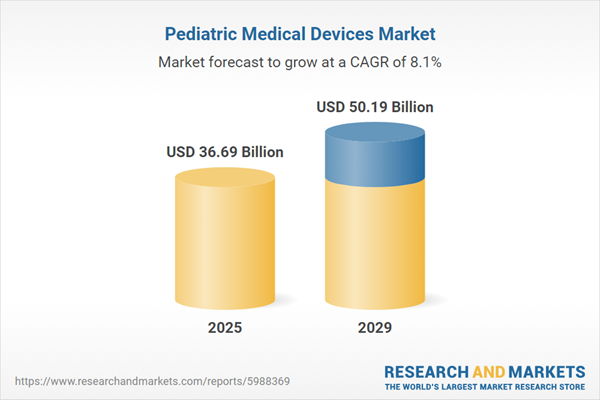

The pediatric medical devices market size has grown strongly in recent years. It will grow from $33.84 billion in 2024 to $36.69 billion in 2025 at a compound annual growth rate (CAGR) of 8.4%. The growth in the historic period can be attributed to increasing awareness, growing investments in infrastructure, population growth, government initiatives, and insurance expansion.

The pediatric medical devices market size is expected to see strong growth in the next few years. It will grow to $50.19 billion in 2029 at a compound annual growth rate (CAGR) of 8.1%. The growth in the forecast period can be attributed to value-based care models, advancements in manufacturing processes, personalized solutions, focus on home-based care, and collaborative innovation. Major trends in the forecast period include remote monitoring solutions, pediatric telemedicine services, wearable health devices for children, pediatric robotics in surgery, and the integration of AI in pediatric healthcare.

The increasing need for minimally invasive surgical procedures in pediatric care is anticipated to drive the expansion of the pediatric medical devices market in the foreseeable future. These procedures involve utilizing small incisions or natural body openings, alongside specialized instruments and imaging technology, to diagnose, treat, or manage pediatric health conditions with reduced trauma and faster recovery compared to traditional open surgeries. The escalating demand for such procedures stems from technological advancements, which enable safer and more precise interventions while minimizing post-operative complications. Pediatric medical devices play a crucial role in facilitating precise access, visualization, and manipulation of pediatric anatomy during minimally invasive surgeries, ensuring safe and effective treatment with minimal impact on surrounding tissues. For instance, as reported by Washington University in St. Louis in March 2023, the number of operating room cases for minimally invasive surgery increased from 2,208 in 2021 to 2,400 in 2022, indicating a growth of 192 cases within a year. Hence, the rising demand for minimally invasive pediatric surgical procedures is a key driver of growth in the pediatric medical devices market.

Major companies engaged in the pediatric medical devices market are innovating orthopedic implants to cater to the distinct healthcare requirements of pediatric patients, spanning from musculoskeletal disorders to congenital anomalies. Orthopedic implants are medical tools employed to substitute or bolster impaired or absent bone or joint structures within the musculoskeletal system. For instance, in March 2024, OrthoPediatrics Corporation, a US-based medical device enterprise, introduced the RESPONSE Rib and Pelvic Fixation system, customized for pediatric patients grappling with Early Onset Scoliosis (EOS). This comprehensive system encompasses implants, tools, and interconnecting devices, furnishing surgeons with a versatile solution for rib and pelvic fixation, including provisions for patients vulnerable to Thoracic Insufficiency Syndrome. Equipped with features such as a variety of implant choices, sleek designs, and locking mechanisms, this system amplifies precision and adaptability in addressing EOS instances.

In July 2022, OrthoPediatrics Corporation, a US-based medical device company, completed the acquisition of Pega Medical for $33 million. Through this acquisition, OrthoPediatrics Corporation intends to broaden its pediatric orthopedics offerings, thereby extending assistance to a greater number of children with orthopedic conditions. Pega Medical, based in Canada, specializes in the production of pediatric orthopedic implants.

Major companies operating in the pediatric medical devices market are Cardinal Health Inc., Johnson & Johnson, Siemens AG, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Medtronic plc, Siemens Healthineers, Koninklijke Philips N.V., Becton Dickinson and Company, Strykar Healthcare, GE HealthCare Technologies, Baxter International Inc., Boston Scientific Corporation, Zimmer Biomet Holdings Inc., Olympus Corporation, Terumo Corporation, Smith & Nephew plc, Hamilton Medical, Ningbo David Medical Device Co. Ltd, Phoenix Medical Systems Pvt Ltd, Fritz Stephan GmbH, Trimpeks, Atom Medical Corporation, Elektro-Mag, Novonate Inc.

North America was the largest region in the pediatric medical devices market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the pediatric medical devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the pediatric medical devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Pediatric medical devices are custom-designed healthcare tools crafted explicitly for infants, children, and adolescents, catering to their distinct anatomical, physiological, and developmental requirements for diagnosing, treating, monitoring, or managing diverse pediatric conditions and illnesses. These devices are meticulously adjusted to accommodate the distinctive physiological and developmental characteristics of pediatric patients, guaranteeing their safety, effectiveness, and comfort.

Pediatric medical devices encompass cardiology devices, in vitro diagnostic (IVD) devices, diagnostic imaging devices, anesthesia and respiratory care devices, neonatal intensive care unit (ICU) devices, and more. Cardiology devices include a spectrum of medical tools utilized in diagnosing, treating, and monitoring heart-related conditions, such as cardiac rhythm management devices such as pacemakers and defibrillators, alongside cardiac imaging systems and cardiovascular stents. These devices cater to different age brackets, including infants (0-2 years), children (2-12 years), and adolescents (12-18 years), and serve diverse end-users such as hospitals, diagnostic laboratories, ambulatory surgical centers, and others.

The pediatric medical devices market research report is one of a series of new reports that provides pediatric medical devices market statistics, including pediatric medical devices industry global market size, regional shares, competitors with a pediatric medical devices market share, detailed pediatric medical devices market segments, market trends and opportunities, and any further data you may need to thrive in the pediatric medical devices industry. This pediatric medical device market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The pediatric medical devices market consists of sales of imaging equipment, blood pressure monitors, ventilators, nebulizers, and wheelchairs. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Pediatric Medical Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pediatric medical devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pediatric medical devices ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The pediatric medical devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Cardiology Devices; in Vitro Diagnostic (IVD) Devices; Diagnostic Imaging Devices; Anesthesia and Respiratory Care Devices; Neonatal Intensive Care Unit (ICU) Devices; Other Products2) By Age Group: Infants; Children; Adolescents

3) By End-User: Hospitals; Diagnostic Laboratories; Ambulatory Surgical Centers; Other End-Users

Subsegments:

1) By Cardiology Devices: Pediatric ECG Machines; Pediatric Defibrillators; Pediatric Pacemakers; Pediatric Stethoscopes2) By in Vitro Diagnostic (IVD) Devices: Blood Glucose Monitoring Devices; Point-of-Care Testing Devices; Molecular Diagnostic Devices; Immunoassay Analyzers

3) By Diagnostic Imaging Devices: Pediatric Ultrasound Machines; Pediatric X-Ray Machines; Pediatric MRI Machines; Pediatric CT Scanners

4) By Anesthesia and Respiratory Care Devices: Pediatric Ventilators; Pediatric Anesthesia Machines; CPAP Devices for Pediatrics; Oxygen Concentrators for Pediatrics

5) By Neonatal Intensive Care Unit (ICU) Devices: Neonatal Incubators; Neonatal Ventilators; Neonatal Monitoring Devices; Phototherapy Devices

6) By Other Products: Pediatric Surgical Instruments; Pediatric Infusion Pumps; Pediatric Monitoring Devices; Pediatric Rehabilitation Devices

Key Companies Mentioned: Cardinal Health Inc.; Johnson & Johnson; Siemens AG; F. Hoffmann-La Roche Ltd.; Abbott Laboratories

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Pediatric Medical Devices market report include:- Cardinal Health Inc.

- Johnson & Johnson

- Siemens AG

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Medtronic plc

- Siemens Healthineers

- Koninklijke Philips N.V.

- Becton Dickinson and Company

- Strykar Healthcare

- GE HealthCare Technologies

- Baxter International Inc.

- Boston Scientific Corporation

- Zimmer Biomet Holdings Inc.

- Olympus Corporation

- Terumo Corporation

- Smith & Nephew plc

- Hamilton Medical

- Ningbo David Medical Device Co. Ltd

- Phoenix Medical Systems Pvt Ltd

- Fritz Stephan GmbH

- Trimpeks

- Atom Medical Corporation

- Elektro-Mag

- Novonate Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 36.69 Billion |

| Forecasted Market Value ( USD | $ 50.19 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |