Supermarkets and hypermarkets play a pivotal role in the butter blocks market by serving as key distribution channels for manufacturers and providing consumers with a diverse selection of butter products. These retail outlets offer a one-stop shopping experience, allowing consumers to conveniently purchase butter blocks along with other grocery items. Supermarkets and hypermarkets leverage their large store spaces to stock a wide variety of butter brands, including different flavors, types, and packaging sizes, catering to diverse consumer preferences. Consequently, In South Korea, 713.32 kilo tonnes of butter blocks are expected to be sold through Supermarkets and hypermarkets by the year 2031.

The China market dominated the Asia Pacific Butter Blocks Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $6,829.6 million by 2031. The Japan market is registering a CAGR of 2.8% during (2024 - 2031). Additionally, The India market would capture a CAGR of 4.2% during (2024 - 2031).

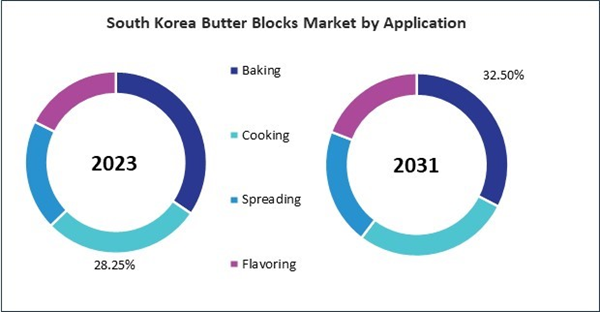

The emergence of baking and cooking trends drives consumer demand for butter blocks by emphasizing quality, flavor, versatility, authenticity, and creativity in culinary pursuits. As these trends continue to evolve, butter blocks remain a staple ingredient in kitchens worldwide, supporting growth and innovation in the market. Baking traditions are often associated with holidays and special occasions, leading to seasonal spikes in demand for butter blocks.

During festive seasons like Christmas, Easter, and Thanksgiving, as well as cultural celebrations and family gatherings, consumers stock up on butter blocks for holiday baking and cooking projects. Also, the trend toward home baking and do-it-yourself (DIY) cooking has gained momentum, especially during lockdowns and social distancing. Many consumers have turned to baking and cooking as creative outlets and sources of comfort, contributing to increased sales of butter blocks for homemade recipes.

Retail sales in Asia Pacific provide consumers with a wide range of butter block options, including different brands, packaging sizes, and types. China is also a global leader in e-commerce, with platforms like Alibaba's Tmall and JD.com dominating the online retail industry. The State Council Information Office of the People's Republic of China reports that retail sales increased by 4.6% annually to 3.79 trillion yuan in August 2023. The rate of expansion surpassed the 2.5 percent growth rate documented in July. Thus, the substantial expansion of butter production and the resilient retail sector collectively contribute to the rising demand for butter blocks in the Asia Pacific region.

Based on Type, the market is segmented into Salted, Unsalted, and Others. Based on Distribution Channel, the market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Online Stores, and Departmental Stores. Based on Application, the market is segmented into Baking, Cooking, Spreading, and Flavoring. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Fonterra Co-operative Group Limited

- Kerry Group PLC

- Royal FrieslandCampina N.V.

- Lactalis Group

- Arla Foods, Inc.

- Amul (The Gujarat Co-operative Milk Marketing Federation Ltd.)

- Glanbia PLC

- Danone S.A.

- Land O'Lakes, Inc.

- Nestle S.A.

Market Report Segmentation

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)- Salted

- Unsalted

- Others

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

- Departmental Stores

- Baking

- Cooking

- Spreading

- Flavoring

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Fonterra Co-operative Group Limited

- Kerry Group PLC

- Royal FrieslandCampina N.V.

- Lactalis Group

- Arla Foods, Inc.

- Amul (The Gujarat Co-operative Milk Marketing Federation Ltd.)

- Glanbia PLC

- Danone S.A.

- Land O'Lakes, Inc.

- Nestle S.A.