Consumer Electronics is the fastest growing segment, Asia-Pacific is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global High Density Interconnect PCB Market experiences significant expansion driven by the continuous miniaturization of electronic devices. Demand for compact, lighter, and higher-performing electronics necessitates advanced printed circuit board solutions. HDI technology directly facilitates this trend by enabling finer lines, smaller vias, and greater connection densities, crucial for integrating advanced functionalities within reduced device dimensions. For example, according to Apple's announcement, in June 2023, the company planned to introduce resin-coated copper materials in its iPhone models in 2024, replacing some copper-clad laminates, a strategic shift underscoring commitment to space-efficient designs.Key Market Challenges

The inherent manufacturing complexity and elevated production costs associated with High Density Interconnect (HDI) PCBs present a significant impediment to the growth of the global market. The intricate design requirements for HDI PCBs, including microvias and fine line technology, necessitate specialized equipment and highly precise processes. This directly contributes to higher unit costs, which can constrain broader adoption in various cost-sensitive applications. For instance, establishing a single high-end HDI PCB production line requires an investment exceeding $7 million, according to Revista Española de Electrónica in 2025.Key Market Trends

The Global High Density Interconnect PCB Market is significantly influenced by the proliferation of flexible and rigid-flex HDI form factors. This trend addresses the evolving demand for compact, lightweight, and highly adaptable electronic devices by integrating rigid and flexible substrates into a single, interconnected structure. Such designs minimize the need for traditional connectors, consequently reducing overall assembly size, weight, and potential points of failure, while simultaneously enhancing signal integrity. These advantages are crucial for modern applications such as wearables, medical devices, and advanced automotive systems that require complex circuitry in constrained spaces.Key Market Players Profiled:

- Taiwan Semiconductor Manufacturing Company Limited

- Intel Corporation

- Samsung Electronics Co., Ltd.

- GlobalFoundries Inc.

- United Microelectronics Corporation

- Applied Materials, Inc.

- Cadence Design Systems, Inc.

- Synopsys, Inc.

- Advanced Micro Devices Inc.

- Lam Research Corporation

Report Scope:

In this report, the Global High Density Interconnect PCB Market has been segmented into the following categories:By Interconnection Layers:

- 1 Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HD

By Application:

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global High Density Interconnect PCB Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Taiwan Semiconductor Manufacturing Company Limited

- Intel Corporation

- Samsung Electronics Co., Ltd.

- GlobalFoundries Inc.

- United Microelectronics Corporation

- Applied Materials, Inc.

- Cadence Design Systems, Inc..

- Synopsys, Inc.

- Advanced Micro Devices Inc.

- Lam Research Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

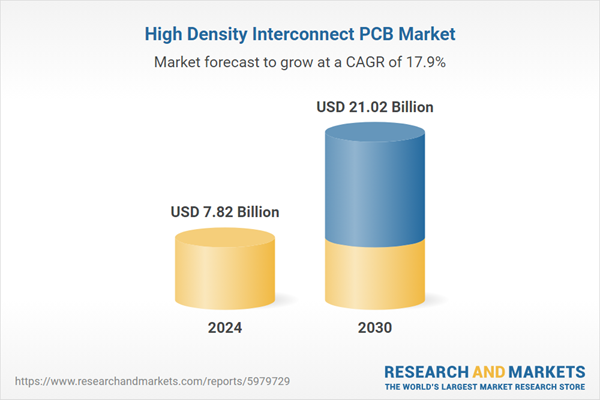

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.82 Billion |

| Forecasted Market Value ( USD | $ 21.02 Billion |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |