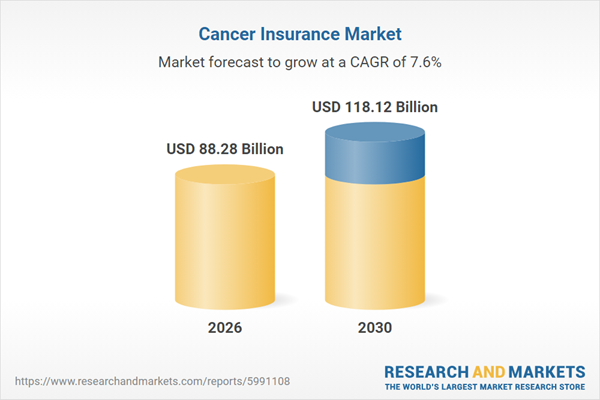

The cancer insurance market size is expected to see strong growth in the next few years. It will grow to $118.12 billion in 2030 at a compound annual growth rate (CAGR) of 7.6%. The growth in the forecast period can be attributed to increasing demand for customized cancer coverage, rising use of digital policy management tools, expansion of telemedicine-linked insurance offerings, growing focus on early diagnosis coverage, increasing adoption of data-driven underwriting models. Major trends in the forecast period include expansion of critical illness insurance coverage, rising demand for supplemental health policies, growing adoption of digital insurance platforms, increasing focus on personalized coverage plans, enhanced integration of data-driven risk assessment.

The increasing incidence of cancer is expected to drive the growth of the cancer insurance market in the coming years. Rising cancer cases are largely attributed to factors such as aging populations, lifestyle changes including tobacco consumption and unhealthy diets, and environmental influences such as pollution and exposure to carcinogenic substances. Cancer insurance offers financial protection by covering medical expenses and related costs that are often not fully addressed by standard health insurance plans, helping individuals manage the substantial financial burden associated with cancer treatment. For example, in July 2024, according to the Australian Institute of Health and Welfare, an Australia-based government agency, approximately 165,000 new cancer cases were diagnosed in Australia in 2023, averaging more than 450 diagnoses per day. Therefore, the growing prevalence of cancer is contributing to the expansion of the cancer insurance market.

Major companies operating in the cancer insurance market are increasingly focusing on innovative insurance offerings, such as cancer insurance policies designed specifically for women, to address gender-specific healthcare and financial needs. These specialized policies aim to support female policyholders by providing tailored coverage and assistance following a cancer diagnosis. For instance, in March 2024, Elephant.in, an India-based insurance company, launched a dedicated cancer insurance policy exclusively for women. This policy is designed to provide strong financial protection against the challenges of cancer diagnosis and treatment and covers five major cancers affecting women - breast, cervical, ovarian, oral, and colorectal cancers. The plan offers lump-sum payouts upon diagnosis of any covered cancer, with coverage amounts ranging from ₹5,00,000 to ₹30,00,000, ensuring timely financial support during treatment.

In March 2024, Osara Health, a US-based healthcare solutions provider, partnered with Allstate Benefits to deliver comprehensive cancer support programs to insurance policyholders. This collaboration represents a significant development in the US health insurance landscape, aiming to improve the overall cancer care journey for individuals undergoing treatment. Allstate Benefits is a US-based insurance provider offering cancer insurance policies.

Major companies operating in the cancer insurance market are UnitedHealth Group Incorporated, Ping An Insurance (Group) Company of China Ltd, Cigna Group, Allianz SE, Legal & General Group plc, AXA SA, Aetna Inc, MetLife Inc, Dai-ichi Life Holdings Inc, Munich Re Group, China Pacific Life Insurance Co Ltd, American International Group Inc, Liberty Mutual Insurance Company, China Life Insurance Company Limited, Zurich Insurance Group Ltd, MAPFRE SA, Huaxia Life Insurance Co Ltd, Aegon NV, AFLAC Incorporated, Atlas Cancer Insurance Services Ltd, Unum Group, Prudential plc, Bajaj Finserv Limited, Mutual of Omaha Insurance Company, Sun Life Financial Inc, Saga Plc.

North America was the largest region in the cancer insurance market in 2025. The regions covered in the cancer insurance market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cancer insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The cancer insurance market includes revenues earned by entities by providing services such as lump-sum payments, non-medical expense coverage, support services, and nutritional counseling. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Cancer Insurance Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses cancer insurance market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase::

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cancer insurance? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The cancer insurance market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Report Scope

Markets Covered:

1) By Insurance Coverage Type: Cancer Insurance; Supplemental Cancer Insurance Riders2) By Plan Structure: Individual Cancer Insurance Plans; Family Cancer Insurance Plans; Group Cancer Insurance Plans

3) By Benefit Type: Lump-Sum Benefit Plans; Indemnity-Based Expense Coverage; Income Replacement or Loss of Income Coverage; Comprehensive Coverage

4) By Coverage Scope: Diagnosis-Only Coverage; Treatment & Hospitalization Coverage; Post-Treatment & Recovery Coverage; Comprehensive Cancer Coverage

5) By Distribution Channel: Insurance Agents; Insurance Brokers; Bancassurance; Direct Sales; Other Distribution Channels

Subsegments:

1) By Cancer Insurance: Lump-Sum Cancer Insurance Plans; Indemnity-Based Cancer Insurance Plans; Treatment-Specific Cancer Coverage; Hospitalization & Surgery Cancer Coverage; Post-Treatment & Recovery Expense Coverage2) By Supplemental Cancer Insurance Riders: Diagnosis Benefit Rider; Chemotherapy and Radiation Therapy Rider; Hospital Cash & ICU Benefit Rider; Income Replacement or Loss of Income Rider; Transportation, Lodging and Non-Medical Expense Rider

Companies Mentioned: UnitedHealth Group Incorporated; Ping An Insurance (Group) Company of China Ltd; Cigna Group; Allianz SE; Legal & General Group plc; AXA SA; Aetna Inc; MetLife Inc; Dai-ichi Life Holdings Inc; Munich Re Group; China Pacific Life Insurance Co Ltd; American International Group Inc; Liberty Mutual Insurance Company; China Life Insurance Company Limited; Zurich Insurance Group Ltd; MAPFRE SA; Huaxia Life Insurance Co Ltd; Aegon NV; AFLAC Incorporated; Atlas Cancer Insurance Services Ltd; Unum Group; Prudential plc; Bajaj Finserv Limited; Mutual of Omaha Insurance Company; Sun Life Financial Inc; Saga Plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Cancer Insurance market report include:- UnitedHealth Group Incorporated

- Ping An Insurance (Group) Company of China Ltd

- Cigna Group

- Allianz SE

- Legal & General Group plc

- AXA SA

- Aetna Inc

- MetLife Inc

- Dai-ichi Life Holdings Inc

- Munich Re Group

- China Pacific Life Insurance Co Ltd

- American International Group Inc

- Liberty Mutual Insurance Company

- China Life Insurance Company Limited

- Zurich Insurance Group Ltd

- MAPFRE SA

- Huaxia Life Insurance Co Ltd

- Aegon NV

- AFLAC Incorporated

- Atlas Cancer Insurance Services Ltd

- Unum Group

- Prudential plc

- Bajaj Finserv Limited

- Mutual of Omaha Insurance Company

- Sun Life Financial Inc

- Saga Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 88.28 Billion |

| Forecasted Market Value ( USD | $ 118.12 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |