As the pharmaceutical segment grows, particularly in biopharmaceuticals, the demand for it for protein purification also rises. Therefore, the pharmaceutical segment captured $251.31 million revenue in the market in 2022.This is because many biopharmaceuticals, including monoclonal antibodies and recombinant proteins, require precise purification steps during manufacturing.

Bio-based and organic fertilizers are essential in organic farming, emphasizing natural processes and avoiding synthetic chemicals. When derived and used by organic farming standards, it becomes a preferred nitrogen and sulfur source for organic farmers. Ammonium sulfate, as a naturally occurring compound, fits well with the principles of organic farming. Using a natural nitrogen and sulfur source aligns with the desire for organic inputs, contributing to bio-based and organic fertilizers containing it marketability. Additionally, Monoclonal antibodies are a major class of biopharmaceuticals, and their production involves multiple purification steps where itis frequently utilized. The rising demand for monoclonal antibodies for treating various diseases contributes significantly to the demand for this in biopharmaceutical manufacturing. Recombinant proteins, including enzymes and therapeutic proteins, often undergo purification processes where it used. The growth of recombinant protein production for medical, diagnostic, and industrial applications drives the need for efficient protein purification methods, supporting the demand for this. Thus, because of the expansion of biopharmaceutical manufacturing, the market is anticipated to increase significantly.

However, Volatile raw material prices directly impact the production costs of it. Manufacturers may experience sudden increases in production costs when ammonia and sulfuric acid prices rise sharply, leading to reduced profit margins or potential losses. Fluctuating raw material prices create challenges for manufacturers to maintain stable and predictable profitability. Manufacturers may struggle to set consistent product prices, impacting their ability to forecast and plan for financial stability. The unpredictability of raw material prices adds complexity to risk management strategies for its producers. Companies may find developing effective risk mitigation plans challenging, leading to increased exposure to financial risks associated with volatile markets. Therefore, high volatile raw material prices are a significant challenge that hampers the growth of market.

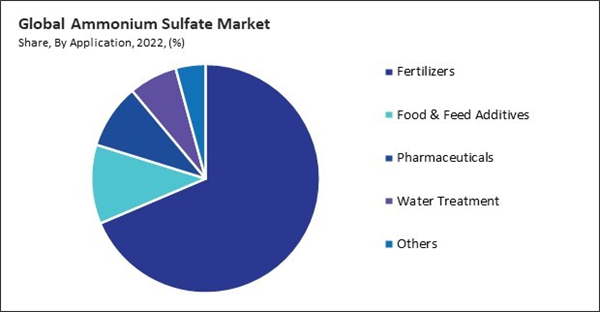

By Application Analysis

Based on application, the market is classified into fertilizers, pharmaceuticals, food & feed additives, water treatment, and others. In 2022, the fertilizers segment witnessed the largest revenue share in the market. Fertilizers, including this, help address nutrient deficiencies in the soil, ensuring that crops receive a balanced supply of essential nutrients. Improved nutrient content in plants leads to healthier crops with better nutritional value. This is especially important for crops intended for human consumption, where nutrient-rich produce is desirable for human health. Fertilizers contribute to maintaining and enhancing soil fertility by replenishing nutrients that are depleted during plant growth and harvesting. Optimal soil fertility is crucial for sustained agricultural productivity. By providing nitrogen, Ammonium sulfate contributes to soil health and fertility, supporting the long-term sustainability of farming practices.By Product Analysis

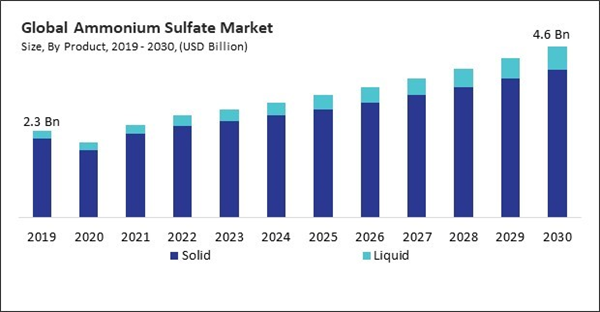

By product, the market is categorized into solid and liquid. The liquid segment covered a considerable revenue share in the market in 2022. Liquid fertilizers can be uniformly distributed across the field, ensuring even coverage of nutrients. This is especially useful for crops that require precision nutrition management. Liquid fertilizers can be formulated with additives to enhance nutrient stability and reduce the risk of nutrient loss through volatilization or leaching. Liquid formulations can be applied directly to the leaves (foliar application), allowing for efficient nutrient absorption through the foliage. Foliar feeding is advantageous for providing nutrients during critical growth stages or addressing nutrient deficiencies. It can be a strategic approach for certain crops and situations.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region acquired a significant revenue share in the market. North America has a diverse range of crops, and the intensification of crop production contributes to higher fertilizer demand. The growing emphasis on sustainable agriculture practices and environmentally friendly fertilizers impacts the choice of fertilizers used in the region. Ammonium sulfate is utilized in various industrial processes in North America, including producing chemicals, textiles, and pharmaceuticals. The growth of industrial sectors in North America contributes to the demand for this as a raw material.Recent Strategies Deployed in the Market

- 2023-Jun: BASF SE came into partnership with Yara Clean Ammonia Norge As, a maritime transportation company in Oslo. Through this partnership, BASF SE would establish and build a large-scale facility for low-carbon blue ammonia production, incorporating carbon capture technology, in the Gulf Coast region of the United States.

- 2023-Jul: Evonik Industries AG took over Nova Chemicals, a Canadian petrochemical company. Through this acquisition, Evonik Industries AG would enhance its portfolio of sustainable cosmetic active ingredients.

- 2023-Jan: SABIC (Saudi Arabian Oil Company) came into partnership with Atmonia, a chemical manufacturing company. Through this partnership, SABIC (Saudi Arabian Oil Company) would Implement Atmonia's technology for ammonia production is underway in Saudi Arabia, Bahrain, Kuwait, and Oman. Atmonia, an Icelandic company, is pioneering a sustainable production process for ammonia.

- 2022-Nov: Helm AG came into partnership with Bi-PA NV, a Bioresearch company in Belgium. Through this partnership, Helm AG would enhance its crop production with sustainable agriculture by supplying innovative solutions to answer grower needs to the market.

- 2022-Sep: BASF SE came into partnership with RiKarbon Inc., a US-based chemical manufacturing company. Through this partnership, BASF SE would enhance its chemical portfolio and extend its innovative offering to its customers.

- 2022-Jul: LANXESS AG took over International Flavors & Fragrances Inc. (IFF), an American corporation that produces flavors, fragrances, and cosmetic actives. Through this acquisition, LANXESS AG would expand its range of antimicrobial active ingredients and formulations for material protection, preservatives, and disinfectants while fortifying its global presence, particularly in the United States.

List of Key Companies Profiled

- BASF SE

- Evonik Industries AG (RAG-Stiftung)

- LANXESS AG

- SABIC (Saudi Arabian Oil Company)

- Sumitomo Chemical Co. Ltd.

- Honeywell International, Inc.

- Helm AG

- ArcelorMittal S.A.

- Akzo Nobel N.V.

- Domo Chemicals GmbH

Market Report Segmentation

By Product (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Solid

- Liquid

- Fertilizers

- Food & Feed Additives

- Pharmaceuticals

- Water Treatment

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Australia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- Morocco

- Chile

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- BASF SE

- Evonik Industries AG (RAG-Stiftung)

- LANXESS AG

- SABIC (Saudi Arabian Oil Company)

- Sumitomo Chemical Co. Ltd.

- Honeywell International, Inc.

- Helm AG

- ArcelorMittal S.A.

- Akzo Nobel N.V.

- Domo Chemicals GmbH