Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A distribution transformer, often referred to as a service transformer, lowers the voltage used in distribution lines to the level utilized by the customer as the last voltage transformation in an electrical power distribution system. The location where cables exit an underground power line or utility pole and enter a customer's property is known as a service drop, and it is here that distribution transformers are often found. They are typically used to supply electricity to facilities outside of communities at voltages lower than 30 kV, such as isolated residences, farmyards, or pumping stations.

Government Regulations Towards Renewable Energy and Increasing Demand of Electricity Is Propelling The Market

The growing number of residential and commercial uses for transformers as well as their low cost are driving up demand for wet insulated power transformers. Two research and development projects that might create attractive market expansion potential include the integration of wet insulating power transformers with smart grids and the installation of renewable energy grids with eco-friendly coolants.Due to company’s excellent efficiency, these transformers are used in situations where high voltage and low losses are essential factors. They offer higher insulation and cooling capabilities when compared to dry power transformers, which advances the sector.

Smart grids can quickly adapt to variations in electricity consumption and can be accessed and monitored remotely. They deliver power and cooling efficiently, which reduces carbon emissions. The growth of the North American power and transformer market would be aided by the development of green transformers, high voltage transmission technologies, and stringent government restrictions targeted at reducing greenhouse gas emissions throughout the projected period.

Distribution Transformer Expected to Dominate the Market

The ultimate voltage transformation in the electric power distribution system is provided by a distribution transformer, also known as a service transformer. The voltage applied in distribution lines will then be stepped down to the level used by different clients in the residential, commercial, and industrial sectors.The existing transmission and distribution system is being upgraded and expanded in North American nations including the United States and Canada. Due to the country's fast urbanization and industrialization, countries like Mexico are intending to expand their energy transmission and distribution systems.

North America produced around 5447.3 Terawatt-Hours (TWh) of power in 2018, which was more than the 5294.4 TWh it produced in 2017. The increase in energy production indicates a rise in the number of power plants, and these new distribution transformers are being used to transmit electricity to consumers.

High Maintenance and Fluctuating Raw Material Cost

Steel, aluminum, and copper are the main components used to make power transformers. Due to an increase in the overall cost of these raw materials, the sale of power transformers will be restricted in low- and middle-income countries. Due to changes in the raw material supply and disruptions caused by pandemics in the distribution and supply networks, power transformers are more expensive than conventional power distribution systems. High-power transformer installation and maintenance expenses in comparison to present power distribution systems are anticipated to limit the market's growth. Raw material prices are predicted to fluctuate.Market Segmentation

The North America Power & Distribution Transformer Market is segmented based on type, rating, end user, and phase. Based on Type, the market is segmented into power transformer & distribution transformer. Based on Rating, the market is segmented into upto 100 kVA, 100.1-500kVA, 500.1-1000kVA, 1000.1-5000kVA, 5.1-100MVA, 100.1-500MVA, Above 500MVA, Based on End User, the market is segmented into residential, commercial, industrial, and utility. Based on phase, the market is divided into single phase and three phase, based on insulation, the market is divided into oil immersed & dry.Market player

Major players operating in the North America Power & Distribution Transformer Market are ABB Ltd, Crompton Greaves Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, General Electric Corporation, Siemens AG, Schneider Electric SE, TBEA Co., Ltd, Toshiba Corporation, Emerson Electric Co.Report Scope:

In this report, North America Power & Distribution Transformer Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Power & Distribution Transformer Market, By Type:

- Power Transformer

- Distribution Transformer

Power & Distribution Transformer Market, By Rating:

- upto 100 kVA

- 100.1-500kVA

- 500.1-1000kVA

- 1000.1-5000kVA

- 5.1-100MVA

- 100.1-500MVA

- Above 500MVA

Power & Distribution Transformer Market, By End User:

- Residential

- Commercial

- Industrial

- Utility

Power & Distribution Transformer Market, By Phase:

- Single Phase

- Three Phase

Power & Distribution Transformer Market, By Insulation

- Oil Immersed

- Dry

Power & Distribution Transformer Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Power & Distribution Transformer MarketAvailable Customizations:

North America Power & Distribution Transformer Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB Ltd.

- Crompton Greaves Ltd.

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- General Electric Corporation

- Siemens AG

- Schneider Electric SE

- TBEA Co., Ltd.

- Toshiba Corporation

- Emerson Electric Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | October 2023 |

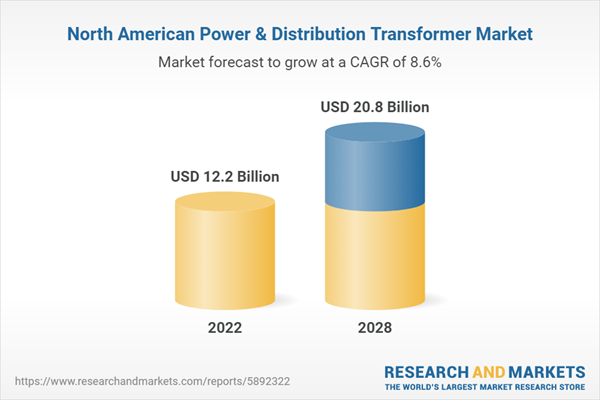

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 12.2 Billion |

| Forecasted Market Value ( USD | $ 20.8 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |