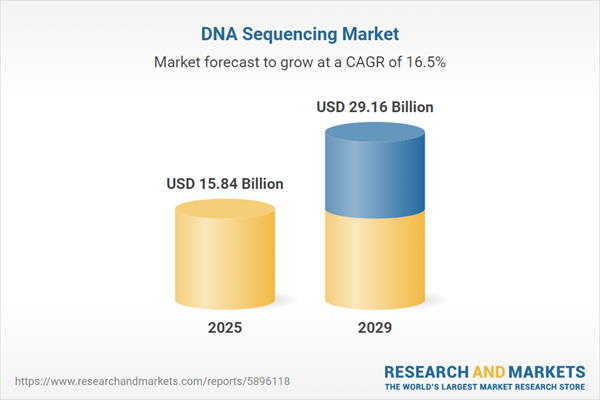

The DNA sequencing market size is expected to see rapid growth in the next few years. It will grow to $29.16 billion in 2029 at a compound annual growth rate (CAGR) of 16.5%. The growth in the forecast period can be attributed to next-generation sequencing (NGS) advancements, point-of-care sequencing, population genomics initiatives, ai and machine learning integration, precision medicine adoption. Major trends in the forecast period include single-cell sequencing advancements, epigenetics and transcriptomics focus, liquid biopsy development, ethical and privacy considerations, integration of nanotechnology.

The rising prevalence of cancer is anticipated to drive the growth of the DNA sequencing market in the future. Cancer is characterized by uncontrolled cell proliferation, affecting various organs and leading to significant morbidity and mortality globally. DNA sequencing is essential for identifying genetic mutations, understanding tumor biology, and informing treatment decisions, resulting in better outcomes in cancer care. For example, in January 2024, the American Cancer Society, a US-based nonprofit organization focused on cancer advocacy, reported that the number of cancer cases rose to 2,001,140, up from 1,958,310 in 2023, reflecting an increase of 2.19%. Thus, the growing prevalence of cancer is propelling the growth of the DNA sequencing market.

The rising demand for personalized medicine is also expected to drive the growth of the DNA sequencing market in the coming years. Personalized medicine is an innovative healthcare approach that considers individual differences in patients’ genes, environments, and lifestyles. The increasing focus on personalized medicine, which tailors treatments to an individual's genetic profile, has heightened the demand for DNA sequencing technologies to identify specific genetic variations and guide treatment decisions. For instance, in February 2024, the Personalized Medicine Coalition, a US-based nonprofit organization, reported that the FDA approved 16 novel personalized therapies for patients with rare diseases in 2023, compared to just six in 2022. Therefore, the rising demand for personalized medicine is driving the growth of the DNA sequencing market moving forward.

An emerging trend gaining traction in the DNA sequencing market is the progress in single-cell DNA sequencing technologies. Leading companies in the market are embracing innovative technologies to maintain their competitive positions. For example, in May 2023, Mission Bio Inc., a biotechnology company based in the US, introduced Tapestri v3, an advanced version of its high-throughput single-cell DNA and multi-omics analysis platform. Tapestri v3 incorporates breakthrough improvements in chemistry, significantly enhancing the detection of rare cells across various applications. Its improved cell capture capabilities allow researchers to identify previously undetectable single cells, providing a deeper understanding of diseases. This enhanced technology is particularly promising for applications such as measurable residual disease (MRD) assessment in cancer, where Tapestri v3 enables the detection of relapse-driving clones that were previously overlooked. Additionally, it offers advantages for developers of cell and gene therapy by enabling quality assessment at the single-cell level.

Major players in the DNA sequencing market are directing their efforts towards developing innovative solutions, including production-scale sequencers. These advanced DNA sequencing machines are designed for large-scale and high-throughput sequencing, facilitating the efficient processing of significant volumes of genetic material in research, clinical, or industrial settings. For instance, in September 2022, Illumina, Inc., a US-based biotechnology company, launched the 'NovaSeq X Series,' a new production-scale sequencer capable of sequencing more than 20,000 genomes per year with the highest levels of accuracy. This sustainable high-throughput sequencer achieves a 90% reduction in packaging, a 50% reduction in plastic waste, and eliminates the need for dry ice shipments, enhancing global access to genomic medicine and demonstrating a commitment to environmental responsibility.

In March 2024, Clinical Microbiomics, a contract research organization based in Denmark, acquired DNASense ApS for an undisclosed amount. This acquisition is intended to enhance Clinical Microbiomics' capabilities in long-read DNA and RNA sequencing, allowing for a deeper understanding of microbiome complexities and speeding up discoveries in microbiome and metabolome analysis. DNASense ApS is a Denmark-based microbiome CRO specializing in long-read DNA and RNA sequencing technologies.

Major companies operating in the DNA sequencing market include F. Hoffmann-La Roche Ltd, Abbott Laboratories Inc., Thermo Fisher Scientific Inc., Danaher Corporation, Merck KGaA, Siemens Healthineers AG, Eurofins Scientific SE, Agilent Technologies Inc., Illumina Inc., PerkinElmer Inc., Bio-Rad Laboratories Inc., QIAGEN N.V., BGI Genomics, Myriad Genetics Inc., Natera Inc., 10x Genomics Inc., GenScript Biotech Corporation, Novogene Corporation, Twist Bioscience, Genewiz LLC, Oxford Nanopore Technologies Ltd., Pacific Biosciences of California Inc., Macrogen Inc., LI-COR Inc., MGI Tech Co. Ltd., Zymo Research Corporation, Igenomix, Codex DNA, GenapSys Inc., SeqOnce Biosciences Inc.

North America was the largest region in the DNA sequencing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the DNA sequencing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the DNA sequencing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

DNA sequencing involves determining the precise order or sequence of nucleotides (adenine, cytosine, guanine, and thymine) in a DNA molecule. This molecular biology and genetics technique is fundamental, enabling scientists to decipher the genetic code embedded within an organism's DNA.

The primary components of DNA sequencing are instruments, consumables, and services. Instruments, defined as mechanical tools or implements, particularly those used for delicate or precise operations, are employed in DNA sequencing to automate and execute the various steps involved in sequencing DNA samples. Technologies such as third-generation DNA sequencing, next-generation sequencing, and Sanger sequencing are applied in diagnostics, biomarkers and cancer research, reproductive health studies, personalized medicine initiatives, forensics, and other scientific domains. This technology is utilized by a diverse range of entities, including hospitals and healthcare organizations, academic and research institutions, as well as pharmaceutical and biotechnology companies.

The DNA sequencing market research report is one of a series of new reports that provides DNA sequencing market statistics, including the DNA sequencing industry's global market size, regional shares, competitors with an DNA sequencing market share, detailed DNA sequencing market segments, market trends and opportunities, and any further data you may need to thrive in the DNA sequencing industry. This DNA sequencing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The DNA sequencing market consists of revenues earned by entities by providing bioinformatics and data analysis software and sequencing services. The market value includes the value of related goods sold by the service provider or included within the service offering. The DNA sequencing market also includes sales of DNA sequencing kits, sequencing reagents, and laboratory equipment used in providing DNA sequencing services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

DNA Sequencing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dna sequencing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dna sequencing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dna sequencing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Instruments; Consumables; Services2) By Technology: Third Generation DNA Sequencing; Next-Generation Sequencing; Sanger Sequencing

3) By Application: Diagnostics; Biomarkers and Cancer; Reproductive Health; Personalized Medicine; Forensics; Other Applications

4) By End User: Hospitals and Healthcare Organizations; Academics and Research Institutions; Pharmaceutical and Biotechnology Companies; Other End Users

Subsegments:

1) By Instruments: Next-Generation Sequencing (NGS) Systems; Sanger Sequencing Systems; Single-Molecule Sequencing Instruments2) By Consumables: Reagents; Kits; Chips and Flow Cells

3) By Services: Sequencing Services; Data Analysis Services; Bioinformatics Services

Key Companies Mentioned: F. Hoffmann-La Roche Ltd; Abbott Laboratories Inc.; Thermo Fisher Scientific Inc.; Danaher Corporation; Merck KGaA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Merck KGaA

- Siemens Healthineers AG

- Eurofins Scientific SE

- Agilent Technologies Inc.

- Illumina Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- QIAGEN N.V.

- BGI Genomics

- Myriad Genetics Inc.

- Natera Inc.

- 10x Genomics Inc.

- GenScript Biotech Corporation

- Novogene Corporation

- Twist Bioscience

- Genewiz LLC

- Oxford Nanopore Technologies Ltd.

- Pacific Biosciences of California Inc.

- Macrogen Inc.

- LI-COR Inc.

- MGI Tech Co. Ltd.

- Zymo Research Corporation

- Igenomix

- Codex DNA

- GenapSys Inc.

- SeqOnce Biosciences Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.84 Billion |

| Forecasted Market Value ( USD | $ 29.16 Billion |

| Compound Annual Growth Rate | 16.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |