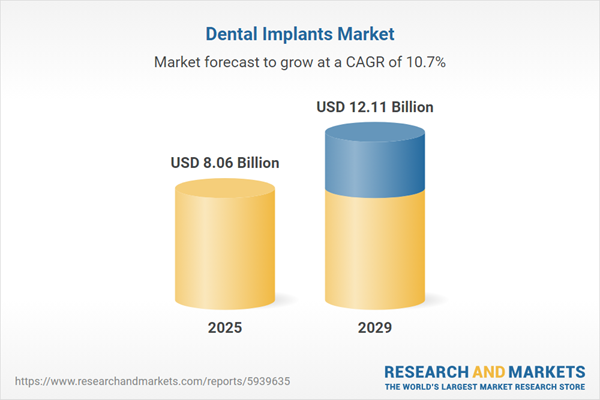

The dental implants market size is expected to see rapid growth in the next few years. It will grow to $12.11 billion in 2029 at a compound annual growth rate (CAGR) of 10.7%. The growth in the forecast period can be attributed to increasing incidence of dental disorders, increasing government initiatives to improve oral health, and rapid urbanization will drive the market. Major trends in the forecast period include use of biomaterials for improved durability and corrosion resistance, 3d-printed dental implants to improve quality and efficiency, focus on innovative technologies such as virtual dental implants and focus on strategic partnerships, collaborations and acquisitions to improve product portfolio.

The increasing incidence of dental caries that necessitate dental implants for treatment is driving up the demand for these implants. Dental caries is a complex, chronic condition resulting from various factors, including nutrition, saliva, microorganisms, trace minerals, genetic predisposition, and tooth morphology, ultimately leading to tooth decay. For instance, a research survey published in April 2024 by BMC Public Health, a UK-based journal under BioMed Central focusing on public health research, found that among 1,281 children, the prevalence of dental caries was 51%. The survey reported a dmft index score of 2.46, a Significant Caries Index (SiC) score of 6.39, and a SiC10 score of 10.35. Factors associated with the experience of dental caries included the frequency of sweet drink consumption, the age at which tooth brushing commenced, post-brushing eating habits, whether the children had received a government oral examination (p < 0.05), and the mother’s education level. However, no significant relationships were observed with sex, fluoride toothpaste usage, brushing frequency, parental assistance in brushing, or flossing frequency (p > 0.05).

The growth of the aging population is anticipated to drive the dental implants market in the future. The aging population, typically individuals aged 65 or older, benefits significantly from dental implants to enhance oral health, function, and overall well-being. Dental implants address the unique challenges faced by the elderly due to tooth loss and other dental issues. For example, based on data from the United Nations Department of Economic and Social Affairs in July 2022, the proportion of the global population aged 65 and older is projected to increase from 10% in 2022 to 16% by 2050. Hence, the rise in the aging population is a key factor propelling the growth of the dental implants market.

Advancements in dental implant technology have been marked by the introduction of new technologies and equipment, enhancing the consistency and quality of implant treatments. Companies are now developing implants that cater to patients' aesthetic preferences. For example, in June 2022, ZimVie unveiled the T3 Pro Tapered implant and Encode Emergence Healing Abutment, designed to offer both restorative care and aesthetic considerations.

Major companies in the dental implants market are increasingly prioritizing the introduction of innovative devices, including conical implants, to bolster their market position. Conical implants are a specific type of dental implant characterized by a tapered or conical shape. In February 2023, ABA Technologies, in collaboration with AB Dental Devices Ltd., launched the i-ON Conical Implant, featuring a twin platform design, a cool neck, and a precisely engineered bacteria-sealed implant-abutment interface. Tailored for soft bone zones, this implant focuses on enhancing durability, preventing infection, and achieving optimal aesthetic outcomes. It streamlines surgical procedures with quick and simple insertion, facilitating the formation and maintenance of natural and aesthetically pleasing soft tissue.

In May 2023, Straumann Group, a Switzerland-based dental equipment manufacturer, acquired GalvoSurge Dental AG for an undisclosed amount. This acquisition is part of Straumann's strategy to expand its cutting-edge concepts, particularly in supporting the treatment of peri-implantitis, a significant concern related to dental implants. GalvoSurge Dental AG, based in Switzerland, is a manufacturer of dental medical devices.

Major companies operating in the dental implants market include Henry Schein Inc, Envista Holdings Corporation, Straumann Group, DENTSPLY Sirona, Dentium Co Ltd, ZimVie, The 3M Company, Osstem Implant Co. Ltd., BioHorizons, Thommen Medical AG, Zimmer Biomet, Platon Japan, Bicon, LLC, Adin Dental Implant Systems Ltd., Shofu Dental Corporation, T-Plus Implant Tech. Co., Ltd, KYOCERA Medical Corporation, Nippon Piston Ring, DIO Implant, AQB Implant, Sigdent Dental Implants, Noris Medical, Cortex Dental Implants, BEGO, Shandong WeiGao Group Medical Polymer Company Limited, Henan Baistra Industries Corp, CONMET, Jsc Oez Vladmiva, Dental-Trade, Dental' LLC, Rus Atlant, Dentomal, Ria Ltd, Clifton Dental Practice, Dentalux, Dental Hygienist Pardubice, Valeo Compressor Europe s.r.o, Lasak Ltd., HIOSSEN, ACE Surgical, MegaGen, Implant Direct, MIS Implants, Anatomage, Dental Wings, Blue Sky Bio, Aseptico, Inc., Titan Implants, Septodont, VITA North America, Zest Anchor, S.I.N. Dental Implants, Conexao, Geistlich Pharma, Botiss Biomaterials, Dr. Thomas dental implant clinic, Masar Medical Co, Southern Implants (Pty) Ltd.

Asia-Pacific was the largest region in the dental implant market in 2024. Western Europe was the second-largest region in the dental implant industry. Africa was the smallest region in the dental implant industry report. The regions covered in the dental implants market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dental implants market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Dental implants are medical devices that undergo surgical implantation into the jaw to restore an individual's chewing functionality or enhance their appearance.

The primary types of dental implants include tapered implants and parallel-walled implants. A tapered implant is characterized by a cylindrical structure where the endosseous section narrows in diameter toward the apex. These implants are typically composed of materials such as titanium and zirconium and find application across various end-users, including hospitals and dental clinics.

The dental implants market research report is one of a series of new reports that provides dental implants market statistics, including dental implants industry global market size, regional shares, competitors with a dental implants market share, detailed dental implants market segments, market trends and opportunities, and any further data you may need to thrive in the dental implants industry. The dental implants market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Dental implants consist of sales of implants such as endosteal implants, subperiosteal implants, and transosteal implants. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Dental Implants Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental implants market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental implants? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental implants market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Tapered Implants, Parallel Walled Implants2) By Material: Titanium, Zirconium, Other Materials

3) By End-Use: Hospitals, Dental Clinics, Other End Uses

Subsegments:

1) By Tapered Implants: Conical Tapered Implants; Platform-Switching Tapered Implants; Micro-threaded Tapered Implants2) By Parallel Walled Implants: Standard Parallel Walled Implants; Short Parallel Walled Implants; Wide Parallel Walled Implants

Key Companies Mentioned: Henry Schein Inc; Envista Holdings Corporation; Straumann Group; DENTSPLY Sirona; Dentium Co Ltd

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Henry Schein Inc

- Envista Holdings Corporation

- Straumann Group

- DENTSPLY Sirona

- Dentium Co Ltd

- ZimVie

- The 3M Company

- Osstem Implant Co. Ltd.

- BioHorizons

- Thommen Medical AG

- Zimmer Biomet

- Platon Japan

- Bicon, LLC

- Adin Dental Implant Systems Ltd.

- Shofu Dental Corporation

- T-Plus Implant Tech. Co., Ltd

- KYOCERA Medical Corporation

- Nippon Piston Ring

- DIO Implant

- AQB Implant

- Sigdent Dental Implants

- Noris Medical

- Cortex Dental Implants

- BEGO

- Shandong WeiGao Group Medical Polymer Company Limited

- Henan Baistra Industries Corp

- CONMET

- Jsc Oez Vladmiva

- Dental-Trade

- Dental' LLC

- Rus Atlant

- Dentomal

- Ria Ltd

- Clifton Dental Practice

- Dentalux

- Dental Hygienist Pardubice

- Valeo Compressor Europe s.r.o

- Lasak Ltd.

- HIOSSEN

- ACE Surgical

- MegaGen

- Implant Direct

- MIS Implants

- Anatomage

- Dental Wings

- Blue Sky Bio

- Aseptico, Inc.

- Titan Implants

- Septodont, VITA North America

- Zest Anchor

- S.I.N. Dental Implants

- Conexao

- Geistlich Pharma

- Botiss Biomaterials

- Dr. Thomas dental implant clinic

- Masar Medical Co

- Southern Implants (Pty) Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.06 Billion |

| Forecasted Market Value ( USD | $ 12.11 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 57 |