Fiberglass pipes are corrosion-resistant alternative to metal and other conventional pipes. Fiberglass pipes comprise of several characteristics such as high durability, corrosion resistance, abrasion resistance, non-conductive nature to electricity, low maintenance cost, and chemical resistance, among others, which enhance its application across various industries. These pipes are widely used across several industries such as petrochemical, oil & gas, chemicals, water treatment, and power plants, among others.

Based on end-use, the global fiberglass pipes market is segmented into oil & gas, sewage, chemicals, agriculture, and others. In 2022, the oil & gas segment held a largest market share and chemicals segment is expected to be the fastest growing segment during the forecast period. Fiberglass pipes are utilized in chemical plants to transport chemical liquids and industrial gases. They are a better solution for transporting chemicals with high PH value and are also cost-efficient. Fiberglass pipes have good resistance to the atmosphere, water, and general concentrations of acids, alkalis, salts, and various oils and solvents. It has good design ability and can flexibly design multiple products according to needs to meet industrial requirements. Fiberglass pipes are lightweight with high-strength, as compared to other pipes, due to which these pipes are easy to install and convenient to transport.

The global fiberglass pipes market is segmented into Asia Pacific, Europe, Middle East & Africa, North America, and South & Central America. In 2022, Asia Pacific held the largest share of the global fiberglass pipes market and is expected to grow at the fastest CAGR during the forecast period. The chemical manufacturing industry is an important part of manufactured exports for several Asian nations, including China, South Korea, India, and Japan. According to the International Council of Chemical Associations (ICCA), the Asia Pacific chemical industry is the largest contributor to the region’s GDP and employment, generating 45% of the industry's total annual economic value and 69% of all jobs supported. All major Asian economies heavily depend on oil imports from the Middle East & Africa. Various countries in the region have initiated projects to cater to the growing demand for oil and gas. For instance, in April 2023, Asia's largest underwater hydro-carbon pipeline, below the river Brahmaputra connecting Jorhat and Majuli in Assam, India, was completed by the Indradhanush Gas Grid Limited (IGGL). Thus, the growing investments in oil & gas related projects are expected to boost the fiberglass pipes market.

The COVID-19 pandemic affected economies and industries in various countries across all the continents with lockdowns, travel restrictions, and business shutdowns. These shutdowns disturbed global supply chains, manufacturing activities, delivery schedules, and product sales. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. Asia reported shortage of fiberglass due to supply chain disruption, transportation delays, and reduced material exports from China. The pandemic restricted the research and development in various end-use industries such as chemicals & materials and agriculture, reducing fiberglass pipes utilization in the region.

Fiberglass pipes are utilized in piping systems of oil & gas and chemical facilities. Therefore, slowdown and slump in production activities of end-use industries significantly reduced the demand for fiberglass pipes. According to the US Bureau of Labor Statistics, the oil demand in China declined due to widespread shutdowns of crude oil facilities. However, the fiberglass pipes market in the region witnessed a significant recovery due to the growing demand from the oil & gas and chemicals’ sectors in 2021. The domestic demand for fiberglass pipes increased in China following the economic recovery in 2021, which would offer more opportunities for fiberglass producers in the domestic market compared to export market, during the forecast period.

Amiblu Holding GmbH, Chemical Process Piping Pvt Ltd, EPP Composites Pvt Ltd, Fibrex FRP Piping Systems, Future Pipe Industries LLC, Gruppo Sarplast Srl, Kuzeyboru AS, Lianyungang Zhongfu Lianzhong Composites Group Co Ltd, NOV Inc, Saudi Arabian Amiantit Co, Sunrise Industries (India) Ltd, Poly Plast Chemi Plants (I) Pvt Ltd, Plasticon Germany GmbH, and Kurotec-KTS GmbH, are among the leading players in the global fiberglass pipes market. These companies are adopting strategies such as mergers & acquisitions and product launches to expand their geographic presence and consumer bases.

The overall global fiberglass pipes market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants, including valuation experts, research analysts, and key opinion leaders-specializing in the global fiberglass pipes market.

Table of Contents

Companies Mentioned

- Amiblu Holding GmbH

- Chemical Process Piping Pvt Ltd

- EPP Composites Pvt Ltd

- Fibrex LLC

- Future Pipe Industries LLC

- Gruppo Sarplast Srl

- Kuzeyboru AS

- Lianyungang Zhongfu Lianzhong Composites Group Co Ltd

- NOV Inc

- Saudi Arabian Amiantit Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | June 2023 |

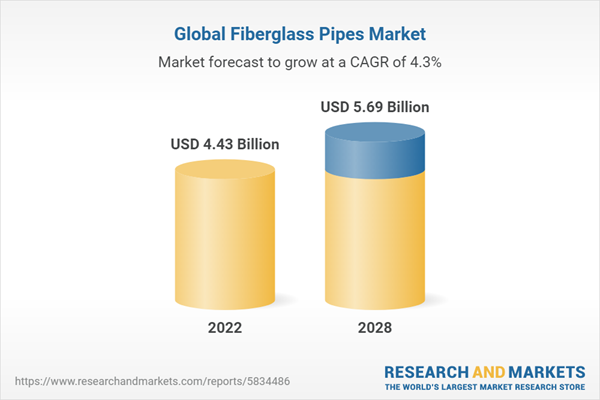

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 4.43 Billion |

| Forecasted Market Value ( USD | $ 5.69 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |