Geographic Atrophy Market Overview

Geographic atrophy (GA) is the atrophic late form of age-related macular degeneration (AMD) and causes the destruction of retinal cells responsible for vision. It is reported to affect over 1 million individuals in the United States and around 5 million individuals globally. This progressive condition is predominantly found in older adults. Thus, as the aging population increases, the demand for the geographic atrophy market is expected to witness a surge.The market is influenced by the growing awareness regarding this severe eye disease and its impact on vision. This is prompting more patients to seek early diagnosis and treatment. The growth in new drug approvals by regulatory bodies such as the FDA and EMA is also anticipated to aid in the market expansion. Moreover, factors such as significant investment in research and development in the retinal ophthalmology field, increased strategic partnerships among biotech and pharmaceutical companies, and advancements in diagnostic tools are expected to drive market growth.

Geographic Atrophy Market Growth Drivers

Increasing Prevalence of Geographic Atrophy Drives Market Growth

Recent data suggests that 1 out of 5 individuals aged 85 or more are affected by geographic atrophy in at least one eye. Bilateral geographic atrophy is reported to result in severe visual impairment, with a substantial burden on patients as well as healthcare providers. Although the prevalence and incidence of this eye disease varies across different regions, it is estimated that the highest burden of geographic atrophy is found in European ancestry. The increasing aging population is one of the primary drivers of the growing cases of this retinal disorder, which is anticipated to bolster market growth in the coming years.Rise in Drug Approvals to Meet Rising Geographic Atrophy Market Demand

In February 2023, global biopharma company Apellis Pharmaceuticals, Inc. announced that the United States Food and Drug Administration (FDA) granted approval to its drug SYFOVRE™ (pegcetacoplan injection) indicated for geographic atrophy (GA) secondary to age-related macular degeneration (AMD). The regulatory approval, based on the positive results from the Phase 3 OAKS and DERBY clinical studies, marked a milestone in the field of retinal ophthalmology, with SYFOVRE being the first FDA-cleared treatment for geographic atrophy. The rise in such regulatory approvals is set to fuel the market growth.Geographic Atrophy Market Trends

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:Growth in Strategic Partnerships

Many pharmaceutical companies are engaging in collaborations and acquisitions to accelerate the development of new treatments for retinal diseases including geographic atrophy. For instance, in December 2023, Japan-based Astellas Pharma Inc. completed the acquisition of United States biopharmaceutical company IVERIC Bio, Inc. to expand its portfolio in the ophthalmology disease segment.Improvements in Diagnostic Technologies

The market is positively influenced by the improvements in diagnostic technologies, such as optical coherence tomography (OCT) and fundus autofluorescence (FAF). The adoption of such advanced diagnostic tools is resulting in early detection and better monitoring of the disease, which is expected to boost the geographic atrophy market value.Increased Investment in Research and Development

One of the major market trends is the growing R&D funding by pharmaceutical companies which is aimed at discovering and developing new treatments for geographic atrophy. Such substantial investments are helping in better understanding the disease and bringing effective therapies to the market.Advancements in Drug Development

The market is benefitting from the development of new therapeutic agents that are reaching late-stage clinical trials. These drugs are designed to target the underlying mechanism of this severe retinal disease and show the potential for better management of the condition. The rising focus on biologics and gene therapy solutions to treat geographic atrophy is projected to aid market expansion.Geographic Atrophy Market Segmentation

The EMR’s report titled “Geographic Atrophy Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Age Group

- 60-75 Years

- Above 75 Years

Market Breakup by Treatment

- Medications

- Supplements

- Others

Market Breakup by Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Market Breakup by Region

- United States

- EU-4 and the United Kingdom

- Japan

- India

Geographic Atrophy Market Share

Distribution Channel Segment is Projected to Fuel Market Growth

Based on the distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. Hospital pharmacies cover a significant market share as they offer immediate access to medications for geographic atrophy in hospital settings. The online pharmacy segment is a growing market segment that allows patients to place orders for their medications remotely. Online pharmacies provide convenience and home delivery services and thus are gaining demand in the market.Geographic Atrophy Market Analysis by Region

Based on the region, the market includes the United States, EU-4 (Germany, France, Italy, Spain), and the United Kingdom, Japan, and India. The United States represents a significant market share owing to the large population in the region affected by age-related macular degeneration (AMD), including geographic atrophy. The market growth is supported by increased access to advanced therapies and the presence of a positive regulatory environment that ensures faster market entry for new treatments.Leading Players in the Geographic Atrophy Market

The key features of the market report comprise the patent analysis, clinical trial analysis, grant analysis, and strategic initiatives by the leading key players. The major companies in the market are as follows:Apellis Pharmaceuticals, Inc

Based in Massachusetts, United States, Apellis Pharmaceuticals is a clinical-stage biopharmaceutical company that is one of the leading players in the market. The company developed the first-ever treatment for geographic atrophy, SYFOVRE™ (pegcetacoplan injection), which the FDA approved in February 2023.Iveric Bio

Iveric Bio, a part of Japan's Astellas Pharma, has a robust presence in the market and specializes in developing novel therapeutics for ophthalmic diseases. In August 2023, its therapy IZERVAY™ (avacincaptad pegol intravitreal solution) received FDA clearance for the treatment of geographic atrophy.Alkeus Pharmaceuticals Inc

United States-based Alkeus Pharmaceuticals Inc., a late-stage biopharmaceutical company, is known for developing therapies against serious and untreatable eye diseases. Its lead candidate Gildeuretinol acetate (ALK-001) is undergoing clinical development for geographic atrophy and Stargardt's disease.Hemera Biosciences

Privately owned biotechnology company Hemera Biosciences is known for developing gene therapy to treat patients with age-related macular degeneration (AMD). The firm has developed drug candidate HMR59, a gene therapy designed to increase the expression of CD59, which has the potential to preserve vision in geographic atrophy patients.Other key players in the market include Allegro Ophthalmics, Stealth BioTherapeutics, Novartis AG, Regenerative Patch Technologies, LLC, F. Hoffmann-La Roche AG, Gensight Biologics, NGM Biopharmaceuticals, AstraZeneca PLC, and Lineage Cell Therapeutics.

Key Questions Answered in the Geographic Atrophy Market Report

- What was the geographic atrophy market value in 2024?

- What is the geographic atrophy market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on age group?

- What is the market breakup based on treatment?

- What is the market breakup by distribution channel?

- What are the major factors aiding the geographic atrophy market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- How does the prevalence and incidence of geographic atrophy affect the market landscape?

- What are the major geographic atrophy market trends?

- How does the rise in the geriatric population impact the market size?

- Which age group will dominate the market share?

- Which treatment is expected to have a high market value in the coming years?

- Which distribution channel is projected to contribute to the highest market growth?

- Who are the key players involved in the geographic atrophy market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Apellis Pharmaceuticals, Inc.

- Iveric Bio

- Alkeus Pharmaceuticals Inc.

- Hemera Biosciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

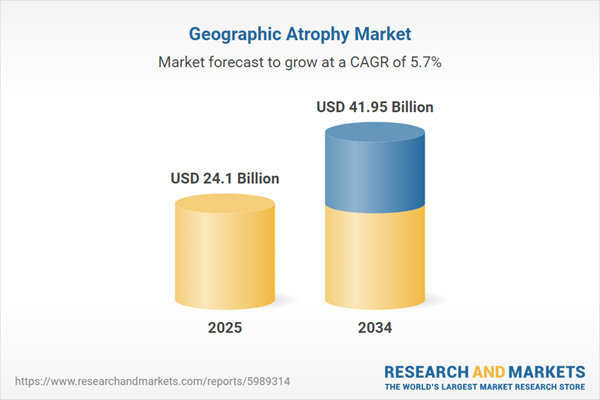

| Estimated Market Value ( USD | $ 24.1 Billion |

| Forecasted Market Value ( USD | $ 41.95 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |