Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary drivers of growth in the global medical and surgical drainage system market is the increasing prevalence of chronic diseases and surgeries worldwide. The rising incidence of conditions such as cancer, cardiovascular diseases, and orthopedic issues necessitates the use of drainage systems to manage post-operative complications, fluid buildup, and infections. Moreover, with an aging population in many regions, there is a growing demand for surgical interventions and medical drainage systems.

Technological advancements in the field have also played a pivotal role in the expansion of this market. Innovations such as minimally invasive procedures, smart drainage systems with real-time monitoring capabilities, and improved materials for drain construction have enhanced patient outcomes and healthcare efficiency. These developments have not only improved the effectiveness of drainage systems but also reduced patient discomfort and recovery times.

Key Market Drivers

Prevalence of Chronic Diseases and Surgical Procedures

The increasing prevalence of chronic diseases and the growing number of surgical procedures are among the primary drivers boosting the global medical and surgical drainage system market. Chronic diseases, such as cancer, cardiovascular conditions, and orthopedic disorders, have become alarmingly common worldwide. As a result, a significant portion of the population is undergoing surgical interventions as part of their treatment plans. This surge in surgical procedures has created a substantial demand for medical and surgical drainage systems.Patients undergoing surgery for chronic illnesses often require effective drainage systems to manage post-operative complications, fluid accumulation, and the risk of infections. These drainage systems play a critical role in the patient's recovery process, preventing complications that could otherwise lead to prolonged hospital stays and increased healthcare costs. Moreover, they aid in reducing pain and discomfort, ultimately enhancing the patient's overall experience.

The aging global population is further exacerbating the prevalence of chronic diseases and the need for surgical procedures. With advanced age, the risk of chronic conditions and degenerative diseases increases, necessitating surgical interventions. Elderly patients often require drainage systems as part of their post-operative care to ensure a smooth recovery.

The demand for medical and surgical drainage systems is not only driven by the sheer number of surgical procedures but also by the increasing complexity of these surgeries. Advancements in medical technology have made it possible to perform more intricate procedures with improved outcomes. However, such surgeries often involve a higher risk of post-operative complications, making efficient drainage systems indispensable. These systems help in managing excess fluids and prevent complications like hematoma or seroma formation..

Aging Population

The aging population is a significant factor driving the growth of the global medical and surgical drainage system market. As populations in many parts of the world continue to age, there is a growing demand for medical interventions and surgical procedures. With advanced age comes an increased likelihood of chronic illnesses, degenerative diseases, and a greater need for surgical treatments. This demographic shift is leading to a surge in the number of surgeries, and subsequently, the demand for effective medical and surgical drainage systems.Elderly individuals often require surgical interventions for a range of medical conditions, including joint replacements, cardiac procedures, and cancer treatments. These surgeries can result in fluid accumulation, a common post-operative complication, which can be effectively managed by drainage systems. As the elderly population increases, so does the prevalence of these surgical procedures, leading to a higher demand for drainage solutions.

Furthermore, the aging population is more prone to complications post-surgery, making efficient drainage systems even more crucial. Drainage systems help prevent issues such as hematoma, seroma, and infection, which can prolong recovery periods and increase healthcare costs. As healthcare providers aim to enhance patient outcomes and ensure a smoother recovery process, the use of advanced medical and surgical drainage systems becomes increasingly important.

The need for medical and surgical drainage systems is not only driven by the sheer number of surgeries but also by the evolving nature of these procedures. Medical technology is continually advancing, allowing for more complex and precise surgeries. While these advanced surgical techniques often lead to better outcomes, they also require more sophisticated drainage solutions to manage the intricacies of post-operative care effectively..

Technological Advancements

Advancements in surgical techniques have led to a significant increase in minimally invasive procedures. These procedures are associated with smaller incisions, reduced trauma to the patient, and quicker recovery times. However, they often require specialized drainage systems designed to accommodate the unique needs of these surgeries. These systems are more precise and less invasive, contributing to improved patient outcomes.The introduction of smart drainage systems equipped with real-time monitoring capabilities is a major technological advancement in this market. These systems can provide healthcare providers with real-time data on fluid output, enabling them to make informed decisions about patient care. This technology not only enhances patient safety but also reduces the need for constant manual monitoring, improving the efficiency of healthcare services.

Technological innovations have led to the development of better materials for drainage system construction. These materials are more biocompatible, reducing the risk of adverse reactions or infections. Moreover, innovative design features in modern drainage systems make them more comfortable for patients, resulting in greater patient satisfaction and compliance with post-operative care instructions.

Technological advancements have enabled the integration of medical and surgical drainage systems with electronic health records and healthcare information systems. This integration streamlines data management, facilitates communication among healthcare providers, and ensures a comprehensive patient care approach. It also allows for better traceability and accountability in patient care.

Newer drainage systems are designed to minimize the risk of complications, such as blockages or accidental dislodgement. This reduces the need for additional surgical interventions or procedures to address complications, resulting in cost savings and a smoother recovery process for patients.

Infection control has become a top priority, especially in light of global health challenges such as the COVID-19 pandemic. Technological advancements have led to the development of drainage systems with enhanced infection control features, reducing the risk of contamination and ensuring a sterile post-operative environment.

Key Market Challenges

High Cost of Advanced Drainage Systems

One of the primary concerns surrounding advanced drainage systems is their financial burden on healthcare facilities. Hospitals, clinics, and surgical centers often operate under tight budgets, and the high upfront costs of advanced drainage systems can strain their financial resources. This can lead to difficulties in procuring these systems and subsequently affect the quality of patient care.Developing regions, where healthcare resources are often scarce, face significant challenges in providing access to advanced medical and surgical drainage systems. The cost of these systems can be prohibitive in areas with limited healthcare infrastructure and economic constraints, resulting in a lack of access to modern and more effective drainage solutions.

The high cost of advanced drainage systems can exert pressure on healthcare budgets at both the institutional and national levels. As governments and healthcare organizations allocate funds for various medical needs, the substantial expense of drainage systems can reduce the resources available for other critical healthcare initiatives, such as improving patient care or expanding healthcare services.

The cost of advanced drainage systems can also impact patients directly. Depending on the healthcare system and insurance coverage, patients may bear some of the financial burden associated with the use of these systems. The increased costs for patients can deter them from seeking advanced medical procedures, potentially affecting their health outcomes.

The medical and surgical drainage system market faces challenges in promoting the adoption of advanced systems due to their high cost. Healthcare providers may be hesitant to invest in these systems, especially if they are already operating on tight budgets. As a result, some facilities may continue to rely on older, less efficient drainage solutions.

Global Supply Chain Disruptions

The medical and surgical drainage systems rely on a complex network of components and materials. Disruptions in the supply chain can result from shortages of these key components, ranging from plastics and metals to electronic sensors. Such shortages can lead to production delays and increased costs, ultimately affecting the pricing and availability of drainage systems.Transportation disruptions have impacted the timely delivery of medical and surgical drainage systems. Restrictions on cargo movement, canceled flights, and delays in customs clearance have contributed to logistical challenges. As a result, healthcare facilities may experience difficulties in procuring these essential devices.

Supply chain disruptions can increase production costs due to higher prices for materials, expedited shipping, and emergency measures to maintain production. These increased costs may be passed on to healthcare facilities, which can limit their capacity to acquire advanced drainage systems.

Supply chain disruptions can lead to fluctuations in inventory levels, causing shortages of medical and surgical drainage systems. Healthcare facilities may find it challenging to maintain adequate stock, which can lead to delays in patient care and increased risk of complications.

Supply chain disruptions can make it challenging for manufacturers and healthcare providers to accurately forecast demand. Inconsistent supply chains can lead to uncertainty in inventory management and hinder the ability to respond to changing healthcare needs.

Key Market Trends

Growing Popularity of Minimally Invasive Surgeries

The growing popularity of minimally invasive surgeries is a significant trend that is boosting the global medical and surgical drainage system market. Minimally invasive procedures, characterized by smaller incisions and reduced tissue trauma, offer numerous advantages to patients, including quicker recovery times, reduced pain, and shorter hospital stays. As these minimally invasive surgeries become more prevalent, there is an increasing demand for specialized drainage systems designed to cater to their unique needs.Unlike traditional open surgeries, minimally invasive procedures often involve the use of endoscopic or laparoscopic techniques, where small incisions are made to access the surgical site. These procedures can result in fluid accumulation in the surgical area, making effective post-operative drainage systems crucial.

Advanced drainage systems designed specifically for minimally invasive surgeries are equipped with precision engineering to ensure the efficient removal of fluids and reduce the risk of complications such as hematoma and seroma formation. The design and technology incorporated in these systems help healthcare providers manage drainage in a way that aligns with the minimally invasive approach, promoting optimal patient outcomes.

Minimally invasive surgeries are favored not only for their patient benefits but also for their cost-effectiveness and convenience. They have become increasingly common for a wide range of medical conditions, from gallbladder removal to joint surgeries. Ambulatory surgical centers, which specialize in same-day surgical procedures, are witnessing significant growth, and these centers depend on efficient drainage systems to facilitate quick patient recovery and discharge.

As the popularity of minimally invasive surgeries continues to rise, the demand for advanced medical and surgical drainage systems tailored to these procedures is on the ascent. These systems enhance patient comfort, reduce the risk of complications, and enable healthcare providers to offer more efficient post-operative care. This growing demand is a key driver for innovation in the medical and surgical drainage system market, with manufacturers developing specialized solutions to cater to the evolving needs of modern healthcare.

Growing Ambulatory Surgical Centers

The global medical and surgical drainage system market is experiencing a significant boost from the growing prevalence of ambulatory surgical centers (ASCs). These centers, specialized in offering same-day surgical procedures, are on the rise and have become a pivotal factor driving the demand for medical and surgical drainage systems.Ambulatory surgical centers have gained popularity due to their cost-effectiveness, convenience, and patient-centered approach. Patients benefit from quicker turnaround times, reduced hospital stays, and a more comfortable environment. However, these same-day surgical procedures often necessitate efficient drainage systems to ensure smooth patient recovery and discharge.

ASCs require specialized medical and surgical drainage systems that are designed to meet the unique needs of same-day surgery patients. These systems are engineered to facilitate the safe and efficient removal of fluids, reducing the risk of complications such as hematoma or seroma formation. The design of these systems aligns with the specific requirements of ASCs, offering healthcare providers the tools they need to deliver high-quality care in a timely manner.

The growth of ambulatory surgical centers has resulted in an increased demand for advanced drainage solutions. As the number of these centers continues to rise, they become a significant driver for innovation in the medical and surgical drainage system market. Manufacturers are developing specialized drainage systems tailored to the needs of ASCs, further enhancing patient outcomes and healthcare efficiency.

The convenience and effectiveness of ASCs are transforming the way surgeries are performed, with a focus on minimizing patient discomfort, reducing costs, and streamlining healthcare delivery. The role of advanced drainage systems in this context is integral, as they play a crucial part in managing post-operative complications and fluid buildup, ensuring that patients can recover swiftly and with minimal risk of complications.

Segmental Insights

Product Type Insights

Based on the Product Type, closed emerged as the dominant segment in the global market for Global Medical and Surgical Drainage System Market in 2022. Closed drainage systems effectively prevent the entry of external pathogens into the patient's body, reducing the risk of post-operative infections. Infection control is a top priority in healthcare, and closed systems provide a high level of security in this regard. Closed systems offer enhanced safety for both patients and healthcare providers. The sealed design minimizes the potential for accidental exposure to bodily fluids, protecting against potential infections. Closed drainage systems are typically more comfortable for patients. Since the collected fluids are sealed within the system, patients are not exposed to the sight or odor of drainage, which can be distressing. This can lead to improved patient compliance with post-operative care instructions. The closed design allows for precise measurement and monitoring of fluid output. Healthcare providers can accurately track the patient's drainage, enabling them to make informed decisions about care. Closed systems simplify the disposal of collected fluids and drainage materials, reducing the risk of environmental contamination and the need for elaborate disposal protocols.Application Insights

Based on the Application, Orthopedic Surgery emerged as the dominant segment in the global market for Global Medical and Surgical Drainage System Market in 2022. Orthopedic surgeries, which involve procedures related to the musculoskeletal system, are among the most common surgical interventions globally. These surgeries encompass joint replacements, fracture repairs, spine surgeries, and more. With an aging population and an increase in sports-related injuries, the demand for orthopedic surgeries has been steadily rising. Many orthopedic surgeries involve procedures that generate excess fluids in the surgical area. To manage these fluids and prevent complications like hematoma or seroma formation, drainage systems are crucial. Effective drainage systems improve patient outcomes, reduce recovery times, and minimize the risk of infections, making them an essential component of orthopedic surgical care. Advances in orthopedic surgical techniques and materials, such as improved joint prostheses and fixation devices, have led to more complex surgeries. As the complexity of orthopedic procedures increases, the need for innovative and specialized drainage systems becomes paramount to ensure optimal patient care and recovery.Regional Insights

North America emerged as the dominant player in the Global Medical and Surgical Drainage System Market in 2022, holding the largest market share. North America boasts a well-developed and advanced healthcare infrastructure, including state-of-the-art healthcare facilities, highly skilled healthcare professionals, and access to cutting-edge medical technologies. This infrastructure enables the effective utilization of medical and surgical drainage systems in patient care. The United States, in particular, has one of the highest healthcare expenditures in the world. This substantial investment in healthcare resources allows for the adoption of advanced medical technologies and a greater demand for medical and surgical drainage systems. North America has a relatively high prevalence of chronic diseases, such as cardiovascular conditions, diabetes, and various cancers. Patients with these conditions often require surgical procedures and post-operative care, including the use of medical drainage systems. The high incidence of chronic illnesses contributes to the demand for drainage systems.Report Scope:

In this report, the Global Medical and Surgical Drainage System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Medical and Surgical Drainage System Market, By Product Type:

- Open

- Closed

Global Medical and Surgical Drainage System Market, By Flow Type:

- Active

- Passive

Global Medical and Surgical Drainage System Market, By Application:

- Cardiac and Thoracic Surgery

- Abdominal

- Orthopedic

- Other Surgeries

Global Medical and Surgical Drainage System Market, By Material Type:

- Silastic

- Rubber

- Other Material

Global Medical and Surgical Drainage System Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Medical and Surgical Drainage System Market.Available Customizations:

Global Medical and Surgical Drainage System Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- B. Braun SE

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- Convatec Group Plc

- Cook Medical

- Hangzhou Fushan Medical Appliances Co., LTD.

- Johnson & Johnson

- Medela AG

- Medtronic plc

- Ningbo Luke Medical Co., LTD

Table Information

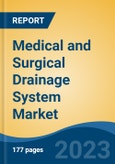

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 2.21 Billion |

| Forecasted Market Value ( USD | $ 2.88 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |