The COVID-19 pandemic changed people's mobility habits, with many preferring personal automobiles over public transit or ride-sharing options. This growing demand for personal automobiles benefited the auto finance business as more consumers looked for car financing choices. Auto loans are rebounding after contracting during Covid year. According to the RBI's credit figures for last year, the auto loan portfolio increased by 2.6% month on month. Vehicle loans post-pandemic increased, more than doubling from pre Covid period.

With a combination of the country's enormous population and expanding demand for automobiles, India has a sizable auto lending sector. The auto loan industry in India has grown gradually over the years, owing to reasons such as rising disposable income, greater credit availability, and a growing middle class. Post-COVID-19 automobile loans taken through commercial banks observed a continuous increase, leading to a rise in interest revenue of lenders.

The demand in Indian markets, along with the decline of global car sectors like Japan, Europe, and the United States, has resulted in an influx of new companies and enormous capital expenditures in the industry. Overseas automakers such as Kia and Honda are expanding manufacturing units in India and are using their Indian operations to grow their businesses. Nowadays, the majority of customers choose to purchase a vehicle with the assistance of some financial assistance. The current financing cost for used automobiles is roughly 10 -15%, presenting a substantial opportunity for both manufacturers and financial institutions.

India Auto Loan Market Trends

Rising Interest Rates

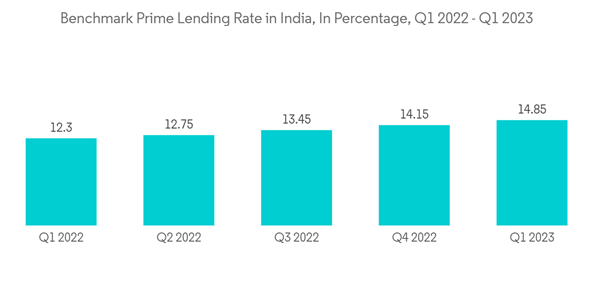

The Reserve Bank of India, to control inflation post-COVID-19, adopted a contractionary monetary policy by raising the rate of interest. This increase in the rate of interest increased the cost of vehicle loans and EMI interest on the loans taken by borrowers. With its policy mandates to control inflation, RBI had overall increased its interest rates. With a continuously rising interest rate on loans, outstanding debt of automobile loans was observed a continuous increase of 22 % last year, leading to a rising risk for bank loans. Many prefer personal automobiles over public transit or ride-sharing options after COVID-19, even after the rise of interest rates. Growth in personal vehicle loans in India still exists at a significant level of around 10%. With rising interest rates spread in the market, an increasing number of players, such as financial companies and fintech, are entering to reap the benefits.Government Initiatives for Automobile Market

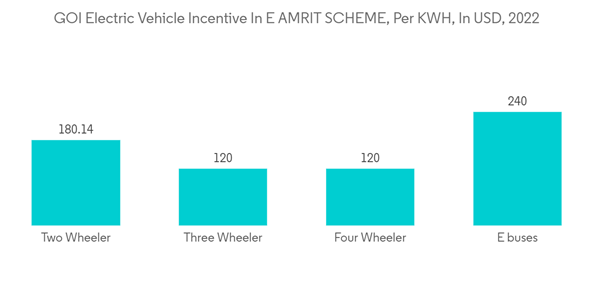

The Indian government has implemented plenty of regulations and measures to encourage auto manufacture and make finance more accessible. Schemes such as the "Pradhan Mantri Mudra Yojana" and "Stand-Up India" attempt to give financial aid and foster entrepreneurship, particularly automotive-related firms. Furthermore, the Goods and Services Tax (GST) has simplified tax systems, resulting in earlier combined VAT and excise duty tax rates on cars declining. With the government's aim towards increasing the sale of electric vehicles in the market, it is providing incentives for sales of all kinds of electric vehicles, which exist at more than 2 million units in the current year and are expected to rise over the coming period. In addition to this, banks are also offering interest subsidies to Electric vehicle loan borrowers, which increases their ESG scores as well. These policy initiatives are helping the auto loan industry to adopt green finance and increase their business as well.India Auto Loan Industry Overview

In India, the auto loan industry is relatively fragmented, with a mix of big banks, non-banking financial firms (NBFCs), and other financial institutions functioning in the market. Technological innovations in the banking industry are resulting in lenders offering their digital loan services to increase their reach and market size. Some of the key players in the Indian auto loan market are HDFC Bank Limited, State Bank of India, ICICI Bank Limited, Mahindra & Mahindra Financial Services Limited, and Axis Bank Limited.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.