AC electric motors can be seamlessly integrated into automated manufacturing processes and robotics. Thus, the industrial machinery segment acquired $7,931.8 million revenue in 2022. Automation systems can control and monitor these motors remotely, allowing for greater flexibility, precision, and consistency in industrial operations.

Industries are pressured to lower their energy use and carbon footprint due to rising public awareness of environmental issues, including carbon emissions and climate change. Energy-efficient AC electric motors offer a solution by minimizing power wastage during operation, helping industries meet sustainability targets and comply with environmental regulations. Hence, the rising demand for energy-efficient motors propels the market’s growth.

Additionally, Electric vehicles rely on electric motors as their primary power source for propulsion, replacing traditional internal combustion engines. AC electric motors, including induction motors and permanent magnet synchronous motors (PMSMs), are widely used in EVs due to their efficiency, torque characteristics, and controllability. Thus, the growing adoption of electric vehicles globally drives the market’s growth.

However, AC electric motors, especially those with advanced features such as high-efficiency ratings or specialized applications, often incur a higher upfront cost than standard motors. The initial investment required to purchase these motors can be substantial, particularly for businesses operating on tight budgets or in cost-sensitive industries. In conclusion, high initial investment cost of AC electric motors is hampering the growth of the market.

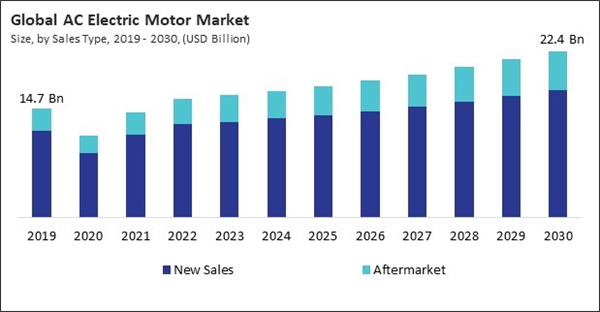

By Sales Type Analysis

By sales type, the market is divided into new sales and aftermarket. In 2022, the new sales segment registered 79% revenue share in the market. Manufacturers continually innovate and develop new AC electric motors with enhanced efficiency, performance, and features.By Output Power Analysis

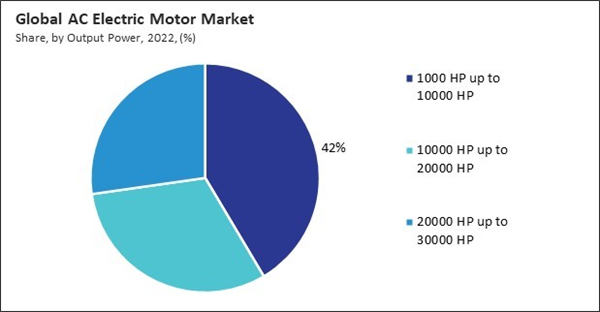

Based on output power, the market is divided into 1000 HP up to 10000 HP, 10000 HP up to 20000 HP, and 20000 HP up to 30000 HP. The 10000 HP up to 20000 segments attained a significant 31.2% revenue share in the market.By End Use Analysis

On the basis of end-use industry, the market is segmented into transportation, HVAC, industrial machinery, and others. The industrial machinery segment recorded the largest 50% revenue share in the market in 2022. Industrial machinery encompasses various applications across various industries, including manufacturing, construction, mining, agriculture, and transportation.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed a maximum 39% revenue share in the market in 2022.Recent Strategies Deployed in the Market

- Jan-2024: WEG Equipamentos Eletricos SA introduced W23 Sync+, a hybrid motor that merges synchronous reluctance and permanent magnet. With the launch of W23 Sync+, WEG would offer great ability beyond all speed, in addition to this W23 Sync+ would also prolong its high efficiency below 2%.

- Sep-2023: WEG Equipamentos Eletricos SA acquired Regal Rexnord Corporation's generator and industrial electric trade, a worldwide producer of electromechanical articles. Through this acquisition, WEG would expand its business internationally and diversify its industrial operations.

- Jun-2023: ABB Ltd. introduced AMI 5800 NEMA, an adjustable motor to bring classic efficiency reliability pumps, compressors, fans, etc. Additionally, The AMI 5800 would also offer great modularity and modifications to include both improved and newly built projects in numerous industries.

- May-2023: WEG Equipamentos Eletricos SA formed a partnership with GM, a global automotive corporation. Under this partnership, WEG would offer personalized services and AC recharging stations. Moreover, WEG would provide technology for the installation of attainable recharging stations in parking lots and garages.

- Apr-2023: WEG Equipamentos Eletricos SA entered into a partnership with GWM, a Chinese manufacturer of automobiles. Under this partnership, WEG would introduce electrification into the Brazilian markets. Moreover, the company would deliver WEG wall chargers to its customers with 7.4 kW of power, alternating current (AC).

List of Key Companies Profiled

- WEG Equipamentos Eletricos SA

- Toshiba Corporation

- General Electric Company

- Hitachi, Ltd.

- ABB Ltd.

- Nidec Corporation

- Siemens AG

- Kirloskar Electric Co. Ltd.

- Schneider Electric SE

- Emerson Electric Co.

Market Report Segmentation

By Sales Type- New Sales

- Aftermarket

- 1,000 HP up to 10,000 HP

- 10,000 HP up to 20,000 HP

- 20,000 HP up to 30,000 HP

- Industrial Machinery

- HVAC

- Transportation

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- WEG Equipamentos Eletricos SA

- Toshiba Corporation

- General Electric Company

- Hitachi, Ltd.

- ABB Ltd.

- Nidec Corporation

- Siemens AG

- Kirloskar Electric Co. Ltd.

- Schneider Electric SE

- Emerson Electric Co.