Global Electrophoresis Equipment Market Overview

Electrophoresis equipment facilitates the migration of molecules toward oppositely charged electrodes. Gel electrophoresis is widely used in laboratories to separate DNA, RNA, or protein molecules on the basis of their size or electric charge. The increased application of this laboratory method in genomic and proteomic research activities is significantly driving the electrophoresis equipment market demand.The rise in the launch of innovative products by the leading pharmaceutical companies is poised to boost market growth. In February 2024, Invitrogen, a brand operated by Thermo Fisher Scientific, revealed its fully integrated E-Gel™ Power Snap Plus Electrophoresis System. With the capability to run, visualize, and image DNA samples in a single platform, this device can handle 96 samples per run. The electrophoresis system offers high-resolution images and a user-friendly interface with preset protocols, real-time visualization, and easy analysis of routine DNA examinations, among others. The development of such integrated platforms will enhance efficiency in research and biotechnology applications. Consequently, this will propel the electrophoresis equipment market growth.

The market is further driven by the increasing research funding and rising investment by the biotechnology and pharmaceutical companies to address the growing demand for technologically advanced electrophoresis equipment. In addition, the increased focus on personalized therapeutics is poised to influence the market size of electrophoresis equipment positively.

Global Electrophoresis Equipment Market Segmentation

Electrophoresis Equipment Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Products

- Electrophoresis Reagents

- Electrophoresis Systems

- Gel Documentation Systems

- Electrophoresis Software

Market Breakup by Application

- Diagnostic Application

- Research Application

- Quality Control & Process Validation

Market Breakup by End User

- Hospital & Diagnostic Centers

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Electrophoresis Equipment Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Thermo Fisher Scientific

- Bio-RAD Laboratories

- Merck Group

- Agilent Technologies

- Danaher Corporation

- QIAGEN

- Harvard Apparatus

- Lonza Group Ltd.

- Perkin Elmer

- Shimadzu Corporation

- Biocompare

- Thistle Scientific

Key Queries Solved in the Global Electrophoresis Equipment Market Report

- How will the market landscape evolve in the coming years?

- What are the major market trends influencing the market?

- What are the major drivers, opportunities, and restraints in the market?

- What will be the effect of each driver, challenge, and opportunity on the market?

- Which country is poised to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- What type of products are available in the market?

- What are the latest product launches in the market?

- What type of technologies are being applied to the novel products?

- What type of electrophoresis systems are expected to dominate the respective market segment?

- What application areas are expected to significantly impact the growth of the market?

- Who are the key players of the market?

- What are the key research initiatives expected to boost the electrophoresis equipment market value during the forecast period?

- What are the most impactful partnerships, collaborations, and mergers & acquisitions shaping the market dynamics of the electrophoresis equipment?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific

- Bio-RAD Laboratories

- Merck Group

- Agilent Technologies

- Danaher Corporation

- QIAGEN

- Harvard Apparatus

- Lonza Group Ltd.

- Perkin Elmer

- Shimadzu Corporation

- Biocompare

- Thistle Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

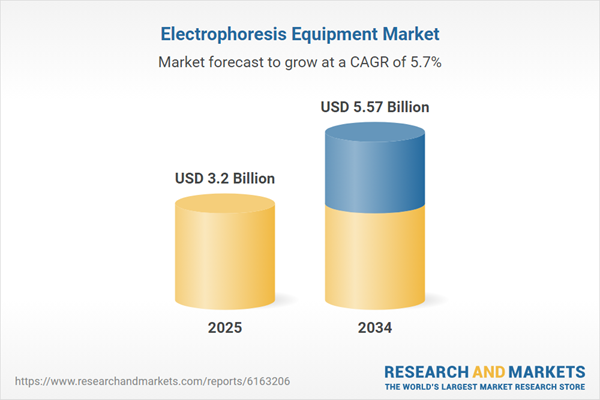

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 5.57 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |