Direct Reduced Iron Market, by Form

10.4.6.12.3 Rest of Asia Pacific: Direct Reduced Iron Market, by Production Process

10.4.6.12.4 Rest of Asia Pacific: Direct Reduced Iron Market, by Application

10.5 Middle East and Africa: Direct Reduced Iron Market

10.5.1 Middle East and Africa: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.2 Middle East and Africa: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.3 Middle East and Africa: Direct Reduced Iron Market, by Form

10.5.4 Middle East and Africa: Direct Reduced Iron Market, by Production Process

10.5.5 Middle East and Africa: Direct Reduced Iron Market, by Application

10.5.6 Middle East and Africa: Direct Reduced Iron Market, by Key Country

10.5.6.1 Iran: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.2 Iran: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.2.1 Iran: Direct Reduced Iron Market, by Form

10.5.6.2.2 Iran: Direct Reduced Iron Market, by Form

10.5.6.2.3 Iran: Direct Reduced Iron Market, by Production Process

10.5.6.2.4 Iran: Direct Reduced Iron Market, by Application

10.5.6.3 Saudi Arabia: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.4 Saudi Arabia: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.4.1 Saudi Arabia: Direct Reduced Iron Market, by Form

10.5.6.4.2 Saudi Arabia: Direct Reduced Iron Market, by Form

10.5.6.4.3 Saudi Arabia: Direct Reduced Iron Market, by Production Process

10.5.6.4.4 Saudi Arabia: Direct Reduced Iron Market, by Application

10.5.6.5 UAE: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.6 UAE: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.6.1 UAE: Direct Reduced Iron Market, by Form

10.5.6.6.2 UAE: Direct Reduced Iron Market, by Form

10.5.6.6.3 UAE: Direct Reduced Iron Market, by Production Process

10.5.6.6.4 UAE: Direct Reduced Iron Market, by Application

10.5.6.7 Rest of Middle East & Africa: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.8 Rest of Middle East & Africa: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.8.1 Rest of Middle East & Africa: Direct Reduced Iron Market, by Form

10.5.6.8.2 Rest of Middle East & Africa: Direct Reduced Iron Market, by Form

10.5.6.8.3 Rest of Middle East & Africa: Direct Reduced Iron Market, by Production Process

10.5.6.8.4 Rest of Middle East & Africa: Direct Reduced Iron Market, by Application

10.6 South & Central America: Direct Reduced Iron Market

10.6.1 South & Central America: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.2 South & Central America: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.3 South & Central America: Direct Reduced Iron Market, by Form

10.6.4 South & Central America: Direct Reduced Iron Market, by Production Process

10.6.5 South & Central America: Direct Reduced Iron Market, by Application

10.6.6 South & Central America: Direct Reduced Iron Market, by Key Country

10.6.6.1 Brazil: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.6.2 Brazil: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.6.2.1 Brazil: Direct Reduced Iron Market, by Form

10.6.6.2.2 Brazil: Direct Reduced Iron Market, by Form

10.6.6.2.3 Brazil: Direct Reduced Iron Market, by Production Process

10.6.6.2.4 Brazil: Direct Reduced Iron Market, by Application

10.6.6.3 Argentina: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.6.4 Argentina: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.6.4.1 Argentina: Direct Reduced Iron Market, by Form

10.6.6.4.2 Argentina: Direct Reduced Iron Market, by Form

10.6.6.4.3 Argentina: Direct Reduced Iron Market, by Production Process

10.6.6.4.4 Argentina: Direct Reduced Iron Market, by Application

10.6.6.5 Rest of South & Central America: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.6.6 Rest of South & Central America: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.6.6.1 Rest of South & Central America: Direct Reduced Iron Market, by Form

10.6.6.6.2 Rest of South & Central America: Direct Reduced Iron Market, by Form

10.6.6.6.3 Rest of South & Central America: Direct Reduced Iron Market, by Production Process

10.6.6.6.4 Rest of South & Central America: Direct Reduced Iron Market, by Application

10.2 North America: Direct Reduced Iron Market

10.2.1 North America: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.2.2 North America: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.2.3 North America: Direct Reduced Iron Market, by Form

10.2.4 North America: Direct Reduced Iron Market, by Production Process

10.2.5 North America: Direct Reduced Iron Market, by Application

10.2.6 North America: Direct Reduced Iron Market, by Key Country

10.2.6.1 US: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.2.6.2 US: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.2.6.2.1 US: Direct Reduced Iron Market, by Form

10.2.6.2.2 US: Direct Reduced Iron Market, by Form

10.2.6.2.3 US: Direct Reduced Iron Market, by Production Process

10.2.6.2.4 US: Direct Reduced Iron Market, by Application

10.2.6.3 Canada: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.2.6.4 Canada: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.2.6.4.1 Canada: Direct Reduced Iron Market, by Form

10.2.6.4.2 Canada: Direct Reduced Iron Market, by Form

10.2.6.4.3 Canada: Direct Reduced Iron Market, by Production Process

10.2.6.4.4 Canada: Direct Reduced Iron Market, by Application

10.2.6.5 Mexico: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.2.6.6 Mexico: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.2.6.6.1 Mexico: Direct Reduced Iron Market, by Form

10.2.6.6.2 Mexico: Direct Reduced Iron Market, by Form

10.2.6.6.3 Mexico: Direct Reduced Iron Market, by Production Process

10.2.6.6.4 Mexico: Direct Reduced Iron Market, by Application

10.3 Europe: Direct Reduced Iron Market

10.3.1 Europe: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.2 Europe: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.3 Europe: Direct Reduced Iron Market, by Form

10.3.4 Europe: Direct Reduced Iron Market, by Production Process

10.3.5 Europe: Direct Reduced Iron Market, by Application

10.3.6 Europe: Direct Reduced Iron Market, by Key Country

10.3.6.1 Germany: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.2 Germany: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.2.1 Germany: Direct Reduced Iron Market, by Form

10.3.6.2.2 Germany: Direct Reduced Iron Market, by Form

10.3.6.2.3 Germany: Direct Reduced Iron Market, by Production Process

10.3.6.2.4 Germany: Direct Reduced Iron Market, by Application

10.3.6.3 France: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.4 France: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.4.1 France: Direct Reduced Iron Market, by Form

10.3.6.4.2 France: Direct Reduced Iron Market, by Form

10.3.6.4.3 France: Direct Reduced Iron Market, by Production Process

10.3.6.4.4 France: Direct Reduced Iron Market, by Application

10.3.6.5 Italy: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.6 Italy: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.6.1 Italy: Direct Reduced Iron Market, by Form

10.3.6.6.2 Italy: Direct Reduced Iron Market, by Form

10.3.6.6.3 Italy: Direct Reduced Iron Market, by Production Process

10.3.6.6.4 Italy: Direct Reduced Iron Market, by Application

10.3.6.7 United Kingdom: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.8 United Kingdom: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.8.1 United Kingdom: Direct Reduced Iron Market, by Form

10.3.6.8.2 United Kingdom: Direct Reduced Iron Market, by Form

10.3.6.8.3 United Kingdom: Direct Reduced Iron Market, by Production Process

10.3.6.8.4 United Kingdom: Direct Reduced Iron Market, by Application

10.3.6.9 Russia: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

10.3.6.10 Russia: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

10.3.6.10.1 Russia: Direct Reduced Iron Market, by Form

10.3.6.10.2 Russia: Direct Reduced Iron Market, by Form

10.3.6.10.3 Russia: Direct Reduced Iron Market, by Production Process

10.3.6.10.4 Russia: Direct Reduced Iron Market, by Application

10.3.6.11 Rest of Europe: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.3.6.12 Rest of Europe: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.3.6.12.1 Rest of Europe: Direct Reduced Iron Market, by Form

10.3.6.12.2 Rest of Europe: Direct Reduced Iron Market, by Form

10.3.6.12.3 Rest of Europe: Direct Reduced Iron Market, by Production Process

10.3.6.12.4 Rest of Europe: Direct Reduced Iron Market, by Application

10.4 Asia Pacific: Direct Reduced Iron Market

10.4.1 Asia Pacific: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.4.2 Asia Pacific: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.3 Asia Pacific: Direct Reduced Iron Market, by Form

10.4.4 Asia Pacific: Direct Reduced Iron Market, by Production Process

10.4.5 Asia Pacific: Direct Reduced Iron Market, by Application

10.4.6 Asia Pacific: Direct Reduced Iron Market, by Key Country

10.4.6.1 Malaysia: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.2 Malaysia: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.2.1 Malaysia: Direct Reduced Iron Market, by Form

10.4.6.2.2 Malaysia: Direct Reduced Iron Market, by Form

10.4.6.2.3 Malaysia: Direct Reduced Iron Market, by Production Process

10.4.6.2.4 Malaysia: Direct Reduced Iron Market, by Application

10.4.6.3 China: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.4 China: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.4.1 China: Direct Reduced Iron Market, by Form

10.4.6.4.2 China: Direct Reduced Iron Market, by Form

10.4.6.4.3 China: Direct Reduced Iron Market, by Production Process

10.4.6.4.4 China: Direct Reduced Iron Market, by Application

10.4.6.5 India: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.6 India: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.6.1 India: Direct Reduced Iron Market, by Form

10.4.6.6.2 India: Direct Reduced Iron Market, by Form

10.4.6.6.3 India: Direct Reduced Iron Market, by Production Process

10.4.6.6.4 India: Direct Reduced Iron Market, by Application

10.4.6.7 Japan: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.8 Japan: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.8.1 Japan: Direct Reduced Iron Market, by Form

10.4.6.8.2 Japan: Direct Reduced Iron Market, by Form

10.4.6.8.3 Japan: Direct Reduced Iron Market, by Production Process

10.4.6.8.4 Japan: Direct Reduced Iron Market, by Application

10.4.6.9 South Korea: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.10 South Korea: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.10.1 South Korea: Direct Reduced Iron Market, by Form

10.4.6.10.2 South Korea: Direct Reduced Iron Market, by Form

10.4.6.10.3 South Korea: Direct Reduced Iron Market, by Production Process

10.4.6.10.4 South Korea: Direct Reduced Iron Market, by Application

10.4.6.11 Rest of Asia Pacific: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

10.4.6.12 Rest of Asia Pacific: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.4.6.12.1 Rest of Asia Pacific: Direct Reduced Iron Market, by Form

10.4.6.12.2 Rest of Asia Pacific: Direct Reduced Iron Market, by Form

10.4.6.12.3 Rest of Asia Pacific: Direct Reduced Iron Market, by Production Process

10.4.6.12.4 Rest of Asia Pacific: Direct Reduced Iron Market, by Application

10.5 Middle East and Africa: Direct Reduced Iron Market

10.5.1 Middle East and Africa: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.2 Middle East and Africa: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.3 Middle East and Africa: Direct Reduced Iron Market, by Form

10.5.4 Middle East and Africa: Direct Reduced Iron Market, by Production Process

10.5.5 Middle East and Africa: Direct Reduced Iron Market, by Application

10.5.6 Middle East and Africa: Direct Reduced Iron Market, by Key Country

10.5.6.1 Iran: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.2 Iran: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.2.1 Iran: Direct Reduced Iron Market, by Form

10.5.6.2.2 Iran: Direct Reduced Iron Market, by Form

10.5.6.2.3 Iran: Direct Reduced Iron Market, by Production Process

10.5.6.2.4 Iran: Direct Reduced Iron Market, by Application

10.5.6.3 Saudi Arabia: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.4 Saudi Arabia: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.4.1 Saudi Arabia: Direct Reduced Iron Market, by Form

10.5.6.4.2 Saudi Arabia: Direct Reduced Iron Market, by Form

10.5.6.4.3 Saudi Arabia: Direct Reduced Iron Market, by Production Process

10.5.6.4.4 Saudi Arabia: Direct Reduced Iron Market, by Application

10.5.6.5 UAE: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.6 UAE: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.6.1 UAE: Direct Reduced Iron Market, by Form

10.5.6.6.2 UAE: Direct Reduced Iron Market, by Form

10.5.6.6.3 UAE: Direct Reduced Iron Market, by Production Process

10.5.6.6.4 UAE: Direct Reduced Iron Market, by Application

10.5.6.7 Rest of Middle East & Africa: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.5.6.8 Rest of Middle East & Africa: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.5.6.8.1 Rest of Middle East & Africa: Direct Reduced Iron Market, by Form

10.5.6.8.2 Rest of Middle East & Africa: Direct Reduced Iron Market, by Form

10.5.6.8.3 Rest of Middle East & Africa: Direct Reduced Iron Market, by Production Process

10.5.6.8.4 Rest of Middle East & Africa: Direct Reduced Iron Market, by Application

10.6 South & Central America: Direct Reduced Iron Market

10.6.1 South & Central America: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.2 South & Central America: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.3 South & Central America: Direct Reduced Iron Market, by Form

10.6.4 South & Central America: Direct Reduced Iron Market, by Production Process

10.6.5 South & Central America: Direct Reduced Iron Market, by Application

10.6.6 South & Central America: Direct Reduced Iron Market, by Key Country

10.6.6.1 Brazil: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.6.2 Brazil: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.6.2.1 Brazil: Direct Reduced Iron Market, by Form

10.6.6.2.2 Brazil: Direct Reduced Iron Market, by Form

10.6.6.2.3 Brazil: Direct Reduced Iron Market, by Production Process

10.6.6.2.4 Brazil: Direct Reduced Iron Market, by Application

10.6.6.3 Argentina: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.6.4 Argentina: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.6.4.1 Argentina: Direct Reduced Iron Market, by Form

10.6.6.4.2 Argentina: Direct Reduced Iron Market, by Form

10.6.6.4.3 Argentina: Direct Reduced Iron Market, by Production Process

10.6.6.4.4 Argentina: Direct Reduced Iron Market, by Application

10.6.6.5 Rest of South & Central America: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

10.6.6.6 Rest of South & Central America: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

10.6.6.6.1 Rest of South & Central America: Direct Reduced Iron Market, by Form

10.6.6.6.2 Rest of South & Central America: Direct Reduced Iron Market, by Form

10.6.6.6.3 Rest of South & Central America: Direct Reduced Iron Market, by Production Process

10.6.6.6.4 Rest of South & Central America: Direct Reduced Iron Market, by Application

11. Impact of COVID-19 Pandemic on Direct Reduced Iron Market

11.1 Overview

11.2 Impact of COVID-19 on Direct Reduced Iron Market

11.3 North America: Impact Assessment of COVID-19 Pandemic

11.4 Europe: Impact Assessment of COVID-19 Pandemic

11.5 Asia Pacific: Impact Assessment of COVID-19 Pandemic

11.6 Middle East & Africa: Impact Assessment of COVID-19 Pandemic

11.7 South & Central America: Impact Assessment of COVID-19 Pandemic

11.2 Impact of COVID-19 on Direct Reduced Iron Market

11.3 North America: Impact Assessment of COVID-19 Pandemic

11.4 Europe: Impact Assessment of COVID-19 Pandemic

11.5 Asia Pacific: Impact Assessment of COVID-19 Pandemic

11.6 Middle East & Africa: Impact Assessment of COVID-19 Pandemic

11.7 South & Central America: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Merger and Acquisition

12.2 Merger and Acquisition

13. Company Profiles

13.1 Nucor Corp

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Cleveland-Cliffs Inc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Kobe Steel Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 SMS Group GmbH

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Voestalpine AG

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Ternium SA

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 JSW Steel Ltd

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Tenova SpA

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Liberty Steel Group Holdings UK Ltd

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Bharat Engineering Works Pvt Ltd

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Cleveland-Cliffs Inc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Kobe Steel Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 SMS Group GmbH

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Voestalpine AG

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Ternium SA

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 JSW Steel Ltd

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Tenova SpA

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Liberty Steel Group Holdings UK Ltd

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Bharat Engineering Works Pvt Ltd

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About the Publisher

14.2 Glossary of Terms

14.2 Glossary of Terms

List of Tables

Table 1. Direct Reduced Iron (DRI) Market -Volume and Forecast to 2030 (Kilo Tons)

Table 2. Direct Reduced Iron (DRI) Market -Revenue and Forecast to 2030 (US$ Million)

Table 3. Global Direct Reduced Iron Market, by Form - Volume and Forecast to 2028 (Kilo Tons)

Table 4. Global Direct Reduced Iron (DRI) Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 5. Global Direct Reduced Iron (DRI) Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 6. Global Direct Reduced Iron (DRI) Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 7. North America Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 8. North America Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 9. North America Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 10. North America Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 11. US Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 12. US Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 13. US Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 14. US Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 15. Canada: Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 16. Canada: Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 17. Canada: Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 18. Canada: Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 19. Mexico Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 20. Mexico Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 21. Mexico Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 22. Mexico Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 23. Europe Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 24. Europe Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 25. Europe Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 26. Europe Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 27. Germany Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 28. Germany Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 29. Germany Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 30. Germany Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 31. France Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 32. France Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 33. France Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 34. France Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 35. Italy Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 36. Italy Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 37. Italy Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 38. Italy Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 39. United Kingdom Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 40. United Kingdom Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 41. United Kingdom Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 42. United Kingdom Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 43. Russia: Direct Reduced Iron Market, by Form- Volume and Forecast to 2030 (Kilo Tons)

Table 44. Russia: Direct Reduced Iron Market, by Form- Revenue and Forecast to 2030 (US$ Million)

Table 45. Russia: Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 46. Russia: Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 47. Rest of Europe Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 48. Rest of Europe Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 49. Rest of Europe Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 50. Rest of Europe Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 51. Asia Pacific Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 52. Asia Pacific Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 53. Asia Pacific Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 54. Asia Pacific Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 55. Malaysia Direct Reduced Iron Market, by Form- Volume and Forecast to 2030 (Kilo Tons)

Table 56. Malaysia Direct Reduced Iron Market, by Form- Revenue and Forecast to 2030 (US$ Million)

Table 57. Malaysia Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 58. Malaysia Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 59. China Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 60. China Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 61. China Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 62. China Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 63. India Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 64. India Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 65. India Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 66. India Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 67. Japan Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 68. Japan Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 69. Japan Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 70. Japan Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 71. South Korea Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 72. South Korea Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 73. South Korea Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 74. South Korea Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 75. Rest of Asia Pacific Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 76. Rest of Asia Pacific Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 77. Rest of Asia Pacific Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 78. Rest of Asia Pacific Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 83. Iran Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 84. Iran Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 85. Iran Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 86. Iran Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 87. Saudi Arabia Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 88. Saudi Arabia Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 89. Saudi Arabia Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 90. Saudi Arabia Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 91. UAE Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 92. UAE Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 93. UAE Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 94. UAE Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 95. Rest of Middle East & Africa Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 96. Rest of Middle East & Africa Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 97. Rest of Middle East & Africa Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 98. Rest of Middle East & Africa Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 99. South & Central America Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 100. South & Central America Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 101. South & Central America Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 102. South & Central America Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 103. Brazil Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 104. Brazil Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 105. Brazil Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 106. Brazil Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 107. Argentina Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 108. Argentina Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 109. Argentina Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 110. Argentina Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 111. Rest of South & Central America Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 112. Rest of South & Central America Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 113. Rest of South & Central America Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 114. Rest of South & Central America Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 115. Glossary of Terms, Global Direct Reduced Iron (DRI) Market

Table 2. Direct Reduced Iron (DRI) Market -Revenue and Forecast to 2030 (US$ Million)

Table 3. Global Direct Reduced Iron Market, by Form - Volume and Forecast to 2028 (Kilo Tons)

Table 4. Global Direct Reduced Iron (DRI) Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 5. Global Direct Reduced Iron (DRI) Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 6. Global Direct Reduced Iron (DRI) Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 7. North America Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 8. North America Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 9. North America Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 10. North America Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 11. US Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 12. US Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 13. US Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 14. US Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 15. Canada: Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 16. Canada: Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 17. Canada: Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 18. Canada: Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 19. Mexico Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 20. Mexico Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 21. Mexico Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 22. Mexico Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 23. Europe Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 24. Europe Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 25. Europe Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 26. Europe Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 27. Germany Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 28. Germany Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 29. Germany Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 30. Germany Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 31. France Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 32. France Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 33. France Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 34. France Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 35. Italy Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 36. Italy Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 37. Italy Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 38. Italy Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 39. United Kingdom Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 40. United Kingdom Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 41. United Kingdom Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 42. United Kingdom Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 43. Russia: Direct Reduced Iron Market, by Form- Volume and Forecast to 2030 (Kilo Tons)

Table 44. Russia: Direct Reduced Iron Market, by Form- Revenue and Forecast to 2030 (US$ Million)

Table 45. Russia: Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 46. Russia: Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 47. Rest of Europe Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 48. Rest of Europe Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 49. Rest of Europe Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 50. Rest of Europe Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 51. Asia Pacific Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 52. Asia Pacific Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 53. Asia Pacific Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 54. Asia Pacific Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 55. Malaysia Direct Reduced Iron Market, by Form- Volume and Forecast to 2030 (Kilo Tons)

Table 56. Malaysia Direct Reduced Iron Market, by Form- Revenue and Forecast to 2030 (US$ Million)

Table 57. Malaysia Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 58. Malaysia Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 59. China Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 60. China Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 61. China Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 62. China Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 63. India Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 64. India Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 65. India Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 66. India Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 67. Japan Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 68. Japan Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 69. Japan Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 70. Japan Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 71. South Korea Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 72. South Korea Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 73. South Korea Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 74. South Korea Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 75. Rest of Asia Pacific Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 76. Rest of Asia Pacific Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 77. Rest of Asia Pacific Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 78. Rest of Asia Pacific Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 83. Iran Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 84. Iran Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 85. Iran Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 86. Iran Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 87. Saudi Arabia Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 88. Saudi Arabia Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 89. Saudi Arabia Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 90. Saudi Arabia Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 91. UAE Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 92. UAE Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 93. UAE Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 94. UAE Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 95. Rest of Middle East & Africa Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 96. Rest of Middle East & Africa Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 97. Rest of Middle East & Africa Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 98. Rest of Middle East & Africa Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 99. South & Central America Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 100. South & Central America Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 101. South & Central America Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 102. South & Central America Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 103. Brazil Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 104. Brazil Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 105. Brazil Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 106. Brazil Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 107. Argentina Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 108. Argentina Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 109. Argentina Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 110. Argentina Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 111. Rest of South & Central America Direct Reduced Iron Market, by Form - Volume and Forecast to 2030 (Kilo Tons)

Table 112. Rest of South & Central America Direct Reduced Iron Market, by Form - Revenue and Forecast to 2030 (US$ Million)

Table 113. Rest of South & Central America Direct Reduced Iron Market, by Production Process - Revenue and Forecast to 2030 (US$ Million)

Table 114. Rest of South & Central America Direct Reduced Iron Market, by Application - Revenue and Forecast to 2030 (US$ Million)

Table 115. Glossary of Terms, Global Direct Reduced Iron (DRI) Market

List of Figures

Figure 1. Direct Reduced Iron (DRI) Market Segmentation

Figure 2. Direct Reduced Iron (DRI) Market Segmentation - By Geography

Figure 3. Global Direct Reduced Iron (DRI) Market Overview

Figure 4. Global Direct Reduced Iron (DRI) Market, By Form

Figure 5. Global Direct Reduced Iron (DRI) Market, by Geography

Figure 6. Global Direct Reduced Iron (DRI) Market, Industry Landscape

Figure 7. Porter’s Five Forces Analysis of Direct Reduced Iron (DRI) Market

Figure 8. Direct Reduced Iron (DRI) Market, Ecosystem

Figure 9. Expert Opinion

Figure 10. Global Direct Reduced Iron (DRI) Market Impact Analysis of Drivers and Restraints

Figure 11. Geographic Overview of Direct Reduced Iron (DRI) Market

Figure 12. Direct Reduced Iron (DRI) Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 13. Direct Reduced Iron (DRI) Market - Revenue and Forecast to 2030 (US$ Million)

Figure 14. Direct Reduced Iron (DRI) Market Revenue Share, By Form (2022 and 2030)

Figure 15. Lumps: Direct Reduced Iron (DRI) Market - Volume and Forecast To 2030 (Kilo Tons)

Figure 16. Lumps: Direct Reduced Iron (DRI) Market - Revenue and Forecast To 2030 (US$ Million)

Figure 17. Pellets: Direct Reduced Iron (DRI) Market - Volume and Forecast To 2030 (Kilo Tons)

Figure 18. Pellets: Direct Reduced Iron (DRI) Market - Revenue and Forecast To 2030 (US$ Million)

Figure 19. Fine: Direct Reduced Iron (DRI) Market - Volume and Forecast To 2030 (Kilo Tons)

Figure 20. Fine: Direct Reduced Iron (DRI) Market - Revenue and Forecast To 2030 (US$ Million)

Figure 21. Direct Reduced Iron (DRI) Market Revenue Share, By Production Process (2022 and 2030)

Figure 22. Coal Based: Direct Reduced Iron (DRI) Market - Revenue and Forecast To 2030 (US$ Million)

Figure 23. Gas Based: Direct Reduced Iron (DRI) Market - Revenue and Forecast To 2030 (US$ Million)

Figure 24. Direct Reduced Iron (DRI) Market Revenue Share, By Application (2022 and 2030)

Figure 25. Steel Making: Direct Reduced Iron (DRI) Market - Revenue and Forecast To 2030 (US$ Million)

Figure 26. Construction: Direct Reduced Iron (DRI) Market - Revenue and Forecast To 2030 (US$ Million)

Figure 27. Global Direct Reduced Iron Market Revenue Share, by Region (2022 and 2030)

Figure 28. North America: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

Figure 29. North America: Direct Reduced Iron Market - Revenue and Forecast to 2030 (US$ Million)

Figure 30. North America: Direct Reduced Iron Market Revenue Share, by Form (2022 and 2030)

Figure 31. North America: Direct Reduced Iron Market Revenue Share, by Production Process (2022 and 2030)

Figure 32. North America: Direct Reduced Iron Market Revenue Share, by Application (2022 and 2030)

Figure 33. North America: Direct Reduced Iron Market Revenue Share, by Key Country (2022 and 2030)

Figure 34. US: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

Figure 35. US: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 36. Canada: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

Figure 37. Canada: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

Figure 38. Mexico: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

Figure 39. Mexico: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

Figure 40. Europe: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

Figure 41. Europe: Direct Reduced Iron Market- Revenue and Forecast to 2030 (US$ Million)

Figure 42. Europe: Direct Reduced Iron Market Revenue Share, by Form (2022 and 2030)

Figure 43. Europe: Direct Reduced Iron Market Revenue Share, by Production Process (2022 and 2030)

Figure 44. Europe: Direct Reduced Iron Market Revenue Share, by Application (2022 and 2030)

Figure 45. Europe: Direct Reduced Iron Market Revenue Share, by Key Country (2022 and 2030)

Figure 46. Germany: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

Figure 47. Germany: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

Figure 48. France: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

Figure 49. France: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

Figure 50. Italy: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

Figure 51. Italy: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

Figure 52. United Kingdom: Direct Reduced Iron Market-Volume and Forecast to 2030 (Kilo Tons)

Figure 53. United Kingdom: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

Figure 54. Russia: Direct Reduced Iron Market- Volume and Forecast to 2030 (Kilo Tons)

Figure 55. Russia: Direct Reduced Iron Market-Revenue and Forecast to 2030 (US$ Million)

Figure 56. Rest of Europe: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 57. Rest of Europe: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 58. Asia Pacific: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 59. Asia Pacific: Direct Reduced Iron Market - Revenue and Forecast to 2030 (US$ Million)

Figure 60. Asia Pacific: Direct Reduced Iron Market Revenue Share, by Form (2022 and 2030)

Figure 61. Asia Pacific: Direct Reduced Iron Market Revenue Share, by Production Process (2022 and 2030)

Figure 62. Asia Pacific: Direct Reduced Iron Market Revenue Share, by Application (2022 and 2030)

Figure 63. Asia Pacific: Direct Reduced Iron Market Revenue Share, by Key Country (2022 and 2030)

Figure 64. Malaysia: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 65. Malaysia: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 66. China: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 67. China: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 68. India: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 69. India: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 70. Japan: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 71. Japan: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 72. South Korea: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 73. South Korea: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 74. Rest of Asia Pacific: Direct Reduced Iron Market - Volume and Forecast to 2030 (Kilo Tons)

Figure 75. Rest of Asia Pacific: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)

Figure 76. Middle East and Africa: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

Figure 77. Middle East and Africa: Direct Reduced Iron Market - Revenue and Forecast to 2030 (US$ Million)

Figure 78. Middle East and Africa: Direct Reduced Iron Market Revenue Share, by Form (2022 and 2030)

Figure 79. Middle East and Africa: Direct Reduced Iron Market Revenue Share, by Production Process (2022 and 2030)

Figure 80. Middle East and Africa: Direct Reduced Iron Market Revenue Share, by Application (2022 and 2030)

Figure 81. Middle East and Africa: Direct Reduced Iron Market Revenue Share, by Key Country (2022 and 2030)

Figure 82. Iran: Direct Reduced Iron Market -Volume and Forecast to 2030 (Kilo Tons)

Figure 83. Iran: Direct Reduced Iron Market -Revenue and Forecast to 2030 (US$ Million)