The market is estimated to reach a value of more than USD 730 million by 2027.

The COVID-19 pandemic positively impacted the Diabetes Drugs market growth in Egypt. Patients with diabetes, infected with COVID-19 may experience elevated blood glucose, abnormal glucose variability, and diabetic complications. The prevalence of diabetes in people with COVID-19 caused a significant increase in severity and mortality of COVID-19 in people with either type 1 (T1DM) or type 2 diabetes mellitus (T2DM), especially in association with poor glycemic control. While new-onset hyperglycemia and new-onset diabetes (both T1DM and T2DM) have been increasingly recognized in the context of COVID-19 and have been associated with worse outcomes. To avoid aggravation, a patient's blood glucose should be monitored and managed regularly.

Diabetic drugs are medicines developed to stabilize and control blood glucose levels amongst people with diabetes. Diabetic drugs are commonly used to manage diabetes. Diabetic drugs have been potential candidates for treating diabetic patients affected by SARS-CoV-2 infection during the COVID-19 pandemic.

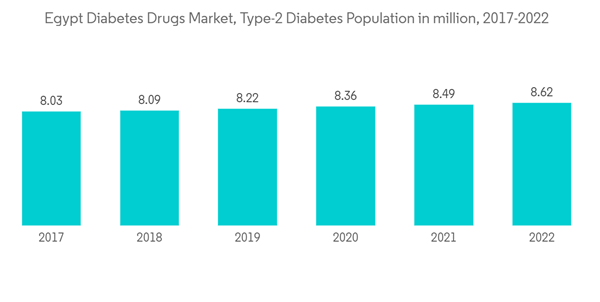

Egypt is the ninth country in terms of Diabetes prevalence worldwide. Currently, as per IDF, about 18.4% of the adult population in Egypt has diabetes. More than 11% of the Egyptian population suffers from diagnosed Type-2 diabetes according to Egypt Youth Association for Health Development. 73 million adults (20-79) are living with diabetes in the IDF MENA Region in 2021. This figure is estimated to increase to 95 million by 2030. Diabetes is associated with many health complications. Patients with diabetes require many corrections throughout the day to maintain nominal blood glucose levels, such as administering additional insulin or ingesting additional carbohydrates by monitoring their blood glucose levels. Diabetes poses an emerging healthcare burden across the country and is one of the leading causes of premature death, morbidity, and loss of economic growth.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Egypt Diabetes Drugs Market Trends

The oral anti-diabetic drugs segment holds the highest market share in the Egypt Diabetes Drugs Market in the current year

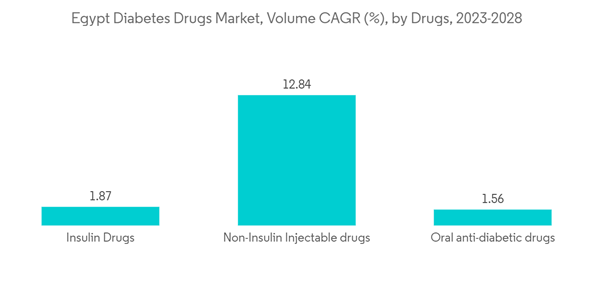

The oral anti-diabetic drugs segment holds the highest market share of about 88.8% in the Egypt Diabetes Drugs Market in the current year.Oral Anti-Diabetic Drugs are available internationally and are recommended for use when escalation of treatment for type 2 diabetes is required along with lifestyle management. Oral agents are typically the first medications used in treating type 2 diabetes due to their wide range of efficacy, safety, and mechanisms of action. Anti-diabetic drugs help diabetes patients control their condition and lower the risk of diabetes complications. People with diabetes may need to take anti-diabetic drugs for their whole lives to control their blood glucose levels and avoid hypoglycemia and hyperglycemia. Oral anti-diabetic agents present the advantages of easier management and lower cost. So they became an attractive alternative to insulin with better acceptance, which enhances adherence to the treatment.

In July 2022, Zydus Lifesciences announced that it had received final approval to market Empagliflozin and Metformin Hydrochloride tablets in multiple strengths. Empagliflozin and Metformin Hydrochloride tablets are used with proper diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus. They are also used to lower the risk of cardiovascular death in patients with type 2 diabetes mellitus and established cardiovascular disease.

The Egyptian Government launched the '100 million Seha' initiative, which seeks to screen Egyptians for non-communicable diseases like diabetes. Various healthcare companies announced their collaboration with the Egypt Ministry of Health to promote the initiative. Such initiatives are expected to create awareness among the people regarding monitoring and controlling diabetes, thereby enhancing the market prospects in the coming years.

Metformin is expected to dominate the Egypt Diabetes Drugs Market over the forecast period

Metformin is expected to dominate the Egypt Diabetes Drugs Market and register a CAGR of around 1.5% over the forecast period.Biguanides are a class of medications used to treat type 2 diabetes. They work by reducing the production of glucose that occurs during digestion. Metformin is the only biguanide currently available in most countries for treating diabetes. Glucophage (metformin) and Glucophage XR (metformin extended release) are well-known brand names for these drugs. Others include Fortamet, Glumetza, and Riomet. Metformin is also available in combination with several other types of diabetes medications, such as sulfonylureas.

Diabetes reduces lifespan, and people with the disease are likely to experience blindness and be hospitalized for amputations, kidney failure, heart attacks, strokes, and heart failure. Metformin is the first-line choice for the management of hyperglycemia in T2DM. Besides being an important glucose-lowering agent, metformin also includes significant anti-inflammatory properties. Other options must be considered when metformin is contraindicated or not tolerated or when treatment goals are not achieved after three months of use at the maximum tolerated dose. Dipeptidyl peptidase-4 inhibitors, sodium-glucose cotransporter-2 inhibitors, and glucagon-like peptide-1 agonists are generally used to supplement treatment with metformin.

In Egypt, the social level plays an important role in patients' access to health care. The number of healthcare centers, hospitals, and pharmacies is very low in rural areas compared to big cities and urban areas. The financial level is a major determinant of people's access to health care, as the salaries of most employees in Egypt are not enough to afford their monthly diabetes supplies. For students and school children with type 1 diabetes, the National Health Insurance System covers insulin, and the student pays nothing for NPH, mixed and short-acting insulins, and only 60% of the price of other types of insulin, which are usually unavailable in the pharmacies of the National Health Insurance System. However, the government is working in the direction of improving the access of patients through various initiatives.

Egypt Diabetes Drugs Industry Overview

The Egypt Diabetes Drugs Market is moderately consolidated, with major manufacturers, namely Eli Lilly, Sanofi, Novo Nordisk, AstraZeneca, and other generic players holding a presence in the region. A major share of the market is held by manufacturers concomitant with strategy-based M&A operations and constantly entering the market to generate new revenue streams and boost existing ones.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novo Nordisk A/S

- Takeda

- Pfizer

- Eli Lilly

- Janssen Pharmaceuticals

- Astellas

- Boehringer Ingelheim

- Merck and Co.

- AstraZeneca

- Bristol Myers Squibb

- Julphar

- Novartis

- Sanofi Aventis