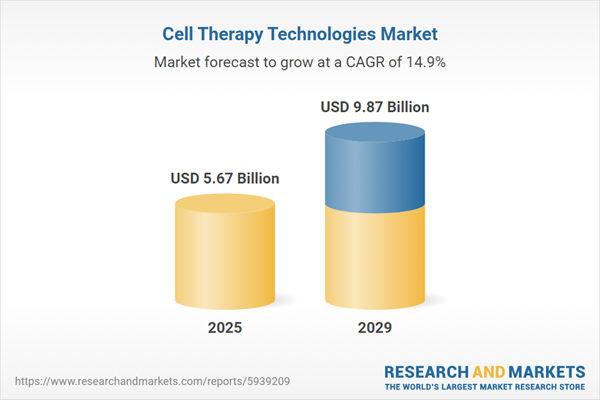

The cell therapy technologies market size is expected to see rapid growth in the next few years. It will grow to $9.87 billion in 2029 at a compound annual growth rate (CAGR) of 14.9%. The growth in the forecast period can be attributed to rising aging population, increasing prevalence of cancer, increasing research and development spending in pharmaceutical sector, and advancements in cell therapies. Major trends in the forecast period include developing innovative products, using advanced technologies, development of innovative cell therapies, investing in manufacturing facilities, and partnerships and collaborations.

The global cell therapy technologies market has experienced growth, driven by increasing government investments in cell-based research. Governments are allocating funds to support research activities focused on developing therapies for various diseases, including cancer, cardiovascular disease (CVD), and more. An example of this investment trend is observed in the actions of The California Institute for Regenerative Medicine (CIRM), a research center dedicated to stem cell research. In May 2022, CIRM invested over $11 million to fund a clinical trial for a cell therapy designed to treat throat cancer. The success of this therapy could potentially spare patients from undergoing radiotherapy and its associated side effects.

The rising incidence of cancer is anticipated to fuel the growth of the cell therapy technologies market throughout the forecast period. Cell therapy utilizes living cells as therapeutic agents to combat diseases. In the context of cancer treatment, cell therapy harnesses the immune system's natural capability to identify and eliminate abnormal cells within the body. For example, in January 2024, the American Cancer Society, a US-based nonprofit organization focused on cancer advocacy, reported that the number of cancer cases rose to 2,001,140, up from 1,958,310 in 2023, indicating a growth of 2.19%. Consequently, the increase in cancer cases is expected to significantly contribute to the expansion of the cell therapy technologies market in the future.

Major companies are focusing on developing innovative products using advanced technologies to achieve growth in the dynamic landscape of the cell therapy technologies market. An illustrative example of this trend is seen in the actions of Invetech, an Australia-based company specializing in the design, engineering, and manufacture of commercial-scale diagnostic products and cell and gene therapies. In June 2022, Invetech launched Korus, a novel closed system for autologous cell therapies. Korus is designed to redefine industry standards in elutriation and cell wash by utilizing a mild elutriation process that provides a cleaner cell population for various cell therapy production processes, such as tumor-infiltrated lymphocytes (TIL), dendritic cells, chimeric antigen receptor (CAR)-T cells, or induced pluripotent stem cell (IPSC)-derived therapy. The technology features elutriation and cell wash using gentle counterflow centrifugation, resulting in purified cell populations for downstream processing development and commercial manufacture. Korus aims to enhance overall process performance through improved recovery and purity of target cells, enabling developers to expedite clinical development and scale-up of their products.

Product innovation remains a key focus in the cell therapy technologies market, with companies striving to develop cutting-edge products to solidify their market positions. In September 2022, denovoMATRIX GmbH, a Germany-based innovator in cell and gene therapy manufacturing, launched animal component-free cell culture product lines at cell therapy grade (CTG). These product lines are equipped with documentation and traceability information to comply with industry regulatory standards, catering to the stem cell therapy manufacturing market. Additionally, in December 2021, Novartis, a Switzerland-based pharmaceutical corporation, introduced T-Charge, its next-generation CAR-T platform. T-Charge serves as the foundation for various new investigational CAR-T cell therapies in the Novartis pipeline. The platform preserves T cell stemness, enhancing proliferative potential and reducing exhausted T cells in the product. With T-Charge, CAR-T cell expansion primarily occurs within a patient’s body (in-vivo), eliminating the need for extended culture time outside the body (ex-vivo). These unique characteristics contribute to better and more durable therapeutic responses, improved long-term outcomes, and a reduced risk of severe adverse events.

In July 2022, Evotec, a German biotechnology company, acquired Rigenerand Srl for an undisclosed sum. This acquisition integrates Rigenerand, a cutting-edge cell technology firm specializing in cGMP (current good manufacturing practice) production of cell therapies based in Medolla, Italy, which will now operate under the name Evotec (Modena) Srl. Rigenerand Srl originally hails from Italy and is focused on advanced cell technology.

Major companies operating in the cell therapy technologies market include Lonza Group AG, Thermo Fisher Scientific Inc, Merck KGaA, Terumo Corporation, Danaher Corporation, Fresenius Medical Care AG & Co. KGaA, Fujifilm Holdings Corporation, Sartorius AG, Becton Dickinson and Company, Avantor Inc., Cellular Biomedicine Group, CORESTEM, Astellas Pharma Inc, Anterogen Co. Ltd, Arce Therapeutics, CARsgen Therapeutics, Huadong Medicine, Co.Don AG, AstraZeneca, Neogene Therapeutics, GammaDelta Therapeutics Limited, Nightstar, SOTIO, Accell Clinical Research, Genestack, Novartis AG, Pfizer, Celgene Corporation, Johnson & Johnson, F. Hoffmann-La Roche Ltd, Bayer AG, Gilead Sciences, Juno Therapeutics, Allogene Therapeutics, Bluebird Bio, Amgen, Regen BioPharma, Bellicum, Amgen Brazil, GlaxoSmithKline plc, Biogen Brazil, Takeda Pharmaceutical Company Limited, Pfizer S.R.L, Biotchpharma, BrainStorm Cell Therapeutics, Pluristem, Bayer East Africa Ltd, Adcock Ingram, Next BioSciences, CryoSave, BioHeart, Stem Cell Technologies.

North America was the largest region in the cell therapy technologies market in 2024. Asia-Pacific is predicted to record the fastest growth over the forecast period. The regions covered in the cell therapy technologies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cell therapy technologies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Cell therapy represents a treatment method involving the injection of active cells into a patient's body to address specific disorders, aiming to modify sets of cells for disease treatment. This technique involves modifying cells outside the body, derived either from the patient or a donor, and then reintroducing them into the patient's system.

The primary product categories encompass consumables, equipment, systems, and software. Consumables refer to items intended for depletion or use during regular application. They find application across various cell types such as T-cells, stem cells, and others. Processes within cell therapy technologies include cell processing, preservation, distribution, handling, process monitoring, and quality control. These technologies have diverse applications spanning life science companies, research institutes, and cell banks.

The cell therapy technologies market research report is one of a series of new reports that provides cell therapy technologies market statistics, including cell therapy technologies industry global market size, regional shares, competitors with a cell therapy technologies market share, detailed cell therapy technologies market segments, market trends, and opportunities, and any further data you may need to thrive in the cell therapy technologies industry. This cell therapy technologies market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The cell therapy market consists of sales of cell therapy technologies that are medicinal solutions used for developing and improving cell therapy, such as cell processing, cell banking, and point-of-care technologies. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cell Therapy Technologies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cell therapy technologies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cell therapy technologies? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cell therapy technologies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Consumables, Equipment, Systems and Software2) By Cell Type: T-Cells, Stem Cells, Other Cells

3) By Process: Cell Processing, Cell Preservation, Distribution and Handling, Process Monitoring and Quality Control

4) By End User: Life Science Companies, Research Institutes and Cell Banks

Subsegments:

1) By Consumables: Cell Culture Media; Bioreactors and Cell Culture Vessels; Cell Separation and Processing Kits; Cryopreservation Bags and Vials2) By Equipment: Cell Counters; Centrifuges; Cell Sorting Equipment; Incubators

3) By Systems and Software: Closed-System Cell Processing Systems; Automated Cell Culture Systems; Point-of-Care Cell Therapy Systems; Laboratory Information Management Systems (LIMS); Data Management Software For Cell Therapies; Process Optimization and Tracking Software

Key Companies Mentioned: Lonza Group AG; Thermo Fisher Scientific Inc; Merck KGaA; Terumo Corporation; Danaher Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Lonza Group AG

- Thermo Fisher Scientific Inc

- Merck KGaA

- Terumo Corporation

- Danaher Corporation

- Fresenius Medical Care AG & Co. KGaA

- Fujifilm Holdings Corporation

- Sartorius AG

- Becton Dickinson and Company

- Avantor Inc.

- Cellular Biomedicine Group

- CORESTEM

- Astellas Pharma Inc

- Anterogen Co. Ltd

- Arce Therapeutics

- CARsgen Therapeutics

- Huadong Medicine

- Co.Don AG

- AstraZeneca

- Neogene Therapeutics

- GammaDelta Therapeutics Limited

- Nightstar

- SOTIO

- Accell Clinical Research

- Genestack

- Novartis AG

- Pfizer

- Celgene Corporation

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Gilead Sciences

- Juno Therapeutics

- Allogene Therapeutics

- Bluebird Bio

- Amgen

- Regen BioPharma

- Bellicum

- Amgen Brazil

- GlaxoSmithKline plc

- Biogen Brazil

- Takeda Pharmaceutical Company Limited

- Pfizer S.R.L

- Biotchpharma

- BrainStorm Cell Therapeutics

- Pluristem

- Bayer East Africa Ltd

- Adcock Ingram

- Next BioSciences

- CryoSave

- BioHeart

- Stem Cell Technologies.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.67 Billion |

| Forecasted Market Value ( USD | $ 9.87 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 52 |