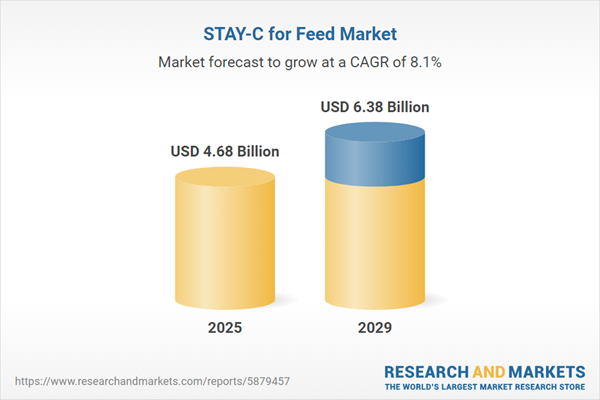

The stay-C for feed market size is expected to see strong growth in the next few years. It will grow to $6.38 billion in 2029 at a compound annual growth rate (CAGR) of 8.1%. The growth in the forecast period can be attributed to increasing focus on antibiotic alternatives, rising consumer demand for quality meat, environmental sustainability concerns, precision livestock farming, strategic alliances in the livestock industry. Major trends in the forecast period include technological advancements in feed additives, increased research and development, blockchain traceability in feed supply chain, plant-based additives, and digitalization of feed management.

The forecast of 8.1% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper U.S. livestock producers by increasing the cost of STAY-C (stabilized vitamin C) feed additives sourced from China and India, thereby raising animal nutrition expenses and complicating livestock health management. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The rising demand for meat and poultry products is anticipated to propel the growth of the STAY-C for feed market in the future. Meat encompasses the flesh of animals consumed as food, including fish, fowl, and poultry. STAY-C is essential for maintaining feed health and producing collagen, which supports muscles, vascular tissues, bones, and cartilage. For example, in February 2023, the United States Department of Agriculture (USDA), a US-based federal agency, reported that consumers averaged approximately 227 pounds of poultry, beef, and pork in 2022, up from 224.9 pounds in 2021, despite rising meat prices. Therefore, the increasing demand for meat and poultry products is driving the growth of the STAY-C for feed market.

The escalating number of diseases in animals is expected to contribute to the growth of the STAY-C for feed market. Animal diseases, representing the clinical or pathological effects of infections, necessitate the benefits of STAY-C for wound healing, immunity, and disease resistance. For example, a report from the Welsh Government revealed 665 new Tuberculosis cases in herds in 2023, marking an 8.5% increase from the previous year. Additionally, there was a 64% rise in zoonotic cases in Africa, according to an article from the World Health Organization in July 2022. Hence, the increasing incidence of diseases in animals serves as a driving force for the growth of the STAY-C for feed market.

The upward trajectory in livestock production is poised to propel the growth of the STAY-C for feed market in the foreseeable future. Livestock, encompassing domesticated animals for various uses, relies on STAY-C as a feed additive to support overall health, growth, and well-being. Cornell University reported that the United States produced a total of 86.3 billion pounds of cattle, calves, hogs, and pigs in 2022, a slight increase over the previous year. Therefore, the burgeoning livestock production is a significant driver fueling the STAY-C for feed market.

Major companies in the Stay-C-for-feed market are prioritizing strategic partnerships to enhance product development, expand market reach, and improve animal health solutions. A strategic partnership generally involves a collaborative relationship between two or more organizations, combining their resources, expertise, and efforts to achieve shared goals. For example, in February 2024, Cargill, Incorporated, a US-based food corporation that offers STAY-C for feed, formed a partnership with Enough, a UK-based producer of mycoprotein-based food. Through this collaboration, Cargill invested in Enough’s Series C funding round and signed a commercial agreement to utilize and market its Abunda mycoprotein. This ingredient is produced through a zero-waste fermentation process using fungi and sustainably sourced sugars from Cargill’s glucose syrup, making it a complete food ingredient rich in amino acids and dietary fiber. The expanded partnership with Cargill will facilitate the co-creation of alternative protein foods and help scale production across Europe and beyond.

In May 2023, the merger of Firmenich International SA, a Switzerland-based fragrance and flavor company, and DSM resulted in the formation of DSM-Firmenich AG. This merger aims to establish a premier innovation partner in nutrition, health, and beauty. DSM-Firmenich is expected to lead in reinventing and manufacturing essential nutrients, flavors, and perfumes, leveraging its extensive team and capabilities based on over a century of advanced science. DSM, a Netherlands-based company, is a leading manufacturer of industrial chemicals, including STAY-C for feed, and components for food, medicine, and cosmetics.

Major companies operating in the stay-C for feed market include Cargill Incorporated, Archer-Daniels-Midland Company, BASF SE, Charoen Pokphand Foods Public Company Limited, Evonik Industries AG, CP Group, Solvay Group, DSM, Guangdong Haid Group Co Ltd, ForFarmers N.V., Nutreco N.V., Chr. Hansen Holding A/S, New Hope Group, Balchem Corporation, Longxing Chemical Stock Co. Ltd., Spectrum Chemical Manufacturing Corporation, Plamed Group, Lallemand Inc., Polifar Group, Hugestone Enterprise Co. Ltd., Kangcare Bioindustry Co. Ltd., Shanghai Longyu Biotechnology Co. Ltd., Tianjin YR Chemspec Technology Co. Ltd., Ajinomoto Co. Inc., Hubei Artec Biotechnology Co. Ltd.

Asia-Pacific was the largest region in the STAY-C for feed market in 2024. The regions covered in the stay-c for feed market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the stay-c for feed market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The STAY-C for feed market research report is one of a series of new reports that provides STAY-C for feed market statistics, including STAY-C for feed industry global market size, regional shares, competitors with a STAY-C for feed market share, detailed STAY-C for feed market segments, market trends and opportunities, and any further data you may need to thrive in the STAY-C for feed industry. This STAY-C for feed market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

STAY-C for feed refers to a vital water-soluble antioxidant employed to ensure high stability and optimal vitamin C levels in animal feed. This is particularly advantageous for supporting reproduction, wound healing, growth, and overall development.

The primary functions of STAY-C for feed can be categorized into single-functioned and multi-functioned. Single-functioned feed pertains to a feedstuff used for a specific purpose, often focused on collagen formation. STAY-C is available in various formulations, including dry, liquid, and others, catering to the nutritional needs of swine, ruminants, poultry, aquatic animals, and other species.

The STAY-C for feed market consists of sales of animal nutrition solutions including single ingredients, organic acids, proprietary feed additives, feed supplements, L-ascorbic acid and antioxidants. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

STAY-C for Feed Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on stay-c for feed market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for stay-c for feed? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The stay-c for feed market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Function: Single Functioned; Multi Functioned2) By Formulation: Dry; Liquid; Other Formulations

3) By Livestock: Swine; Ruminants; Poultry; Aquatic Animals; Other Livestock

Subsegments:

1) By Single Functioned: Stay-c for Specific Feed Types; Basic Formulations With a Single Benefit2) By Multi Functioned: Stay-c With Multiple Benefits; Formulations Combining Various Ingredients for Enhanced Performance

Companies Mentioned: Cargill Incorporated; Archer-Daniels-Midland Company; BASF SE; Charoen Pokphand Foods Public Company Limited; Evonik Industries AG; CP Group; Solvay Group; DSM; Guangdong Haid Group Co Ltd; ForFarmers N.V.; Nutreco N.V.; Chr. Hansen Holding a/S; New Hope Group; Balchem Corporation; Longxing Chemical Stock Co. Ltd.; Spectrum Chemical Manufacturing Corporation; Plamed Group; Lallemand Inc.; Polifar Group; Hugestone Enterprise Co. Ltd.; Kangcare Bioindustry Co. Ltd.; Shanghai Longyu Biotechnology Co. Ltd.; Tianjin YR Chemspec Technology Co. Ltd.; Ajinomoto Co. Inc.; Hubei Artec Biotechnology Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this STAY-C for Feed market report include:- Cargill Incorporated

- Archer-Daniels-Midland Company

- BASF SE

- Charoen Pokphand Foods Public Company Limited

- Evonik Industries AG

- CP Group

- Solvay Group

- DSM

- Guangdong Haid Group Co Ltd

- ForFarmers N.V.

- Nutreco N.V.

- Chr. Hansen Holding A/S

- New Hope Group

- Balchem Corporation

- Longxing Chemical Stock Co. Ltd.

- Spectrum Chemical Manufacturing Corporation

- Plamed Group

- Lallemand Inc.

- Polifar Group

- Hugestone Enterprise Co. Ltd.

- Kangcare Bioindustry Co. Ltd.

- Shanghai Longyu Biotechnology Co. Ltd.

- Tianjin YR Chemspec Technology Co. Ltd.

- Ajinomoto Co. Inc.

- Hubei Artec Biotechnology Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.68 Billion |

| Forecasted Market Value ( USD | $ 6.38 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |