Pet Safety is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The intensified trend of pet humanization significantly propels the Global Pet Tech Market. Owners increasingly view their animal companions as integral family members, fostering a willingness to invest substantially in their well-being and quality of life. This paradigm shift generates demand for technologically advanced solutions catering to pet health, safety, and entertainment, mirroring human-centric care. Pet tech products like smart feeders, interactive cameras, and advanced health monitors directly benefit from this sentiment.Key Market Challenges

The growing concern over data privacy and security vulnerabilities represents a significant challenge to the expansion of the Global Pet Tech Market. As interconnected pet devices gather and transmit sensitive personal and household data, the potential for security breaches or misuse of information generates substantial apprehension among consumers. This directly impacts market growth by eroding trust and increasing the reluctance of pet owners to adopt advanced technological solutions for their companions.Key Market Trends

The Global Pet Tech Market is significantly influenced by the development of integrated smart home pet care ecosystems. This trend involves the seamless connection of various pet devices, such as automated feeders, environmental controls, and monitoring cameras, within a unified smart home platform. This integration offers pet owners enhanced convenience and a holistic view of their pets' routines and well-being through a centralized system. According to CEDIA, the association for smart home professionals, in May 2024, the smart home industry was predicted to grow by 30% on average across categories, nearing $30 billion, reflecting a broader consumer demand for integrated household solutions that extend to pet care.Key Market Players Profiled:

- GoPro, Inc.

- FitBark Inc.

- Garmin Inc.

- Pawp, Inc.

- Dogtra Co.

- Chewy, Inc.

- Mars, Inc.

- Motorola Solutions Inc.

- CleverPet, Inc.

- Tractive GmbH

Report Scope:

In this report, the Global Pet Tech Market has been segmented into the following categories:By Type:

- RFID

- GPS

- Sensors

- Others

By Product:

- Monitoring Equipment

- Tracking Equipment

- Feeding Equipment

- Pet Wearables

- Others

By Application:

- Pet Safety

- Pet Healthcare

- Pet Owner Convenience

- Communication & Entertainment

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pet Tech Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GoPro, Inc.

- FitBark Inc.

- Garmin Inc.

- Pawp, Inc.

- Dogtra Co.

- Chewy, Inc.

- Mars, Inc.

- Motorola Solutions Inc.

- CleverPet, Inc.

- Tractive GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

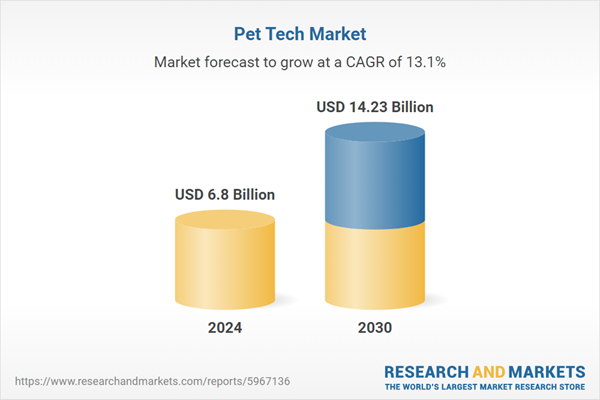

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.8 Billion |

| Forecasted Market Value ( USD | $ 14.23 Billion |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |