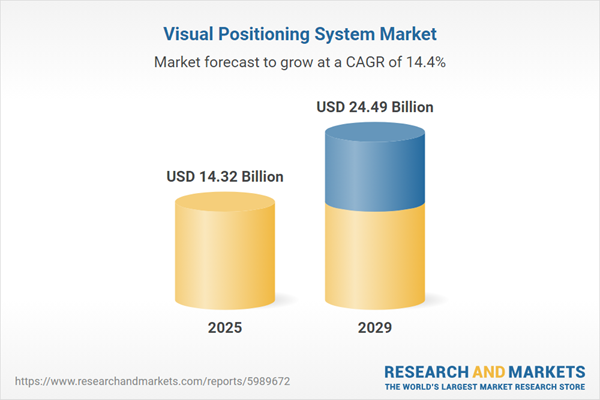

The visual positioning system market size has grown rapidly in recent years. It will grow from $12.49 billion in 2024 to $14.32 billion in 2025 at a compound annual growth rate (CAGR) of 14.6%. The growth in the historic period can be attributed to the surge in smart city initiatives, the need for precise applications like public safety and traffic management, increased investments in automotive, increased demand for drones, rise in demand for precise navigation solutions.

The visual positioning system market size is expected to see rapid growth in the next few years. It will grow to $24.49 billion in 2029 at a compound annual growth rate (CAGR) of 14.4%. The growth in the forecast period can be attributed to the growing adoption of automated guided vehicles (AGVS), increasing use of unmanned aerial vehicles (UAVs), growing urbanization, increasing use of smartphones and internet connectivity, and development of autonomous vehicles. Major trends in the forecast period include demand for artificial intelligence (AI)-enabled optical sensors, technological developments and industrialization, advancements in visual simultaneous localization and mapping, demand for innovative solutions, and advancements in machine vision technology.

The expansion of autonomous vehicles is poised to drive the growth of the visual positioning systems market in the future. These vehicles, which operate without constant human intervention or monitoring, rely on advanced sensor technologies, computer systems, and artificial intelligence for navigation. The increasing adoption of autonomous vehicles can be attributed to advancements in artificial intelligence and sensor technology, coupled with substantial investments from both private companies and governments to enhance transportation safety and efficiency. Visual positioning systems play a critical role in supporting autonomous vehicle technology, offering the precision, reliability, and shared reference frame necessary for safe and reliable self-driving capabilities as these vehicles gain popularity. For example, according to the National Association of Insurance Commissioners in December 2022, it is projected that there will be 3.5 million autonomous vehicles on American roads by 2025 and 4.5 million by 2030. Hence, the growing number of autonomous vehicles is expected to fuel the expansion of the visual positioning systems market.

Key players in the visual positioning system market are directing their efforts towards developing augmented reality (AR) platforms to gain a competitive edge. AR-based VPS enhances users' understanding of their surroundings by seamlessly integrating virtual information with the real world, providing an immersive and contextually rich experience. For instance, in May 2022, Niantic, a US-based software development company, introduced the Lightship VPS system, allowing for persistent AR content and enabling multiple users to view the same content in the same location. This is made possible by having both devices share the same map, ensuring consistent real-world experiences.

In August 2024, TKH Group, a Netherlands-based technology company, acquired Liberty Robotics Inc. for an undisclosed amount. The acquisition aims to strengthen TKH Group's strategic growth in the field of 3D vision systems, with a particular focus on the automotive and logistics sectors. Liberty Robotics Inc., a US-based technology company, specializes in 3D vision guidance systems for robotic applications.

Major companies operating in the visual positioning system market are Google LLC, Qualcomm Inc., Broadcom Inc., ABB Ltd., MediaTek Inc., STMicroelectronics, Infineon Technologies AG, Omron Corporation, Fanuc Corporation, Hexagon AB, Trimble Inc., Sick AG, MiTAC Digital Technology Corporation, Topcon Corporation, Pepperl + Fuchs Inc., Cognex Corporation, Niantic Inc., Twin Disc inc., Sonardyne International Ltd., Navis Engineering, Praxis Automation Technology BV.

North America was the largest region in the visual positioning system market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the visual positioning system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the visual positioning system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A visual positioning system (VPS) utilizes vision technology to precisely locate a device or object by analyzing visual data from its surroundings. It captures images and compares them to a database of known locations, ensuring accurate positioning. This technology improves situational awareness and navigation accuracy, particularly in areas where GPS signals are weak or unavailable.

The key components of a visual positioning system include sensors, camera systems, markers, and other elements. Sensors detect and measure physical properties or environmental changes, converting them into interpretable signals. These sensors come in various types such as 1D, 2D, and 3D, offering solutions such as navigation, analytics, tracking, and industrial applications. Visual positioning systems support different location types such as indoor and outdoor positioning systems, utilized across sectors such as commerce, healthcare, industry, transportation, hospitality, defense, and more.

The visual positioning systems market research report is one of a series of new reports that provides visual positioning systems market statistics, including visual positioning systems industry global market size, regional shares, competitors with a visual positioning systems market share, detailed visual positioning systems market segments, market trends and opportunities, and any further data you may need to thrive in the Visual positioning systems industry. This visual positioning systems research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The visual positioning system market consists of revenues earned by entities by providing services such as navigation, asset tracking, and supply chain management. The market value includes the value of related goods sold by the service provider or contained within the service offering. The visual positioning system market also includes sales of depth-sensing tools and GPS tools. Values in this market are ‘factory gate’ values, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Visual Positioning System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on visual positioning system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for visual positioning system ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The visual positioning system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Sensors; Camera Systems; Markers; Other Components2) By Type: 1D (One-Dimensional); 2D (Two-Dimensional); 3D (Three-Dimensional)

3) By Solution: Navigation; Analytics; Tracking; Industrial Solutions; Other Solutions

4) By Location: Indoor Positioning System; Outdoor Positioning System

5) By Application: Commercial Application; Retail; Healthcare; Industrial; Transportation and Logistics; Hospitality; Defense Application; Other Applications

Subsegments:

1) By Sensors: Optical Sensors (Photodetectors); Lidar Sensors (Light Detection and Ranging); Inertial Measurement Units (Imus) (Gyroscopes, Accelerometers); Ultrasonic Sensors (for Distance Measurement); Magnetic Sensors (for Orientation and Positioning); Gps Sensors (for Hybrid Systems)2) By Camera Systems: Monocular Cameras (Single Lens for Positioning); Stereo Camera Systems (Two Cameras for Depth Perception); 360-Degree Cameras (Panoramic Cameras for Complete Spatial Coverage); Depth Cameras (Time-of-Flight Cameras); Infrared Cameras (Used for Low-Light or Night-Time Positioning); Rgb Cameras (Standard Cameras for Image Processing)

3) By Markers: Qr Code Markers (for Machine Vision-Based Positioning); Fiducial Markers (Distinct Visual Patterns for Positioning); Barcodes (for Indoor Navigation and Item Tracking); Ar (Augmented Reality) Markers (Used in Ar-Based Positioning Systems); Optical Flow Markers (for Dynamic and Real-Time Positioning); Custom Visual Markers (Designed for Specific Positioning Needs)

4) By Other Components: Processing Units (Microcontrollers, Gpus for Data Processing); Software and Algorithms (for Image Processing, Position Estimation); Communication Modules (Wi-fi, Bluetooth, Li-Fi); Power Supply Units ( Batteries, Power Management Systems); Mounting Hardware (Brackets, Supports for Sensors and Cameras); Calibration Tools (To Ensure Accurate Measurements and Alignment)

Key Companies Mentioned: Google LLC; Qualcomm Inc.; Broadcom Inc.; ABB Ltd.; MediaTek Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Visual Positioning System market report include:- Google LLC

- Qualcomm Inc.

- Broadcom Inc.

- ABB Ltd.

- MediaTek Inc.

- STMicroelectronics

- Infineon Technologies AG

- Omron Corporation

- Fanuc Corporation

- Hexagon AB

- Trimble Inc.

- Sick AG

- MiTAC Digital Technology Corporation

- Topcon Corporation

- Pepperl + Fuchs Inc.

- Cognex Corporation

- Niantic Inc.

- Twin Disc inc.

- Sonardyne International Ltd.

- Navis Engineering

- Praxis Automation Technology BV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 14.32 Billion |

| Forecasted Market Value ( USD | $ 24.49 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |