Aircraft De-Icing Market Trends:

Technological Advancements in De-icing Methods

The development of de-icing systems that avoid chemicals and instead utilize high-frequency electric currents to melt ice represents a notable technological advancement. These systems eliminate the need for traditional chemical de-icers, which can harm the environment and pose logistical challenges. On December 5 2023, Boston-based company De-Ice™ disclosed that Air Canada would be the inaugural airline to implement its chemical-free de-icing solutions on Airbus A320 planes, leading to a notable decrease in winter departure delays and carbon emissions. This technology utilizes high-frequency electric current for de-icing. These improvements lessen the impact on the environment of de-icing chemicals and improve efficiency by minimizing delays from ice accumulation. Moreover, these aircraft de-icing market recent developments assist airlines in adhering to stringent environmental regulations and meeting the growing demand from customers for sustainable air travel practices. The shift to innovative, eco-conscious de-icing methods is reshaping winter airport operations, improving sustainability and efficiency.Improvements in Sustainable De-icing Practices

Progress in sustainable de-icing methods is revolutionizing the aircraft de-icing industry by emphasizing environmental responsibility while maintaining effectiveness. These advancements consist of creating environment-friendly de-icing fluids that decompose efficiently, decreasing environmental impact and lessening damage to nearby ecosystems. Moreover, businesses are putting resources into developing more effective de-icing machinery that requires less liquid but still delivers top-notch results. New technologies like heated pavements and infrared de-icing systems are becoming popular as they provide greener and more energy-efficient options compared to conventional chemical techniques. These sustainable methods not only assist in complying with strict environmental regulations but also support worldwide sustainability objectives, ultimately promoting a more eco-friendly and effective aviation sector. In September 2023, Vilnius Airport started operating the first de-icing wastewater treatment plant in the Baltic States, which is a €2.9m project partially funded by the European Union (EU) to enhance sustainability by treating and reusing wastewater from aircraft de-icing.Rising Frequency of Extreme Weather Events

The increasing frequency of extreme weather events caused by climate change is driving the aircraft de-icing demand. Regular and intense winter storms, significant snowfall, and icy weather require strong de-icing protocols to guarantee the safety of flights and reduce interruptions. Airlines and airports are responding by investing in advanced de-icing technologies and equipment to effectively tackle these challenges. This trend is particularly important in areas with unpredictable winter weather, where it is vital to ensure operational continuity. For instance, Canada experienced more than $3 billion in insured losses as a result of natural disasters and extreme weather events. According to the Catastrophe Indices and Quantification Inc. (CatIQ), insured costs for extreme weather events exceeded $3.1 billion in 2023 on a national scale.Aircraft De-Icing Market Segmentation:

The publisher provides an analysis of the key aircraft de-icing market trends in each segment, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on fluid type, application, and equipment.Breakup by Fluid Type:

- Type I

- Type II

- Type III

- Type IV

Type I accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the fluid type. This includes type I, type II, type III, and type IV. According to the report, type I represented the largest segment.Type I is the most prominent segment in market, largely because it is widely used to remove ice and frost from aircraft surfaces before takeoff. This fluid, which is high in glycol content and low in viscosity, is popular for its fast and effective de-icing abilities, making it perfect for use in changing weather conditions. The widespread use of type I fluid is motivated by its affordability, simplicity, and quick results, which are essential for upholding flight schedules and safety. Its ability to work with many different types of aircraft and perform well in various temperatures helps to make it a leading product in the market.

Breakup by Application:

- Military

- Commercial

Commercial holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes military and commercial. According to the report, commercial accounted for the largest market share.Commercial dominates the market, driven by the wide network of commercial airlines and the large number of passenger and cargo flights worldwide. The increasing need for de-icing in regions with severe winter weather is crucial to guarantee safety and efficiency due to the rising demand for air travel. Commercial airline companies make notable investments in advanced de-icing technologies and systems to reduce delays and improve the passenger journey, all while following strict regulatory requirements. Moreover, the growing focus on enhancing airport facilities and the rising volume of flights play a major role in the market dominance of the commercial sector.

Breakup by Equipment:

- De-Icing Trucks

- Sweepers

- Others

De-icing trucks represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes de-icing trucks, sweepers, and others. According to the report, de-icing trucks represented the largest segment.De-icing trucks represent the largest market as per the aircraft de-icing market outlook because they play a crucial part in maintaining the safety and efficiency of planes in winter weather. These specially designed vehicles have advanced spraying systems and heated fluid tanks to apply de-icing quickly and anti-icing fluids on the surfaces of aircraft. Their ability to move easily and be adaptable allows them to quickly service various airplanes in different areas of an airport, leading to shorter turnaround times and ensuring flight schedules are kept. The growing use of de-icing trucks is driven by the need for effective and dependable de-icing options in large international airports and smaller regional hubs, highlighting their importance in present-day airport activities. For example, NextGen De-icing was introduced by Equivu Capital Holdings on June 21, 2023. NextGen De-icing's goal was to reduce winter operation expenses and flight interruptions for airlines by utilizing less de-icing fluid and sophisticated equipment like de-icing trucks with advanced technology.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest aircraft de-icing market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. according to the report, North America represents the largest regional market for aircraft de-icing.North America dominates the market, mainly because of its vast airline network and regular exposure to harsh winter conditions. Robust de-icing infrastructure and operations are required due to the existence of large international airports and high air traffic volumes. Moreover, strict aviation safety rules and substantial funding for innovative technologies contribute to the aircraft de-icing market growth. The North American market is advantaged by the strong presence of top industry players and ongoing advancements in de-icing solutions, guaranteeing the effectiveness and safety of aircraft operations during the winter months. For instance, in 2023, Air Canada experimented with a new idea by utilizing heated tape strips for de-icing planes instead of glycol sprays, which was tested by a Boston startup named De-Ice. The technology went through regulatory testing, demonstrating its safety and durability.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include B/E Aerospace Inc. (Rockwell Collins Inc.), BASF SE, Clariant AG, General Atomic Technologies, Global Ground Support LLC (Air T Inc.), JBT Corporation (FMC Technologies), Kilfrost Ltd., The Dow Chemical Company, Tronair Inc., UTC Aerospace Systems (Collins Aerospace) and Vestergaard Company A/S.

- Aircraft de-icing companies are prioritizing strategic efforts to strengthen their market position and technological skills. They are putting resources into research and development (R&D) to create eco-friendly and efficient solutions for de-icing, focusing on environmental issues and meeting regulations. On November 15, 2023, Syracuse Hancock International Airport inaugurated the United States' initial glycol recycling plant to repurpose de-icing liquid, decreasing wastewater and guaranteeing a more stable glycol source for airlines. Businesses are also broadening their range of products by merging, acquiring, and forming partnerships to enhance their competitive advantage. Furthermore, they are utilizing cutting-edge technologies like automation and IoT to enhance the efficiency and effectiveness of de-icing procedures. These players are working closely with airports and airlines worldwide to provide tailored de-icing services and equipment, guaranteeing operational reliability and safety in winter weather.

Key Questions Answered in This Report

1. What is the expected growth rate of the global aircraft de-icing market?2. What has been the impact of COVID-19 on the global aircraft de-icing market?

3. What are the key factors driving the global aircraft de-icing market?

4. What is the breakup of the global aircraft de-icing market based on the fluid type?

5. What is the breakup of the global aircraft de-icing market based on the application?

6. What are the key regions in the global aircraft de-icing market?

7. Who are the key players/companies in the global aircraft de-icing market?

Table of Contents

Companies Mentioned

- B/E Aerospace Inc. (Rockwell Collins Inc.)

- BASF SE

- Clariant AG

- General Atomic Technologies

- Global Ground Support LLC (Air T Inc.)

- JBT Corporation (FMC Technologies)

- Kilfrost Ltd.

- The Dow Chemical Company

- Tronair Inc.

- UTC Aerospace Systems (Collins Aerospace)

- Vestergaard Company A/S

Table Information

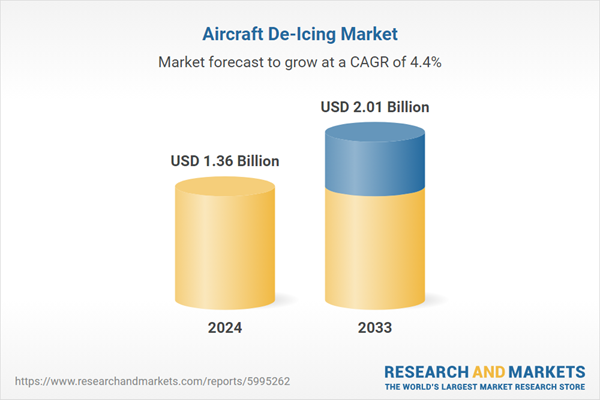

| Report Attribute | Details |

|---|---|

| No. of Pages | 117 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.36 Billion |

| Forecasted Market Value ( USD | $ 2.01 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |