Surgical dressings are paramount in burn wound management, as they provide a protective barrier against infection, manage wound exudate, and create an optimal environment for tissue regeneration. Thus, the burns application segment would account for nearly 20% of the market share by 2030. Burns, whether caused by thermal, chemical, electrical, or radiation sources, are common traumatic injuries that necessitate specialized wound care. In the initial stages, non-adherent dressings and antimicrobial agents are often used to prevent adherence to the wound and reduce the risk of infection. As the wound heals, advanced dressings, such as hydrogels and foam dressings, are employed to maintain a moist environment, minimize pain, and expedite the healing process. Some of the factors affecting the market are rise in the number of surgeries around the globe, increase in the number of injuries and accident cases and stringent regulations for manufacturing.

The global healthcare landscape has witnessed a surge in surgical procedures. This can be attributed to various factors, including population growth, an aging demographic, advancements in surgical techniques, and expanding healthcare services in emerging markets. The more surgeries conducted, the greater the demand for these dressings. Additionally, As the global population increases, more people are at risk of injuries and accidents. Increased urbanization and industrialization can lead to higher population densities, increasing the likelihood of accidents. These accidents often lead to various injuries, some requiring surgical intervention. The increase in injuries and accidents has led to a growing demand for surgical treatments and, by extension, surgical dressings. The aspects mentioned above will boost market growth.

However, adhering to strict regulatory requirements often necessitates significant investments in compliance measures, including quality control, documentation, and quality assurance processes. These costs can be substantial for manufacturers, particularly smaller or newer entrants into the market. Stringent regulations can increase the overall cost of manufacturing, which may be passed on to patients in the form of higher healthcare costs. This factor will challenge market growth in the coming years.

Additionally, the pandemic increased the demand for PPE, including surgical gloves, masks, gowns, and face shields. Infection control became a paramount concern during the pandemic. This heightened focus on infection prevention led to increased usage of antimicrobial dressings and advanced wound care products designed to reduce the risk of infection and promote faster wound healing. Telemedicine gained prominence as healthcare providers sought to limit in-person visits to reduce the risk of COVID-19 transmission. In this context, remote monitoring and consultations became essential. Dressings used for remote wound monitoring, which could transmit data to healthcare providers, gained importance. Therefore, the pandemic had a significant moderate impact on the market.

Product Outlook

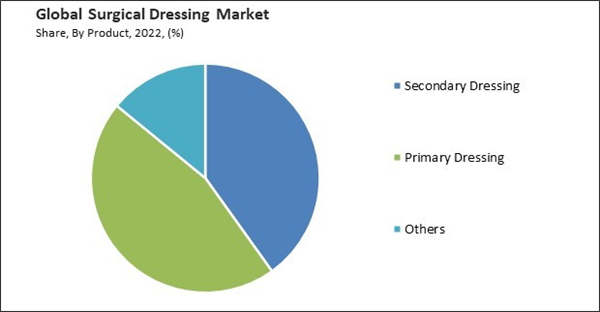

On the basis of product, the market is segmented into primary dressing, secondary dressing, and others. The secondary dressing segment covered a considerable revenue share in the surgical dressing market in 2022. Secondary dressings are designed to hold the primary dressing in place. They help prevent displacement or accidental removal of the primary dressing during patient movement or activities. Secondary dressings are usually designed to be conformable and flexible, allowing them to adapt to the shape and contours of the wound and body.End-use Outlook

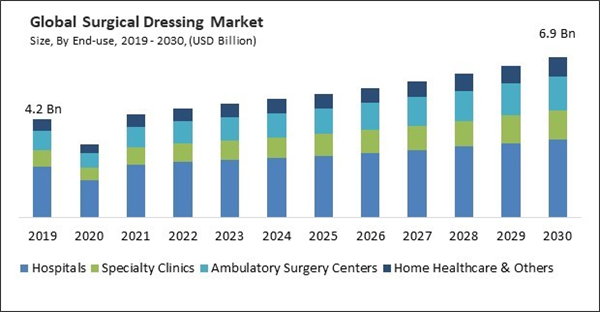

By end-use, the market is classified into hospitals, speciality clinics, ambulatory surgery centers, and home healthcare & others. The ambulatory surgery centers segment covered a considerable revenue share in the market in 2022. The rise in demand for surgical dressings can be attributed to the increase in the number of ambulatory surgical centers (ASCs) around the globe. ASCs are medical aptitudes that provide same-day surgical care to patients who do not need an overnight hospital stay. Ambulatory surgical centers are gaining popularity due to their cost-effectiveness, convenience, and ability to provide high-quality care in a comfortable outpatient setting. The demand for these dressings rises as ASCs grow, as they are an essential component of wound care management.Application Outlook

Based on application, the market is fragmented into diabetes-based surgeries, cardiovascular disease, ulcers, burns, transplant sites, and others. The cardiovascular disease segment recorded a remarkable revenue share in the market in 2022. As cardiovascular disease (CVD) prevalence rises, surgical procedures related to CVD are expected to increase. The increasing number of cardiovascular diseases has increased CVD procedures. Consequently, as the number of cardiac operations rises, the demand for these dressings is expected to increase significantly over the forecast period.Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region dominated the market with the maximum revenue share. There is an increase in the number of surgeries being performed in this region, specifically in the US, and the rise in the incidence of chronic wounds and other conditions that require these dressings for management among the population. Thus, the increase in the adoption of advanced surgical dressing products, along with developed healthcare infrastructure in North America, contributes toward the growth of the market in this region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 3M Company, Smith & Nephew PLC, Molnlycke Health Care AB, Convatec, Inc., Johnson & Johnson, Baxter International, Inc., Coloplast Group, Medtronic PLC, Integra LifeSciences Holdings Corporation and Cardinal Health, Inc.

Scope of the Study

Market Segments Covered in the Report:

By End-use(Volume, Million Units, USD Billion/Million, 2019 - 2030)- Hospitals

- Specialty Clinics

- Ambulatory Surgery Centers

- Home Healthcare & Others

- Secondary Dressing

- Bandages

- Absorbents

- Adhesive Tapes

- Protectives

- Others

- Primary Dressing

- Foam Dressing

- Alginate Dressing

- Soft Silicone Dressing

- Composite Dressing

- Hydrogel Dressing

- Hydrocolloid Dressing

- Film Dressing

- Others

- Diabetes Based surgeries

- Burns

- Ulcers

- Cardiovascular Disease

- Transplant Sites

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- 3M Company

- Smith & Nephew PLC

- Molnlycke Health Care AB

- Convatec, Inc.

- Johnson & Johnson

- Baxter International, Inc.

- Coloplast Group

- Medtronic PLC

- Integra LifeSciences Holdings Corporation

- Cardinal Health, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- 3M Company

- Smith & Nephew PLC

- Molnlycke Health Care AB

- Convatec, Inc.

- Johnson & Johnson

- Baxter International, Inc.

- Coloplast Group

- Medtronic PLC

- Integra LifeSciences Holdings Corporation

- Cardinal Health, Inc.