Urbanization in China is accompanied by shifts in dietary patterns towards more processed, convenience-oriented foods. Urban consumers in China are more likely to prioritize health-conscious choices, including products fortified with prebiotics ingredients, to maintain digestive wellness and overall well-being. Consequently, the Asia Pacific region would generate a revenue of USD 3,290.8 million in 2023. The expanding middle class in nations such as China, India, and Indonesia have increased disposable incomes and spending on wellness and health products.

Clean label products containing simple, recognizable ingredients are gaining popularity among consumers seeking healthier, more transparent food options. Prebiotic ingredients derived from natural, minimally processed sources align with clean label trends and can appeal to consumers looking for products with fewer artificial additives and preservatives. Therefore, the market is expanding significantly due to the rising focus on sustainability and clean labels.

Additionally, E-commerce offers consumers convenient access to a wide range of prebiotic ingredients and products, allowing them to browse, compare, and purchase items from the comfort of their homes. DTC channels provide direct access to manufacturers, simplifying the purchasing process and eliminating the need for intermediaries. Thus, because of the e-commerce and direct-to-consumer channels, the market is anticipated to increase significantly.

However, Higher costs associated with prebiotics ingredients can make products containing these ingredients less accessible to a broader consumer base, particularly in regions with lower income levels. This limits market penetration and may exclude certain demographics from benefiting from prebiotics. Thus, high-cost considerations can slow down the growth of the market.

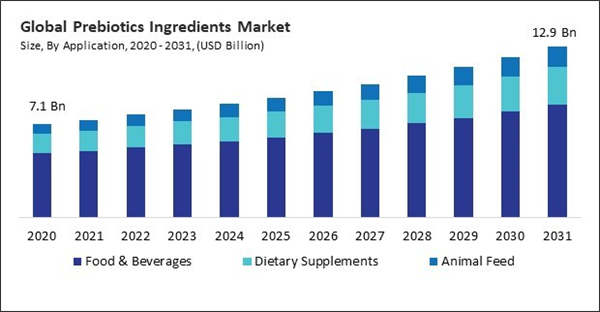

By Application Analysis

By application, the market is bifurcated into food & beverages, dietary supplements, and animal feed. In 2023, the food & beverages segment witnessed the 67.58 % revenue share in the market. Prebiotic ingredients formulate snack foods such as granola bars, energy bars, crackers, and popcorn to add fiber and prebiotic benefits. These ingredients encourage the growth of beneficial bacteria and help strengthen the immune system in early life stages.By Ingredient Analysis

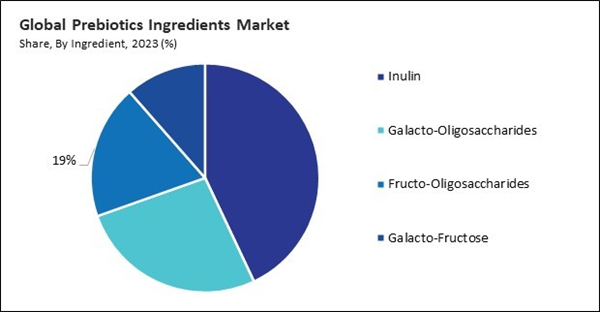

On the basis of ingredients, the market is segmented into inulin, fructo-oligosaccharides, galacto-oligosaccharides, and galacto-fructose. The fructo-oligosaccharides segment covered a 18.9 % revenue share in the market in 2023. Fructo-oligosaccharides can enhance the absorption of certain nutrients, such as calcium and magnesium, by increasing the surface area of the intestinal lining and promoting mineral solubility. FOS can assist individuals with diabetes or metabolic syndrome in regulating blood glucose levels, reduce insulin resistance, and improve glycemic control by stimulating the development of beneficial gut bacteria and modulating gut hormone secretion.By Source Analysis

Based on source, the market is categorized into cereals, vegetables, roots, and others. In 2023, the cereals segment dominated the market with 38.08 % revenue share. Consumers widely favor breakfast cereals because of their practicality and ease of preparation. The widespread use and demand will aid in the growth of the segment. Manufacturers can offer consumers a convenient and nutritious breakfast option that supports digestive health by incorporating prebiotic ingredients into cereal products. The cereals segment is highly competitive, driving innovation and product differentiation among manufacturers.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region acquired a 29.2% revenue share in the market. North American consumers are becoming increasingly health-conscious, seeking foods and ingredients offering health benefits beyond basic nutrition. Food and beverage manufacturers in North America are innovating with prebiotic ingredients to develop new product formulations that appeal to consumer preferences for taste, texture, and convenience.Recent Strategies Deployed in the Market

- 2023-May: Beneo GmbH has introduced a novel product named Benco-scL85, which is a short-chain fructooligosaccharide (scFOS). Derived from beet sugar, scFOS provides a gentle sweetness, excellent solubility, and natural attributes, enhancing taste and texture in various applications like bakery, dairy, and cereals. This new variant provides customers with enhanced flexibility for sugar substitution and fortification of foods with dietary fiber.

- 2023-Apr: Royal FrieslandCampina N.V. introduces a novel offering named Biotis Fermentis, an innovative high-protein solution that promotes gut health. This solution blends whey protein, prebiotic galactooligosaccharides, and probiotic cultures, fermenting them together to craft a distinctive formulation supporting athletic performance and overall well-being.

- 2022-Dec: Jarrow Formulas has introduced a new product called Immune Booster, designed to promote a healthy immune system, and support normal digestion. This innovative product contains PreforPro®, a highly regarded prebiotic that aids in balancing the gut microbiota by creating an environment conducive to the growth of beneficial probiotic bacteria. Immune Booster also includes bacteriophages to further support gut health. Additionally, Immune Booster features DE111®, a clinically proven ingredient known for its immune-supporting properties as a spore-forming probiotic strain.

- 2022-Jan: Jarrow Formulas introduces Probiotic+ Gummies, a new line comprising three premium probiotic gummy products. Probiotic+ Immune Gummies promote digestive and immune health with two clinically studied probiotic strains and essential vitamins. Probiotic Duo Gummies support digestive and immune health with 3 billion live cells. Probiotic+ Prebiotic Gummies aid digestion, immune support, and gut balance with probiotics and prebiotics.

- 2021-Sep: Royal FrieslandCampina N.V. entered into a partnership with Lallemand Inc., a renowned researcher, developer, and producer of probiotic yeast and bacteria. Through this partnership, both entities aim to introduce two novel gut health products, namely PRO-Digest Health Shot and PRO-Digest Bowel Support. The PRO-Digest Health Shot blends Biotis GOS with 5 billion CFU per serving of Lallemand Health Solutions’ B. lactis LAFTI B94. On the other hand, PRO-Digest Bowel Support is specifically formulated to alleviate digestive discomfort and enhance day-to-day symptoms for individuals with digestive issues, featuring 10 billion CFU of L. paracasei HA-196.

List of Key Companies Profiled

- Beneo GmbH (Sudzuker AG)

- Cargill, Incorporated

- Roquette Freres SA

- Royal FrieslandCampina N.V.

- Ingredion Incorporated

- Jarrow Formulas, Inc.

- Nexira, Inc.

- COSUCRA Groupe Warcoing S.A.

- Cooperatie Koninklijke Cosun U.A. (Royal Cosun)

- Yakult Honsha Co., Ltd.

Market Report Segmentation

By Application- Food & Beverages

- Dietary Supplements

- Animal Feed

- Inulin

- Galacto-Oligosaccharides

- Fructo-Oligosaccharides

- Galacto-Fructose

- Cereals

- Vegetables

- Roots

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Beneo GmbH (Sudzuker AG)

- Cargill, Incorporated

- Roquette Freres SA

- Royal FrieslandCampina N.V.

- Ingredion Incorporated

- Jarrow Formulas, Inc.

- Nexira, Inc.

- COSUCRA Groupe Warcoing S.A.

- Cooperatie Koninklijke Cosun U.A. (Royal Cosun)

- Yakult Honsha Co., Ltd.