This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

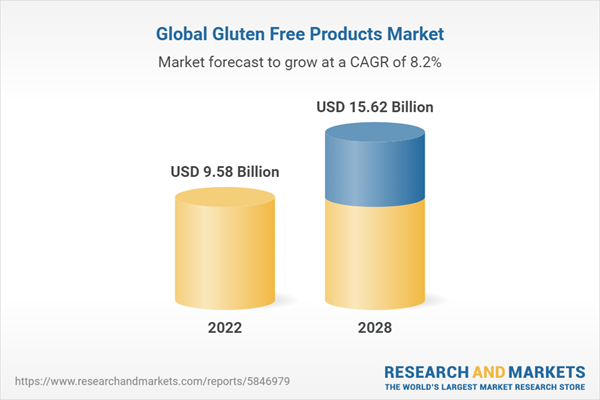

According to the research report, Global Gluten Free Products Market Outlook, 2028 the market is expected to reach market size of USD 15.62 Billion by 2028 with a significant CAGR of 8.15% from USD 9.85 Billion in 2022. Due to their demanding schedules and stressful lifestyles, customers are increasingly opting for gluten-free, ready-to-eat meals, pasta, and baby food items. There is also an increasing need for weight-control programmes and diet plans that incorporate grain-free dietary options. Consumers' increased need for convenience and ready-to-eat meals due to their ease of consumption and preparation has boosted product demand. They seek ready meals that are rich in nutritional value, natural, and meet their dietary needs without sacrificing taste and flavour. Furthermore, the development of the health-on-the-go trend, particularly among millenials, has led convenience food makers to develop premium convenience foods such as deli-style snacks and ready meals inspired by international cuisines. This element demonstrates consumers' readiness to try new meals, implying abundant prospects for market expansion in the near future. To improve the taste, texture, and nutritional profile of gluten-free products, manufacturers have been focusing on ingredient innovations. They have been using alternative flours and grains, such as rice, corn, quinoa, amaranth, and buckwheat, to develop gluten-free products that closely mimic their gluten-containing counterparts. Gluten-free products are becoming increasingly appealing as a result of technological advances, including product developments. Furthermore, technological breakthroughs in manufacturing processes are being made with the goal of lowering product prices. Extrusion cooking and annealing are two innovative manufacturing procedures that help increase the stiffness of the product while lowering cooking loss. The rising obesity rate is also driving a rise in demand for gluten-free products. As a result, pulses have replaced wheat as a key ingredient in gluten-free products.

North America is leading the market of gluten free products globally with highest market share as well. The gluten-free product industry in North America has expanded significantly in recent years, owing to an increasing prevalence of celiac disease and gluten intolerance among consumers. This market has received a lot of interest from health-conscious people looking for alternate food options. With an increase in demand for gluten-free products. The rising number of working women has increased consumer reliance on gluten-free ready meals and convenience foods. This, in turn, has increased demand for shelf-stable and convenience foods, fueling the expansion of the gluten-free products industry. Furthermore, growing worries about health-related diseases such as physical inactivity and vaccine-preventable diseases, among others, are projected to drive customers to choose gluten-free products. Gluten-related illnesses, such as celiac disease and gluten sensitivity, have witnessed a considerable increase in awareness and diagnosis in North America.

Asia-Pacific is expected to be the fastest growing market of gluten free product market globally. The Asia-Pacific region has experienced significant economic growth, resulting in an increase in disposable income for many individuals. As disposable incomes rise, consumers are willing to spend more on premium and specialized products, including gluten-free options. Apart from gluten-related disorders, there is a general increase in awareness and concern for food allergens in the Asia-Pacific region. This has led to a greater demand for allergen-free products, including gluten-free alternatives. Consumers are seeking products that cater to various dietary restrictions and allergens, making the region a favourable market for gluten-free products. China has a long history of gluten-free dishes that have been staples in its cuisine. Popular cuisines include rice-based dishes like fried rice, gluten-free dim sum options such as rice rolls and steamed dumplings, and gluten-free noodles made from rice, mung bean, or sweet potato starch. Traditional Chinese medicine concepts, which emphasize balance and harmony in food, also influence the development of gluten-free products in China. In Japan, the concept of wagashi has influenced the gluten-free market. Wagashi refers to traditional Japanese confectionery, and there has been a growing trend of creating gluten-free versions of these sweets. Ingredients like mochi (sticky rice cake), red bean paste, and matcha (powdered green tea) are used to make gluten-free wagashi, offering a traditional and gluten-free indulgence.

Based on the report, the market is bifurcated into product types, bakery products ( breads, rolls, buns and cakes, cookies, crackers, wafers and biscuits baking mixes and flours), snacks & RTE products, soups , sauces, pizzas & pasta and other types( condiments & dressings, dairy Products , gluten-free baby food, meats/ meats alternatives). Among them the bakery products dominating the gluten free market globally. Bakery products provide gluten-free baked foods such as cookies, pastries, breads, and many more. Because bakery items are commonplace in Europe and North America, their popularity has grown among gluten-free and health-conscious consumers. Furthermore, increased innovation in the bakery sector in developing nations such as India, China, Brazil, and others is projected to boost bakery product market growth. Furthermore during the forecast period snacks and RTE products are expected to register highest CAGR of the market. The form type of the market include, solid and liquid. Solid segment is leading the market of gluten free products globally. Solid forms provide a wide range of options for gluten-free products. This includes solid foods like bread, pasta, cereals, snacks, and baked goods. These products are often seen as direct substitutes for their gluten-containing counterparts, offering consumers a similar experience in terms of taste and texture. Solid forms of gluten-free products are favoured by many consumers because they are convenient, familiar, and easy to incorporate into their daily diets. Solid foods are often associated with meals and snacks, making them a natural choice for those seeking gluten-free alternatives. During the anticipated time frame the liquid form is expected to register maximum CAGR of the market.

According to the report the market is segmented into sources, plant based and animal based. The Plant based sources are the major sources used in gluten free products and is dominating the market with highest market share as well. Gluten-free grains and flours are derived naturally from plant sources such as rice, corn, quinoa, amaranth, buckwheat, millet, and sorghum. These grains are readily available worldwide and serve as the base for many gluten-free goods. Plant-based ingredients in gluten-free products frequently contain a variety of nutrients, including fibre, vitamins, minerals, and antioxidants. These ingredients respond to consumer’s desire for healthier, more nutritious food options. Based on distribution channel the market is divided into specialty stores (bakery stores, confectionery stores, gourmet stores), supermarkets & hypermarkets, online, conventional stores (grocery stores, mass merchandizers, warehouse clubs), others (drugstores & pharmacies). Specialty stores often have a wider selection of gluten-free products compared to mainstream supermarkets. These stores specialize in catering to specific dietary needs and preferences, including gluten-free diets. They carry a diverse range of gluten-free options across various categories, including bread, pasta, snacks, baking ingredients, and more. Specialty stores often dedicate specific sections or aisles to gluten-free products, making it easier for consumers to find and browse through a comprehensive assortment of options. This organized layout enhances the shopping experience for individuals following a gluten-free diet, as they can quickly identify and access the products they need. Speciality stores are one of the major sources of distributing gluten free products. Furthermore during the forecast period online channel is anticipated to grow positively with highest CAGR.

Companies mentioned in the report:

General Mills Inc, The Kellogg Company, Mondelez International, Inc, The Kraft Heinz Company, Barilla Group, Conagra Brands, Inc, Hormel Foods Corporation, The Hershey Company, Dr. Schär AG / SPA, The Hain Celestial Group, Bob's Red Mill, Warburtons Ltd, Avena Foods Limited, Quinoa Corporation, Norside Food Ltd, Freedom Foods Group Ltd, Earth Goods, Ecotone , Amy's Kitchen, Raisio Group.Considered in this report:

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report:

- Global Gluten Free Products market with its value and forecast along with its segments

- Region-wise Gluten Free Products market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

By Product Type:

- Bakery products (Breads, rolls, buns and cakes Cookies, crackers, wafers and biscuits Baking mixes and flours)

- Snacks & RTE Products

- Soups

- Sauces

- Pizzas & Pasta

- Other Types (Condiments & Dressings, Dairy Products , Gluten-free Baby Food, Meats/ Meats Alternatives)

By Form:

- Solid

- Liquid

By Sources:

- Plant (Rice & corn, Oilseeds & Pulses, Others)

- Animal (Dairy, Meat)

By Distribution Channel:

- Specialty Stores(Bakery Stores, Confectionery Stores, Gourment Stores)

- Supermarkets & Hypermarkets

- Online

- Conventional Stores(Grocery Stores, Mass Merchandizers, Warehouse clubs)

- Others(Drugstores & pharmacies)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third party sources such as press releases, annual report of companies, analysing the government generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.Intended audience:

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to Gluten Free Products industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | June 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 9.58 Billion |

| Forecasted Market Value ( USD | $ 15.62 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |