Rapid urbanization and changing lifestyles in the Asia Pacific region have shifted towards more active and adventurous forms of recreation. Consequently, the Asia pacific region would acquire nearly, 25% of the total market share by 2030. As urban populations seek opportunities to escape the hustle and bustle of city life, these sports activities such as off-roading, trail riding, and water sports offer an attractive outlet for outdoor adventure and excitement.

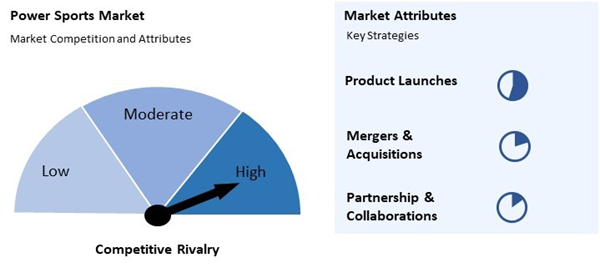

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in February, 2024, CFMOTO unveiled The CFORCE 800 and CFORCE 1000 ATVs. The two ATVs feature upgraded engines, suspension, and TFT screens. The CFORCE 800 Touring ATV boasts a new 800cc engine with ride-by-wire throttle, redesigned CVT transmission, and advanced rider interface. Its counterpart, the CFORCE 1000, with a high-output twin-cylinder engine, offers power and performance for challenging trails. Moreover, in February, 2024, Bombardier Recreational Products Inc. (BRP) expanded its electric snowmobile lineup with two new models: the Ski-Doo Expedition Electric and the Lynx Adventure Electric. The models feature wider, longer tracks for better flotation, traction, and versatility in backcountry terrain and have a range of up to 50.

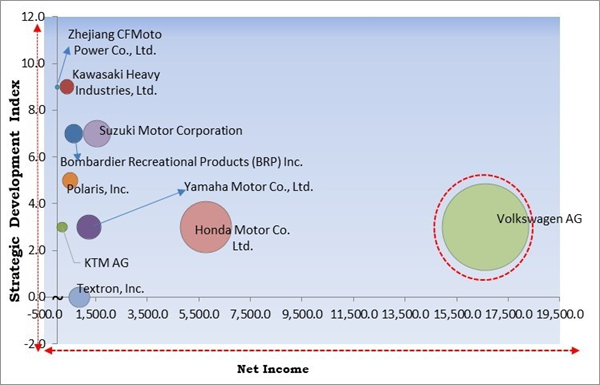

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Volkswagen AG is the forerunner in the Market. In August, 2023, Ducati, a subsidiary of Volkswagen AG, unveiled the Diavel V4 motorcycle. The Diavel V4 boasts a V4 Granturismo engine delivering 168 hp and 126 Nm torque, catering to diverse rider preferences. Companies such as Honda Motor Co. Ltd., Suzuki Motor Corporation and Yamaha Motor Co., Ltd. are some of the key innovators in Market.Market Growth Factors

Rental and tour services provide individuals who do not own sports vehicles with access to these recreational vehicles. Additionally, rental services allow prospective buyers to experience different types of sports vehicles before purchasing. Therefore, expansion of rental and tour services is propelling the market’s growth.As tourism grows, there is a higher demand for recreational activities and attractions. Tourists often seek thrilling and memorable experiences, leading to increased interest in sports activities such as off-roading, jet skiing, ATV tours, and motorcycle adventures. Furthermore, tourism exposes visitors to new experiences and products, including sports vehicles and equipment. Hence, the expansion of the tourism industry is propelling the growth of the market.

Market Restraining Factors

Sports vehicles, such as ATVs, UTVs, snowmobiles, and personal watercraft, often have a substantial upfront cost. In addition to the initial buying price, having a sports vehicle entails additional expenses for maintenance, insurance, taxes, and registration. In conclusion, the high cost of ownership is hampering the market’s growth.By Application Analysis

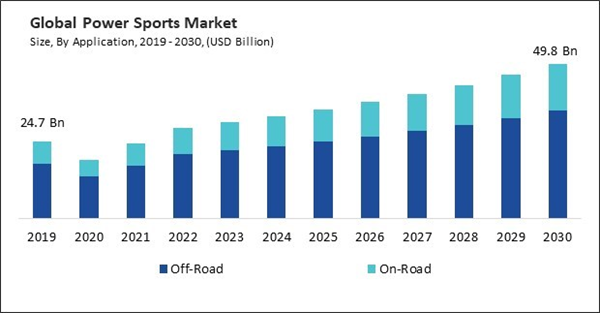

By application, the market is divided into on-road and off-road. The on-road segment procured a 28% revenue share in the market in 2022. With increasing urbanization and city congestion, there’s a growing demand for compact and agile vehicles that can navigate traffic efficiently. On-road sports vehicles such as motorcycles, scooters, and electric bicycles provide convenient and cost-effective transportation solutions for urban commuters. Additionally, the on-road segment offers a wide variety of customization choices.By Propulsion Analysis

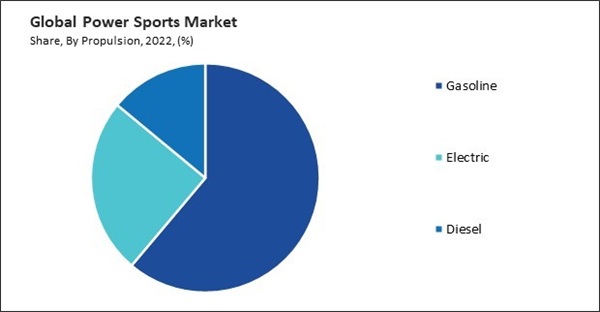

On the basis of propulsion, the market is segmented into gasoline, diesel, and electric. In 2022, the electric segment attained a 24% revenue share in the market. Customers who prefer a quieter and more serene riding experience may find that electric vehicles function far more silently than their gasoline-powered counterparts, particularly in recreational contexts like off-roading or residential neighborhoods.By Vehicle Type Analysis

Based on vehicle type, the market is divided into all-terrain vehicles, side by side vehicles, personal watercrafts, heavy weight motorcycles, and others. The heavy weight motorcycles segment attained a 20% revenue share in the market in 2022. Heavyweight motorcycles, often called cruisers, touring bikes, or luxury bikes, are associated with prestige, status, and lifestyle. These motorcycles typically feature powerful engines, premium finishes, and luxury amenities, appealing to riders seeking comfort, style, and performance.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed a 40% revenue share in the market in 2022. North America has a strong cultural affinity for recreational activities involving motorized vehicles. The region has a rich history of automotive and motorcycle culture, with iconic events like the Daytona bike week and Sturgis motorcycle rally drawing enthusiasts from across the continent. This cultural influence contributes to the demand for these sports in North America.Market Competition and Attributes

The market is fiercely competitive, with major players like Polaris, Yamaha, Honda, Kawasaki, and BRP vying for market share. Innovation, including electric/hybrid powertrains and advanced features, drives competition. Diversified product lines cater to various customer segments. Marketing, branding, and global expansion strategies play crucial roles. Adherence to regulations and environmental standards is essential. This dynamic landscape fosters continuous evolution and competition, ensuring a vibrant and responsive industry focused on delivering cutting-edge products and experiences to consumers worldwide.

Recent Strategies Deployed in the Market

- Dec-2023; India Yamaha Motor, a subsidiary of Yamaha Motor Co., Ltd., introduced the R3 sports motorcycle. The bike comes Equipped with a 321cc liquid-cooled, two-cylinder, 4-stroke engine with fuel injection, multi-function LCD instrument cluster, and LED headlights.

- Nov-2023; Suzuki Motor Corporation unveiled GSX-8R sports motorcylce. Based on the highly acclaimed GSX-8S, the GSX-8R features a fairing and separate handlebar tailored for sport riding, while showcasing Suzuki's sport bike heritage through its modern and innovative design. Powered by a 776cm3 parallel 2-cylinder engine and complemented by a frame and suspension optimized for performance, the GSX-8R excels in everyday commuting, sport riding, and touring alike.

- Nov-2023: Kawasaki unveiled two middleweight motorcycles, the Ninja 500 and Z500, at EICMA 2023. Both feature a 451cc parallel-twin engine generating 45.4 hp and 42.6 Nm torque.

- Oct-2022; BRP Inc. took over all assets associated with the powersports business of Kongsberg Inc. located in Shawinigan, Quebec, known as "KA Shawinigan," a subsidiary of Kongsberg Automotive ASA. KA Shawinigan is recognized for its expertise in the development and manufacturing of electronic and mechatronic products. This strategic acquisition aligns with BRP's product strategy, particularly concerning its electrification plan, and is anticipated to enhance the company's proficiency in mechatronics while strengthening its innovation capabilities.

- 2020-Sep: Polaris Inc entered a partnership with Zero Motorcycles, an electric motorcycle technology provider. This partnership aimed to accelerate Polaris' position in powersports electrification.

List of Key Companies Profiled

- Yamaha Motor Co., Ltd.

- Zhejiang CFMoto Power Co., Ltd.

- Bombardier Recreational Products (BRP) Inc.

- Kawasaki Heavy Industries, Ltd.

- Textron, Inc.

- Polaris, Inc.

- Suzuki Motor Corporation

- Honda Motor Co. Ltd.

- KTM AG (PIERER Mobility AG)

- Volkswagen AG

Market Report Segmentation

By Application- Off-Road

- On-Road

- Gasoline

- Electric

- Diesel

- All-terrain Vehicles

- Side By Side Vehicles

- Personal Watercrafts

- Heavy Weight Motorcycles

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Yamaha Motor Co., Ltd.

- Zhejiang CFMoto Power Co., Ltd.

- Bombardier Recreational Products (BRP) Inc.

- Kawasaki Heavy Industries, Ltd.

- Textron, Inc.

- Polaris, Inc.

- Suzuki Motor Corporation

- Honda Motor Co. Ltd.

- KTM AG (PIERER Mobility AG)

- Volkswagen AG