Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One significant hurdle hampering market growth is the intrinsic instability of the raw material supply chain. Unlike synthetic alternatives, natural ingredients are tethered to agricultural cycles, rendering them highly vulnerable to weather variations and crop failures. This dependency frequently leads to price volatility and inconsistent availability for manufacturers.

Market Drivers

The primary catalyst for market growth is rising health awareness and a growing aversion to synthetic additives, as consumers prioritize wellness and transparency in their dietary choices. Shoppers are actively seeking products void of artificial preservatives, forcing manufacturers to reformulate with natural alternatives. This trend is evident in the booming functional segment; according to Kerry's '2025 Taste Charts' report from January 2025, the global functional beverage and supplement market is valued at US$240 billion, fueled largely by demand for health-supportive ingredients. Consequently, major industry players are leveraging this clean-label movement to achieve significant revenue gains. For instance, Givaudan reported full-year group sales of CHF 7.41 billion in January 2025, marking a robust 12.3% like-for-like growth driven by strong volume demand across all segments.A second pivotal factor is the rapid growth of the plant-based and organic food sectors, which depend heavily on natural solutions to replicate the sensory profiles of conventional animal products. Plant-based formulations often necessitate sophisticated natural flavor masking and vibrant coloring agents from fruits and vegetables to neutralize the earthy notes of soy or pea proteins. The impact of this sector on the supply chain is substantial; according to the GNT Group's October 2024 corporate sustainability update, global sales of their plant-based EXBERRY colors have risen by over 50% since 2020, underscoring the increasing industrial need for natural sensory inputs. As these alternative protein markets mature, they continue to demand advanced natural ingredient innovations to sustain consumer appeal while adhering to strict vegan and organic certification standards.

Market Challenges

The inherent instability of the raw material supply chain poses a significant barrier to the expansion of the global natural food flavors and colors market. In contrast to synthetic counterparts that offer consistent pricing and unlimited scalability, natural ingredients are wholly dependent on successful harvest yields, making them susceptible to climate change and seasonal disruptions. This unpredictability generates severe operational risks for food and beverage manufacturers, who face difficulties maintaining profit margins when input costs fluctuate drastically or when specific natural hues and profiles become unavailable.Consequently, this volatility deters companies from fully committing to natural formulations, as securing long-term supply contracts at stable rates becomes difficult. The repercussions of such uncertainty are reflected in recent industry sentiment regarding input expenditures. According to the Food and Drink Federation, business confidence among food manufacturers dropped to -47% in the fourth quarter of 2024, a decline largely attributed to rising commodity costs and supply chain turbulence. This eroded confidence directly correlates with a reluctance to invest in new natural product development, thereby hindering overall market growth.

Market Trends

The rise of precision fermentation for bio-identical ingredients is transforming the market by providing a scalable, sustainable alternative to agriculturally dependent supply chains. This technology employs programmed microorganisms to generate specific flavor and color molecules that are chemically identical to those found in nature but require significantly fewer resources. This approach effectively alleviates the volatility linked to crop-based sourcing while satisfying the strict "natural" definitions mandated by regulatory bodies. The commercial viability of this method is reflected in recent financial results; according to the 'Interim Report for the First Nine Months of 2025' by Novonesis in November 2025, the company's Food & Health Biosolutions segment achieved 6% organic sales growth in the third quarter, highlighting the increasing industrial adoption of bio-engineered sensory solutions.Concurrently, there is a distinct shift toward coloring foodstuffs and fruit concentrates, where ingredients are processed exclusively through physical methods to preserve their botanical classifications. Unlike selective extraction, this trend emphasizes the use of whole-food concentrates to facilitate "cleaner" label declarations, such as listing "carrot juice concentrate" instead of "carotene." Manufacturers are actively reformulating to meet this standard, driving substantial revenue growth for key suppliers. According to Sensient Technologies' 'Third Quarter 2025 Financial Results' from October 2025, the company's Color Group reported revenue of $178.2 million, a 9.9% year-over-year increase largely fueled by the accelerated transition from synthetic dyes to these botanical solutions.

Key Players Profiled in the Natural Food Flavors and Colors Market

- International Flavors & Fragrances Inc.

- Symrise AG

- Roha Group

- The Archer-Daniels-Midland Company

- GNT Group B.V.

- Kalsec Inc.

- Kerry Group PLC

- Dsm-Firmenich

- Givaudan S.A.

- San-Ei Gen F.F.I.,Inc.

Report Scope

In this report, the Global Natural Food Flavors and Colors Market has been segmented into the following categories:Natural Food Flavors and Colors Market, by Color Type:

- Caramel

- Carotenoids

- Anthocyanins

- Curcumin

- Others

Natural Food Flavors and Colors Market, by Flavor Type:

- Natural Extracts

- Aroma Extract

- Essential Oil

Natural Food Flavors and Colors Market, by Application:

- Food & Beverages

- Bakery & Confectionery

- Dairy & Frozen Dessert

- Meat Products

- Others

Natural Food Flavors and Colors Market, by End User:

- Residential

- Commercial

Natural Food Flavors and Colors Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Natural Food Flavors and Colors Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Natural Food Flavors and Colors market report include:- International Flavors & Fragrances Inc

- Symrise AG

- Roha Group

- The Archer-Daniels-Midland Company

- GNT Group B.V.

- Kalsec Inc

- Kerry Group PLC

- Dsm-Firmenich

- Givaudan S.A.

- San-Ei Gen F.F.I.,Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

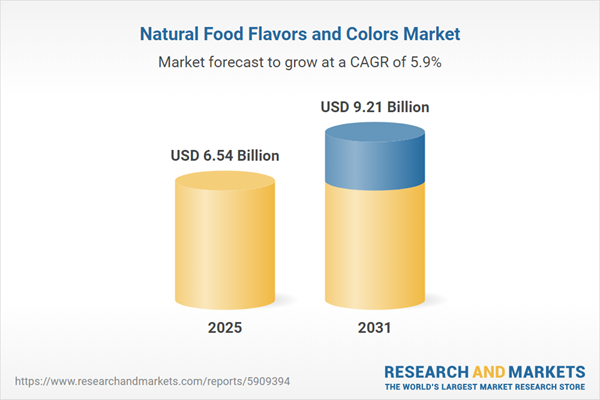

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.54 Billion |

| Forecasted Market Value ( USD | $ 9.21 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |