Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market progress faces significant hurdles due to the volatility of raw material costs, specifically copper and specialized polymers, alongside fragile supply chains. Manufacturers are under intense pressure to lower harness weight and costs while managing these fluctuating inputs and global logistical interruptions. This instability is compounded by the uncertain rate of the electric vehicle transition in specific regions, which creates difficulties for long-term capital investment and production planning for specialized suppliers, potentially hindering steady industry expansion.

Market Drivers

The accelerating adoption of electric and hybrid vehicles acts as a major driver for the secondary wiring harness industry. In contrast to internal combustion engines, electrified powertrains demand extensive auxiliary low-voltage cabling to sustain battery management systems, thermal regulation units, and regenerative braking controls. This transition requires specialized harnesses capable of enduring higher thermal loads while maintaining low weight to ensure range efficiency. Highlighting this trend, the International Energy Agency (IEA) noted in its 'Global EV Outlook 2024' from April 2024 that nearly 14 million new electric cars were registered globally in 2023, reaching a total of 40 million on the road, which directly drives the procurement of specialized secondary power distribution assemblies.Simultaneously, the incorporation of sophisticated connectivity and infotainment systems is transforming wire harness architecture. Modern vehicles are becoming digital cockpits equipped with sensor arrays, always-on 5G modules, and multiple high-definition displays, all requiring intricate secondary data transmission networks. As per LG Electronics' 'Earnings Release Q4 2023' in January 2024, their Vehicle Component Solutions division reached a record revenue of KRW 10.1 trillion, fueled by e-powertrain and infotainment growth. Additionally, Aptiv PLC reported record full-year revenue of $20.1 billion in 2024, demonstrating the sustained commercial demand for advanced signal distribution technologies that utilize thinner, more flexible wiring solutions.

Market Challenges

The volatility of material costs, particularly for specialized polymers and copper, represents a major obstacle to stability in the Global Automotive Secondary Wiring Harness Market. Because these secondary systems depend heavily on durable insulation and conductive metals, manufacturers are extremely susceptible to price swings that deplete profit margins. When input costs increase unexpectedly, suppliers find it difficult to sustain competitive pricing without sacrificing the weight reduction or quality targets required by automakers. This economic uncertainty impedes long-term production strategies and deters the capital investment needed to expand facilities or create specialized sub-assemblies for electrified powertrains.The consequences of this financial pressure are reflected in recent industry feedback regarding supply chain operations. In 2024, the European Association of Automotive Suppliers (CLEPA) indicated that 77% of automotive suppliers faced substantial challenges in passing cost hikes on to vehicle manufacturers, with 60% anticipating revenue declines due to these enduring pressures. The inability to push rising material costs downstream compels harness manufacturers to absorb the financial losses, which directly restricts their capacity to support steady market growth or finance the innovation necessary for decentralized zonal architectures.

Market Trends

The shift toward Zonal Electronic Architectures is fundamentally reshaping vehicle data and power distribution networks by reducing secondary harness lengths. By substituting domain-centralized layouts with zone controllers positioned closer to actuators and sensors, manufacturers can significantly consolidate circuits and shorten wire lengths, thereby reducing the weight and complexity of physical cabling. This architectural evolution facilitates the integration of harnesses into space-limited chassis and supports the software-defined vehicle ecosystem by separating compute functions from input/output management. Evidencing the commercial appeal of this approach, Aptiv PLC revealed in its February 2024 'Fourth Quarter 2023 Earnings Call' that it had secured $5.2 billion in customer awards for its Smart Vehicle Architecture solutions the previous year.Concurrently, the increase in automation for manufacturing standardized secondary sub-harnesses is becoming a vital solution to stringent quality demands and rising labor costs. Although traditional harness assembly is labor-intensive, the transition to modular designs enables suppliers to utilize automated machinery for crimping, cutting, and assembling sub-components, which effectively cuts production time and human error. This operational shift enhances margin stability and supports scalability for high-volume programs requiring exact repeatability. Confirming the financial benefits of such efficiency, Lear Corporation reported in February 2025, during its 'Fourth Quarter and Full Year 2024 Results', that its E-Systems segment revenue exceeded global industry volume by 6 percentage points, attributed to strategic investments in its 'IDEA by Lear' automated manufacturing capabilities.

Key Players Profiled in the Automotive Secondary Wiring Harness Market

- Aptiv PLC

- Yazaki Corporation

- Furukawa Electric Co. Ltd.

- THB Group

- Spark Minda, Nexans

- Samvardhana Motherson Group

- Leoni AG

- Sumitomo Electric Industries Ltd.

- Lear Corporation

- Ashok Minda Group

Report Scope

In this report, the Global Automotive Secondary Wiring Harness Market has been segmented into the following categories:Automotive Secondary Wiring Harness Market, by Vehicle Type:

- ICE

- EV

Automotive Secondary Wiring Harness Market, by Application:

- Cabin

- Door Harness

- Engine Harness

- Airbag Harness

- Electronic Parking Brakes

- Electronic Gear Shift System

Automotive Secondary Wiring Harness Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Secondary Wiring Harness Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Secondary Wiring Harness market report include:- Aptiv PLC

- Yazaki Corporation

- Furukawa Electric Co. Ltd.

- THB Group

- Spark Minda, Nexans

- Samvardhana Motherson Group

- Leoni AG

- Sumitomo Electric Industries Ltd.

- Lear Corporation

- Ashok Minda Group

Table Information

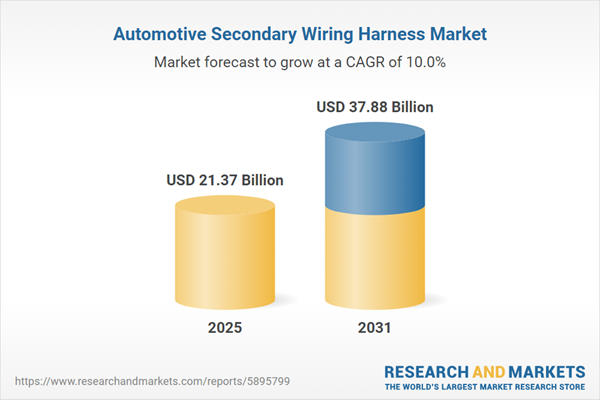

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 21.37 Billion |

| Forecasted Market Value ( USD | $ 37.88 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |