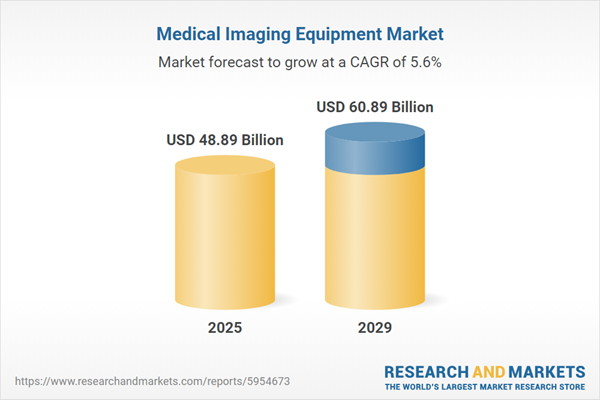

The medical imaging equipment market size has grown strongly in recent years. It will grow from $45.75 billion in 2024 to $48.89 billion in 2025 at a compound annual growth rate (CAGR) of 6.9%. The growth in the historic period can be attributed to rising aging population, increasing disease burden, government initiatives, rising awareness, integration of AI.

The medical imaging equipment market size is expected to see strong growth in the next few years. It will grow to $60.89 billion in 2029 at a compound annual growth rate (CAGR) of 5.6%. The growth in the forecast period can be attributed to increasing personalized medicine, increasing remote patient monitoring, increasing emerging markets growth, value-based healthcare, increasing precision medicine. Major trends in the forecast period include digital health integration, innovative imaging modalities, technological advancements, telemedicine integration, portable and point-of-care imaging.

The anticipated surge in the prevalence of chronic diseases is poised to drive the expansion of the medical imaging equipment market. Chronic diseases, characterized by prolonged and gradual progression, are influenced by shifting lifestyles, genetic predispositions, and aging demographics. Medical imaging equipment plays a pivotal role in supporting patients with chronic conditions, enabling early detection, precise diagnosis, personalized treatment planning, and continuous monitoring of disease progression and treatment efficacy. In September 2022, the World Health Organization reported a staggering 41 million deaths annually, with 74% attributed to non-communicable diseases (NCDs) or chronic diseases. Major contributors include 17.9 million deaths from cardiovascular diseases, 9.3 million deaths from cancer, 4.1 million deaths from chronic respiratory diseases, and 2 million deaths from diabetes. This data underscores the pressing need for advanced medical imaging solutions.

Key players in the medical imaging equipment market are strategically focusing on the development of cutting-edge products, exemplified by Exo's latest innovation, the Exo Iris. Equipped with real-time artificial intelligence (AI) technology, such as SweepAI, this device automates image capture, reducing dependence on operator expertise for consistent and precise imaging. Launched in September 2023, Exo Iris is designed to be affordable, compact, and user-friendly, catering to various healthcare providers in emergency, acute care, outpatient, and at-home settings. Notable features include an ultra-wide field of view for imaging up to 150 degrees, allowing caregivers to capture comprehensive organ or full-body images in a single view. The device is complemented by Exo Works, a point-of-care ultrasound workflow solution, enabling seamless documentation and exam review in seconds from any location.

In July 2023, Radon Medical Imaging LLC acquired Tristate Biomedical Solutions LLC. This undisclosed acquisition positions Radon to enhance its medical imaging equipment maintenance and repair services, fortify its business operations, and extend its geographic footprint. Tristate Biomedical Solutions LLC, a reputable U.S.-based medical equipment company, specializes in offering biomedical and imaging equipment solutions.

Major companies operating in the medical imaging equipment market are Medtronic plc., Siemens Healthineers, Fujifilm Medical Systems, Philips Healthcare, Stryker Corporation, GE Healthcare, Analogic Corporation, EIZO Corporation, Terumo Corporation, Mindray Medical International Limited, Hologic Inc., Shimadzu Corporation, PerkinElmer Inc., Carestream Health, Barco NV, Varian Medical Systems Inc., Esaote S.p.A., Samsung Medison Co. Ltd., Canon Medical Systems Corporation, Hitachi Healthcare Ltd., Planmed Oyj, Misonix Inc., Nano X Imaging Ltd., InnoScan Inc.

Asia-Pacific was the largest region in the medical imaging equipment market in 2024. The regions covered in the medical imaging equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical imaging equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, the USA, Canada, Italy, and Spain.

The medical imaging equipment market consists of sales of positron emission tomography (PET) scanners, fluoroscopy machines, digital radiography systems, angiography machines, ophthalmic imaging equipment, and nuclear medicine cameras. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Medical imaging equipment encompasses a wide range of devices and technologies utilized in the medical field to visualize the internal structures and functions of the body. This category of equipment plays a crucial role in enhancing patient care by facilitating accurate diagnosis, personalized treatment planning, and effective monitoring of health conditions.

Key medical imaging equipment comprises computed tomography (CT), x-ray systems, magnetic resonance imaging (MRI) systems, ultrasound systems, nuclear imaging equipment, mammography equipment, contrast media injectors, c-arms, and fluoroscopy devices. Computed tomography (CT) utilizes X-rays to generate detailed cross-sectional images of the body and encompasses diverse modalities, including stand-alone, portable, and hand-held devices. These technologies find application in various medical fields such as cardiology, neurology, orthopedics, gynecology, and oncology. Target end-users encompass diagnostic imaging centers, ambulatory surgical centers, specialty clinics, and research institutes.

The medical imaging equipment market research report is one of a series of new reports that provides medical imaging equipment market statistics, including medical imaging equipment industry global market size, regional shares, competitors with a medical imaging equipment market share, detailed medical imaging equipment market segments, market trends and opportunities, and any further data you may need to thrive in the medical imaging equipment industry. This medical imaging equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Imaging Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical imaging equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical imaging equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical imaging equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Equipment: Computed Tomography; X-Ray Systems; Magnetic Resonance Imaging (MRI) Systems; Ultrasound Systems; Nuclear Imaging Equipment; Mammography Equipment; Contrast Media Injectors; C-Arms And Fluoroscopy Device2) By Modality: Stand-Alone Devices; Portable Devices; Hand-Held Devices

3) By Application: Cardiology; Neurology; Orthopedics; Gynecology; Oncology; Other Applications

4) By End-User: Diagnostic Imaging Centers; Ambulatory Surgical Centers; Specialty Clinics; Research Institutes

Subsegments:

1) By Computed Tomography (CT) Systems: Stationary CT Scanners; Portable Or Handheld CT Scanners2) By X-Ray Systems: Analog X-Ray Systems; Digital X-Ray Systems; Fluoroscopy X-Ray Systems

3) By Magnetic Resonance Imaging (MRI) Systems: Closed MRI Systems; Open MRI Systems; Extremity MRI Systems

4) By Ultrasound Systems: Diagnostic Ultrasound Systems; Therapeutic Ultrasound Systems; Portable Ultrasound Systems

5) By Nuclear Imaging Equipment: Single Photon Emission Computed Tomography (SPECT); Positron Emission Tomography (PET) Scanners; Hybrid PET Or CT Scanners

6) By Mammography Equipment: Analog Mammography Systems; Digital Mammography Systems; 3D Tomosynthesis Mammography Systems

7) By Contrast Media Injectors: CT Contrast Media Injectors; MRI Contrast Media Injectors; PET Or CT Contrast Media Injectors

8) By C-Arms And Fluoroscopy Devices: Mobile C-Arms; Mini C-Arms; Fixed C-Arms; Fluoroscopy Systems

Key Companies Mentioned: Medtronic plc.; Siemens Healthineers; Fujifilm Medical Systems; Philips Healthcare; Stryker Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Medical Imaging Equipment market report include:- Medtronic plc.

- Siemens Healthineers

- Fujifilm Medical Systems

- Philips Healthcare

- Stryker Corporation

- GE Healthcare

- Analogic Corporation

- EIZO Corporation

- Terumo Corporation

- Mindray Medical International Limited

- Hologic Inc.

- Shimadzu Corporation

- PerkinElmer Inc.

- Carestream Health

- Barco NV

- Varian Medical Systems Inc.

- Esaote S.p.A.

- Samsung Medison Co. Ltd.

- Canon Medical Systems Corporation

- Hitachi Healthcare Ltd.

- Planmed Oyj

- Misonix Inc.

- Nano X Imaging Ltd.

- InnoScan Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 48.89 Billion |

| Forecasted Market Value ( USD | $ 60.89 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |