Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A dry type of transformer is one that does not utilize any insulating liquid and doesn't submerge its windings or core in it. Instead, the windings and core are stored in an air-pressured, airtight tank. Additionally, dry type transformers have several benefits, including safety for people and property, maintenance-free operation, ease of installation, reduced side clearance, environmental friendliness, excellent capacity to support overloads, reduced cost for fire protection systems and civil installation work, excellent performance in case of seismic events, no fire hazard, and long lifespan due to low thermal and dielectric resistance.

High Demand for Indoor Application Purpose

Dry type transformer is the booming market in India. Since, these transformers do not use any type of oil for cooling, dry type transformers are always in high demand for indoor application purpose because dry type transformers are specifically utilized in buildings since, they are less hazardous and safer for the environment. They’re also less explosive, so they’re utilized in malls, offices, hospitals, etc. In addition to this, Indian government introduced many schemes and initiatives related to to infrastructure sector such as Make in India, National Infrastructure Pipeline (NIP), which positively augment the demand for dry type transformers across the country during the forecast period.Rising Demand for Digital Dry Type Transformers

Expansion and replacement of power grids with smart grids will enhance the demand for digital dry type transformers during the forecast period. Digital dry type transformers can supply the user with information on its performance. This will enable the user to analyse the data and schedule the maintenance and retirement schedule of the transformer. Making informed decisions will increase production and profitability by preventing or at least reducing transformer downtime. Additionally, the development of 3D core VPI transformers for electric car charging stations has the potential to present the dry type transformer industry with new opportunities.Expansion of Electricity Distribution

India dry type transformer market is driven by its wide applicability in the distribution of electricity. The expansion of electricity distribution network across the country and rapid industrialization drives the dry type transformer market growth. Heavy to small scale industries employ machineries that have specific voltage requirement. Some industries, such as oil & gas, mining, and marine have specialized voltage requirements, as fire safety is important in these sectors. In an effort to reduce the dependence on coal-based electricity generation, the government has agreed to increase the adoption of renewable energy generation in the total electricity produced. Dry type transformers are replacing wet transformers in the renewable energy sector due to their safety and design aspects. Safety accounts for greater significance in energy sector meaning that dry type transformer is becoming a transformer of choice in cleaner energy segment that offer extended protection. This is a major driving force for the India dry type transformer market.Market Segments

India Dry Type Transformer Market is segmented into core, technology, classes of insulation, type, phase configuration, installation, winding, rating, mounting, application, by region and by company. Based on core, the market is segmented into closed, shell, berry. Based on Technology, the market is segmented into cast resin and vacuum pressure impregnated. Based on classes of insulation, the market is segmented into class R, class H, class F, class B, class A. Based on type, the market is segmented into open wound, vacuum pressure impregnated, vacuum pressure encapsulated. Based on phase configuration, the market is segmented into single, three. Based on installation, the market is segmented into outdoor, indoor. Based on winding, the market is segmented into copper winding and aluminum winding. Based on rating, the market is segmented into < 5 MVA, 5 MVA to 30 MVA, > 30 MVA. Based on mounting, the market is segmented into pad and pole. Based on application, the market is segmented into industries, inner-city substations, indoor/underground substations, renewable generation.Market Players

India Dry Type Transformer Market players include ABB India Ltd, Siemens India Limited, Alstom T&D India, Kirloskar Electric Company Limited, Gujarat Transformers Pvt. Ltd, Urja Techniques (India) Pvt. Ltd, Uttam Bharat, Kotsons Pvt. Ltd, ABC Transformers, Servomax Limited.Report Scope:

In this report, India Dry Type Transformer Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:India Dry Type Transformer Market, By Core:

- Closed

- Shell

- Berry

India Dry Type Transformer Market, By Technology:

- Cast Resin

- Vacuum Pressure Impregnated

India Dry Type Transformer Market, By Classes of Insulation:

- Class R

- Class H

- Class F

- Class B

- Class A

India Dry Type Transformer Market, By Type:

- Open Wound

- Vacuum Pressure Impregnated

- Vacuum Pressure Encapsulated

India Dry Type Transformer Market, By Phase Configuration:

- Single

- Three

India Dry Type Transformer Market, By Installation:

- Outdoor

- Indoor

India Dry Type Transformer Market, By Winding:

- Copper Winding

- Aluminum Winding

India Dry Type Transformer Market, By Rating:

- < 5 MVA

- 5 MVA to 30 MVA

- >30 MVA

India Dry Type Transformer Market, By Mounting:

- Pad

- Pole

India Dry Type Transformer Market, By Application:

- Industries

- Inner-city Substations

- Indoor/Underground Substations

- Renewable Generation

India Dry Type Transformer Market, By Region:

- North India

- West India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in India Dry Type Transformer Market.Available Customizations:

The publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB India Ltd

- Siemens India Limited

- Alstom T&D India

- Kirloskar Electric Company Limited

- Gujarat Transformers Pvt. Ltd

- Urja Techniques (India) Pvt. Ltd

- Uttam Bharat

- Kotsons Pvt. Ltd

- ABC Transformers

- Servomax Limited

Table Information

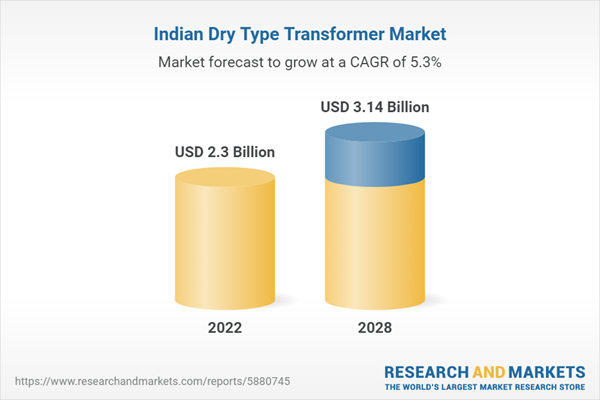

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 3.14 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |