Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A key driver of this evolution is the growing consumer demand for convenient, efficient, and accessible banking solutions. Neobanks offer an array of services, including account management, payments, savings, and investment options, often with lower fees and enhanced user experiences compared to traditional banks.

Fintech startups, unburdened by legacy systems, can swiftly adapt to technological advancements, providing agile and responsive services. Their mobile-first approach caters to the on-the-go lifestyle of modern consumers, who increasingly prefer digital interactions over traditional brick-and-mortar banking.

Regulatory support and advancements in financial technology infrastructure have further fueled the expansion of neobanks globally. These institutions have gained popularity across various demographics, attracting both tech-savvy millennials seeking innovative banking solutions and underserved populations looking for more accessible financial services.

However, the competitive landscape is intensifying as traditional banks also embrace digital transformation to stay relevant. The neobanking market's trajectory hinges on ongoing technological developments, regulatory frameworks, and the ability of neobanks to maintain a balance between innovation, customer trust, and regulatory compliance in an ever-evolving financial landscape.

Key Market Drivers

Consumer Demand for Convenience and Accessibility

One of the primary drivers of the neobanking revolution is the changing expectations of consumers. Modern consumers seek convenience, efficiency, and accessibility in their financial services. Neobanks offer precisely that, with user-friendly, mobile-first platforms that allow customers to access their accounts, make payments, and conduct financial transactions from the comfort of their smartphones or computers. These digital banks operate 24/7, eliminating the need for physical branch visits or adhering to traditional banking hours. This convenience aligns with the busy, on-the-go lifestyles of today's consumers, making neobanking an attractive alternative.Technological Advancements

Neobanks heavily rely on technological innovation to deliver their services. Unlike traditional banks burdened with legacy systems and processes, neobanks are built from the ground up with cutting-edge technology. They leverage cloud computing, artificial intelligence (AI), and data analytics to streamline operations, enhance user experiences, and provide personalized financial solutions. For instance, AI-powered chatbots and virtual assistants offer real-time customer support and personalized financial advice. Machine learning algorithms analyze spending patterns to provide tailored budgeting recommendations. These technological advancements not only improve efficiency but also lower operational costs, enabling neobanks to pass these benefits on to customers in the form of lower fees and better interest rates.Fintech Startup Agility

Neobanks are often fintech startups unencumbered by the bureaucracy and legacy systems that traditional banks grapple with. This agility allows them to adapt swiftly to technological advancements and changing customer preferences. Startups can experiment with new features, services, and business models without the constraints of established institutions. They can also pivot quickly in response to market feedback. This flexibility has led to continuous innovation in the neobanking sector, with new features and services regularly introduced to meet evolving customer needs. Consequently, neobanks have gained a reputation for being at the forefront of financial technology, attracting tech-savvy consumers who appreciate cutting-edge solutions.Regulatory Support and Open Banking Initiatives

Regulatory bodies in various regions have recognized the potential benefits of neobanks and have taken steps to support their growth. Open banking initiatives, which require traditional banks to share customer data securely with authorized third-party providers, have played a crucial role in fostering the growth of neobanks. These initiatives create a level playing field for fintech startups by granting them access to valuable financial data, enabling them to offer innovative financial services. Regulatory sandboxes and favorable licensing regimes have also emerged in some jurisdictions, allowing neobanks to experiment and grow with reduced regulatory barriers. Moreover, regulations governing digital identity verification and electronic signatures have made it easier for neobanks to onboard customers securely and remotely, further enhancing accessibility and reducing the need for physical documentation.Demographic Shifts and Financial Inclusion

Neobanks have gained traction among various demographic groups, each attracted by specific features and benefits. Millennials and Generation Z, in particular, have embraced neobanks due to their digital-first approach, ease of use, and low or transparent fees. These younger consumers are more likely to adopt new technologies and are less tied to traditional banking relationships. However, neobanks are not limited to younger generations; they have also made strides in catering to underserved populations. Many neobanks offer financial products tailored to individuals with limited access to traditional banking services, such as immigrants and the underbanked. By providing affordable and accessible banking solutions, neobanks contribute to financial inclusion and help bridge the gap between those who have access to financial services and those who do not.Key Market Challenges

Regulatory Compliance and Stability

Regulatory compliance is a critical challenge for neobanks. While regulatory support has been a driver in some regions, navigating complex and varying regulatory landscapes globally poses a significant hurdle. Neobanks must ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations, data protection laws, and other financial regulations. Meeting these requirements is not only essential for legal adherence but also for building trust among customers who expect their financial institutions to operate securely and ethically.Furthermore, as neobanks expand across borders, they encounter diverse regulatory environments, each with its own set of rules and standards. Adapting to these regulatory variations can be resource-intensive and time-consuming. A misstep in compliance could result in fines, legal challenges, or reputational damage, all of which could undermine the viability of neobanks.

Achieving stability is another regulatory-related challenge. Traditional banks often rely on established structures and practices that have stood the test of time. Neobanks, being relatively new entrants, must prove their stability and resilience to regulators and customers alike. The perceived fragility of fintech startups could be a barrier to attracting more risk-averse customers.

Cybersecurity and Data Privacy

With the increasing digitization of financial services, the risk of cybersecurity threats and data breaches is a major concern for neobanks. These institutions handle vast amounts of sensitive financial and personal data, making them attractive targets for cybercriminals. A successful cyberattack could result in financial losses, reputational damage, and compromised customer trust.Neobanks must invest heavily in robust cybersecurity measures to safeguard their systems and data. This includes implementing advanced encryption technologies, conducting regular security audits, and staying abreast of the latest cyber threats. The challenge here is not only the initial investment but the ongoing commitment to staying ahead of evolving cyber threats.

Additionally, neobanks need to address concerns related to data privacy. Customers entrust these institutions with their personal and financial information, and any perceived or actual mishandling of data can lead to loss of trust. Striking the right balance between providing personalized services and respecting user privacy is a nuanced challenge that neobanks need to navigate carefully.

Customer Acquisition and Retention

While neobanks attract tech-savvy consumers seeking modern, convenient banking solutions, they face challenges in customer acquisition and retention. Established banks benefit from brand recognition, a long history of trust, and a vast network of physical branches. Neobanks, on the other hand, need to work harder to build brand awareness and establish trust.Customer acquisition costs can be high, especially as neobanks often rely on digital marketing and word-of-mouth to reach potential customers. Furthermore, attracting a diverse customer base, including those who might be more conservative in adopting new financial technologies, poses an ongoing challenge.

Once acquired, retaining customers requires consistent service quality, competitive offerings, and an ongoing commitment to meeting evolving customer expectations. With the rise of competition in the neobanking space and the increasing digitalization of traditional banks, customer loyalty is hard-won and easily lost.

Monetization and Profitability

Neobanks have disrupted traditional banking models by offering low fees or fee-free services, competitive interest rates, and other customer-friendly features. While this approach is attractive to consumers, it poses a challenge for neobanks in terms of monetization and profitability. Unlike traditional banks that generate revenue through various fee structures, neobanks often rely on alternative revenue streams, such as interchange fees, partnerships, or premium subscription services.Achieving profitability without resorting to the traditional fee structures that neobanks sought to avoid is a delicate balance. The challenge is to find sustainable monetization strategies that align with customer expectations and provide value while ensuring the financial viability of the neobank. As the industry matures, neobanks must demonstrate their ability to generate consistent profits and manage costs effectively to secure long-term success.

Key Market Trends

Expansion of Financial Services Offerings

Neobanks initially gained popularity by offering basic banking services, such as checking and savings accounts, with user-friendly mobile interfaces and minimal fees. However, a significant trend in recent years has been the expansion of their financial services offerings. Neobanks are increasingly becoming one-stop shops for a wide range of financial products, including investment accounts, loans, insurance, and more.This trend is driven by the desire to capture a larger share of the customer's financial wallet and offer a holistic financial experience. By providing a comprehensive suite of services, neobanks aim to deepen customer relationships, increase customer retention, and generate additional revenue streams. For example, some neobanks offer robo-advisory services to help customers invest, while others provide personal loans or insurance products, creating a seamless ecosystem for users.

Partnerships and Ecosystem Integration

Neobanks are forging strategic partnerships with other fintech companies, established financial institutions, and even non-financial organizations to create integrated financial ecosystems. These partnerships enable neobanks to offer a broader range of services without having to build every capability in-house.For instance, neobanks may collaborate with lending platforms to provide access to loans, team up with insurance providers to offer coverage, or integrate with third-party payment processors to facilitate seamless transactions. By leveraging these partnerships, neobanks can enhance their value proposition and create a more comprehensive and user-friendly experience for customers.

Moreover, neobanks are increasingly exploring opportunities beyond traditional banking services. They may integrate with e-commerce platforms, ride-sharing apps, or other non-banking services to provide users with a holistic financial experience. These ecosystem-based strategies not only attract more customers but also increase engagement and cross-selling opportunities.

Focus on Personalization and AI-driven Insights

Personalization is a growing trend in neobanking, driven by advancements in artificial intelligence and data analytics. Neobanks are using AI algorithms to analyze customer data and provide tailored financial insights, advice, and product recommendations.For example, AI can analyze a customer's spending habits and financial goals to suggest a customized savings plan. Chatbots and virtual assistants powered by AI provide real-time customer support and answer inquiries about account balances, transactions, and financial tips. By delivering personalized and proactive recommendations, neobanks aim to enhance customer engagement and satisfaction.

Additionally, neobanks are using AI to detect and prevent fraud, offering an added layer of security to their digital services. AI-driven fraud detection systems can identify unusual patterns of behavior and alert customers to potential security threats.

Green Banking and Sustainability Initiatives

Sustainability and environmental responsibility are gaining prominence in the neobanking sector. Many neobanks are adopting eco-friendly practices and incorporating sustainability into their mission statements. They offer customers options to make environmentally conscious financial choices, such as green investment portfolios, carbon footprint tracking, or donations to environmental causes with every transaction.Neobanks are also exploring partnerships with eco-friendly fintech companies and organizations that support sustainable initiatives. They may offer incentives for customers who choose environmentally friendly options, such as digital statements instead of paper ones or cashback rewards for using public transportation.

This trend aligns with the growing global awareness of climate change and environmental conservation, making it an attractive feature for customers who want to align their financial decisions with their values.

Geographic Expansion and Internationalization

While neobanks typically start in one geographic region, many are looking to expand their reach and go international. This trend is driven by the desire to tap into new markets, diversify customer bases, and achieve economies of scale.Expanding internationally, however, poses challenges related to regulatory compliance, adapting to diverse consumer preferences, and navigating different financial landscapes. Neobanks need to understand the unique needs of each market they enter and tailor their offerings and marketing strategies accordingly.

Internationalization also presents an opportunity for neobanks to serve customers who frequently travel or have international ties. Some neobanks offer multi-currency accounts and reduced foreign transaction fees to cater to this segment of users.

Regulatory Evolution and Open Banking

Regulatory developments are profoundly impacting the neobanking sector. Open banking regulations, which require traditional banks to share customer data with authorized third parties, have played a pivotal role in fostering innovation and competition. Neobanks are leveraging open banking to access valuable financial data, offer more tailored services, and create new revenue streams.However, compliance with evolving regulations remains a challenge. Neobanks must adapt to changes in data privacy laws, anti-money laundering (AML) regulations, and customer protection rules, which vary from region to region. Staying compliant while also innovating and expanding is a delicate balance that neobanks must maintain.

Moreover, some neobanks are aspiring to obtain full banking licenses, which would enable them to offer a wider range of services and increase customer trust. However, obtaining such licenses can be a lengthy and resource-intensive process.

Segmental Insights

Account Type Insights

The personal account segment is emerging as a pivotal growth area within the neobanking sector. Characterized by a focus on individual consumers, this segment addresses the unique financial needs and preferences of users in a highly personalized manner. Neobanks, leveraging advanced technologies like artificial intelligence and data analytics, are providing a spectrum of services tailored for personal account holders.In this dynamic landscape, neobanks are redefining the banking experience for individuals, offering features such as customizable savings plans, real-time spending insights, and personalized budgeting recommendations. The emphasis on user-centric design and intuitive mobile interfaces aligns with the expectations of modern consumers who seek seamless and personalized interactions in their financial dealings.

Furthermore, neobanks are incorporating innovative tools to empower personal account holders. From AI-driven financial advice to automated savings strategies, these banks are not only simplifying banking processes but also fostering financial literacy and responsible money management. This heightened focus on the personal account segment reflects a broader industry trend of delivering tailored, user-centric financial solutions that resonate with the evolving expectations of today's individual consumers. As this segment continues to grow, neobanks are likely to introduce even more sophisticated and personalized services, cementing their role as the preferred choice for those seeking a modern and individualized banking experience.

Application Insights

The personal banking segment is experiencing significant growth within the neobanking market. This segment caters to individual consumers, and neobanks are increasingly focusing on providing tailored financial solutions to meet the unique needs of personal account holders.One of the key drivers behind the growth of the personal banking segment is the consumer demand for a more personalized and user-friendly banking experience. Neobanks leverage technology and data analytics to offer highly customized services, such as budgeting tools, automated savings plans, and real-time spending insights. These features empower individuals to take control of their finances and make informed decisions.

Moreover, neobanks are capitalizing on the convenience factor by offering seamless, mobile-first banking experiences. Personal account holders can access their accounts, make transactions, and manage their finances on the go, eliminating the need for physical branch visits and time-consuming paperwork.

The personal banking segment also benefits from the ongoing trend of digitalization in the financial industry. Consumers, especially tech-savvy millennials and Gen Z, are increasingly adopting digital banking solutions, making neobanks an attractive option.

As neobanks continue to innovate and expand their services, the personal banking segment is poised for further growth. With a focus on personalization, convenience, and technology-driven solutions, neobanks are reshaping the way individuals manage their finances and are well-positioned to capture a significant share of the personal banking market in the coming years.

Regional Insights

The Asia-Pacific region is emerging as a high-growth segment within the neobanking market. This dynamic region, characterized by its diverse economies, burgeoning middle class, and rapid digitalization, presents significant opportunities for neobanks to expand their footprint and capture a vast customer base.One of the primary drivers behind the growth of neobanking in Asia-Pacific is the region's large population of tech-savvy individuals who are increasingly seeking modern and convenient financial solutions. Neobanks, with their mobile-first approach and user-friendly interfaces, align perfectly with the digital preferences of consumers in this region. Moreover, the relative underdevelopment of traditional banking infrastructure in some areas makes neobanks an attractive and accessible alternative.

Regulatory support and initiatives promoting financial inclusion are also fostering the growth of neobanking in Asia-Pacific. Governments and regulatory bodies in several countries are embracing fintech innovations and open banking initiatives, creating a conducive environment for neobanks to operate and expand.

Additionally, Asia-Pacific's diverse markets present opportunities for neobanks to offer specialized services tailored to local needs. Neobanks in the region are collaborating with local partners, launching innovative products, and adapting to cultural nuances to attract and retain customers.

As the Asia-Pacific neobanking segment continues to evolve, it is likely to witness increased competition and innovation, making it a focal point for neobanks seeking international expansion and growth. With the region's economic vibrancy and technological advancements, neobanks have a bright future as they cater to the financial needs of a rapidly growing and digitally engaged population.

Report Scope:

In this report, the Global Neobanking Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Neobanking Market, By Account Type:

- Business Account

- Savings Account

Neobanking Market, By Application:

- Enterprise

- Personal

Neobanking Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Argentina

- Colombia

- Brazil

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Neobanking Market.Available Customizations:

Global Neobanking market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Atom Bank PLC

- Fidor Bank Ag

- Monzo Bank Ltd.

- Movencorp Inc.

- Mybank

- N26

- Revolut Ltd.

- Simple Finance Technology Corp.

- Ubank Limited

- Webank, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2023 |

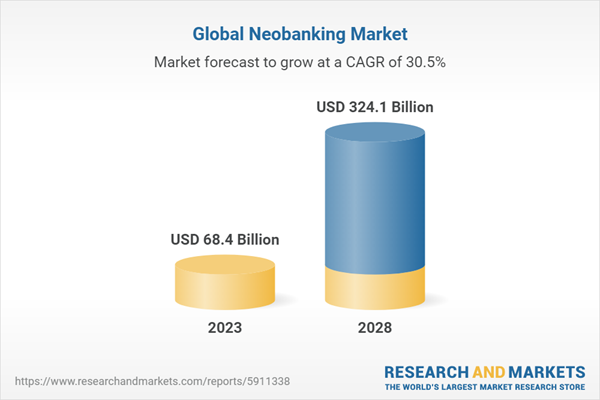

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 68.4 Billion |

| Forecasted Market Value ( USD | $ 324.1 Billion |

| Compound Annual Growth Rate | 30.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |