Sandwich ELISA is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Overview

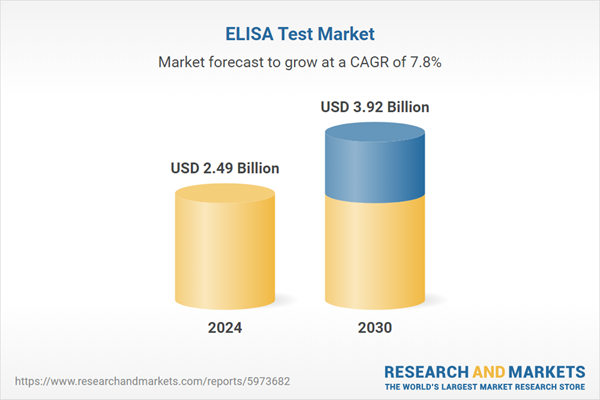

The Global ELISA Test Market, valued at USD 2.49 Billion in 2024, is projected to experience a CAGR of 7.84% to reach USD 3.92 Billion by 2030. The Enzyme-Linked Immunosorbent Assay (ELISA) is a biochemical technique primarily employed for detecting and quantifying soluble substances such as peptides, proteins, antibodies, and hormones in biological samples. The global ELISA test market's expansion is significantly driven by the escalating prevalence of infectious and chronic diseases, including conditions like HIV and various cancers, which necessitate accurate and timely diagnostic tools. Furthermore, continuous advancements in diagnostic technology, enhancing the sensitivity, specificity, and automation of ELISA assays, contribute substantially to market growth.Key Market Drivers

The global ELISA Test Market is significantly shaped by the escalating prevalence of infectious and chronic diseases, driving a persistent need for accurate and timely diagnostic solutions. The burden of such conditions necessitates widespread testing, with ELISA assays playing a crucial role in disease surveillance and management. For instance, according to the World Health Organization, as of 30 April 2024, over 7.6 million dengue cases were reported globally in 2024, demonstrating the continuous demand for effective diagnostic tools to monitor and control infectious disease outbreaks. This growing disease landscape directly increases the volume of diagnostic procedures required, thereby expanding the market for ELISA tests globally.Key Market Challenges

High initial investment costs for advanced ELISA equipment and reagents represent a significant challenging factor in the global ELISA test market. The substantial capital expenditure required for acquiring and maintaining sophisticated ELISA systems can limit the adoption of these diagnostic tools, particularly in healthcare settings with restricted budgets.This directly impedes market growth by creating a barrier to entry for smaller laboratories and those in developing regions. For instance, according to a 2024 Lab Manager Industry and Equipment Trends Survey, 55 percent of respondents cited investment in tools, equipment, and instruments as a top challenge, with 64 percent noting difficulty in securing budget approval for new technology. These financial constraints often force laboratories to extend the lifespan of older, less efficient equipment or forgo advanced automation, impacting their capacity for high-throughput testing and the adoption of newer, more sensitive ELISA assays.

Key Market Trends

Miniaturization and Point-of-Care ELISA Platforms are significantly transforming the global ELISA test market by expanding diagnostic accessibility and speeding up result delivery in various settings. This trend facilitates testing closer to patients, moving beyond traditional centralized laboratories and enabling more immediate clinical decisions. The American Association for Clinical Chemistry (AACC) notably underscored the growing importance of decentralized diagnostic solutions by featuring point-of-care as a key topic at its 2023 Annual Scientific Meeting, encompassing a range of cutting-edge diagnostic tests.This strategic shift responds to the demand for rapid, on-site diagnostics that improve patient management, particularly for conditions requiring frequent monitoring or swift intervention. Abbott, a leading diagnostics company, demonstrated advancements in its point-of-care portfolio, with its second-quarter 2024 results highlighting strong demand for rapid diagnostics used for respiratory diseases, often utilizing compact, near-patient platforms. These advancements are critical for the broader adoption of ELISA technologies in diverse healthcare environments.

Key Market Players Profiled:

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux India Private Limited

- Enzo Biochem Inc.

- BioLegend, Inc.

- ELISA Technologies, Inc.

- RayBiotech, Inc.

- Eurofins Scientific (Ireland) Limited

Report Scope:

In this report, the Global ELISA Test Market has been segmented into the following categories:By Method:

- Direct ELISA

- Indirect ELISA

- Sandwich ELISA

- Competitive ELISA

By Application:

- Vaccine Development

- Immunology

- Diagnostics

- Toxicology

- Drug Monitoring and Pharmaceutical Industry

- Transplantation

- Others

By Technology:

- Chemiluminescent

- Colorimetric

- Fluorescent

By End User:

- Hospitals

- Diagnostic Centers

- Research Laboratories

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global ELISA Test Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this ELISA Test market report include:- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux India Private Limited

- Enzo Biochem Inc.

- BioLegend, Inc.

- ELISA Technologies, Inc.

- RayBiotech, Inc.

- Eurofins Scientific (Ireland) Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.49 Billion |

| Forecasted Market Value ( USD | $ 3.92 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |