Shortening's high smoke point and stability at elevated temperatures make it a preferred choice for frying and deep-frying applications in the foodservice industry. This is particularly relevant in establishments offering fried snacks, appetizers, and main courses, where the texture and flavor imparted by shortening contribute to the overall dining experience. Consequently, the snacks & savory products segment would generate approximately 18.48 % share of the market by 2030. Also, France would utilize 8,481.41 Tonnes of shortening in bakery products by 2030. Chefs can experiment with diverse recipes, creating unique and signature dishes that set their establishments apart in a competitive market.

The general awareness surrounding the impact of diet on overall health has seen a significant uptick. The possible health hazards connected to specific fats, especially trans fats, are better known to consumers. Healthy substitutes are becoming more popular in the baking and cooking industries because of this increased awareness. Thus, because of the growing trend towards healthier alternatives, the market is anticipated to increase significantly.

Additionally, the expansion of retail in physical stores and online platforms provides shortening manufacturers with increased access to diverse consumer bases. With products on supermarket shelves and e-commerce platforms, shortening becomes more accessible to a wider audience, reaching consumers in urban, suburban, and rural areas. Hence, expansion of retail and e-commerce platforms has been a pivotal factor in driving the growth of the market.

However, fluctuating raw material prices can result in increased production costs for shortening manufacturers. Manufacturers may find it difficult to keep their shortening product costs competitive when fat and oil prices rise. This can, therefore, result in lower profit margins or the need to pass along higher expenses to customers, which may affect sales. Fluctuating raw material prices shortens manufacturers' volatility in the supply chains. Thus, fluctuating raw material prices can slow down the growth of the market.

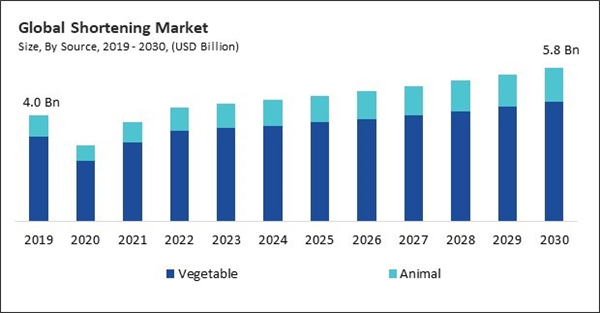

By Source Analysis

By source, the market is bifurcated into vegetables and animal. In 2022, the vegetable segment held 79.36% revenue share in the market. Vegetable shortening is often chosen by consumers seeking alternatives to traditional shortening made from animal fats. It is perceived as a healthier option, particularly when reducing saturated fats and avoiding trans fats, which can contribute to heart health concerns. Vegetable shortening is widely used in baking applications, including preparing cookies, cakes, pies, and pastries.By Application Analysis

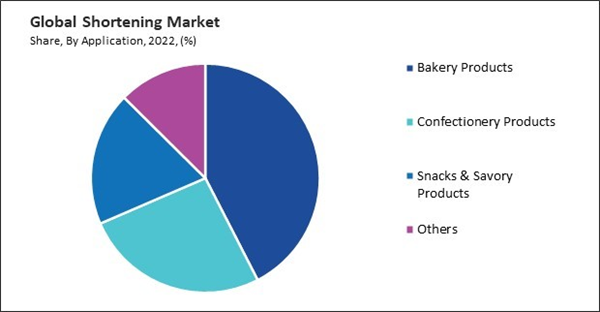

Based on application, the market is classified into bakery products, confectionery products, snacks & savory products, and others. The confectionery products segment acquired a 26% revenue share in the market in 2022. Shortening is used to create creamy fillings for chocolates and truffles, enhancing the consistency and mouthfeel of these confectionery items. It contributes to the smoothness of the filling, making it more palatable. Shortening is used in the production of cake batters, contributing to the tenderness and fluffiness of cakes.By Sales Channel Analysis

On the basis of sales channel, the market is divided into direct sales and indirect sales. In 2022, the indirect sales segment dominated the market with 68% revenue share. In terms of volume, indirect sales segment sell 1,88,351.49 tonnes of paraformaldehyde in 2022. Indirect sales channels offer convenience for consumers by providing a one-stop shopping experience. Shortening products are readily available alongside other baking and cooking essentials, making it easier for consumers to purchase them during routine shopping trips. Shortening products gain visibility through shelf space in supermarkets and retail stores.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a 28% revenue share in the market. The Asia Pacific region is characterized by rapidly growing population and ongoing urbanization. For example, according to the report titled Cities as Engines of Growth, published in 2022 by the Government of India, the population of urban areas in India is projected to have increased approximately fourfold, from 109 million in 1970 to 460 million in 2018.List of Key Companies Profiled

- Cargill, Incorporated

- Wilmar International Limited

- Bunge Limited

- Associated British Foods PLC (Wittington Investments Limited)

- The J.M Smucker Company

- Premium Vegetable Oils Sdn Bhd

- Ventura Foods, LLC

- Namchow Holdings Co., Ltd.

- Fuji Oil Co., Ltd. (Fuji Oil Holdings Inc.)

- AAK AB

Market Report Segmentation

By Source (Volume, Tonnes, USD Billion, 2019-2030)- Vegetable

- Animal

- Bakery Products

- Confectionery Products

- Snacks & Savory Products

- Others

- Indirect Sales

- Direct Sales

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Cargill, Incorporated

- Wilmar International Limited

- Bunge Limited

- Associated British Foods PLC (Wittington Investments Limited)

- The J.M Smucker Company

- Premium Vegetable Oils Sdn Bhd

- Ventura Foods, LLC

- Namchow Holdings Co., Ltd.

- Fuji Oil Co., Ltd. (Fuji Oil Holdings Inc.)

- AAK AB