Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Environmental Concerns Regarding the Use of Synthetic Fertilizers & Pesticides

Rising environmental concerns regarding the use of synthetic fertilizers and pesticides are accelerating the adoption of biological alternatives like inoculants in agriculture. These synthetic inputs, while effective in boosting crop yields, have been linked to severe ecological degradation. Globally, it’s estimated that around 64% of agricultural land is contaminated with pesticide residues above safe levels, posing long-term risks to soil health and biodiversity. Moreover, persistent overuse of chemical fertilizers continues to damage ecosystems and pollute waterways, raising alarm among environmentalists and regulatory authorities.Recent findings indicate that more than 50% of river miles in the United States are in poor biological condition, largely due to nitrogen and phosphorus runoff from conventional farming. This nutrient overload contributes to the formation of hypoxic zones in major water bodies, leading to mass die-offs of aquatic life and loss of biodiversity. These side effects have increased calls for stricter regulation on agrochemical usage and heightened interest in environmentally friendly soil additives.

Additionally, in 2024, over 470 different chemicals, including banned pesticides, were found in river and groundwater systems in a single national study, with more than half classified as harmful to aquatic life. This widespread contamination highlights the ongoing threat posed by synthetic agrochemicals, especially when poorly managed or over-applied. Such data reinforces the urgent need to transition toward more sustainable inputs like microbial inoculants, which enhance nutrient efficiency without the harmful runoff.

Another pressing concern is the inefficiency of synthetic nitrogen fertilizers. Studies show that only about 50% of applied nitrogen is taken up by crops, with the remainder lost to the environment through leaching or greenhouse gas emissions. This inefficiency not only contributes to climate change through nitrous oxide, a gas with nearly 300 times the global warming potential of CO₂ but also results in soil degradation and declining long-term fertility. Together, these environmental impacts are pushing both policymakers and farmers to reconsider traditional chemical-based agriculture in favor of biological and regenerative solutions.

Key Market Challenges

Inconsistent Field Performance

Inconsistent field performance remains a critical barrier to the widespread adoption of agricultural inoculants. Unlike chemical fertilizers and pesticides that often deliver predictable and immediate outcomes, the efficacy of inoculants depends heavily on external variables such as soil type, pH, moisture content, microbial competition, and weather conditions. A strain that performs well in one geographic region or soil profile may fail to show results in another, causing uncertainty among farmers.Additionally, native microbial communities already present in the soil can outcompete introduced inoculants, reducing their effectiveness. This variability not only affects crop yields but also undermines farmer trust in biological solutions, particularly in regions where immediate and consistent results are necessary to ensure food security and income stability. As a result, farmers may revert to chemical inputs, perceiving inoculants as unreliable despite their long-term benefits.

Key Market Trends

Shift Toward Organic, Eco Friendly Farming

The shift toward organic and eco-friendly farming is a major trend driving the adoption of agricultural inoculants across the globe. With rising concerns about soil degradation, water pollution, and chemical residues in food, both farmers and consumers are increasingly favoring natural and sustainable farming inputs. Organic farming avoids synthetic fertilizers and pesticides, creating a demand for biologically derived alternatives such as microbial inoculants. These products improve plant nutrient uptake, enhance soil fertility, and promote crop resilience through natural mechanisms. Inoculants, including nitrogen-fixing bacteria and phosphate-solubilizing microbes, align perfectly with organic principles and are often permitted under organic certification programs. As awareness grows about the long-term environmental and health benefits of organic agriculture, governments are offering incentives and technical support to encourage adoption, further strengthening the role of inoculants in sustainable crop production systems.Key Market Players

- Corteva, Inc.

- BASF SE

- Bayer AG

- Novozymes A/S

- Cargill, Incorporated (US)

- Koninklijke DSM N.V.

- Chr. Hansen Holding A/S

- Agrauxine SA

- BIO-Cat Inc

- Kemin Industries, Inc.

Report Scope:

In this report, Global Inoculants market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Inoculants Market, By Type:

- Agricultural Inoculants

- Silage Inoculants

Inoculants Market, By Microbes:

- Bacterial

- Fungal

- Others

Inoculants Market, By Crop Type:

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

- Forage

- Others

Inoculants Market, By Form:

- Liquid

- Dry

Inoculants Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive landscape

Company Profiles: Detailed analysis of the major companies in global Inoculants market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Corteva, Inc.

- BASF SE

- Bayer AG

- Novozymes A/S

- Cargill, Incorporated (US)

- Koninklijke DSM N.V.

- Chr. Hansen Holding A/S

- Agrauxine SA

- BIO-Cat Inc

- Kemin Industries, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

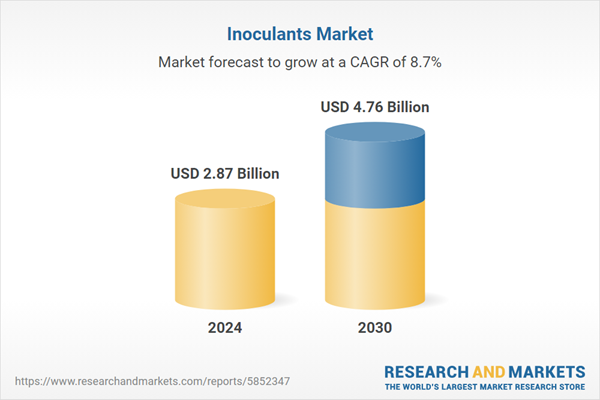

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.87 Billion |

| Forecasted Market Value ( USD | $ 4.76 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |