What you’ll learn from these reports:

The Video Game Monetization Models in Asia & MENA report focuses on five major monetization models: Premium Games, Subscriptions, In-Game Purchases, In-Game Advertising, and Real Money Gaming. The publisher collects primary and secondary data to build our models, including our proprietary gamer surveys, industry interviews, company financial reports, government and official statistics, and macroeconomic data. It is a comprehensive guide for game companies to devise the right strategy to boost gamers' spending and maximize profit margins while still abiding by existing regulations.

Key takeaways from the analysis:

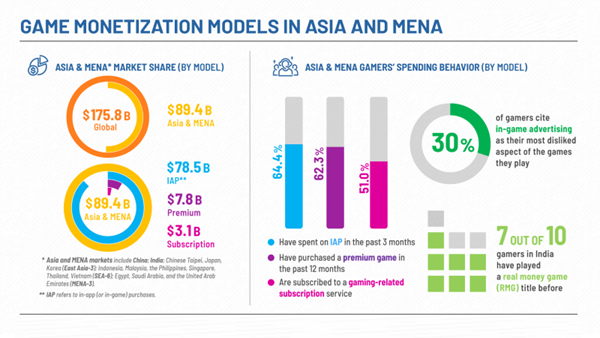

- In-game purchases (IAP) account for 87.8% of player spending in Asia & MENA, making it the most important monetization model.

- Price is the largest barrier for non-spending gamers in Asia & MENA, with 39.3% of non-spending mobile gamers and 44.3% of non-spending PC gamers citing it as the #1 factor for why they do not spend on video games.

- 62.3% of gamers in Asia & MENA have purchased a premium game in the past 12 months on any platform.

- According to our 2023 survey, 30% of paying gamers in Asia & MENA have purchased a monthly subscription to access a video game. This increases to 51% when including all types of gaming subscriptions including value added services such as Twitch Prime.

- 30% of mobile gamers in Asia & MENA cite in-game advertising (IGA) as their most disliked aspect of the games they play.

- Real Money Gaming (RMG) is most popular in India where 7 in 10 gamers have played an RMG title.

Table of Contents

- Methodology

- Executive Summary

- Overview of Game Monetization Models

- In-Game Purchases (In-App Purchases/IAPs)

- Overview

- Most Popular IAPs

- Spending on IAPs

- IAPs motivations

- Barrier for non-spending gamers

- Loot boxes

- Alternative monetization

- Premium Games

- Overview

- Gamers who purchased premium games

- Preferred platform for premium games

- Premium games monetization

- Barrier for non-spending gamers

- How to succeed with premium games

- Subscriptions

- Preference for subscription among gamers

- Purchase of gaming subscription service

- Various Types of Gaming Subscriptions

- Opportunity for Cloud Gaming Subscriptions

- In-Game Subscription Offerings

- In-Game Advertising (IGA)

- Perception towards IGA

- Gamer behavior towards IGA4

- How Game Developers Are Navigating the Post-IDFA Era

- Native Advertising and Branded Worlds

- Real Money Gaming

- Overview

- RMG in India

- Key User Concerns for RMG

- Appendix

- Genre List

- Glossary

- About the Publisher

List of Exhibits

- % of paying mobile gamers who purchase

- % of paying PC gamers who purchase

- Spending on in-game purchases globally (2022)

- Spending on in-game purchases in Asia & MENA (2022)

- Why mobile gamers make in-game purchases

- Why PC gamers make in-game purchases

- Why non-paying mobile gamers do not spend on games

- Why non-paying PC gamers do not spend on games

- % of revenue from alternative monetization channels in Southeast Asia (2022)

- % of paying gamers that spend on premium games (platform)

- % of paying gamers that spend on premium games (age)

- Spending on premium games globally (2022)

- Spending on premium games in Asia & MENA (2022)

- Most popular platforms among PC gamers

- Average # of games purchased (12 months)*

- % of non-spenders that say price is the most prohibitive factor

- Steam’s premium games pricing recommendation

- Naraka: Bladepoint daily concurrent players on Steam

- % of paying gamers that have purchased a monthly subscription for a game

- Spending on gaming subscriptions globally (2022)

- Spending on gaming subscriptions in Asia & MENA (2022)

- % of gamers in Asia & MENA that have purchased a monthly subscription

- Gamer adoption of cloud gaming in Asia & MENA

- How mobile gamers in Asia & MENA engage with ads

- How PC gamers in Asia & MENA engage with ads

- What real money games do you play?

- Which platforms did you use in the past year?

- Average hours per week playing RMG titles

- Average spend per month on RMG titles

- The most important factors Reasons to play RMG

- Most disliked factors about RMG titles

Companies Mentioned

- All-India Gaming Federation (AIGF)

- Apple

- Blacknut

- From Software

- Japan Online Game Association (JOGA)

- Microsoft

- Ministry of Electronics and IT (MeitY)

- Motion Twin

- NetEase

- Sony

- Supercell

- Valve (Steam)