Speak directly to the analyst to clarify any post sales queries you may have.

RECENT DEVELOPMENTS

- In 2022, 3M introduced its high-flow PFAS Cartridges and improved its AP Easy Connect Undersink System with auto-shutoff and leak detection features.

- In 2022, Culligan introduced the Aqua-Pure RO System with AutoFlush technology for extended membrane life.

- In 2022, Brita introduced the Smart Pitcher with a filter indicator and united with Water.org to deliver clean water access in developing countries.

- In 2022, EcoQuest expanded its range of biodegradable carbon filters from coconut shells.

- In 2023, Doulton introduced the PureMax Ceramic Filter, which has improved bacteria and virus removal abilities.

- In 2023, GE Appliances integrated Alexa voice control into its filtration systems for hands-free operation.

- In 2023, A.O. Smith developed the Home Connect RO Filtration System with remote monitoring and control abilities.

MARKET TRENDS & DRIVERS

Rise in Adoption of Smart Filtration Systems

Advancements in filter materials, including self-cleaning mechanisms and high-capacity membranes, are improving performance and extending filter lifespans. Integration of smart features such as automatic filter replacements, water quality monitoring, and connectivity with home automation systems is gaining traction in the residential water filtration parts & accessories market. Integrating smart technology with residential water filtration systems is increasingly gaining traction. These systems provide various features, including remote monitoring and control, leak detection and automatic shutoff, and personalized filtration settings. These innovations may lead to higher-priced parts and accessories but provide improved convenience and user experience. Cartridge service life and replacement reminder, calculation of money saved compared to bottled water, number of plastic bottles and CO2 saved, and mapping of local public drinking water sources are some of the other major features provided.Importance of Reverse Osmosis (RO) Filtration Systems

Over the past decade, Reverse Osmosis has been accepted as one of the most prominent forms of filtration technology for water treatment systems. It removes the dissolved inorganic solids, including magnesium and calcium ions, from the potable water by forcing them into a semipermeable membrane under pressure to remove the contaminants. It is often combined with other technologies like mechanical (sediment) filters and activated carbon filters for enhanced results. Multistage filtration membranes in the RO systems make it the most expensive water treatment system in the residential water filtration parts & accessories market. The systems are increasingly preferred in households of developing economies due to their pollutant removal effectiveness. The RO membranes have become an ideal solution for homes with salty water sources where it eliminates the risk of high sodium intake. Brands like iSpring offer 5-stage reverse osmosis filters for under-the-sink installation that can remove 99.9% of the contaminants in water.INDUSTRY RESTRAINTS

Adherence to Standards and Certifications

The market for water filters is competitive globally; it highly demands the validation of the performance and quality of the filters from the manufacturer’s end to ensure the safety and standard of their product. Filter, membrane testing, and other certification programs help enhance the positive customer perception and demonstrate that it adheres to local and international guidelines and regulations. Though there are no federal regulations for water filter systems, RO systems, and other cleaners, voluntary national standards and NSF international protocols have been developed as minimum requirements for ensuring safety and performance. Certifications like NSF/ANSI are required as a priority by the majority of the retailers as well. The circumstances can be more challenging for international players venturing into other regions where adhering to domestic guidelines can be an additional burden to establish themselves.SEGMENTATION INSIGHTS

INSIGHTS BY PARTS & ACCESSORIES

The cartridge filter parts & accessories segment is expected to be the largest revenue segment of the global residential water filtration parts & accessories market. Cartridge filters have gained widespread popularity in residential water filtration due to their user-friendly features, cost-effectiveness, adaptability, and convenience. The substantial aftermarket revenue generated by the continuous demand for replacement cartridges further highlights their prominence as a key segment in the continually expanding market. Cartridges are available in several pore sizes and filter media, catering to water quality concerns and user preferences.Segmentation by Parts & Accessories

- Cartridge Filters

- Filter Housing

- Others

INSIGHTS BY CARTRIDGE FILTERS

The global residential water filtration parts & accessories market by cartridge filters is segmented into sediment filters, activated carbon filters, ro membranes, and others. In 2023, the sediment filters segment accounted for the largest revenue share of the global market. Sediment filter captures and filters dirt, debris, and other contaminants from water. They are designed to remove the suspended sediments and particulates. Whole house filtration systems also utilize sediment filters to eliminate particulate matter from entering faucets and shower systems. The segment is highly significant as a pre-filter for other filtration systems like reverse osmosis or UV treatments. Surface and depth filters are some of the commonly deployed sediment filters in the market.Segmentation by Cartridge Filters

- Sediment Filters

- Activated Carbon Filters

- RO Membranes

- Others

INSIGHTS BY APPLICATION

The global residential water filtration parts & accessories market by application is segmented into the whole house, under the sink, countertop, pitchers & dispenser, faucet, shower mounted, and inline. The whole house application segment holds the largest revenue segment of the global market in 2023. Consumers prefer whole house water systems for their chlorine and odor-free water, softer skin and hair, bottled quality drinking water, scale-free pipes and fixtures, and home appliances like refrigerator protection. Furthermore, the capacity of the water filter, flow rate (gallons per minute), and type of filtration method are the major determining factors for adopting whole-house water filtration systems. Proper sizing of the whole house filter will ensure its optimum functioning at peak hours when there is a requirement for filtered water for numerous applications like cooking, drinking, bathing, and laundry. They can also accommodate softeners that remove hard water stains and appliance corrosion. The most common whole-house water filter systems utilize reverse osmosis filtration technology. Culligan, Pentair, APEC, iSpring, Aquasana, and SpringWell are key players in the whole-house residential water filtration parts & accessories market. Culligan offers Filtr-Cleer filters for well water and Medallist Series as economical and low maintenance range.Segmentation by Application

- Whole House

- Under the Sink

- Countertop

- Pitchers & Dispenser

- Faucet

- Shower Mounted

- Inline

INSIGHTS BY DISTRIBUTION CHANNEL

The offline distribution channel segment is expected to be the largest revenue segment of the global residential water filtration parts & accessories market. The water filter parts and accessories are mainly sold through retail distribution channels such as specialty stores, hypermarkets, and certain home improvement stores. The distribution environment is rapidly evolving, with systems and processes being upgraded at a rapid pace. Mostly, offline distribution through specialty, brick-and-mortar stores have an edge over certain counterfeit products from unauthorized sellers in e-commerce. Vendors in the residential water filtration parts & accessories market have a lot of opportunities to explore and sell their products through this segment, owing to the larger customer outreach these possess. Since these stores offer multiple categories of products under one roof, it is convenient for customers to purchase everything needed at once.Segmentation by Distribution Channel

- Offline

- Online

GEOGRAPHICAL ANALYSIS

APAC holds the most significant share of the global residential water filtration parts & accessories market share, accounting for over 38% of the global share in 2023. The APAC region, expected to account for over 70% of the middle-class population by 2030, possesses huge potential for appliances like water filters with rising environmental concerns. Moreover, the rising groundwater depletion in countries like India can stimulate market demand in price-sensitive nations. Also, the high concentration of industries in China, Japan, and South Korea eventually increases the threat of pollution and contamination in drinking water sources. Poor sewage disposal mechanisms, low and ineffective public water treatment plants, and high incidence of waterborne diseases like typhoid are expected to propel the demand for filtration systems.Segmentation by Geography

- APAC

- China

- India

- Japan

- South Korea

- Indonesia

- Australia

- Thailand

- North America

- The U.S.

- Canada

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Netherlands

- Poland

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- Turkey

- UAE

COMPETITIVE LANDSCAPE

The global residential water filtration parts & accessories market is highly competitive, with the presence of a large number of vendors. Advanced filtration technologies are key as consumers expect continuous product innovations and upgrades. The existing scenario drives vendors to alter and refine their unique value proposition to achieve a strong market presence. Further, the key players in the global residential water filtration parts & accessories market are 3M, Culligan, Pentair, A.O. Smith, and APEC Water Systems. As global players are likely to increase their footprint in the market, regional vendors will likely find it increasingly difficult to compete with global players. The competition will be based solely on features such as filtration method, quality, quantity, technology, services, price, and distribution. The market competition is expected to intensify further with increased product and after-service extensions, technological innovation growth, and mergers and acquisitions. Other significant determinants include durability, warranty, footprint, filter replacement cycle, annual and ongoing expenses, design, and compatibility.Key Company Profiles

- 3M

- Culligan

- Pentair

- A.O. Smith

- APEC Water Systems

Other Prominent Vendors

- BRITA

- Whirlpool Corporation

- Doulton

- SpringWell Water Filtration Systems

- Berkey Filters

- Toray Industries

- Watts

- GE Appliances

- BWT

- CINTROPUR

- Coway

- Rainsoft

- iSpring Water Systems

- GHP Group

- Express Water

- AquaHomeGroup

- Aquafilter

- SoftPro Water Systems

- Woder

- Waterdrop

KEY QUESTIONS ANSWERED:

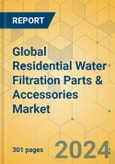

1. How big is the global residential water filtration parts & accessories market?2. What is the growth rate of the global residential water filtration parts & accessories market?

3. Which region dominates the global residential water filtration parts & accessories market share?

4. What are the significant trends in the residential water filtration parts & accessories market?

5. Who are the key players in the global residential water filtration parts & accessories market?

Table of Contents

Companies Mentioned

- 3M

- Culligan

- Pentair

- A.O. Smith

- APEC Water Systems

- BRITA

- Whirlpool Corporation

- Doulton

- SpringWell Water Filtration Systems

- Berkey Filters

- Toray Industries

- Watts

- GE Appliances

- BWT

- CINTROPUR

- Coway

- Rainsoft

- iSpring Water Systems

- GHP Group

- Express Water

- AquaHomeGroup

- Aquafilter

- SoftPro Water Systems

- Woder

- Waterdrop

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 301 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 9.5 Billion |

| Forecasted Market Value ( USD | $ 13.88 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |