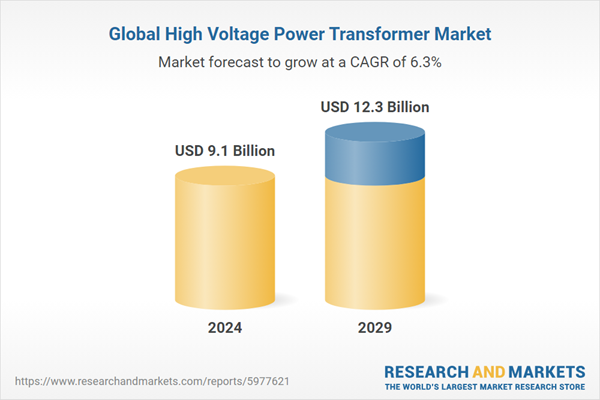

The global market for high voltage power transformers is poised for substantial growth, with a projected trajectory reaching USD 12.3 billion by the year 2029. This represents a noteworthy increase from the estimated value of USD 9.1 billion in 2024, reflecting a steady Compound Annual Growth Rate (CAGR) of 6.3% over the period spanning from 2024 to 2029.

Several factors are driving robust growth in the high voltage power transformer market, notably the increasing global demand for energy, which has significantly boosted electricity consumption in recent years. The industrial sector plays a pivotal role in this surge, fueled by escalating industrialization, manufacturing activities, and infrastructure development across various regions. Commercial enterprises depend heavily on a stable and continuous power supply to sustain operations. As the global energy scenario continues to evolve, factors like the integration of renewable energy sources, advancements in smart grid technologies, and a focus on energy efficiency will further drive the demand for high voltage power transformers.

LPT (> 60 MVA) segment, by power rating, to be fastest growing market from 2024 to 2029

LPT (> 60 MVA) segment is anticipated to be the fastest-growing market from 2024 to 2029 due to several pivotal factors. Large power transformers typically have a minimum capacity rating of at least 60 MVA. These massive liquid dielectric power transformers are the foundation of the electrical system and are custom-built, pricey pieces of machinery. In substations large power transformers play a crucial role in the grid's architecture by adjusting voltage levels to suit the needs of various areas of the electricity grid. Large power transformers are essential for incorporating renewable energy sources, such as wind and solar farms, into the national grid as the world shifts to more environmentally friendly energy alternatives. They transform the variable voltage power produced by these renewable energy sources into a more stable, grid-compatible voltage. This enables the efficient transmission of renewable energy over long distances, contributing to a cleaner and more sustainable energy landscape.

Utilities, by end user, to be the largest market from 2024 to 2029

The Utilities, by end user, to be the largest market from 2024 to 2029. The utility sector, with its expansive infrastructure and continuous expansion initiatives, stands as the primary consumer base for voltage transformers. Within this sector, there exists a strong and consistent demand, offering a stable foundation for industry participants. This segment encompasses both public and private entities engaged in power generation and transmission activities. Factors such as increasing electricity needs, modernization of grids, integration of renewable energy sources, and the critical requirement for dependable power supply collectively position the utility segment as the largest and most rapidly growing application area for power transformers in the foreseeable future. Significant investments by governments and private utilities to enhance aging power infrastructure further drive the market for advanced high-voltage power transformers that are more energy-efficient and capable of managing increased loads.

Asia Pacific to be largest and fastest growing region in high voltage power transformer market

Asia Pacific is projected to be both the largest and fastest-growing region in the high voltage power transformer market. Rapid urbanization, industrialization, population growth, and expanding economies boost the need for electricity, resulting in the implementation of more transformers. Efforts to modernize power grids, spurred by aging infrastructure and the integration of renewable energy sources, further increase demand. Moreover, the emphasis on smart grids powered by automation and monitoring technologies accelerates the development of advanced transformers with enhanced capabilities. According to the International Energy Agency (IEA), Asia Pacific is the world’s largest energy-consuming region, with over half the global energy demand.

The region anticipates continued electricity demand growth, driven by economic development and urbanization, with challenges remaining in ensuring energy access, particularly in rural areas. The International Renewable Energy Agency (IRENA) highlights the vast renewable energy potential in Asia Pacific, stressing the need for substantial investments to meet climate goals and enhance energy security through regional cooperation in renewable energy development and grid integration. This surge in demand across multiple fronts makes Asia Pacific the largest and fastest-growing market for high voltage power transformers.

Breakdown of Primaries

Through in-depth interviews with subject-matter experts, C-level executives of leading market players, industry consultants, and other specialists, significant qualitative and quantitative data were obtained and confirmed, along with future market prospects. The primary interviews were distributed as follows:

- By Company Type: Tier 1 - 55%, Tier 2 - 30%, and Tier 3 - 15%

- By Designation: C-Level - 30%, Directors - 20%, and Others - 50%

- By Region: North America - 18%, Europe - 8%, Asia Pacific - 60%, Middle East & Africa - 8%, and South America - 4%

Note: Others include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2022: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million

The market for High voltage power transformers is primarily controlled by reputable international giants. In the industrial control transformer market, some of the leading companies are Siemens Energy (Germany), Hitachi Energy Ltd. (Switzerland), Schneider Electric (France), Toshiba Energy Systems & Solutions Corporation (Japan), and General Electric Company (US) and a few more.

Research Coverage

The report provides an in-depth analysis of the High voltage power transformers market, complete with thorough definitions, descriptions, and projections based on various parameters. These parameters encompass Power Rating LPT (> 60 MVA), SPT (≤ 60 MVA), Cooling Type (Oil immersed & Dry type), End-User (Industrial, Commercial, Utilities), and geographic regions (Asia Pacific, North America, Europe, Middle East and Africa, South America). It offers both qualitative and quantitative assessments, focusing on the primary market drivers, constraints, opportunities, and challenges. The report also covers essential elements of the market such as competitive landscape assessment, analysis of market dynamics, value-based estimations, and future trend insights in the High voltage power transformers market.

Key Benefits of Buying the Report

The report is thoughtfully designed to meet the needs of both seasoned industry leaders and new entrants in the High voltage power transformers market. It provides dependable revenue projections for both the overall market and its various sub-segments, making it a crucial tool for stakeholders looking to gain a deep understanding of the competitive environment. This information helps stakeholders develop effective market strategies for their businesses. Furthermore, the report serves as a key resource for stakeholders to grasp the current market scenario, offering vital insights into the drivers, constraints, challenges, and opportunities for growth. With these insights, stakeholders can make well-informed decisions and keep up with the rapidly changing dynamics of the High voltage power transformers industry.

- Analysis of key DROC’s: Drivers (Pressing need for grid modernization and expansion with increasing electricity demand, Rising adoption of renewable energy sources), restraints (Limited budget for grid expansion projects in developing countries, Need for skilled professionals to install advanced transformers), opportunities (Development of customized transformers to deploy in HVDC transmission systems, Shift toward smart grid technology), and challenges (Aging grid infrastructure, Cybersecurity threats due to adoption of digital technologies).

- Product Development/ Innovation: In the high voltage power transformer market, product development and innovation are crucial elements driving the sector's progress. As technology advances, manufacturers are increasingly dedicated to crafting innovative products that enhance performance, efficiency, and safety. These advancements typically incorporate smart technologies, cutting-edge materials, and environmentally friendly insulation options, addressing the changing demands of the power distribution landscape. Additionally, ongoing research and development initiatives are focused on producing transformers that support sustainable and eco-conscious objectives. By embracing advanced technologies and innovative design techniques, companies in the oil-immersed high voltage power transformer market strive to not only comply with existing industry standards but also surpass them, offering customers top-of-the-line solutions that boost the efficiency and reliability of power distribution systems. This focus on continual product development and innovation reflects the industry's commitment to adapting to market shifts and enhancing the functionality and capabilities of high voltage power transformers.

- Market Development: Market development in the high voltage power transformer sector is an ongoing and dynamic process, driven by efforts to explore new geographic territories and application areas. Companies in this industry consistently look for opportunities to extend their market presence and respond to emerging demands. This often includes entering previously unexplored regions or adapting existing products for new applications. Additionally, market development strategies involve leveraging evolving trends, such as the growing integration of renewable energy sources and the upgrading of electrical grids. By actively engaging in these market development activities, companies not only expand their customer base but also tailor their products to meet the diverse and changing needs of different sectors. This strategic approach promotes sustained growth, enhances competitiveness, and equips companies to effectively manage the shifting dynamics of the high voltage power transformer market. Through focused efforts, collaborations, and strategic alliances, market development serves as a key pathway for securing long-term viability and prominence in this essential segment of the power distribution industry.

- Market Diversification: Market diversification in the high voltage power transformer industry involves expanding product lines and services strategically to reduce risks, tap into new revenue streams, and boost overall business resilience. Companies in this field may diversify by enlarging their selection of transformer types, voltage capacities, or specialized applications. This expansion could include breaking into niche markets, tailoring products for specific applications, or widening their product range to cater to a variety of customer needs. By broadening their portfolio, companies can decrease their dependence on specific products or market segments, enhancing their ability to manage market fluctuations and economic changes. Diversification may also entail geographic expansion into new regions or countries to leverage unique market demands. Effective diversification strategies are rooted in a deep understanding of market trends, consumer behaviors, and technological advancements, equipping companies to adjust and prosper in the constantly changing high voltage power transformer market. A well-executed approach to diversification enables companies to navigate market shifts, seize emerging opportunities, and maintain a competitive advantage in this challenging industry.

- Competitive Assessment: An extensive analysis of the market presence, growth plans, and service offerings of major competitors in the high voltage power transformer market has been conducted. This research has been applied to notable firms including Siemens Energy (Germany), Hitachi Energy Ltd. (Switzerland), Schneider Electric (France), Toshiba Energy Systems & Solutions Corporation (Japan), and General Electric Company (US) and others. The assessment provides in-depth understanding of these big players' competitive positions, illuminating their growth-oriented strategies and range of offerings in the oil immersed high voltage power transformer industry.

Table of Contents

Companies Mentioned

- Siemens Energy

- Hitachi Energy Ltd.

- Schneider Electric

- Toshiba Energy Systems & Solutions Corporation

- General Electric Company

- HD Hyundai Electric Co. Ltd.

- CG Power & Industrial Solutions Ltd.

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- Bharat Heavy Electricals Limited

- Fuji Electric Co. Ltd.

- WEG

- Efacec

- LS Electric Co. Ltd.

- Transformers & Rectifiers (India) Ltd.

- SGB-SMIT

- Niagara Transformer Corp.

- Hammond Power Solutions

- Ningbo Ironcube Works International Co. Ltd.

- Wilson Power Solutions

- ABC Transformers (P) Ltd.

- Vijay Power

- JSHP Transformer

- Chint Group

- Jiangshan Scotech Electrical Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 254 |

| Published | June 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 12.3 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |