Adopting minimally invasive surgery (MIS) techniques in thoracic surgery has driven the development of specialized graspers for small incisions. These slender and articulated graspers allow surgeons to manipulate delicate tissue through tiny ports. Thereby, the graspers segment would register 1/5th share of the market by 2030. Using minimally invasive graspers has reduced patient trauma, minimized scarring, and accelerated postoperative recovery. Articulating graspers provide enhanced dexterity and maneuverability, making it easier for surgeons to work within the confined space of the thoracic cavity. They often have multiple degrees of freedom, allowing precise and controlled tissue handling. Some of the factors impacting the market are rising prevalence of thoracic diseases, increasing number of senior citizens, and high development costs.

The increasing incidence of thoracic conditions, including lung cancer, esophageal disorders, and cardiovascular diseases, is a significant driver of the market. As the global population ages and lifestyles change, the prevalence of these conditions continues to rise. According to the WHO, cardiovascular diseases (CVDs) are the primary cause of death globally, affecting approximately 17.9 million lives annually. Heart attacks and strokes cause more than four out of five CVD-related fatalities, and one-third of these premature deaths occur in individuals under 70. The focus on patient-centered care and improving patient outcomes is prompting the adoption of minimally invasive techniques and innovative surgical devices that enhance patient comfort, safety, and recovery. Additionally, the aging of the population is associated with an increase in the incidence of thoracic diseases. The demand for devices and thoracic surgery is growing as the world's population ages. As per the World Health Organisation (WHO), one in six people will be 60 or older by 2030. The number of people 60 and older in the world will increase from 1 billion in 2020 to 1.4 billion in 2050. By 2050, there will be 2.1 billion people in the world who are 60 or older. It is anticipated that there will be 426 million persons 80 or older by 2050. Surgical interventions to treat traumatic injuries involve thoracic surgery devices. The increasing older population is a significant driver of the market.

The pandemic accelerated the adoption of minimally invasive surgical techniques requiring specialized thoracic surgery devices. COVID-19 primarily impacted the respiratory system, increasing demand for ventilators and respiratory support devices. Thoracic surgery devices like chest tubes and pleural drainage systems became essential for managing patients with severe respiratory complications. The pandemic disrupted global supply chains, affecting the availability of medical devices, including thoracic surgery devices. Manufacturers faced challenges in procuring raw materials and components, causing delays in production and distribution. This had implications for healthcare facilities that relied on these devices for patient care.

However, Developing and bringing new thoracic surgery devices to market can be cost-intensive. The investment required for research, development, and clinical trials, coupled with the risk of regulatory setbacks, can pose financial challenges for manufacturers. Building prototypes, conducting feasibility studies, and running tests to ensure thoracic surgery devices' reliability, safety, and functionality are essential but costly steps in the development process. High development costs are a significant challenge in the market.

Product Outlook

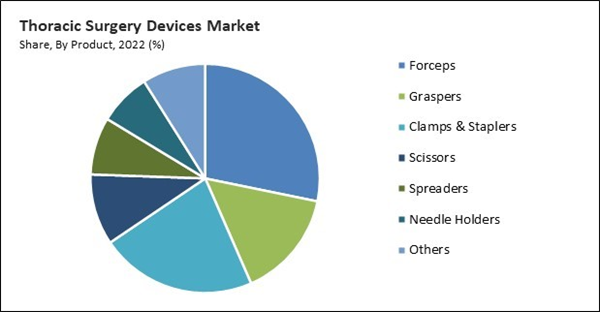

By product, the market is categorized into forceps, clamps & staplers, scissors, graspers, spreaders, needle holders, and others. The clamps & staplers segment covered a considerable revenue share in the market in 2022. Vascular clamps temporarily occlude blood vessels during thoracic surgeries, allowing surgeons to work on the vessels without excessive bleeding. They are commonly employed in aortic aneurysm repair and coronary artery bypass surgery. Clamps are indispensable tools for achieving hemostasis, securing tissues, and providing surgeons with a controlled environment to perform complex procedures. These devices are instrumental in ensuring the success and safety of surgeries in the thoracic cavity, ranging from lung and heart surgeries to vascular and esophageal procedures.Surgery Type Outlook

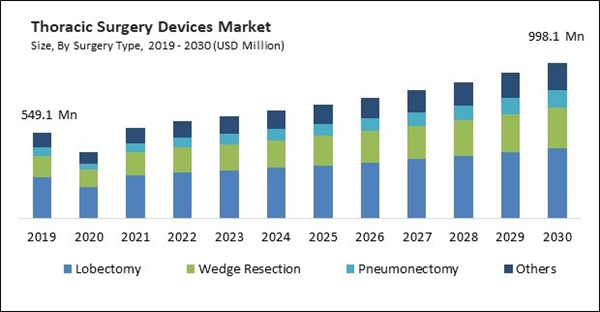

Based on surgery type, the market is classified into lobectomy, wedge resection, pneumonectomy, and others. In 2022, the lobectomy segment witnessed the largest revenue share in the market. Lobectomy is a primary treatment option for lung cancer, particularly in cases where the disease is localized to one lung lobe. Removing the affected lobe can provide a high chance of cure or long-term disease control. For patients with early-stage lung cancer, lobectomy can lead to significantly improved survival rates compared to other treatment options. It offers the potential for a cure and prolonged life. Lobectomy allows for a detailed examination of the removed lobe, providing crucial diagnostic information that helps guide further treatment decisions and staging.End-use Outlook

On the basis of end-use, the market is divided into hospitals, ambulatory surgical centers, and others. In 2022, the hospitals segment dominated the market with the maximum revenue share. Hospitals are primary centers for patient care, diagnosis, and treatment. The rising incidence of thoracic conditions, including lung cancer, cardiovascular diseases, and esophageal disorders, necessitates the availability of advanced thoracic surgery devices to meet patient needs. Hospitals are equipped to diagnose and treat these conditions, leading to a growing demand for thoracic surgery devices. Hospitals are hubs of medical innovation and the adoption of advanced surgical techniques. Minimally invasive procedures, robotic-assisted surgery, and other innovative approaches are frequently performed in hospitals, driving the demand for specialized thoracic surgery devices.Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America boasts a highly developed and advanced healthcare infrastructure. It has state-of-the-art medical facilities, including hospitals, ambulatory surgical centers, and specialized thoracic surgery units, which drive the demand for thoracic surgery devices. The region experiences a relatively high incidence of thoracic conditions, such as lung cancer, cardiovascular diseases, and esophageal disorders. This high disease burden necessitates the availability of advanced thoracic surgery devices.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Cardiotrack, Intuitive Surgical, Inc., Richard Wolf GmbH, Grena Ltd., Dextera Surgical Inc. (Aesculap Inc.), Teleflex, Inc., Medela AG, LivaNova PLC, and Sklar Corporation.

Scope of the Study

Market Segments Covered in the Report:

By Surgery Type- Lobectomy

- Wedge Resection

- Pneumonectomy

- Others

- Forceps

- Graspers

- Clamps & Staplers

- Scissors

- Spreaders

- Needle Holders

- Others

- Hospitals

- Ambulatory Surgical Centers

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Medtronic PLC

- Cardiotrack

- Intuitive Surgical, Inc.

- Richard Wolf GmbH

- Grena Ltd.

- Dextera Surgical Inc. (Aesculap Inc.)

- Teleflex, Inc.

- Medela AG

- LivaNova PLC

- Sklar Corporation

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Medtronic PLC

- Cardiotrack

- Intuitive Surgical, Inc.

- Richard Wolf GmbH

- Grena Ltd.

- Dextera Surgical Inc. (Aesculap Inc.)

- Teleflex, Inc.

- Medela AG

- LivaNova PLC

- Sklar Corporation