Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry faces substantial hurdles related to data privacy and cybersecurity, which threaten to slow the adoption of interconnected smart technologies. As real estate companies digitize vast quantities of sensitive financial and tenant data, the potential for data breaches escalates, leading to increased regulatory oversight. Consequently, stakeholders often express hesitation regarding the replacement of legacy systems with cloud-based platforms, fearing the risks associated with managing proprietary information in a fully digital environment.

Market Drivers

The incorporation of Artificial Intelligence and Big Data Analytics acts as a primary catalyst for the Global PropTech Market, fundamentally altering how assets are valued and managed. Moving beyond experimental phases, these technologies are becoming essential operational infrastructure that facilitates predictive maintenance, automated valuation, and improved tenant experiences. This transition toward data-centric decision-making is highlighted by the rapid rollout of pilot programs across the industry. For instance, JLL's '2025 Global Real Estate Technology Survey' from October 2025 revealed that 88% of investors and landlords have initiated artificial intelligence pilots to enhance their portfolios, indicating that automated analytics are becoming the industry standard for asset optimization.Simultaneously, the increasing focus on sustainability and energy management compliance is necessitating the use of digital monitoring tools. With global regulations on carbon emissions tightening, real estate stakeholders are compelled to invest in PropTech solutions that ensure ESG compliance through granular energy consumption tracking. According to Deloitte's '2025 Commercial Real Estate Outlook' published in February 2025, 76% of industry respondents intend to perform major energy retrofits within the next 12 to 18 months, fueling demand for smart building technologies. This commitment is reflected in capital inflows, as the Center for Real Estate Technology & Innovation reported in October 2025 that the sector attracted $4.2 billion in venture capital during the third quarter of 2025 alone.

Market Challenges

Concerns regarding data privacy and cybersecurity constitute a major obstacle for the Global PropTech Market, significantly braking the integration of interconnected smart technologies. As real estate organizations transfer sensitive tenant records and financial transactions to digital formats, they expose themselves to vulnerabilities inherent in cloud-based platforms and Internet of Things (IoT) networks. The widening digital attack surface creates substantial anxiety among stakeholders regarding the potential financial and reputational damage caused by data breaches. This fear often leads firms to delay digital transformation efforts or cling to isolated legacy systems that are perceived as more secure, effectively stifling innovation.The reality of these risks is underscored by data from the Royal Institution of Chartered Surveyors (RICS), which reported in 2025 that 27% of facility management professionals had experienced a cyber attack on their buildings within the preceding year. This statistic highlights the tangible dangers present in modern building management systems. Consequently, market growth momentum is reduced as decision-makers frequently prioritize the stability of security over the adoption of advanced productivity tools, thereby hindering the widespread realization of operational efficiencies.

Market Trends

The emergence of Blockchain-Based Real Estate Tokenization and Fractional Ownership is democratizing property investment by transforming physical assets into digital tokens, significantly improving liquidity in a traditionally illiquid sector. This technological evolution enables the fractional trading of high-value commercial and residential properties on secure, decentralized ledgers, drastically lowering entry barriers for individual investors. Institutional adoption of on-chain finance is also accelerating, with smart contracts being used to automate compliance and settlement processes. According to InvestaX's January 2025 report, '2024: The Year of Institutional Real World Asset Tokenization,' the market for tokenized real-world assets (excluding stablecoins) expanded by approximately 85% year-over-year, reaching $15.2 billion by December 2024.In parallel, the widespread adoption of Immersive Virtual Reality (VR) and Augmented Reality (AR) Tours is revolutionizing property marketing by allowing high-fidelity remote walkthroughs. These immersive technologies have evolved from novelties into standard marketing assets, reducing the need for physical site visits and opening the market to international buyers. This shift meets the demand for digital-first engagement strategies that offer detailed spatial understanding without geographic constraints. The importance of these tools is confirmed by the National Association of REALTORS® September 2025 survey, which found that 47% of real estate professionals now pay for virtual tour technologies to enhance their listings, cementing the role of immersive media in modern transactions.

Key Players Profiled in the PropTech Market

- Ascendix Technologies

- ZUMPER INC.

- Opendoor

- Altus Group

- Guesty Inc.

- HOLOBUILDER, INC.

- Zillow, Inc.

- ManageCasa

- Coadjute

- Vergesense

Report Scope

In this report, the Global PropTech Market has been segmented into the following categories:PropTech Market, by Property Type:

- Commercial

- Residential

PropTech Market, by Solution:

- Software

- Services

PropTech Market, by Deployment:

- Cloud

- On-premise

PropTech Market, by End User:

- Housing Associations

- Property Managers/Agents

- Property Investors

- Others

PropTech Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global PropTech Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this PropTech market report include:- Ascendix Technologies

- ZUMPER INC

- Opendoor

- Altus Group

- Guesty Inc.

- HOLOBUILDER, INC.

- Zillow, Inc.

- ManageCasa

- Coadjute

- Vergesense

Table Information

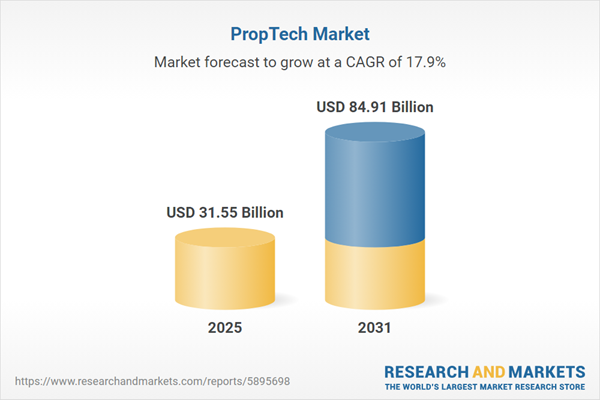

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 31.55 Billion |

| Forecasted Market Value ( USD | $ 84.91 Billion |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |