Global Cancer Biomarkers Market Analysis

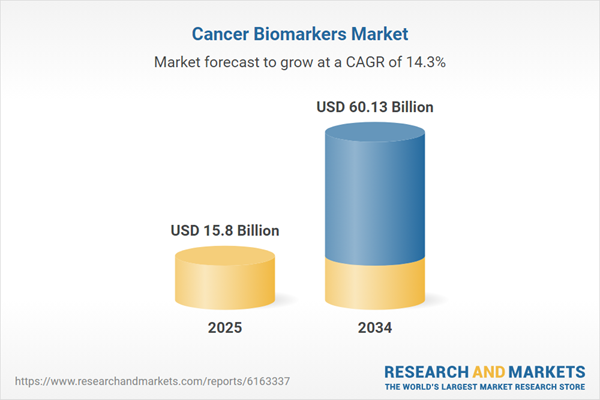

- Market Growth and Size: The cancer biomarkers market is expanding significantly, fuelled by the increasing global burden of cancer and the critical role of biomarkers in early detection, diagnosis, and personalized treatment. The demand for biomarkers in oncology research and clinical applications is rising, reflecting their importance in improving patient outcomes and healthcare efficiency.

- Major Market Drivers: The global cancer biomarkers market growth is propelled by several key drivers. Foremost among these is the rising global incidence of cancer, which necessitates early detection, accurate diagnosis, and effective treatment, thereby increasing the demand for biomarkers in oncology. Technological advancements in genomics, proteomics, and bioinformatics have significantly enhanced the discovery and validation of novel biomarkers, improving the precision and efficiency of cancer diagnoses and prognoses. This era of innovation has paved the way for the development of non-invasive tests, such as liquid biopsies, enabling cancer detection from blood samples and offering a less intrusive option for patients.

- Key Market Trends: The cancer biomarkers market is characterized by several key trends that are shaping its evolution and growth. A significant trend is the increasing preference for non-invasive testing methods, such as liquid biopsies, which allow for the early detection of cancer through simple blood tests, minimizing patient discomfort and risk. This trend reflects a broader shift towards more patient-friendly diagnostic approaches. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in the analysis of biomarker data is revolutionizing the field, enhancing the ability to interpret complex biological information and significantly improving the accuracy and efficiency of cancer diagnoses and treatment plans.

- Geographical Trends: The global cancer biomarkers market share is diverse, with North America leading due to advanced healthcare infrastructure, significant R&D investment, and a strong focus on personalized medicine. Europe follows closely, driven by robust healthcare systems, extensive research initiatives, and early adoption of innovative cancer treatments. The Asia-Pacific region is the fastest-growing, spurred by economic development, increasing healthcare spending, and a rising awareness of cancer's impact.

- Competitive Landscape: The competitive environment in the cancer biomarkers market is marked by intense rivalry among key players, including biotechnology companies, diagnostic laboratories, and pharmaceutical firms. These entities compete on innovation, product development, and strategic partnerships to expand their market presence. The market is characterized by continuous advancements in biomarker research, with companies investing in developing novel biomarkers and diagnostic technologies.

- Challenges and Opportunities: The cancer biomarkers market outlook faces challenges such as the high costs of test development and implementation, regulatory hurdles, and the need for extensive validation, which can restrict market growth and accessibility. However, significant opportunities exist within this landscape. The rising global cancer burden and the shift towards personalized medicine are increasing the demand for biomarkers. Technological advancements in genomics and proteomics, along with the potential integration of AI and machine learning for data analysis, are opening new frontiers for biomarker discovery and application.

Global Cancer Biomarkers Market Trends

Technological Advancements in Detection Methods

There is a notable trend towards the development and adoption of advanced detection and analysis technologies, such as next-generation sequencing (NGS), liquid biopsy, and bioinformatics. These technologies offer higher sensitivity and specificity in detecting cancer biomarkers, even at low concentrations or in early disease stages. The ability to identify biomarkers from non-invasive samples, like blood or urine, is particularly transformative, enabling earlier diagnosis and monitoring of cancer with minimal patient discomfort.Integration of Biomarkers in Personalized Medicine

Personalized or precision medicine is becoming increasingly central to cancer treatment, with biomarkers playing a key role in tailoring therapy to individual patients. As a result, cancer biomarkers market demand is on a surge. Biomarkers are used to predict patient response to specific therapies, allowing for more targeted treatment plans that can improve outcomes and reduce side effects. This trend underscores the shift from a one-size-fits-all approach to a more customized strategy in oncology.Rise in Immuno-Oncology Biomarkers

The success of immunotherapies in treating various cancers has led to a surge in research and development of immuno-oncology biomarkers. These biomarkers help identify patients who are most likely to benefit from immunotherapies and monitor their response to treatment. The exploration of novel immuno-oncology biomarkers is a significant trend, reflecting the growing importance of the immune system in cancer therapy.Expanding Applications of Biomarkers

Beyond diagnosis and therapy selection, cancer biomarkers are increasingly used for risk assessment, prognosis, and monitoring disease recurrence. The cancer biomarkers market size is expected to grow with a growing preference to use biomarkers in cancer screening programs and identify individuals at high risk of developing cancer, enabling early intervention. Additionally, biomarkers are being explored in the context of predicting disease progression and monitoring patients post-treatment for any signs of relapse.Collaborations and Partnerships

The field of cancer biomarkers is characterized by active collaborations and partnerships patients' academic institutions, biotechnology companies, and pharmaceutical firms. These collaborations aim to accelerate the discovery of novel biomarkers, the development of diagnostic tests, and the integration of biomarkers into clinical practice. Such partnerships are crucial for pooling resources, expertise, and technologies to advance the application of biomarkers in oncology.Global Cancer Biomarkers Market Segmentation

Global Cancer Biomarkers Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Protein Biomarkers

- Genetic Biomarkers

- Others

Protein biomarkers are proteins found in bodily fluids or tissues that can indicate the presence of cancer. Due to their pivotal role in signalling the existence or progression of disease, protein biomarkers are extensively used in clinical practices for the diagnosis and monitoring of cancer. Their application extends to determining disease prognosis and monitoring patient response to treatments. The impact of protein biomarkers on the market is profound, as they are instrumental in the development of targeted therapies and non-invasive diagnostic tests. Advancements in proteomics and molecular biology continue to enhance the sensitivity and specificity of protein biomarkers, promising to expand their utility and prevalence in clinical settings and impact the cancer biomarkers market value positively.

Genetic biomarkers includes DNA and RNA variations, mutations, or expressions that provide insights into an individual's risk of developing cancer, the presence of cancer, or how a patient might respond to certain therapies. Genetic biomarkers are at the forefront of personalized medicine, enabling the selection of targeted therapies based on a patient's genetic makeup. The influence of genetic biomarkers on the market is set to grow, driven by advancements in genomic sequencing technologies and bioinformatics. These technologies facilitate the identification and analysis of genetic biomarkers with greater accuracy and lower costs, making personalized cancer treatment more accessible.

Market Breakup by Cancer Type

- Lung cancer

- Breast cancer

- Leukemia

- Melanoma

- Colorectal cancer

- Prostate cancer

- Others

Lung cancer biomarkers, for instance, have revolutionized treatment protocols by identifying mutations that respond to targeted therapies, significantly improving patient outcomes. Similarly, breast cancer treatment has been transformed by the identification of hormone receptor and HER2 status, guiding the use of specific targeted therapies.

The cancer biomarkers market growth is driven by increased understanding of disease prognosis. In leukemia, genetic biomarkers like the Philadelphia chromosome enable the deployment of precise treatments such as tyrosine kinase inhibitors, underscoring the role of biomarkers in personalized medicine. Melanoma treatments have also evolved with the discovery of BRAF mutations, leading to the development of inhibitors that specifically target these genetic anomalies.

Colorectal cancer management is increasingly influenced by biomarkers like KRAS, NRAS, and MSI status, which dictate the effectiveness of chemotherapies and immunotherapies, tailoring treatment plans to individual patient profiles. Prostate cancer screening and treatment rely heavily on PSA levels, with ongoing research into genetic markers aiming to refine risk assessment and treatment strategies further.

Looking forward, the cancer biomarkers market size is poised for significant growth, driven by relentless research, technological advancements, and a shifting treatment paradigm towards personalized medicine. This evolution promises not only to improve patient outcomes and quality of life but also to streamline healthcare resources by targeting therapies to those most likely to benefit, heralding a new era in the oncology landscape.

Market Breakup by Application

- Prognostics

- Diagnostics

- Research and development

- Others

The prognostics segment focuses on predicting the likely progression of cancer in patients, helping to forecast outcomes such as disease recurrence and survival rates. This segment's impact on the market is profound as it enables healthcare providers to tailor treatment plans more effectively, ensuring that patients receive the most appropriate therapies based on their individual risk profiles. As personalized medicine continues to gain traction, the prognostics segment is expected to play an increasingly vital role, influencing treatment decisions and patient management strategies in the forecast period.

Diagnostics, another crucial segment, involves the identification and confirmation of the presence of cancer through biomarker testing. This segment significantly influences early detection efforts, improving the chances of successful treatment outcomes. By providing timely and accurate diagnosis, the diagnostics segment supports the shift towards more preventative and precision-based approaches to cancer care, likely driving advancements in detection technologies and methodologies in the coming years.

Research and development (R&D) in the cancer biomarkers market focuses on discovering new biomarkers and improving existing ones for better accuracy and reliability. This segment underpins the entire cancer biomarkers market, fueling innovation and the development of next-generation diagnostics and prognostics tools. The impact of R&D is pivotal, as it not only enhances current cancer management strategies but also paves the way for groundbreaking treatments and approaches. With ongoing investments and a strong focus on R&D, this segment is expected to significantly influence the market by introducing more sophisticated and effective biomarker solutions.

Each of these segments - prognostics, diagnostics, and research and development - contributes uniquely to the cancer biomarkers market share, driving advancements in cancer care and offering hope for more effective and personalized treatment options in the forecast period.

Market Breakup by Profiling Technology

- Omics

- Imaging

- Immunoassay

- Bioinformatics

- Others

Omics technologies, encompassing genomics, proteomics, metabolomics, and transcriptomics, offer comprehensive insights into the molecular underpinnings of cancer. This segment significantly impacts the market by enabling the identification of novel biomarkers and the mechanisms driving cancer progression. The vast data generated through omics approaches are pivotal for discovering new targets for therapy and diagnostics, making this segment a cornerstone for innovation in personalized medicine. As research progresses, omics technologies are expected to continue influencing the cancer market share by uncovering more tailored and effective treatment options.

Imaging technologies, which include MRI, CT scans, and PET scans, among others, are crucial for the non-invasive detection and monitoring of cancer. This segment contributes to the market by facilitating the early diagnosis and staging of cancer, aiding in treatment planning and the assessment of treatment response. The integration of imaging biomarkers with other molecular diagnostics is anticipated to enhance precision in cancer care, potentially leading to more personalized and effective intervention strategies.

Immunoassays are vital for the quantification and detection of cancer biomarkers in biological samples. This segment impacts the market by providing accessible and cost-effective tools for routine screening and monitoring of cancer biomarkers. The advancements in immunoassay technologies, including high sensitivity and specificity, are expected to bolster their application in clinical practice, supporting the early detection and management of cancer, contributing to expedited cancer biomarkers market growth in coming years.

Bioinformatics plays an indispensable role in managing and analyzing the complex data generated from various cancer biomarker profiling technologies. This segment influences the market by enabling the integration, interpretation, and translation of biomarker data into meaningful insights, which can drive the discovery and development of new cancer diagnostics and therapeutics. The growing need for sophisticated data analysis tools in biomarker research is likely to spur further advancements in bioinformatics, enhancing its market impact.

Market Breakup by End-user

- Pharmaceuticals and biotechnology companies

- Diagnostics and research laboratories

- Hospitals

- Others

Pharmaceuticals and biotechnology companies are key end-users, leveraging cancer biomarkers in the development of new drugs and therapies. This segment significantly impacts the cancer biomarkers market demand, owing to usage in clinical trials and therapeutic targeting, leading to more personalized and effective cancer treatments. The continued focus on precision medicine and targeted therapy development is expected to keep this segment at the forefront of market influence, fueling innovation and the discovery of novel biomarkers.

Diagnostics and research laboratories are pivotal in the identification, validation, and analysis of cancer biomarkers. This segment contributes to the market by facilitating the advancement of diagnostic tests and methodologies, enhancing the accuracy and reliability of cancer detection and monitoring. As the need for early detection and personalized treatment options grows, diagnostics and research laboratories are expected to play an increasingly critical role, driving demand for sophisticated biomarker-based diagnostic solutions.

Hospitals represent a significant end-user segment, applying cancer biomarkers in the clinical setting for patient diagnosis, prognosis, and treatment monitoring. This segment impacts the cancer biomarkers market value by integrating biomarker testing into standard care practices, improving patient outcomes through more informed decision-making and treatment planning. The adoption of biomarker-based protocols in hospitals is anticipated to increase, influenced by the growing emphasis on personalized medicine and evidence-based treatments.

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America, with its advanced healthcare infrastructure, strong focus on research and development, and high healthcare expenditure, plays a leading role in the cancer biomarkers market share. The region's market impact is significant, driven by the presence of major pharmaceutical and biotech companies, extensive cancer research programs, and a robust regulatory framework supporting the adoption of innovative diagnostics and treatments. North America's emphasis on precision medicine and personalized healthcare is expected to continue influencing the market, fostering advancements in biomarker discovery and application.

Europe follows closely, with its well-established healthcare systems and strong emphasis on cancer research and innovation. The region benefits from substantial government and private funding for cancer research, collaboration across countries for cancer control and prevention, and a growing focus on personalized medicine. Europe's market impact is characterized by the adoption of advanced diagnostic technologies and the integration of biomarkers into clinical practice, trends that are expected to persist and drive the market.

The Asia Pacific region is witnessing a surge in the cancer biomarkers market demand, which can be attributed to increasing prevalence of cancer. Increasing healthcare expenditures, growing awareness of cancer diagnostics and treatments, and improving healthcare infrastructures are contributing to market growth. The region's diverse population presents significant opportunities for the development and application of cancer biomarkers. With continued investments in healthcare and research, Asia Pacific is poised to have a substantial impact on the market, especially in terms of expanding access to biomarker-based diagnostics and treatments.

Latin America, while emerging in the cancer biomarkers market, shows promise due to its growing healthcare sector, increasing focus on research and development, and efforts to improve cancer care. The region's impact on the market is expected to grow, driven by the rising demand for early detection and personalized treatment options, along with improving regulatory frameworks and healthcare policies supporting cancer research and innovation.

The Middle East and Africa region, with its unique healthcare challenges and diverse population, is gradually recognizing the importance of cancer biomarkers in improving diagnosis, treatment, and management of cancer. The market impact in this region is influenced by increasing healthcare investments, government initiatives for cancer control, and collaborations with international organizations to enhance cancer care. Although at an earlier stage of adoption, the region's focus on improving healthcare infrastructure and access to advanced diagnostics is expected to influence the market positively.

Leading Key Players in the Global Cancer Biomarkers Market

The cancer biomarkers market is characterized by the presence of several key players, each contributing to the market through innovation, research and development, and the provision of advanced diagnostic and therapeutic solutions. These players include multinational pharmaceutical and biotechnology companies, diagnostic and medical device firms, and specialized biotech companies focused on biomarker discovery and development. Prominent companies in this market often lead in the development of novel biomarkers, leveraging cutting-edge technologies such as next-generation sequencing, bioinformatics, and advanced imaging techniques.The key features of the cancer biomarkers market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc.

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

- Myriad Genetics, Inc.

- Siemens Healthcare Private Limited

- PerkinElmer Inc.

- Bio-Techne

- Hologic, Inc.

- Quest Diagnostics Clinical Laboratories, Inc.

- Charles River Laboratories

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

- Myriad Genetics, Inc.

- Siemens Healthcare Private Limited

- PerkinElmer Inc.

- Bio-Techne

- Hologic, Inc.

- Quest Diagnostics Clinical Laboratories, Inc.

- Charles River Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 15.8 Billion |

| Forecasted Market Value ( USD | $ 60.13 Billion |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |