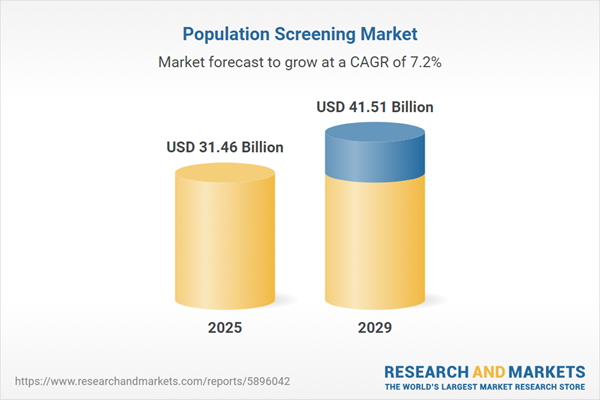

The population screening market size is expected to see strong growth in the next few years. It will grow to $41.51 billion in 2029 at a compound annual growth rate (CAGR) of 7.2%. The growth in the forecast period can be attributed to shift towards personalized medicine, aging population and chronic diseases, integration of ai and data analytics, expansion of screening access. Major trends in the forecast period include advancements in medical technology, genomics and precision screening, telehealth and remote screening, multi-disease screening panels, health equity and accessibility.

The increasing prevalence of cancer is projected to drive the growth of the population screening market in the future. Cancer occurs when certain cells in the human body grow abnormally and spread to other areas of the body. Population screening can facilitate early detection of cancer, making it more treatable and improving prognosis. For example, in January 2023, reports from the American Cancer Society Inc., a US-based voluntary health organization, indicated that there were 608,570 cancer deaths in 2022, alongside an estimated 1.9 million new cancer cases, compared to 606,520 cancer deaths in 2021. Therefore, the rising prevalence of cancer is fueling the growth of the population screening market.

The expanding proportion of aging individuals is anticipated to propel the growth of the population screening market. Aging individuals encompass those who are in the process of growing older or have reached advanced age milestones. Regular population screenings tailored to the specific health needs of aging individuals can significantly contribute to successful aging and better health outcomes. For instance, in June 2023, The United States Census Bureau, a governmental agency in the United States, reported a 0.2-year increase in the country's median age, reaching 38.9 years in 2022, indicating a continual aging trend within the population. Consequently, the growing proportion of aging individuals serves as a driving force behind the expansion of the population screening market.

Leading companies in the population screening market are developing advanced services like newborn mass screening to improve early detection and enhance infant health outcomes. Newborn mass screening is a public health initiative in which newborns are tested shortly after birth for various genetic, metabolic, hormonal, and functional disorders that may not be evident at birth but can result in serious health issues if untreated. For example, in May 2024, Shimadzu Techno-Research Inc., a contract analysis firm and subsidiary of Japan-based Shimadzu Corporation, launched a new contract service that conducts polymerase chain reaction (PCR) testing for expanded newborn mass screening. This service will screen for conditions like severe combined immunodeficiency (SCID), B-cell deficiency (BCD), and spinal muscular atrophy (SMA), which affect a small percentage of newborns but require immediate intervention upon diagnosis.

Major players in the population screening market are introducing new products for targeted disease screening to enhance their profitability. Specific disease screening within population screening refers to the focused identification of individuals at risk for certain diseases within a larger population. For instance, in October 2023, DELFI Diagnostics, a US-based company specializing in advanced machine learning and fragment omics, unveiled First Look Lung. This innovative blood test employs whole-genome machine learning to analyze cell-free DNA fragments as cancer markers. This convenient laboratory-developed test can be easily integrated into routine blood screenings. Its notable features include a 99.7% negative predictive value, effectively ruling out lung cancer, and high sensitivity for detecting early-stage disease. The test provides personalized, actionable reports to healthcare providers, offering a potential solution to improve the low lung cancer screening rates in the United States.

In January 2024, Natera, a US-based biotechnology firm, acquired Invitae for an undisclosed sum. This acquisition aims to broaden Natera's capabilities in non-invasive prenatal and carrier screening, enhancing its service offerings and supporting a larger number of patients and providers. Invitae is a US-based company that offers advanced genetic testing services, including those related to population screening.

Major companies operating in the population screening market include F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens Healthineers AG, Quest Diagnostics Incorporated, Eurofins Scientific SE, Agilent Technologies Inc., Sonic Healthcare Limited, Illumina Inc., SYNLAB International GmbH, Quidel Corporation, Bio-Rad Laboratories Inc., Unilabs, Qiagen N.V., Exact Sciences Corporation, ARUP Laboratories Inc., LGC Limited, OPKO Health Inc., Natera Inc., Cerba HealthCare S.A.S, Invitae Corp, Amedes Holding GmbH, Grail, Luminex Corporation, Novogene Co. Ltd., Trinity Biotech, Gene by Gene Ltd., Innova Medical Group Inc., Evoq Technologies LLC, LabPLUS.

North America was the largest region in the population screening market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the population screening market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the population screening market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Population screening is a systematic process aimed at evaluating the prevalence of a specific trait or disease within an entire population or a subgroup. The objective is to effectively identify individuals or groups at risk of developing a particular condition, distinguishing it from diagnostic testing.

The primary products associated with population screening include hardware equipment, testing or laboratory services, and analytics or interpretation tools. Hardware assumes a pivotal role in population screening by providing essential tools and equipment necessary for conducting screening tests, collecting data, and delivering healthcare services. Businesses engaged in population screening cater to various age groups, including males and females under 15, those between 15 and 65, and individuals aged 65 and above. These screening services are typically offered by a range of entities, including hospitals, research institutes, and diagnostic laboratories.

The population screening research report is one of a series of new reports that provides population screening market statistics, including the population screening industry's global market size, regional shares, competitors with population screening market share, detailed population screening market segments, market trends and opportunities, and any further data you may need to thrive in the population screening industry. This population screening market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The population screening market consists of revenues earned by entities by providing services such as next-generation sequencing (NGS) and microarray-based genotyping, imaging tests, mammography screening, colonoscopy screening, cholesterol screening, and blood pressure screening. The market value includes the value of related goods sold by the service provider or included within the service offering. The population screening market also includes sales of smartphone-based biosensors, kits, and chips, which are used in providing population screening services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Population Screening Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on population screening market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for population screening? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The population screening market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Hardware Equipment; Testing or Lab; Analytics or Interpretation2) By Gender: Male; Female

3) By Age: Ages Less Than 15; 15-65; Ages 65 and Above

4) By Business: Hospitals; Research Institutes; Diagnostic Labs

Subsegments:

1) By Hardware Equipment: Diagnostic Devices; Sample Collection Devices; Imaging Equipment2) By Testing or Lab: Laboratory Testing Kits; Point-of-Care Testing; Blood and Urine Testing Services

3) By Analytics or Interpretation: Software Solutions For Data Analysis; Interpretation Services; Reporting Tools

Key Companies Mentioned: F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Abbott Laboratories; Siemens Healthineers AG; Quest Diagnostics Incorporated

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Siemens Healthineers AG

- Quest Diagnostics Incorporated

- Eurofins Scientific SE

- Agilent Technologies Inc.

- Sonic Healthcare Limited

- Illumina Inc.

- SYNLAB International GmbH

- Quidel Corporation

- Bio-Rad Laboratories Inc.

- Unilabs

- Qiagen N.V.

- Exact Sciences Corporation

- ARUP Laboratories Inc.

- LGC Limited

- OPKO Health Inc.

- Natera Inc.

- Cerba HealthCare S.A.S

- Invitae Corp

- Amedes Holding GmbH

- Grail

- Luminex Corporation

- Novogene Co. Ltd.

- Trinity Biotech

- Gene by Gene Ltd.

- Innova Medical Group Inc.

- Evoq Technologies LLC

- LabPLUS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 31.46 Billion |

| Forecasted Market Value ( USD | $ 41.51 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |