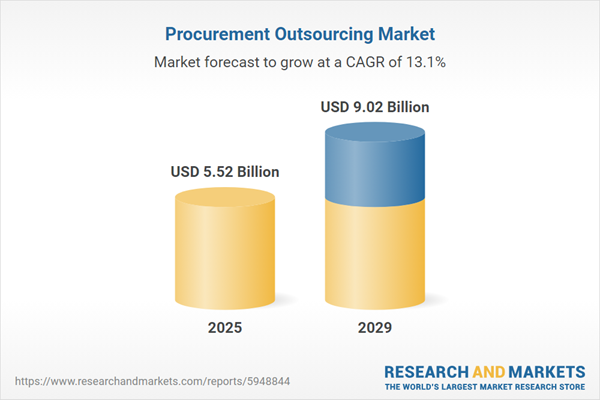

The procurement outsourcing market size has grown rapidly in recent years. It will grow from $4.78 billion in 2024 to $5.52 billion in 2025 at a compound annual growth rate (CAGR) of 15.5%. The growth in the historic period can be attributed to cost efficiency, focus on core competencies, globalization, risk management, flexible resource allocation.

The procurement outsourcing market size is expected to see rapid growth in the next few years. It will grow to $9.02 billion in 2029 at a compound annual growth rate (CAGR) of 13.1%. The growth in the forecast period can be attributed to strategic sourcing, sustainability and csr, resilience planning, demand for specialized skills, data security and compliance. Major trends in the forecast period include digital transformation, technological advancements, agile and flexible procurement models, data analytics and business intelligence, focus on strategic sourcing.

The anticipated growth of the e-commerce industry is set to drive the expansion of the procurement outsourcing market in the coming years. E-commerce, encompassing the online buying and selling of goods and services, utilizes procurement outsourcing for effective management of supplier contracts, ensuring compliance, and identifying opportunities for renegotiation. For example, in October 2023, as reported by the Boston Consulting Group Inc., e-commerce sales in Europe saw a 3% increase, while in the US and Asia, they recorded a 7% rise in 2022. Furthermore, the global e-commerce sector is projected to experience a 9% annual growth by 2027. Consequently, the burgeoning e-commerce industry is expected to be a catalyst for the growth of the procurement outsourcing market.

The rising rate of urbanization is expected to drive the growth of the procurement outsourcing market in the coming years. Urbanization refers to the process by which a larger proportion of the population moves from rural areas to towns and cities, leading to the expansion of urban regions. As urbanization progresses, procurement outsourcing becomes essential for efficiently managing and streamlining the acquisition of goods and services needed for growing city populations. This enables cost savings, process optimization, and improved strategic sourcing capabilities. For example, in February 2024, an article by Our World in Data, a UK-based scientific online publication, reported that approximately 56.9% of the world's population lived in urban areas as of 2024. This trend is expected to continue, with projections indicating that by 2050, over 68% of the global population will reside in urban areas. As a result, the increasing rate of urbanization is driving the growth of the procurement outsourcing market.

Major companies in the procurement outsourcing market are increasingly focusing on technological advancements, such as artificial intelligence (AI), to enhance procurement processes, improve decision-making, and achieve cost efficiencies. AI is a technology designed to create machines that can perform tasks typically requiring human intelligence, such as learning, problem-solving, and pattern recognition. For example, in July 2024, Acquire BPO, an Australia-based business process outsourcing company, launched Acquire.AI. This AI-driven platform offers tailored solutions to enhance business efficiency and customer experiences, supporting widespread AI adoption across various industries and driving growth and operational improvements.

In August 2023, International Business Machines (IBM) Corporation, a technology corporation based in the United States, successfully acquired Apptio Inc. for an undisclosed amount. This strategic acquisition is geared towards expanding IBM Corporation's product offerings and diversifying the automation products accessible to end-users. The move is aimed at strengthening IBM's IT automation portfolio, providing enterprises with a comprehensive technology management platform that facilitates optimization and automation of decisions across their IT environments. Apptio Inc., the acquired company, is a US-based provider of software-as-a-service applications and plays a crucial role in the supply chain of IT services, including offerings related to procurement outsourcing.

Major companies operating in the procurement outsourcing market report are Microsoft Corporation, Siemens AG, General Electric Company, Accenture PLC, International Business Machines Corporation, Ernst & Young LLP, SAP SE, Tata Consultancy Services Limited, Capgemini SE, Cognizant Technology Solutions Corporation, Infosys Limited, DXC Technology Company, Wipro Limited, HCL Technologies Limited, Rockwell Automation Inc., CGI Inc., Concentrix Services India Private Limited (CSIPL), GEP Worldwide, WNS Denali, JAGGAER, Corbus LLC, Aquanima SA, Xchanging Solutions Limited, Intetics Inc., Aegis One Consults Ltd.

North America was the largest region in the procurement outsourcing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the procurement outsourcing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the procurement outsourcing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The procurement outsourcing market includes revenue earned by entities by providing services such as direct procurement, indirect procurement, goods procurement, and services procurement. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Procurement outsourcing involves delegating specific critical procurement tasks related to sourcing and supplier management to a third-party service provider. This approach is employed by service providers to reduce their overall costs or allocate more time for businesses to focus on their core strengths.

The primary components of procurement outsourcing include solutions and services. A solution refers to a software application designed to help businesses automate the process of obtaining services from third-party vendors. The diverse enterprises engaged in this practice range from large enterprises to small and medium enterprises, utilizing on-premises and cloud solutions. The sectors benefiting from procurement outsourcing encompass banking, financial services, insurance (BFSI), energy and utilities, healthcare, IT and telecom, professional services, manufacturing, retail, logistics, and other industry verticals.

The procurement outsourcing market research report is one of a series of new reports that provides procurement outsourcing market statistics, including procurement outsourcing industry global market size, regional shares, competitors with procurement outsourcing market share, detailed procurement outsourcing market segments, market trends, and opportunities, and any further data you may need to thrive in the procurement outsourcing industry. This procurement outsourcing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Procurement Outsourcing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on procurement outsourcing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for procurement outsourcing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The procurement outsourcing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Solution; Services2) By Deployment: On-Premises; Cloud

3) By Enterprise Size: Large Enterprises; Small And Medium Enterprise

4) By Industry Verticals: Banking, Financial Services, And Insurance (BFSI); Energy And Utilities; Healthcare; IT And Telecom; Professional Services; Manufacturing; Retail; Logistics; Other Industry Verticals

Subsegments:

1) By Solution: Procurement Software Solutions; Supplier Management Solutions; E-Sourcing And E-Procurement Solutions; Procurement Analytics And Reporting Tools; Spend Management Solutions2) By Services: Strategic Sourcing Services; Supplier Relationship Management Services; Procurement Operations Management; Purchase Order And Invoice Management Services; Procurement Consulting And Advisory Services; Contract Management Services; Procurement Process Outsourcing (PPO)

Key Companies Mentioned: Microsoft Corporation; Siemens AG; General Electric Company; Accenture plc; International Business Machines Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Procurement Outsourcing market report include:- Microsoft Corporation

- Siemens AG

- General Electric Company

- Accenture plc

- International Business Machines Corporation

- Ernst & Young LLP

- SAP SE

- Tata Consultancy Services Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Infosys Limited

- DXC Technology Company

- Wipro Limited

- HCL Technologies Limited

- Rockwell Automation Inc.

- CGI Inc.

- Concentrix Services India Private Limited (CSIPL)

- GEP Worldwide

- WNS Denali

- JAGGAER

- Corbus LLC

- Aquanima SA

- Xchanging Solutions Limited

- Intetics Inc.

- Aegis One Consults Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.52 Billion |

| Forecasted Market Value ( USD | $ 9.02 Billion |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |