Green Tea Market Trends

The emerging health and wellness trends

Consumers are becoming increasingly aware of their dietary choices and its impact on overall health. In line with this, the widespread adoption of green tea, as it is rich in antioxidants and bioactive compounds that improve brain function, aid in weight loss, reduce the risk of heart disease, and lower the risk of certain types of cancer, is boosting the market growth. Furthermore, the ongoing shift towards healthy living, prompting consumers to substitute traditional beverages like coffee and black tea with green tea, is driving the market growth. Moreover, the growing prevalence of lifestyle diseases, such as obesity and diabetes, propelling consumers to opt for healthier alternatives like green tea, is creating a positive outlook for the market.Increasing consumer awareness of green tea benefits

The growing awareness of green tea's health benefits, fueled by scientific research, media coverage, and marketing efforts, is propelling the market growth. In line with this, the increasing number of studies highlighting green tea's potential health benefits, including improved brain function, antioxidants that may lower the risk of certain cancers, heightened metabolic rate, and a reduction in the risk of cardiovascular diseases, is boosting the market growth. Additionally, information about potential health benefits has been widely disseminated through health blogs, wellness magazines, and social media platforms, making it more accessible to the general public. Besides this, aggressive marketing campaigns by green tea producers, which often highlight the natural, health-promoting aspects of green tea, are driving the market growth.Recent innovations in product offerings

Recent innovation in product offerings, such as the introduction of a range of natural flavors, including lemon, honey, mint, and jasmine, is boosting the market growth. Furthermore, the development of ready-to-drink (RTD) green tea beverages, which offer convenience and accessibility to consumers who are often on the go and looking for healthy beverage options that fit their busy lifestyles, is supporting the market growth. Additionally, the introduction of innovative products, such as sweetened and unsweetened green teas and green tea-based energy drinks, is positively influencing the market growth. Besides this, the widespread utilization of green tea-infused products in the health and beauty sectors is acting as another growth-inducing factor. Moreover, the development of organic and sustainably produced green tea products, catering to the growing demand for environmentally friendly and ethically produced goods, is favoring the market growth.Rapid globalization of tea culture

The globalization of tea culture due to several factors, including increased global travel, cultural exchange, and the influence of Asian diasporas in Western countries, is propelling the market growth. The increasing exposure to new food and beverage (F&B) traditions, including tea-drinking customs, which has led to a growing appreciation and adoption of green tea in regions where it was previously less common, is supporting the market growth. Furthermore, the rising number of specialty tea shops and cafes, which offer a variety of green teas, introducing consumers to its diverse flavors and forms, is catalyzing the market growth. Moreover, the increasing presence of Asian pop culture through mediums, such as film, television, and social media, resulting in a broader acceptance and curiosity about green tea, is driving the market growth.Rising disposable incomes

The increasing disposable incomes, enabling more people to have greater financial resources to spend on non-essential goods, including premium beverages like green tea, is boosting the market growth. Furthermore, the rapid economic growth, leading to a burgeoning middle class in regions that have traditionally been tea-consuming cultures is supporting the market growth. In addition, the ongoing shift towards premium green teas, as consumers seek out products that signify a higher status or offer perceived health benefits, is positively influencing the market growth. Moreover, the escalating disposable income allows consumers to explore and experiment with different types of green teas, including organic and imported varieties, which are generally more expensive than standard black tea or lower-grade green teas.Green Tea Industry Segmentation

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. The report has categorized the market based on type, flavour, and distribution channel.Breakup by Type

- Green Tea Bags

- Green Tea Instant Mixes

- Iced Green Tea

- Loose Leaf

- Capsules

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes green tea bags, green tea instant mixes, iced green tea, loose leaf, capsules, and others. According to the report, green tea bags represented the largest segment.

Breakup by Flavour

- Lemon

- Aloe Vera

- Cinnamon

- Vanilla

- Wild Berry

- Jasmin

- Basil

- Others

A detailed breakup and analysis of the market based on the flavour have also been provided in the report. This includes lemon, aloe vera, cinnamon, vanilla, wild berry, jasmin, basil, and others. According to the report, lemon accounted for the largest market share.

Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online stores, and others. According to the report, supermarkets and hypermarkets represented the largest segment.

Breakup by Region

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AMORE Pacific Corp

- Arizona Beverage Company

- Associated British Foods LLC

- The Coca-Cola Company

- Tata Global Beverages

- Unilever

- Cape Natural Tea Products

- Celestial Seasonings

- Finlays Beverages Ltd.

- Frontier Natural Products Co-Op.

- Hambleden Herbs

- Hankook Tea

- Honest Tea, Inc.

- ITO EN

- Kirin Beverage Corp.

- Metropolitan Tea Company

- Northern Tea Merchants Ltd

- Numi Organic Tea

- Oishi Group Plc.

- Oregon Chai Inc.

- Yogi Tea

Key Questions Answered in This Report

1. How big is the green tea market?2. What is the future outlook of the green tea market?

3. What are the key factors driving the green tea market?

4. Which region accounts for the largest green tea market share?

5. Which are the leading companies in the global green tea market?

Table of Contents

Companies Mentioned

- AMORE Pacific Corp

- Arizona Beverage Company

- Associated British Foods LLC

- The Coca-Cola Company

- Tata Global Beverages

- Unilever

- Cape Natural Tea Products

- Celestial Seasonings

- Finlays Beverages Ltd.

- Frontier Natural Products Co-Op.

- Hambleden Herbs

- Hankook Tea

- Honest Tea Inc.

- ITO EN

- Kirin Beverage Corp.

- Metropolitan Tea Company

- Northern Tea Merchants Ltd

- Numi Organic Tea

- Oishi Group Plc.

- Oregon Chai Inc.

- Yogi Tea

Table Information

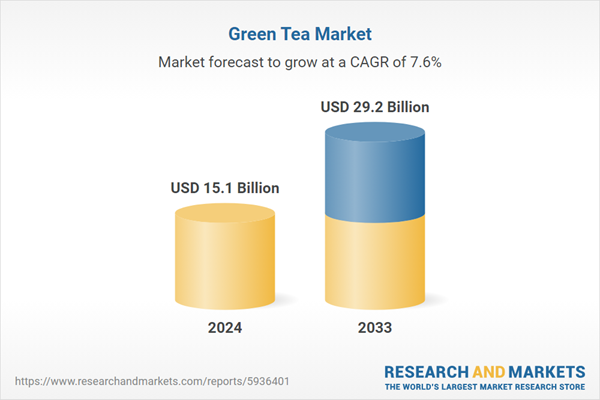

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 15.1 Billion |

| Forecasted Market Value ( USD | $ 29.2 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |