AI is increasingly being included in teleradiology workflows. By spotting patterns and anomalies in medical images, AI algorithms can help radiologists, lowering human errors and increasing diagnostic precision. As AI technologies advance, this trend is anticipated to persist. For instance, in May 2023, Koninklijke Philips N.V. introduced a Philips CT 3500, an innovative high-throughput CT system aimed at meeting the demands of large quantities of screening initiatives and regular radiology. The Philips CT 3500, which is operated by AI, has a number of image-reconstruction and workflow-improving features that work together to provide the reliability, speed, and quality of images required for clinicians to diagnose patients with confidence and to increase return earnings - even in the most rigorous, substantial medical facilities.

In the healthcare and medical technology industries, particularly teleradiology, mergers and acquisitions are frequent occurrences. These deals may include teleradiology corporations buying out smaller rivals, breaking into new markets, or improving their technology and service capabilities. For instance, Teleradiology Solutions revealed in April 2022 that it had signed a contract with Andhra Med Tech Zone to establish a hub in the area for the provision of remote radiology image reads targeted at the public and government sectors by qualified radiologists accompanied by cutting-edge AI approaches.

Teleradiology enables medical facilities to outsource radiology interpretations, potentially lowering the expense of keeping an on-site radiological team. The need for radiology services has increased due to the rising usage of diagnostic imaging methods in healthcare, which has fueled the expansion of the teleradiology industry.

U.S. Teleradiology Market Report Highlights

- Based on product, the X-rays segment held the largest revenue share of 28.93% in 2022. The segment's dominance is due to its lower cost, high utilization in primary diagnosis, and the advent of cutting-edge equipment such as filmless X-ray scanners

- Based on type, the preliminary tests segment held the largest revenue share above 63.26% in 2022. The final tests segment is expected to grow at the fastest CAGR of 13.2% over the forecast period. Final reads are increasingly preferred by providers since they produce thorough, reliable results with fewer errors

- Based on end-use, the hospitals segment held the largest market share of approximately 52.68% in 2022. The ambulatory imaging center segment is expected to grow at a CAGR of 12.2% over the forecast period.

Table of Contents

Companies Mentioned

- Virtual Radiologic (vRad)

- Agfa-Gevaert Group

- ONRAD, Inc.

- Everlight Radiology;

- 4ways Healthcare Ltd.

- RamSoft, Inc.

- USARAD Holdings, Inc.

- Koninklijke Philips N.V.

- Matrix (Teleradiology Division of Radiology Partners)

- Medica Group PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | September 2023 |

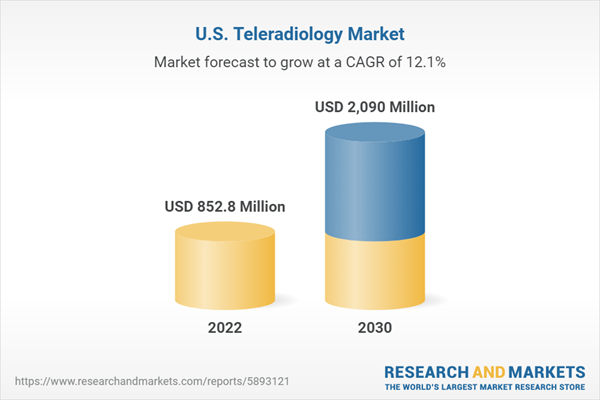

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 852.8 Million |

| Forecasted Market Value ( USD | $ 2090 Million |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |