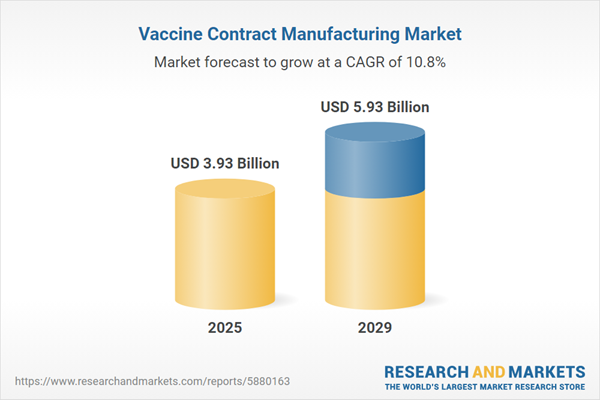

The vaccine contract manufacturing market size is expected to see rapid growth in the next few years. It will grow to $5.93 billion in 2029 at a compound annual growth rate (CAGR) of 10.8%. The growth in the forecast period can be attributed to growing emphasis on pandemic preparedness, increased outsourcing in pharmaceutical manufacturing, expansion of biopharmaceutical companies, accelerated vaccine development timelines, global initiatives for vaccine accessibility. Major trends in the forecast period include integration of single-use technologies in manufacturing, rise in personalized medicine approaches to vaccine development, development of mRNA and viral vector vaccines, adoption of continuous manufacturing processes, expansion of fill-finish services.

The anticipated rise in initiatives promoting vaccinations is set to drive the growth of the vaccine contract manufacturing market in the future. Vaccination serves as an easy, safe, and effective method to defend against contagious diseases by enhancing the immune system and fortifying the body's defenses. The advancement and enhancement of various vaccine manufacturing processes to support vaccine contract manufacturing are expected with increasing initiatives favoring vaccinations. An illustrative example is the U.S. Department of Health and Human Services' announcement in November 2022 of a new $350 million initiative for HRSA (Health Resources and Services Administration)-supported health facilities to enhance COVID-19 vaccine availability, particularly for marginalized communities. Thus, the surge in initiatives supporting vaccinations is a catalyst for the growth of the vaccine contract manufacturing market.

The increasing prevalence of infectious diseases globally is expected to drive the growth of the vaccine contract manufacturing market. Infectious diseases are disorders caused by pathogenic microorganisms such as bacteria, viruses, fungi, or parasites. When outbreaks of infectious diseases occur, such as influenza, measles, or emerging viruses, there is an urgent demand for vaccines to prevent further spread. Contract manufacturers can rapidly scale up production to meet these urgent needs. For instance, in December 2022, data from the Office for National Statistics, a UK-based national statistics institute, indicated that infection rates rose among individuals aged 35 to 69 and also increased for those in school years 12 to 24. The total hospital admission rate for confirmed COVID-19 patients in England rose to 9.56 per 100,000 individuals, with ICU and high dependency unit admissions increasing to 0.29 per 100,000 inhabitants. Additionally, in August 2024, the UK Health Security Agency reported 368 measles cases in England for 2023, nearly a sevenfold increase from the 53 cases in 2022, with the West Midlands and London accounting for 44% and 33% of the cases, respectively. Therefore, the rise in infectious diseases worldwide is driving the growth of the vaccine contract manufacturing market.

Strategic partnerships are a prominent trend gaining traction in the vaccine contract manufacturing market. Major companies are collaborating with entities in this sector to strengthen their market positions. For example, in January 2023, Vaxxas, an Australia-based biotechnology firm known for its innovative needle-free vaccination technology, joined forces with the Coalition for Epidemic Preparedness Innovations, a Norway-based foundation, to finance and coordinate the development of new vaccines and advance Vaxxas' needle-free vaccine patch delivery technology. This initiative aims to eliminate the need for frozen storage for mRNA vaccines. Additionally, in October 2024, LenioBio, a Germany-based biotech company, partnered with ReciBioPharm, a US-based contract development and manufacturing organization (CDMO), to enhance its protein manufacturing capabilities and expedite vaccine production. This partnership supports LenioBio’s strategy to broaden the scope of its CEPI-funded project, which seeks to showcase the speed and efficiency of its proprietary ALiCE protein expression technology in producing vaccine-related proteins for clinical trials.

Major companies in the vaccine contract manufacturing market are directing their efforts toward establishing production sites dedicated to vaccine contract manufacturing. This entails creating facilities exclusively for the manufacturing and production of vaccines on a contractual basis. WuXi Vaccines, a China-based contract development and manufacturing organization (CDMO), expanded its capabilities with the opening of its first standalone vaccine CDMO site in Suzhou, China, in September 2023. This expansion enhances WuXi Vaccines' capacity to contribute to vaccine development and manufacturing, reinforcing its pivotal role in advancing global healthcare solutions.

In October 2024, SK bioscience, a South Korea-based vaccine and biotech firm, acquired a controlling stake in IDT Biologika for approximately $244 million. This acquisition is part of SK bioscience's strategy to accelerate growth, with a goal of achieving consolidated sales of KRW 1 trillion (around USD 757.6 million) within the next five years. The company also intends to expand further by launching next-generation pneumococcal vaccines, positioning itself for continued financial growth beyond 2028. IDT Biologika is a German-based company that operates as a vaccine contract development and manufacturing organization (CDMO).

Major companies operating in the vaccine contract manufacturing market include Pfizer Inc, Johnson & Johnson, AbbVie Inc., Sanofi, GlaxoSmithKline, Merck KGaA, Fujifilm Holdings Corporation, Moderna, BioNTech, GSK Vaccines, AstraZeneca PLC, Ajinomoto Co. Inc., Icon plc, Lonza Group AG, Cytiva, Catalent Inc., Charles River Laboratories International Inc., Serum Institute of India Pvt. Ltd, Samsung Biologics, WuXi Biologics, Novavax, Sinovac Biotech, Emergent BioSolutions Inc., Albany Molecular Research Inc., Soligenix Inc., Bio Farma, Curia Global Inc., Hualan Biological Engineering, BioMARC, Bavarian Nordic A/S, AGC Biologics, IDT Biologika GmbH, Bharat Biotech, Goodwin Biotechnology Inc., Biofabri S.L.

North America was the largest region in the vaccine contract manufacturing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the vaccine contract manufacturing market report forecast period. The regions covered in the vaccine contract manufacturing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the vaccine contract manufacturing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Vaccine contract manufacturing involves an arrangement where outside producers are engaged to create vaccines, overseeing the production, packing, and labeling of vaccines based on the specifications and demands of the contracting business or organization. The primary benefit of vaccine contract manufacturing is the simplification of production, resulting in cost savings and fewer operational challenges.

The main types of services involved in vaccine contract manufacturing include fill-finish and bulk products. Fill-finish specifically pertains to the filling and finishing stages of the vaccine manufacturing process. In the pharmaceutical industry, finishing involves the sterilization and standardization of vaccine components into containers, while filling refers to adding them to containers and sealing them properly. The vaccines produced through this process include inactivated vaccines, live-attenuated vaccines, RNA (ribonucleic acid) vaccines, subunit vaccines, and toxoid-based vaccines. These vaccines are prepared through downstream and upstream processes on preclinical, clinical, and commercial scales of operation, catering to both human use and veterinary end-users.

The vaccine contract manufacturing research report is one of a series of new reports that provides vaccine contract manufacturing market statistics, including the vaccine contract manufacturing industry's global market size, regional shares, competitors with vaccine contract manufacturing market share, detailed vaccine contract manufacturing market segments, market trends and opportunities, and any further data you may need to thrive in the vaccine contract manufacturing industry. This vaccine contract manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The vaccine contract manufacturing market consists of revenues earned by entities by providing services such as analytical, quality control studies, cell or virus banking, and cold chain services. The market value includes the value of related goods sold by the service provider or included within the service offering. The vaccine contract manufacturing market also includes sales of synthetic vaccines and DNA (deoxyribonucleic acid) vaccines, which are used in providing vaccine contract manufacturing services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Vaccine Contract Manufacturing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on vaccine contract manufacturing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vaccine contract manufacturing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The vaccine contract manufacturing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service Type: Fill-Finish; Bulk Product2) By Vaccine Type: Inactivated Vaccines; Live-Attenuated Vaccines; RNA (Ribonucleic Acid) Vaccines; Subunit Vaccines; Toxoid-Based Vaccines

3) By Process: Downstream; Upstream

4) By Scale of Operation: Preclinical; Clinical; Commercial

5) By End-Use: Human Use; Veterinary

Subsegments:

1) By Fill-Finish: Aseptic Fill-Finish; Lyophilization; Vial Filling; Syringe Filling2) By Bulk Product: Cell Culture; Microbial Fermentation; Antigen Production; Buffer Preparation

Key Companies Mentioned: Pfizer Inc; Johnson & Johnson; AbbVie Inc.; Sanofi; GlaxoSmithKline

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc

- Johnson & Johnson

- AbbVie Inc.

- Sanofi

- GlaxoSmithKline

- Merck KGaA

- Fujifilm Holdings Corporation

- Moderna

- BioNTech

- GSK Vaccines

- AstraZeneca PLC

- Ajinomoto Co. Inc.

- Icon plc

- Lonza Group AG

- Cytiva

- Catalent Inc.

- Charles River Laboratories International Inc.

- Serum Institute of India Pvt. Ltd

- Samsung Biologics

- WuXi Biologics

- Novavax

- Sinovac Biotech

- Emergent BioSolutions Inc.

- Albany Molecular Research Inc.

- Soligenix Inc.

- Bio Farma

- Curia Global Inc.

- Hualan Biological Engineering

- BioMARC

- Bavarian Nordic A/S

- AGC Biologics

- IDT Biologika GmbH

- Bharat Biotech

- Goodwin Biotechnology Inc.

- Biofabri S.L

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.93 Billion |

| Forecasted Market Value ( USD | $ 5.93 Billion |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |