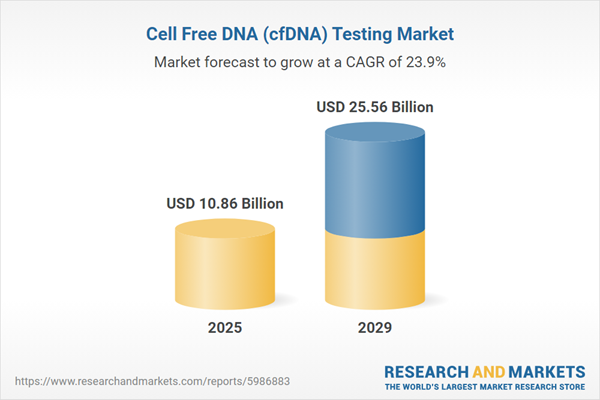

The cell free dna (cfDNA) testing market size has grown exponentially in recent years. It will grow from $8.74 billion in 2024 to $10.86 billion in 2025 at a compound annual growth rate (CAGR) of 24.2%. The growth in the historic period can be attributed to a rise in the adoption of cfDNA testing in prenatal care, increasing use of cfDNA analysis, growing interest in cfDNA research across various medical fields, and rise in gaining approvals from regulatory bodies.

The cell free dna (cfDNA) testing market size is expected to see exponential growth in the next few years. It will grow to $25.56 billion in 2029 at a compound annual growth rate (CAGR) of 23.9%. The growth in the forecast period can be attributed to a shift towards personalized medicine, enhancements in healthcare infrastructure, aging population and increasing incidence of cancer, increasing adoption of precision medicine, increasing awareness and acceptance of liquid biopsy techniques, and increasing investment and funding in cfDNA research. Major trends in the forecast period include adoption of liquid biopsy technologies, advancements in Next-Generation Sequencing (NGS) technology, integration of AI and machine learning in cfDNA testing, development of point-of-care cfDNA tests, and implementation of cloud-based platforms for data storage and analysis.

The increasing prevalence of cancer is expected to drive the growth of the cell-free DNA (cfDNA) testing market in the future. Cancer encompasses a complex group of diseases characterized by abnormal cell growth and spread in the body. These cells can invade and damage normal tissue, posing significant risks if left unchecked. The rise in cancer prevalence is attributed to factors such as aging populations, lifestyle changes, environmental influences, and advancements in detection and diagnostic methods. cfDNA testing detects genetic mutations linked to cancer at early stages, often before symptoms manifest. This early detection enables timely interventions, enhancing patient outcomes and survival rates by identifying cancer in its initial phases. For example, in February 2024, the World Health Organization (WHO) projected over 35 million new cancer cases by 2050, marking a 77% increase from the estimated 20 million cases in 2022. Hence, the increasing prevalence of cancer is fueling the growth of the cell-free DNA (cfDNA) testing market.

Key players in the cell-free DNA (cfDNA) testing market prioritize the development of innovative technologies, such as liquid biopsy tests that offer heightened sensitivity, specificity, and efficiency in detecting cancer-related mutations and genetic changes. Liquid biopsy tests involve diagnostic procedures enabling oncologists to assess circulating cell-free DNA released by tumor cells, facilitating personalized and targeted therapy strategies. For instance, in May 2023, Laboratory Corporation of America Holdings (Labcorp), a US-based life sciences company, introduced Labcorp Plasma Focus, a new liquid biopsy test tailored for patients with advanced or metastatic solid tumors. This test evaluates circulating cell-free DNA (cfDNA) from tumor cells through a standard blood draw, ensuring minimal invasiveness and rapid results. It enhances access to precision oncology by identifying clinically actionable biomarkers across various common cancers such as non-small cell lung, colorectal, breast, esophageal, gastroesophageal junction, gastric cancers, and melanoma.

In February 2022, Laboratory Corporation of America Holdings (LabCorp), a US-based clinical healthcare company, acquired Personal Genome Diagnostics Inc. for an undisclosed sum. This acquisition positions LabCorp to advance its existing liquid biopsy capabilities and broaden its array of state-of-the-art next-generation sequencing (NGS)-based genomic profiling tools for cancer, positioning it at the forefront of improving patient outcomes. Personal Genome Diagnostics Inc. specializes in precision oncology diagnostics, including cell-free DNA testing technology.

Major companies operating in the cell free DNA (CFDNA) testing market are F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Agilent Technologies Inc., Illumina Inc., Qiagen N.V., Exact Sciences Corporation, Bio-Techne Corporation, Natera Inc., Myriad Genetics Inc., NeoGenomics Laboratories Inc., Invitae Corporation, Foundation Medicine Inc., Guardant Health Inc., Integrated DNA Technologies Inc., Caris Life Sciences Inc., Twist Bioscience Corporation, Adaptive Biotechnologies Corporation, Biodesix Inc., Biocept Inc., Personal Genome Diagnostics Inc., Agena Bioscience Inc., Menarini Silicon Biosystems Inc., Circulogene Theranostics LLC.

North America was the largest region in the cell-free DNA (CFDNA) testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the cell free DNA (CFDNA)) testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the cell free DNA (CFDNA) testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cell-free DNA (cfDNA) testing is a non-invasive diagnostic technique that examines DNA fragments freely circulating in the bloodstream. This testing method is integral to liquid biopsy procedures, enabling the detection and analysis of genetic mutations and alterations without resorting to traditional tissue biopsies.

The primary products within the cell-free DNA (cfDNA) testing market include donor-derived cell-free DNA, circulating cell-free tumor DNA, and cell-free fetal DNA. Donor-derived cell-free DNA originates from transplanted donor organs or tissues and can be found in the recipient's bloodstream. Various platforms are utilized for cfDNA testing, such as next-generation sequencing (NGS), real-time PCR (rPCR) and multiplex PCR, quantitative PCR (qPCR) and digital PCR (dPCR), among others. These platforms are applied across various domains including oncology, non-invasive prenatal testing (NIPT), gynecology, transplantation, and other medical conditions.

The cell-free DNA (cfDNA) testing market research report is one of a series of new reports that provides cell-free DNA (cfDNA) testing market statistics, including cell-free DNA (cfDNA) testing industry global market size, regional shares, competitors with a cell-free DNA (cfDNA) testing market share, detailed cell-free DNA (cfDNA) testing market segments, market trends, and opportunities, and any further data you may need to thrive in the cell-free DNA (cfDNA) testing industry. This cell-free DNA (cfDNA) testing research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The cell-free DNA (cfDNA) testing market consists of revenue entities earned by providing services such as liquid biopsy for cancer detection and monitoring, transplant rejection monitoring, and non-invasive prenatal testing. The market value includes the value of related goods sold by the service provider or included within the service offering. The cell-free DNA (cfDNA) testing market also includes sales of products such as digital PCR systems, automated nucleic acid extraction systems, real-time PCR instruments, and library preparation systems for NGS. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cell Free DNA (cfDNA) Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cell free dna (cfdna) testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cell free dna (cfdna) testing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cell free dna (cfdna) testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Donor-Derived Cell-Free DNA; Circulating Cell-Free Tumor DNA; Cell-Free Fetal DNA2) By Platforms: Next Generation Sequencing (NGS); rPCR and Multiplexed PCR; qPCR and dPCR; Other platforms

3) By Application: Oncology; Non-Invasive Prenatal Test (NIPT); Gynecology; Transplantation; Other Applications

Subsegments:

1) By Donor-Derived Cell-Free DNA: Organ Transplant Monitoring; Graft Rejection Detection2) By Circulating Cell-Free Tumor DNA: Cancer Detection; Minimal Residual Disease Monitoring; Liquid Biopsy

3) By Cell-Free Fetal DNA: Non-Invasive Prenatal Testing (NIPT); Fetal Genetic Disorder Screening

Key Companies Mentioned: F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Laboratory Corporation of America Holdings; Quest Diagnostics Incorporated; Agilent Technologies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Cell Free DNA (cfDNA) Testing market report include:- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Agilent Technologies Inc.

- Illumina Inc.

- Qiagen N.V.

- Exact Sciences Corporation

- Bio-Techne Corporation

- Natera Inc.

- Myriad Genetics Inc.

- NeoGenomics Laboratories Inc.

- Invitae Corporation

- Foundation Medicine Inc.

- Guardant Health Inc.

- Integrated DNA Technologies Inc.

- Caris Life Sciences Inc.

- Twist Bioscience Corporation

- Adaptive Biotechnologies Corporation

- Biodesix Inc.

- Biocept Inc.

- Personal Genome Diagnostics Inc.

- Agena Bioscience Inc.

- Menarini Silicon Biosystems Inc.

- Circulogene Theranostics LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.86 Billion |

| Forecasted Market Value ( USD | $ 25.56 Billion |

| Compound Annual Growth Rate | 23.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |