BFSI is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The proliferation of big data represents a foundational driver for the global advanced analytics market. Organizations are facing an escalating volume, velocity, and variety of data originating from numerous sources, including transactional systems, IoT devices, and digital platforms. This immense data inflow overwhelms traditional analytical methods, creating a clear imperative for more capable processing and insight extraction. According to Rivery, in May 2025, "Big data statistics: How much data is there in the world? ", the global volume of data created, captured, copied, and consumed reached 149 zettabytes in 2024, highlighting the vastness of data available for sophisticated analysis. This continuous expansion directly underpins the increasing demand for advanced analytics solutions that can transform raw data into strategic assets.Key Market Challenges

The persistent concern surrounding data governance, privacy, and security represents a significant challenge to the growth of the Global Advanced Analytics Market. Organizations must meticulously manage expansive and intricate datasets, while simultaneously navigating strict regulatory mandates and upholding ethical data practices. This necessity for robust compliance frameworks often introduces considerable operational complexities and demands substantial resource allocation, thereby reallocating investments that could otherwise propel innovation and expansion within advanced analytics.Key Market Trends

The increased adoption of Explainable AI (XAI) is a pivotal trend in the global advanced analytics market, underscoring transparency and trustworthiness in AI-driven decisions. As AI models grow complex, understanding their conclusions is crucial for compliance, risk mitigation, and user acceptance. This enables organizations to debug systems and build stakeholder confidence. According to Mastercard's 2025 Consumer Cybersecurity Survey, 64% of respondents stated that explainable AI features increase trust. Microsoft's Responsible AI Transparency Report outlined how automated dashboards monitoring AI model lifecycles contributed to a 40% reduction in incident detection and investigation time, facilitating greater adoption of AI-powered analytics by addressing algorithmic opacity.Key Market Players Profiled:

- Altair Engineering, Inc.

- Fair Isaac Corporation (FICO)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Knime AG

- Trianz Group

Report Scope:

In this report, the Global Advanced Analytics Market has been segmented into the following categories:By Type:

- Big Data Analytics

- Business Analytics

- Customer Analytics

- Others

By Deployment:

- On-premise

- Cloud

By End-User:

- BFSI

- Government

- IT & Telecom

- Healthcare

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Advanced Analytics Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Altair Engineering, Inc.

- Fair Isaac Corporation (FICO)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Knime AG

- Trianz Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

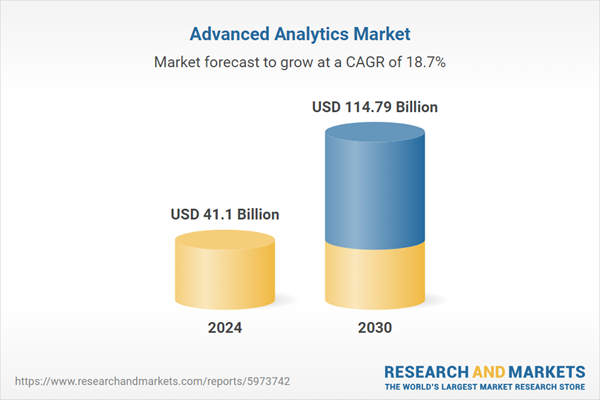

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 41.1 Billion |

| Forecasted Market Value ( USD | $ 114.79 Billion |

| Compound Annual Growth Rate | 18.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |