This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

In recent years, sustainability has become a key focus in the watch industry. Brands are adopting eco-friendly materials, ethical sourcing, and responsible manufacturing processes. This shift reflects a growing awareness of environmental issues among consumers and a commitment to creating timepieces with a reduced ecological footprint. Consumers today seek unique and personalized experiences, and the watch industry is responding by offering customization options. Brands like Rolex, Audemars Piguet, and TAG Heuer allow customers to personalize various elements of their watches, from dial colors to materials and straps. The rise of smartwatches has been a game-changer in the watch industry's adoption rates.

These high-tech timepieces offer more than just a way to tell time; they serve as miniature computers on the wrist. With features such as fitness tracking, health monitoring, and seamless connectivity to smartphones, smartwatches have become indispensable gadgets for individuals seeking a blend of technology and fashion. Major tech players like Apple, Samsung, and Garmin have capitalized on this trend, producing smartwatches that cater to a wide range of needs, from fitness enthusiasts to tech-savvy professionals. The adoption of smartwatches extends beyond the traditional watch-wearing audience, attracting a younger demographic that values functionality alongside style.

The adoption of watches extends beyond the realm of technology; many consumers are drawn to the rich heritage and craftsmanship associated with traditional mechanical watches. Brands like Patek Philippe and Jaeger-LeCoultre have maintained their allure by emphasizing centuries-old watchmaking techniques, creating timepieces that are not just functional but also works of art. The appreciation for heritage and craftsmanship is not limited to luxury brands. Microbrands and independent watchmakers have also gained traction, offering designs and meticulous craftsmanship that appeal to consumers seeking exclusivity and a departure from mass-produced options.

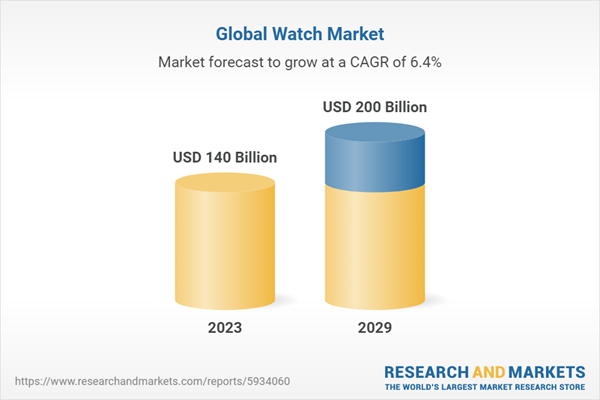

According to the research report, 'Global Watch Market Outlook, 2029', the market is anticipated to cross USD 200 Billion by 2029, increasing from USD 140 Billion in 2023. The market is expected to grow with 6.41% CAGR by 2024-29. Watches have come a long way from their humble beginnings as portable timekeepers in the 16th century. Initially, watches were considered a luxury reserved for the elite, often crafted by skilled artisans and jewelers. With the Industrial Revolution in the 19th century, mass production techniques were introduced, making watches more accessible to the general public. The early to mid-20th century witnessed the dominance of mechanical watches, powered by intricate gear systems and springs.

Swiss watchmaking became synonymous with precision and craftsmanship, with brands like Rolex, Omega, and Patek Philippe setting the standard for quality. These mechanical watches represented the pinnacle of engineering, boasting intricate movements and elegant designs. The late 20th century brought about a revolutionary shift with the introduction of quartz technology. Quartz watches, powered by batteries and quartz crystals, offered unprecedented accuracy and affordability. This innovation transformed the industry, leading to the decline of traditional mechanical watches. Swiss watchmakers faced a crisis, but some, like Swatch, successfully adapted to the changing landscape.

In the 21st century, there has been a remarkable resurgence of interest in mechanical watches. Consumers, driven by a desire for craftsmanship and heritage, have fueled the renaissance of mechanical timepieces. Luxury watches brands have responded by combining traditional craftsmanship with modern technology, creating a harmonious blend of tradition and innovation. The adoption of watches reflects a multifaceted landscape, where technology, personalization, heritage, and style converge. Whether it's the convenience and connectivity of smartwatches, the allure of personalized luxury timepieces, or the appreciation for traditional craftsmanship, the watch industry continues to evolve to meet the diverse demands of consumers.

Market Drivers

- Technology Integration and Smartwatches: The integration of technology, particularly the rise of smartwatches, has been a major driving force in the global watch market. Smartwatches offer a plethora of functionalities beyond traditional timekeeping, such as fitness tracking, health monitoring, and smartphone connectivity. This convergence of technology and horology has attracted a diverse consumer base, including tech enthusiasts, fitness-conscious individuals, and professionals seeking convenience. Major technology companies like Apple, Samsung, and Garmin have entered the watch market, introducing innovative smartwatches that appeal to a broad audience. This trend has expanded the overall market reach and attracted consumers who may not have been traditional watch wearers. As technology continues to advance, the integration of new features and applications into smartwatches is likely to sustain and further drive market growth.

- Luxury and Branding: The global watch market is significantly influenced by the appeal of luxury and branding. Consumers increasingly view watches as status symbols and fashion accessories, driving demand for high-end, prestigious timepieces. The association of luxury watch brands with craftsmanship, heritage, and exclusivity enhances their desirability, creating a market where consumers are willing to invest in a symbol of prestige and quality. Luxury watch brands such as Rolex, Patek Philippe, and Audemars Piguet have experienced sustained demand, with limited edition releases and iconic collaborations contributing to their allure. The growth of the global luxury watch market is also fueled by emerging markets, particularly in Asia, where an expanding affluent class seeks prestigious and recognizable brands. The trend towards personalization and customization in luxury watches further enhances their appeal, providing consumers with a unique and exclusive ownership experience.

Market Challenges

- Competition from Smart Devices: The increasing prevalence and adoption of multifunctional smart devices, including smartphones and smartwatches, pose a challenge to the traditional watch industry. Smart devices often provide not only accurate timekeeping but also a wide array of features that can include communication, navigation, and entertainment. This shift in consumer behavior towards multipurpose devices raises concerns about the continued relevance of traditional watches. To address this challenge, traditional watchmakers are compelled to innovate and differentiate their products. Some have embraced smartwatch technology, incorporating connectivity features into their offerings. Others focus on the unique craftsmanship and heritage associated with mechanical watches, targeting consumers who value the artistry and history behind traditional timepieces.

- Economic Uncertainties and Market Saturation: Economic uncertainties, especially during global crises, impact consumer spending habits, and the watch industry is not immune to such fluctuations. In times of economic downturn, consumers may prioritize essential purchases over luxury items, affecting the sales of watches, particularly in the mid to high-end segments. Additionally, market saturation in certain regions poses challenges for brands to find new growth opportunities. The industry's response involves diversification of product lines, exploring emerging markets, and adapting marketing strategies to resonate with changing consumer sentiments. Brands may introduce more accessible price points or limited edition releases to stimulate demand. Navigating economic uncertainties requires agility and strategic planning to ensure sustained market presence.

Market Trends

- Sustainability and Ethical Practices: A growing trend in the global watch market is the emphasis on sustainability and ethical practices. Consumers are becoming increasingly conscious of environmental and social issues, leading watch brands to adopt eco-friendly materials, ethical sourcing, and responsible manufacturing processes. This trend aligns with the broader global movement towards sustainable and responsible consumerism. Watch brands that prioritize sustainability enhance their appeal to environmentally conscious consumers. The adoption of recycled materials, reduced carbon footprints, and transparent supply chains contribute to a positive brand image. This trend reflects a shift in consumer preferences towards products that align with their values, and watchmakers incorporating sustainable practices are likely to gain a competitive edge.

- Digitalization and Online Retail: The digitalization of the watch market is evident through the increasing prevalence of online retail channels. E-commerce platforms provide consumers with a convenient and accessible way to explore and purchase watches. Additionally, brands are leveraging digital marketing and social media to connect with a global audience, showcase their products, and engage with consumers directly. The trend towards digitalization has reshaped the retail landscape, influencing how consumers discover and buy watches. Online platforms offer a wider reach and enable brands to connect with a diverse customer base. This trend is likely to continue evolving, with augmented reality experiences, virtual try-ons, and other digital innovations enhancing the online shopping experience for watch enthusiasts globally.

COVID-19 Impact

The COVID-19 pandemic has had a profound impact on the watch industry, causing disruptions across the entire supply chain and influencing consumer behavior. The closure of manufacturing facilities, lockdowns, and restrictions on international trade led to production delays, affecting the timely release of new collections and limited edition models. With physical retail outlets forced to shut down temporarily, sales channels were severely constrained, compelling brands to pivot towards digital platforms to maintain a connection with consumers. Consumer sentiment also shifted, with economic uncertainties prompting individuals to reconsider discretionary spending, affecting both entry-level and luxury watch segments.The decline in travel and the cancellation of events further dampened the demand for travel-oriented and celebratory timepieces. However, the industry demonstrated resilience by adapting strategies, emphasizing online sales, and exploring innovative ways to engage with consumers. The pandemic accelerated trends such as digitalization, e-commerce, and a focus on sustainability, pushing the watch industry to rethink traditional approaches and navigate a path towards recovery in a post-pandemic landscape.

Based on the product type, quartz watches utilize the oscillations of a quartz crystal to regulate timekeeping with remarkable precision, outperforming traditional mechanical watches in this regard.

Quartz watches have emerged as leaders in the watch industry for several compelling reasons, encompassing accuracy, affordability, and technological advantages. The quartz watch type relies on a quartz crystal oscillator to regulate timekeeping, marking a departure from the traditional mechanical movements that characterized earlier timepieces. The heart of a quartz watch is the quartz crystal oscillator, which vibrates at a precise frequency when an electric current is applied. This oscillation is incredibly stable and accurate, leading to superior timekeeping precision. Quartz watches typically deviate only a few seconds per month, providing a level of accuracy that surpasses many mechanical counterparts.

Quartz watches are generally more affordable to produce compared to mechanical watches. The components of quartz movements can be mass-produced using automated processes, reducing manufacturing costs. This cost-effectiveness has made quartz watches accessible to a broad consumer base, appealing to those who prioritize functionality and precision without the higher price tag associated with mechanical movements. Quartz watches are powered by batteries, eliminating the need for regular winding or complex mechanical mechanisms. The long-lasting batteries in quartz watches typically only require replacement every few years, making them low-maintenance and convenient for everyday wear.

This ease of use contributes to the popularity of quartz watches among consumers seeking hassle-free timepieces. Quartz movements are known for their robustness and resistance to external factors such as shocks and magnetic fields. This durability enhances the reliability of quartz watches in various environments, making them suitable for everyday use and activities. This resilience is particularly appealing to consumers looking for a watch that can withstand the rigors of modern life. Quartz watches come in a wide range of styles, catering to diverse tastes and preferences. From sleek and minimalist designs to sporty and rugged models, the versatility of quartz movements allows for a broad spectrum of watch styles. This variety ensures that consumers can find a quartz watch suitable for any occasion or personal aesthetic.

The dominance of medium-range watches in the market can be attributed to a combination of factors that strike a balance between quality, affordability, and style.

Medium-range watches typically offer a balanced price-to-quality ratio, providing consumers with a level of craftsmanship and materials that surpass entry-level watches without reaching the high price points associated with luxury timepieces. This sweet spot makes medium-range watches appealing to a wide demographic, offering good value for money and satisfying the preferences of consumers seeking both quality and affordability. Medium-range watches are often designed with versatility in mind, making them suitable for various occasions and everyday wear. The combination of durability, functionality, and style makes these watches adaptable to both professional settings and casual environments.

This versatility contributes to their popularity among consumers who seek a watch that seamlessly fits into their daily lives. Many medium-range watch brands have built a strong reputation for quality and reliability over the years. Consumers often associate these brands with a certain level of craftsmanship and heritage, instilling confidence in their purchases. Brand recognition and a positive reputation contribute significantly to the success of medium-range watches in the market. Medium-range watches offer a diverse range of designs, allowing consumers to find a watch that aligns with their personal style preferences.

Whether it's classic, sporty, or contemporary, medium-range watch brands often provide a variety of designs to cater to different tastes. This diversity in design ensures that consumers have ample choices within the medium price range. Medium-range watches frequently incorporate technological advancements and innovations, providing consumers with modern features without the premium price tag. This includes advancements in materials, movements, and functionalities that enhance the overall appeal of the watches.

Technological integration ensures that medium-range watches remain competitive in a market driven by innovation. The affordability of medium-range watches makes them accessible to a broader audience, including young professionals, enthusiasts, and individuals looking for a quality timepiece without breaking the bank. This accessibility ensures a larger market share, as medium-range watches cater to a diverse consumer base with varying preferences and budget constraints.

The dominance of male-oriented watches in the market can be attributed to various factors that align with the preferences and needs of the male consumer demographic.

Historically, watches were initially designed as functional accessories for men, particularly for military and professional use. This traditional association of watches with masculinity has persisted over time, influencing the market's focus on male-oriented designs. The cultural and historical significance of watches as essential tools for men has contributed to the enduring popularity of male watch types. Male-oriented watches often emphasize functional features that cater to the practical needs of the wearer. This includes features such as chronographs, diving capabilities, aviation functions, and durability.

Men, particularly those with active lifestyles or specific professional requirements, are drawn to watches that offer more than just timekeeping, enhancing their overall utility. Many male-oriented watches are designed with sports and adventure themes, reflecting a connection between watches and outdoor activities. Features like water resistance, robust construction, and specialized functionalities for sports enthusiasts make these watches popular among men who engage in various physical activities. Male watches often feature larger case sizes and bold designs that make a statement. Men, on average, tend to prefer watches with a substantial presence on the wrist.

The emphasis on size and bold aesthetics appeals to the male desire for a visually striking and masculine accessory. Watches have long been considered status symbols and symbols of achievement. Men often view watches as statements of success, professionalism, and personal style. The association of certain watch brands and models with prestige and accomplishment contributes to the appeal of male-oriented watches as symbols of status and achievement. The culture of watch collecting has historically been dominated by male enthusiasts. Men are often drawn to the technical intricacies, craftsmanship, and heritage associated with watches, fostering a collector's mindset.

This passion for collecting has driven the market towards creating diverse and specialized male watch types, catering to the varied tastes of collectors. Many renowned watch brands have a rich history and heritage tied to craftsmanship and traditional watchmaking. The appeal of tradition and heritage often resonates with male consumers who appreciate the artistry and history behind a timepiece. This connection to tradition contributes to the preference for male-oriented watches.

Specialty store watches have become leaders in the industry due to several key factors that cater to consumers' specific preferences and expectations. Specialty store watches are often associated with exclusivity and uniqueness. These watches are not commonly found in mainstream retail outlets, and consumers are drawn to the idea of owning a timepiece that stands out from the crowd.

Many specialty store watches are crafted with a high level of precision and attention to detail. Consumers who appreciate fine craftsmanship and artistry are drawn to these watches, as they often feature intricate movements, hand-finished components, and unique design elements. The emphasis on quality craftsmanship sets specialty store watches apart from mass-produced alternatives. Specialty stores often curate a selection of watch brands known for their craftsmanship, heritage, and innovation. Consumers trust the expertise of these stores in selecting watches that align with discerning tastes.

The curation of reputable brands and models enhances the overall perception of the watches, attracting enthusiasts and collectors seeking expert guidance. Specialty watch stores typically provide a more personalized shopping experience with knowledgeable staff who understand the intricacies of watchmaking. This level of expertise helps consumers make informed decisions based on their preferences, ensuring they find a watch that suits their style and requirements. The personalized service enhances the overall customer satisfaction and loyalty. Specialty stores often collaborate with watchmakers to offer exclusive limited-edition releases.

These collaborations generate excitement among watch enthusiasts, and the limited availability of such models enhances their desirability. Limited editions and collaborations contribute to the uniqueness and collector appeal of specialty store watches. Some specialty stores focus on niche markets, catering to specific interests such as vintage watches, independent watchmakers, or themed collections. By targeting specialized markets, these stores create a dedicated customer base of enthusiasts who appreciate the distinct offerings within their particular area of interest. Specialty stores frequently host events, exhibitions, and launches that provide an exclusive platform for consumers to explore and purchase watches.

These events create a sense of exclusivity and community, allowing enthusiasts to connect with watchmakers, industry experts, and other like-minded individuals. Event exclusivity adds to the allure of specialty store watches. Many specialty watch stores have embraced online platforms, expanding their reach beyond physical locations. This enables consumers worldwide to access and purchase watches from these specialized stores, fostering a global community of watch enthusiasts. The online presence enhances the accessibility and visibility of specialty store watches.

The Asia-Pacific region has emerged as a leading force in the global watch market for several compelling reasons, reflecting a combination of economic, cultural, and consumer-driven factors.

The Asia-Pacific region has experienced substantial economic growth, leading to the expansion of an affluent middle class. As disposable incomes rise, consumers in countries like China, India, Japan, and South Korea have shown an increased interest in luxury goods, including watches. The growing middle class's purchasing power has significantly contributed to the demand for high-quality timepieces. Watches, particularly luxury and prestigious brands, are perceived as status symbols in many Asian cultures. Owning a high-end watch is often associated with success, social standing, and achievement.

As aspirational consumers seek to showcase their status and taste, luxury watches have become highly sought after, driving significant market growth in the region. Watches hold cultural significance in many Asian societies, often symbolizing tradition, respect, and the passage of time. Watches are commonly exchanged as gifts during special occasions and celebrations. The cultural importance of watches as meaningful gifts has contributed to a sustained demand for timepieces across various price points. The culture of watch collecting has gained momentum in the Asia-Pacific region, with enthusiasts actively seeking rare, limited-edition, and vintage timepieces.

Auctions and events dedicated to watch collecting, such as watch fairs and exhibitions, have gained popularity. This growing interest in collecting has propelled the sales of both high-end and niche market watches. The Asia-Pacific region has witnessed a significant shift towards e-commerce, providing consumers with convenient online platforms to explore and purchase watches. E-commerce has played a pivotal role in expanding the reach of watch brands to diverse markets within the region. Online sales, coupled with digital marketing strategies, have contributed to the industry's growth.

Many international watch brands have recognized the potential of the Asia-Pacific market and have strategically expanded their retail presence in key cities. Flagship stores, boutiques, and collaborations with local retailers have strengthened brand visibility and accessibility. A strong physical and online presence allows watch brands to cater to the diverse preferences of consumers in the region. Asia-Pacific countries, particularly Japan and South Korea, are renowned for their technological innovations. The region has played a crucial role in advancing watch technology, contributing to the popularity of high-tech watches and smartwatches.

Consumers in Asia-Pacific appreciate innovation, and brands that incorporate the latest technologies often capture their attention. Many Asia-Pacific countries, such as Singapore, Hong Kong, and South Korea, are major tourist destinations with thriving duty-free shopping hubs. Tourists, especially from neighboring countries, contribute significantly to watch sales. The appeal of duty-free shopping, coupled with the region's status as a travel destination, boosts the demand for watches among international visitors.

The watch market is highly competitive, with the presence of both global and domestic players. Some of the major players in the market include Seiko Holdings Corporation, The Swatch Group, Casio, Fossil Group Inc., and Rolex. Major players focus on leveraging the opportunities to expand their product portfolios and cater to the requirements of various product segments, especially within the integrated analog and smart-watches category. These players are also targeting social media platforms and online distribution channels for the online marketing and branding of their products to capture the maximum attention of customers.

- Hermes International S.A. recently introduced a fresh and captivating addition to their lineup: the Hermes H08 collection of men's watches. This collection boasts five unique 39 mm models, with four of them featuring titanium cases and one showcasing a case made from a composite material filled with graphene. The collection's design, characterized by its cushion-shaped form, draws inspiration from the world of sports, resulting in a harmonious blend of dynamic lines and graceful curves.

- June 2023: Saint Laurent Paris and Girard-Perreguax launched a limited-edition digital watch, the Casquette. The watch features an LED display with quartz movement. The company made only 8000 watches.

- In 2023, Rolex S.A. has introduced Cosmograph Daytona in which the dial receives new graphic balance with resized and restyled hour markers and counter rings. Subtle combinations of colors and finishes accentuate the contrast between the dial and the counters and/or their rings, bringing even greater visual harmony and a more modern demeanor.

- In 2022, Apple Inc. announced the release of the Apple Watch Ultra, a new luxury smartwatch that combines bold design with a wide range of innovative features. This new addition to Apple's lineup aims to offer a premium experience for users seeking a luxury smartwatch.

- August 2022: Casio launched the first G-Shock smartwatch powered by Google's OS Wear. The smartwatch is designed for outdoor sports, including surfing and snowboarding. The watch is available in blue, black, and red colors. The watch has a titanium carbide finish and is water resistant up to 200 meters.

- March 2022: The Swatch Group Ltd announced a partnership between two brands, Swatch and Omega, to launch its new product, Bioceramic MoonSwatch. All designs in the collection come in Swatch's patented Bioceramic, a mix of ceramic (two-thirds) and a material derived from castor oil (one-third).

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Watch market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Movement

- Smart Watch

- Quants

- Mechanical

- Others

By Product Range

- Low- Range

- Mid-Range

- Luxury

By End User

- Male

- Female

- Unisex

By Distribution Channel

- Hypermarket/Supermarket

- Retail Store

- Speciality Store

- Online Retail

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Watch industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Casio Computer Co. Ltd.

- Rolex SA

- LVMH Moet Hennessy -Louis Vuitton

- Citizen Watch Co. Ltd.

- Titan Company Limited

- Apple Inc

- Audemars Piguet Holding SA

- Tapestry Inc.

- Giorgio Armani S.P.A.

- PVH Corporation

- The Swatch Group Ltd

- Seiko Holdings Corporation

- Fossil Group

- Compagnie Financière Richemont S.A

- Timex Group

- Garmin Ltd.

- Hermès International S.A

- Xiaomi Corporation

- Breitling SA

- Movado Group Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 140 Billion |

| Forecasted Market Value ( USD | $ 200 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |