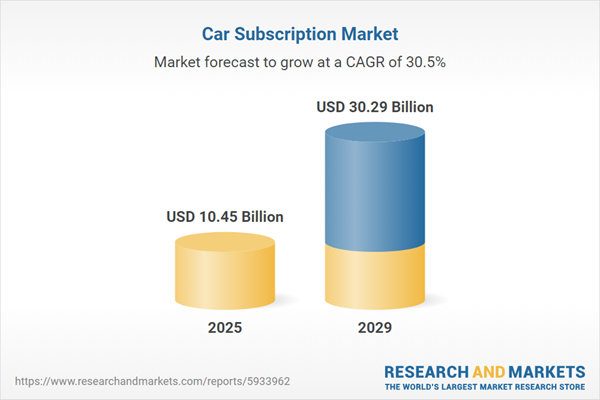

The car subscription market size is expected to see exponential growth in the next few years. It will grow to $30.29 billion in 2029 at a compound annual growth rate (CAGR) of 30.5%. The growth in the forecast period can be attributed to economic uncertainties, environmental awareness, corporate fleet solutions, regulatory support, focus on user experience. Major trends in the forecast period include flexible ownership models, integration with mobility apps and platforms, partnerships with automakers and dealerships, trial periods and test-drive options, data analytics for personalized offerings.

The forecast of 30.5% growth over the next five years reflects a slight reduction of 0.2% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Higher prices for fleet acquisition due to import tariffs on foreign-manufactured vehicles could limit car subscription program growth and affordability. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing popularity of car-sharing and ride-hailing services is projected to drive the growth of the car subscription market in the future. Car sharing is a rental model in which individuals can borrow vehicles for short durations, often by the hour, while ride-hailing involves using a smartphone app to request a local driver to transport individuals to specific destinations. Car subscriptions are integrated into these services, offering members a more affordable, flexible, and convenient means of accessing vehicles. For example, in March 2024, CoMoUK, a UK-based charity, reported that membership in car clubs reached 798,814, up from 767,899 in March 2023, indicating an increase of 342,233 members. Therefore, the rising popularity of car-sharing and ride-hailing services is fueling the growth of the car subscription market.

The rising levels of traffic congestion are anticipated to drive the growth of the car subscription market in the future. Traffic congestion refers to a transportation condition marked by slower speeds, longer travel times, and increased vehicle queues, occurring when the volume of vehicles exceeds the capacity of a road or intersection. Car subscription services can help alleviate this issue by reducing car ownership and promoting carpooling, resulting in fewer vehicles on the road and less congestion overall. For example, in January 2023, INRIX Inc., a UK-based cloud-based analytics firm, reported that in 2022, the average driver in London faced costs of £1,377 ($1,784) due to lost time from congestion, while UK drivers overall lost an average of £707 ($916). Moreover, the typical UK driver spent 80 hours in traffic congestion, a 7-hour increase compared to 2021. Therefore, the increasing traffic congestion is driving the expansion of the car subscription market.

Prominent companies operating within the car subscription market are actively engaged in the development of sophisticated digital platforms, particularly white-label technology platforms, to better cater to the demands of their existing consumer base. A white-label technology platform denotes a software solution initially developed and owned by one company but subsequently rebranded and sold by another entity. For instance, in June 2022, Banco Santander S.A., a financial services company headquartered in Spain, introduced Ulity, a white-label technology platform specifically designed to create subscription-based solutions for the mobility service industry. Ulity stands out by tailoring its solutions to accommodate businesses of various sizes and differing objectives within the industry. It enables these businesses to offer users immediate access to vehicles without any long-term commitments. The software empowers companies to create subscription-based solutions, reduce the cost associated with establishing automobile fleets, diversify existing fleets, enhance fleet longevity, and dynamically manage operations based on fluctuating demand trends.

In July 2023, Sixt SE, a prominent mobility services provider headquartered in Germany, completed the acquisition of Renti Plus for an undisclosed sum. This strategic acquisition empowers Sixt to assume control and augment its existing fleet with over 100 vehicles previously operated by Renti Plus. The collaboration expands the accessibility of the Sixt Plus service while enhancing the customer experience through the integration of Renti Plus' established car subscription platform. Renti Plus, based in Latvia, specializes in offering car subscription services, and this acquisition allows Sixt to further consolidate its market presence and improve its service offerings within the car subscription domain.

Major companies operating in the car subscription market report are Volkswagen AG, Toyota Motor Corp., BMW AG, Mercedes-Benz Group AG, Hyundai Motor Co., Nissan Motor Co. Ltd., Porsche AG, Volvo Car Corporation, Cox Enterprises Inc., Jaguar Land Rover Limited, Hertz Global Holdings Inc., Lyft Inc., Tata Motors Limited, Sixt SE, Onto Ltd., ZoomCar, Carly Holdings Limited, Canoo Inc., OpenRoad Auto Group, Clutch Technologies LLC, Facedrive Inc., Wagonex Limited, Cluno GmbH, Carvolution, MylesCar.

North America was the largest region in the car subscription market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the car subscription market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the car subscription market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The car subscription market includes revenues earned by entities by providing alternative to traditional car ownership, leasing, or renting. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and the resulting trade tensions in spring 2025 are having a considerable impact on the transport services sector by increasing the costs of vehicles, spare parts, and fuel - critical inputs frequently imported from tariff-affected regions. Freight operators, logistics companies, and public transportation providers are experiencing margin pressures as elevated equipment and maintenance expenses coincide with limited flexibility to pass these costs on to customers due to intense market competition. This climate of uncertainty has also led to delays in fleet upgrades and the adoption of greener, more energy-efficient vehicles, hindering progress toward sustainability objectives. In response, transport firms are enhancing route optimization, investing in fuel-efficient technologies, renegotiating supplier agreements, and adopting collaborative logistics strategies to share resources and cushion the financial impact of rising tariffs.

The car subscription market research report is one of a series of new reports that provides car subscription market statistics, including car subscription industry global market size, regional shares, competitors with a car subscription market share, detailed car subscription market segments, market trends and opportunities, and any further data you may need to thrive in the car subscription industry. This car subscription market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Car subscription is a service model that offers vehicles to customers for a monthly fee, providing access to a selection of cars without the commitment of leases or long-term rentals. This allows customers to enjoy the benefits of driving different vehicles without the responsibilities and costs associated with ownership.

The main types of service providers in the car subscription industry include original equipment manufacturers (OEMs) or captives, which are businesses involved in producing and selling goods or components used in products made by another business. Additionally, there are independent or third-party service providers in the car subscription market. Subscription periods typically vary, with options such as more than 12 months, 6 to 12 months, and 1 to 6 months. The range of vehicles available for subscription includes luxury cars, executive cars, economy cars, and others. Car subscription services cater to both private individuals and corporate clients.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Car Subscription Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on car subscription market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for car subscription? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The car subscription market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Service Provider: Original Equipment Manufacturer (OEM) or Captives; Independent or Third Party Service Providers2) by Subscription Period: More Than 12 Months; 6 to 12 Months; 1 to 6 Months

3) by Vehicle: Luxury Car; Executive Car; Economy Car; Other Vehicles

4) by End-Use: Private; Corporate

Subsegments:

1) by Original Equipment Manufacturer (OEM) or Captives: Manufacturer-Backed Subscription Services; Brand-Specific Subscription Platforms2) by Independent or Third Party Service Providers: Car Rental Companies; Mobility-As-A-Service (Maas) Providers; Online Platforms and Startups

Companies Mentioned: Volkswagen AG; Toyota Motor Corp.; BMW AG; Mercedes-Benz Group AG; Hyundai Motor Co.; Nissan Motor Co. Ltd.; Porsche AG; Volvo Car Corporation; Cox Enterprises Inc.; Jaguar Land Rover Limited; Hertz Global Holdings Inc.; Lyft Inc.; Tata Motors Limited; Sixt SE; Onto Ltd.; ZoomCar; Carly Holdings Limited; Canoo Inc.; OpenRoad Auto Group; Clutch Technologies LLC; Facedrive Inc.; Wagonex Limited; Cluno GmbH; Carvolution; MylesCar

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Car Subscription market report include:- Volkswagen AG

- Toyota Motor Corp.

- BMW AG

- Mercedes-Benz Group AG

- Hyundai Motor Co.

- Nissan Motor Co. Ltd.

- Porsche AG

- Volvo Car Corporation

- Cox Enterprises Inc.

- Jaguar Land Rover Limited

- Hertz Global Holdings Inc.

- Lyft Inc.

- Tata Motors Limited

- Sixt SE

- Onto Ltd.

- ZoomCar

- Carly Holdings Limited

- Canoo Inc.

- OpenRoad Auto Group

- Clutch Technologies LLC

- Facedrive Inc.

- Wagonex Limited

- Cluno GmbH

- Carvolution

- MylesCar

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.45 Billion |

| Forecasted Market Value ( USD | $ 30.29 Billion |

| Compound Annual Growth Rate | 30.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |