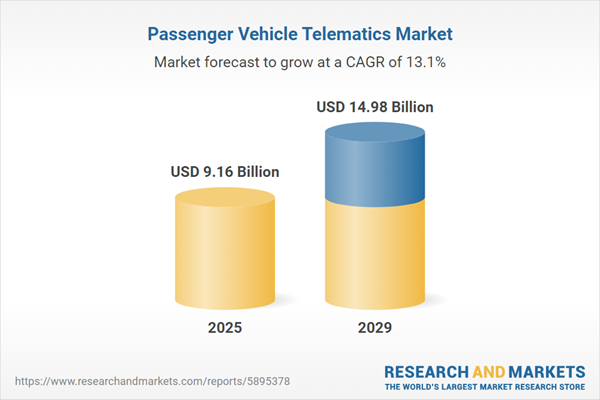

The passenger vehicle telematics market size is expected to see rapid growth in the next few years. It will grow to $14.98 billion in 2029 at a compound annual growth rate (CAGR) of 13.1%. The growth in the forecast period can be attributed to telematics for traffic management, enhanced cybersecurity measures, shift towards mobility as a service (maas), rise in connected infotainment systems, and integration of 5g technology. Major trends in the forecast period include enhanced driver behavior analysis, integration of vehicle-to-infrastructure (v2i) communication, expansion of over-the-air (OTA) updates, enhanced remote vehicle control, and telematics data monetization.

The growth of the passenger vehicle telematics market is anticipated to be fueled by an increase in demand for passenger cars. Passenger cars, designed for people transportation, are incorporating telematics technology to enhance various aspects of vehicle performance, safety, and connectivity. This technology contributes to increased security, enhanced comfort, reduced maintenance costs, and offers services such as speed monitoring and fleet management. In May 2023, the Society of Motor Manufacturers and Traders (SMMT) reported a 16.7% rise in UK passenger car sales to 145,204 units. Additionally, the European Union produced 10.9 million passenger automobiles in 2022, marking an 8.3% increase from the previous year. This surge in passenger car demand is a driving force behind the growth of the passenger vehicle telematics market.

The passenger vehicle telematics market is poised for further expansion due to the increasing implementation of smart city initiatives. These initiatives, encompassing urban development plans that leverage Information and Communication Technology (ICT), are aimed at enhancing city efficiency, environmental sustainability, and overall quality of life. The integration of telematics in automobiles is a pivotal aspect of smart city endeavors, contributing to traffic control, parking assistance, and improved urban mobility. As of January 2023, London has been actively implementing projects to enhance technological innovation and smart city capabilities. Initiatives include a pilot project to improve cellular connectivity rates and plans for providing free Wi-Fi stations with additional features such as phone calls, maps, charging capabilities, and environmental sensors by 2021. Moreover, as of September 2022, over 56% of projects under India's Smart Cities Mission have been completed, indicating a commitment to technological advancements and smart city development. The increasing emphasis on smart city initiatives worldwide is a significant driver for the passenger vehicle telematics market.

Leading companies in the passenger vehicle telematics market are concentrating on creating technologically innovative solutions, such as advanced collision prediction systems, to improve safety and driver assistance features. An advanced collision prediction system is a vehicle safety technology that uses data from various sensors, cameras, radar, and GPS to detect and anticipate potential collisions before they occur. For example, in November 2023, Brigade Electronics Inc., a UK-based provider of vehicle safety systems, introduced Radar Predict, an advanced collision prediction system designed to enhance cyclist safety around heavy goods vehicles (HGVs). This cutting-edge technology functions as a Blind Spot Information System (BSIS), utilizing artificial intelligence to analyze vehicle speed, direction, and the proximity of nearby cyclists to predict possible collisions. Equipped with a dual-radar unit for extensive coverage, Radar Predict offers drivers escalating visual and audible alerts based on the severity of the situation and automatically activates during turns.

Major companies are strategically forming partnerships to leverage embedded vehicle data for applications such as fleet management and dealership lot management. This collaborative approach is geared towards combining the strengths of different entities to pioneer innovative solutions and technologies for more efficient fleet management. A case in point is the strategic partnership announced in November 2023 between CerebrumX Labs Inc., a US-based developer of AI-driven automotive data platforms, and Guidepoint Systems, a US-based provider of vehicle telematics solutions. The joint solution addresses the growing demand from fleet businesses and dealerships for advanced data solutions, aiming to reduce costs, enhance customer experiences, improve operational efficiency, and elevate safety in inventory operations. The collaboration aims to revolutionize fleet management and dealership operations by offering a seamless inventory management system without the need for additional hardware installation. CerebrumX's Augmented Deep Learning Platform (ADLP) seamlessly integrates with Guidepoint's software platform, providing real-time connected vehicle data for accurate and remote inventory management, creating a contactless and streamlined customer experience.

In December 2023, ABAX, a telecommunications equipment company based in Norway, acquired Movolytics for an undisclosed amount. The acquisition is intended to accelerate ABAX's growth, increase its customer base, and boost revenue by around 50%. Additionally, it will enhance ABAX's innovation and service offerings within the UK telecoms market. Movolytics, a UK-based software company, specializes in passenger vehicle telematics, offering real-time tracking, data analytics, and maintenance alerts.

Major companies operating in the passenger vehicle telematics market include Verizon Communications Inc., AT&T Inc, Robert Bosch GmbH, Vodafone Group plc, Qualcomm Inc., Continental AG, Bridgestone Corp., Danaher Corp., Telefonaktiebolaget LM Ericsson, Valeo SA, Harman International Industries, Garmin Ltd., Delphi Technologies plc, Visteon Corp., Trimble Inc., Agero Inc., Omnitracs LLC., Telenav Inc., Fleet Complete, MiX Telematics, OCTO Telematics S.p.A, Masternaut Limited, Bynx Ltd., Airbiquity Inc., AirIQ Inc.

North America was the largest region in the passenger vehicle telematics market in 2024. The regions covered in the passenger vehicle telematics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the passenger vehicle telematics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Passenger vehicle telematics involves the integration of telematics technology into cars used for personal transportation. This technology fuses telecommunications and information systems to collect, transmit, and analyze data concerning vehicle performance, driver conduct, and other pertinent details. Its implementation significantly enhances driving safety, operational efficiency, user convenience, and overall security.

Key categories within passenger vehicle telematics encompass remote message processing systems, brake mechanisms, transmission control systems, navigation interfaces, infotainment units, and safety and security frameworks. A remote message processing system denotes a platform facilitating the remote management and processing of messages, often centralized through servers or cloud-based infrastructure. This incorporates various communication types such as vehicle-to-vehicle (V2V), vehicle-to-everything (V2X), vehicle-to-infrastructure (V2I), and vehicle-to-pedestrian (V2P). These applications cater to diverse vehicle types including passenger cars, light commercial vehicles, and heavy commercial vehicles.

The passenger vehicle telematics market research report is one of a series of new reports that provides passenger vehicle telematics market statistics, including passenger vehicle telematics industry global market size, regional shares, competitors with a passenger vehicle telematics market share, detailed passenger vehicle telematics market segments, market trends and opportunities, and any further data you may need to thrive in the passenger vehicle telematics industry. This passenger vehicle telematics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The passenger vehicle telematics market consists of revenues earned by entities by providing passenger vehicles telematics services such as vehicle tracking and location services, navigation and routing assistance, remote diagnostics, and maintenance, safety, and emergency services. The market value includes the value of related goods sold by the service provider or included within the service offering. The passenger vehicle telematics market also includes sales of GPS tracking devices and electronic logging devices, sensors, an onboard diagnostics (OBD) port adapter, and telematics control units that are used in providing passenger vehicle telematics services. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Passenger Vehicle Telematics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on passenger vehicle telematics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for passenger vehicle telematics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The passenger vehicle telematics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Remote Message Processing System; Brake System; Transmission Control System; Navigation System; Infotainment System; Safety and Security System2) By Communication: Vehicle-To-Vehicle (V2V); Vehicle-To-Everything (V2X); Vehicle-To-Infrastructure (V2I); Vehicle-To-Pedestrian (V2P)

3) By Application: Passenger Car; Light Commercial Vehicle; Heavy Commercial Vehicle

Subsegments:

1) By Remote Message Processing System: Vehicle-To-Vehicle (V2V) Communication; Vehicle-To-Infrastructure (V2i) Communication2) By Brake System: Anti-Lock Braking Systems (ABs); Electronic Brakeforce Distribution (EBD); Emergency Brake Assist (EBA)

3) By Transmission Control System: Automatic Transmission Control Modules (TCM); Continuously Variable Transmission (CVT) Controllers

4) By Navigation System: GPs-based navigation; Real-Time Traffic Updates; Route Planning and Optimization

5) By Infotainment System: Multimedia Systems (Audio, Video); Smartphone Integration (Apple Carplay, Android Auto); in-Car Internet Access

6) By Safety and Security System: Emergency Call (Ecall) Systems; Theft Tracking and Immobilization; Advanced Driver-Assistance Systems (Adas)

Key Companies Mentioned: Verizon Communications Inc.; AT&T Inc; Robert Bosch GmbH; Vodafone Group plc; Qualcomm Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Verizon Communications Inc.

- AT&T Inc

- Robert Bosch GmbH

- Vodafone Group plc

- Qualcomm Inc.

- Continental AG

- Bridgestone Corp.

- Danaher Corp.

- Telefonaktiebolaget LM Ericsson

- Valeo SA

- Harman International Industries

- Garmin Ltd.

- Delphi Technologies plc

- Visteon Corp.

- Trimble Inc.

- Agero Inc.

- Omnitracs LLC.

- Telenav Inc.

- Fleet Complete

- MiX Telematics

- OCTO Telematics S.p.A

- Masternaut Limited

- Bynx Ltd.

- Airbiquity Inc.

- AirIQ Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.16 Billion |

| Forecasted Market Value ( USD | $ 14.98 Billion |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |