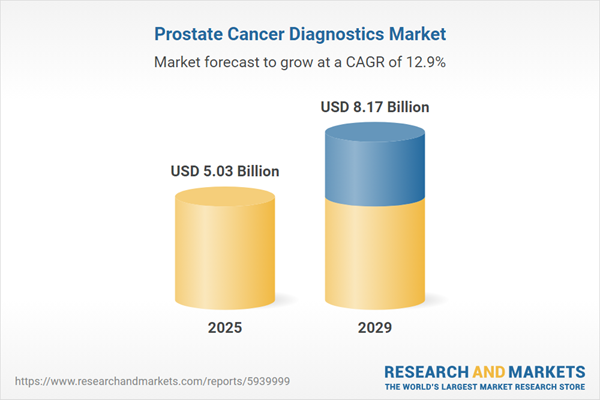

The prostate cancer diagnostics market size is expected to see rapid growth in the next few years. It will grow to $8.17 billion in 2029 at a compound annual growth rate (CAGR) of 12.9%. The growth in the forecast period can be attributed to the integration of artificial intelligence (AI), growth of telemedicine in cancer screening, advancements in genomic profiling, patient-centric approaches, and multiparametric MRI for diagnosis. Major trends in the forecast period include liquid biopsy technologies, technological advances in biomarker detection, clinical research and development, digital pathology integration, emergence of multiplex biomarker assays.

The prostate cancer diagnostics market is anticipated to experience growth, driven by the increasing prevalence of prostate cancer. This condition, affecting the prostate gland in the male and female reproductive systems, necessitates early diagnosis through various tests, including prostate-specific antigen (PSA) testing and advanced imaging techniques. In January 2023, the American Cancer Society (ACS) reported an estimated 288,300 new cases of prostate cancer and 34,700 deaths attributed to the disease for the same year. Consequently, the rising prevalence of prostate cancer is expected to fuel the expansion of the prostate cancer diagnostics market.

The growth of the prostate cancer diagnosis market is being driven by an increase in healthcare spending. Healthcare spending refers to the total financial resources allocated to the healthcare sector within a specific region, country, or organization. This spending supports the allocation and use of resources for prostate cancer diagnosis, facilitating early detection, accurate staging, and timely intervention, all aimed at improving patient outcomes, survival rates, and the overall quality of care for those affected by prostate cancer. For example, in May 2023, a report from the Office for National Statistics, a UK-based government department, indicated that healthcare spending in the UK rose by 5.6% between 2022 and 2023, compared to a growth of 0.9% in 2022. The UK healthcare expenditure was approximately $317.63 billion (£292 billion) in 2023. Thus, the increase in healthcare spending is propelling the growth of the prostate cancer diagnosis market in the future.

Technological innovations represent a prominent trend in the prostate cancer diagnostics market, with major companies introducing advanced AI-powered tools for diagnosis. In March 2023, Qritive, a Singapore-based company, launched QAi Prostate - an AI-powered prostate cancer diagnosis tool designed for pathologists. This tool employs sophisticated machine learning algorithms to identify prostatic adenocarcinoma regions and analyze whole slide images of prostate core needle biopsies. The innovative tool facilitates accurate and swift diagnoses, reducing treatment time.

Strategic partnerships are a key approach adopted by major companies in the prostate cancer diagnostics market to advance cancer precision medicine. In March 2022, Lantheus Holdings Inc., a US-based diagnostic and imaging products company, partnered with Novartis AG, a Switzerland-based pharmaceutical company, to utilize Lantheus' prostate-specific membrane antigen (PSMA) imaging agent, PYLARIFY, in clinical trials for Pluvicto. This collaboration aims to enhance the diagnosis of patients with prostate cancer for improved treatment outcomes.

In August 2022, MDxHealth SA, a US-based precision diagnostics company, acquired Exact Sciences Corporation to bolster its leadership in the precision diagnostics urology market. This acquisition expanded MDxHealth's prostate diagnostics business with the inclusion of the Oncotype DX GPS (Genomic Prostate Score) test. Exact Sciences Corporation, a US-based cancer screening and diagnostic tests company, brought valuable assets, including prostate pipelines software supporting patients throughout their cancer diagnosis and treatment.

Major companies operating in the prostate cancer diagnostics market include F. Hoffman-La Roche AG, Bayer AG, Thermo Fisher Scientific Inc., Abbott Laboratories Inc., Siemens Healthineers AG, Becton Dickinson and Company, Agilent Technologies Inc., Hologic Inc, Biomerieux SA, Beckman Coulter Inc., Qiagen N.V., EXACT Sciences Corporation, Diasorin S.P.A., OPKO Health Inc., Myriad Genetics Inc., Cepheid Inc, NeoGenomics Laboratories Inc., Guardant Health Inc, GRAIL Inc, Fujirebio Diagnostics Inc., Ambry Genetics Corporation, MDxHealth SA, Biocept Inc., Blue Earth Therapeutics Ltd, Exosome Diagnostics Inc., Dana-Farber Cancer Institute, Cellanyx Diagnostics Inc., A3P Biomedical AB.

North America was the largest region in the prostate cancer diagnostics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the prostate cancer diagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the prostate cancer diagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Prostate cancer diagnostics involve the process of determining and confirming the presence of prostate cancer through diagnostic testing and medical evaluations. The primary aim is to assess the status and severity of the illness, guiding treatment choices. This diagnostic approach is commonly applied in the treatment of prostatic adenocarcinoma, transitional cell carcinomas, and neuroendocrine tumors.

The main products in prostate cancer diagnostics include instruments, reagents and consumables, and accessories. Accessories encompass items in the kit that may not be strictly necessary but can enhance effectiveness, such as a prostate-specific antigen (PSA) test kit, biopsy needle, and ultrasound gel, all utilized in the diagnosis of prostate cancer. Various test types, including preliminary and confirmatory tests, diagnose different types of prostate cancers, such as squamous cell cancer, small cell carcinoma, transitional cell cancer, prostatic adenocarcinoma, ductal adenocarcinoma, small cell prostate cancer, and acinar adenocarcinoma. These diagnostic tests are applicable to various age groups, including adults, pediatric, and geriatric populations, and are performed by different end users, including hospitals, independent diagnostic laboratories, cancer research institutes, and others.

The prostate cancer diagnostics market research report is one of a series of new reports that provides prostate cancer diagnostics market statistics, including prostate cancer diagnostics industry global market size, regional shares, competitors with a prostate cancer diagnostics market share, detailed prostate cancer diagnostics market segments, market trends and opportunities, and any further data you may need to thrive in the prostate cancer diagnostics industry. This prostate cancer diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The prostate cancer diagnostics market consists of revenues earned by entities by providing transrectal ultrasound, magnetic resonance imaging (MRI), and computerized tomography (CT) scans. The market value includes the value of related goods sold by the service provider or included within the service offering. The prostate cancer diagnostics market also includes sales of products such as tumor biopsies, and test kits. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Prostate Cancer Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on prostate cancer diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for prostate cancer diagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The prostate cancer diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Products: Instruments; Reagents and Consumables; Accessories2) By Test Type: Preliminary Tests; Confirmatory Tests

3) By Prostate Cancer: Squamous Cell Cancer; Small Cell Carcinoma; Transitional Cell Cancer; Prostatic Adenocarcinoma; Ductal Adenocarcinoma; Small Cell Prostate Cancer; Acinar Adenocarcinoma

4) By Peer Groups: Adult; Pediatric; Geriatrics

5) By End User: Hospitals; Independent Diagnostic Laboratories; Cancer Research Institutes; Other End-Users

Subsegments:

1) By Instruments: Biopsy Instruments; Imaging Devices; Digital Rectal Examination Tools2) By Reagents and Consumables: Diagnostic Assay Kits; Staining Reagents; Sample Collection Materials

3) By Accessories: Biopsy Guides; Specimen Handling Accessories; Calibration and Maintenance Tools

Key Companies Mentioned: F. Hoffman-La Roche AG; Bayer AG; Thermo Fisher Scientific Inc.; Abbott Laboratories Inc.; Siemens Healthineers AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffman-La Roche AG

- Bayer AG

- Thermo Fisher Scientific Inc.

- Abbott Laboratories Inc.

- Siemens Healthineers AG

- Becton Dickinson and Company

- Agilent Technologies Inc.

- Hologic Inc

- Biomerieux SA

- Beckman Coulter Inc.

- Qiagen N.V.

- EXACT Sciences Corporation

- Diasorin S.P.A.

- OPKO Health Inc.

- Myriad Genetics Inc.

- Cepheid Inc

- NeoGenomics Laboratories Inc.

- Guardant Health Inc

- GRAIL Inc

- Fujirebio Diagnostics Inc.

- Ambry Genetics Corporation

- MDxHealth SA

- Biocept Inc.

- Blue Earth Therapeutics Ltd

- Exosome Diagnostics Inc.

- Dana-Farber Cancer Institute

- Cellanyx Diagnostics Inc.

- A3P Biomedical AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.03 Billion |

| Forecasted Market Value ( USD | $ 8.17 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |